Selling iRobot, Enthusiast Gaming, Peloton and Roku - Was I Right?

Reflecting on Sell Decisions from 2022

It’s that time of the year again when I review the sell decisions from previous years. I’ve made this an annual part of my investment process after reading research by Inalytics, which found that professional portfolio managers' buy decisions yielded an average gain of 1.2% annually, while sell decisions led to an average annual loss of 0.7%.

Deciding when to sell a stock is challenging, and investors often stop tracking stocks after selling them, missing opportunities to learn and improve. Implementing a feedback loop by reviewing the outcomes of sell decisions is crucial. This practice helps determine the quality of decisions, learn from them, and avoid repeating mistakes, ultimately leading to better decision-making in the future.

Today’s edition will analyze the sell decisions from 2022. The analysis of the sell decisions from 2021 is linked below.

iRobot (Ticker: IRBT)

I sold IRBT in May 2022. Since then, the stock has returned -78% compared to the broader market return of +39%.

Rationale

The decision to IRBT was based on initial rumours that it was due to be acquired by Amazon. Given that I already owned Amazon, I felt it was wiser to sell the position and redeploy the proceeds rather than wait until the all-cash transaction went through.

Current Reflection

Ironically, the acquisition did not end up going through due to EU antitrust concerns. In January 2024, Amazon agreed to terminate the pending acquisition, and the IRBT share price has fallen off a cliff. In 2023, IRBT’s revenue declined by 25%, which forced the company to lay off 31% of its employees.

Given the deteriorating fundamentals of IRBT and the very real possibility of bankruptcy, the decision to sell proved to be a good one. However, I was somewhat fortunate, as my decision to sell was based on acquisition rumors. The “buy the rumour, sell the news” strategy—or in this case, sell the rumour—proved profitable.

Enthusiast Gaming (Ticker: EGLX)

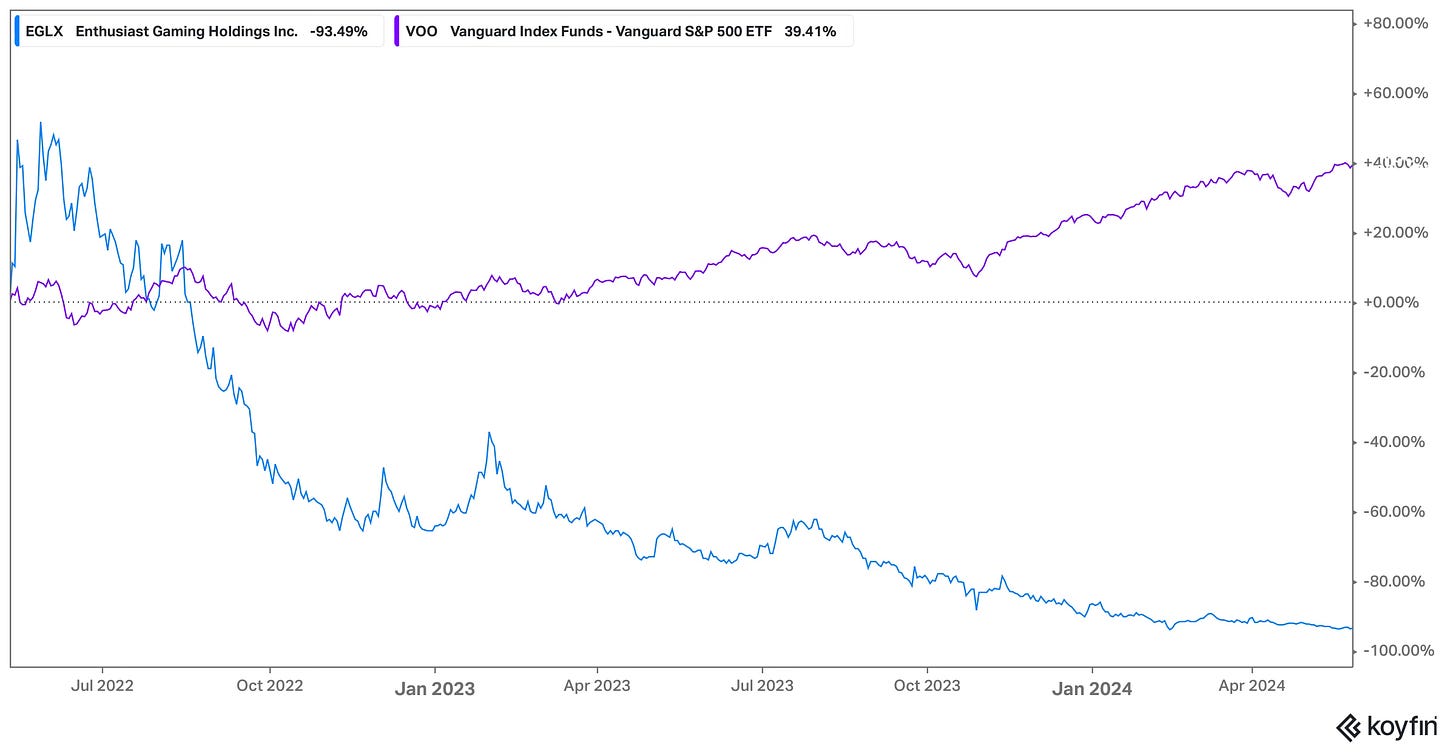

I sold EGLX in May 2022. Since then, the stock has returned -93% compared to the broader market return of +39%.

Rationale

I was initially attracted to the stock as a way to gain exposure to the esports industry. The company grew rapidly in 2020 and 2021, posting triple-digit revenue growth. This position started as a small speculative investment, but unfortunately, as I began to dig deeper, a number of red flags emerged, including a clear lack of a durable competitive advantage and a questionable CEO. I decided to get out while I still could.

Current Reflection

EGLX turned out to be an unmitigated disaster. In June 2022, four vice president-level executives authored a letter to EGLX’s board of directors, requesting that the board ask CEO Adrian Montgomery to resign. In the letter, the group cited failures around strategic planning and equity distribution, as well as issues relating to staffing the company’s human resources department. Montgomery was eventually replaced by Nick Brien in March 2023, but he lasted less than a year and resigned in January 2024.

EGLX as a business has deteriorated severely since I sold my position. In 2023, revenue declined by 12%, and in Q1 2024, it declined by 46%. To compound matters, shareholders have been massively diluted with an extra 16% of shares issued since May 2022. The decision to sell, from a fundamental perspective, proved to be the correct move.

Peloton (Ticker: PTON)

I sold PTON in May 2022. Since then, the stock has returned -77% compared to the broader market return of +39%.

Rationale

I finally sold my PTON position after one too many red flags. Let’s remind ourselves by listing them out:

May 2021: Treadmill recall handled badly by management after a number of injuries and a child’s death.

August 2021: Bike price was lowered despite this being marketed as a premium product - would this ever happen with an iPhone?

November 2021: After stating on the earnings call that a capital raise will not be required, Peloton raised capital (diluting shareholders) less than two weeks later.

January 2022: Hired Morgan McKinsey to review cost structure and suspends production of all connected fitness products.

May 2022: CEO John Foley announces plans to step down as part of a major restructuring that would reduce its workforce by 15%.

Current Reflection

Following the appointment of Barry McCarthy as CEO, things went from bad to worse. The company ended up eroding its brand by heavily discounting its products on Amazon and faced a further recall of over 2 million bikes due to faulty seats. After announcing intentions to sell Precor, the equipment manufacturer it acquired in 2020, PTON announced in 2023 that it was struggling to offload the company.

In May 2024, PTON announced that Barry McCarthy was stepping down along with a 15% workforce layoff. It is ironic that McCarthy was hired to turn the ship around, yet he ended up crashing it into an even larger iceberg. During McCarthy's time in charge, the stock returned -89%.

PTON serves as an important lesson in establishing the difference between a secular trend and a fad. The latter can lead to costly mistakes. As investors, we need to park emotions and instead act based on cold hard facts. While the decision to sell was entirely the correct one from a fundamental perspective, it should have been made a lot sooner given the series of red flags.

Roku (Ticker: ROKU)

I sold ROKU in July 2022. Since then, the stock has retuned -14% compared to the broader market return of +34%.

Rationale

I decided to sell ROKU when it became apparent that the business was cyclical in nature, which was not part of my initial investment thesis. This realization came to me in 2022 when there was a significant slowdown in TV advertising spend due to the macroeconomic environment. I had expected the streaming platform to be far more resilient than it turned out to be. Discovering that there had been an error of judgment in my initial investment thesis was a clear reason for me to sell.

Current Reflection

The cyclicality manifested itself in a big way in 2022, as revenue growth dropped to 13%, following over 55% growth in 2020 and 2021. In 2023, revenue growth fell further to 11%. In contrast, the digital advertising platform, The Trade Desk, continued to grow revenue by 32% and 23% in 2022 and 2023, respectively.

Based on the market sell-off in 2022, it could be argued that I was not the only one who didn’t expect the ROKU business model to be cyclical in nature. While the ROKU business has not deteriorated, given that it is growing the top line by double digits, it has slowed down considerably, especially compared to market expectations in 2022. Ultimately, the rationale behind selling proved accurate and is enough of a reason to remain on the sidelines with this one.

Concluding Remarks

If we look purely at the price action, my rationale for selling has proven to be accurate. Holding onto any of the positions would have resulted in market under-performance. In fact, holding onto IRBT, EGLX, or PTON would have resulted in capital incineration. At the time, I was already selling these positions at a loss, but it is hard to believe how much worse things could have been. I was right to sell, but I was also wrong to buy in the first place.

Looking purely at the price action does not really indicate if my decision-making was based on sound logic. However, looking at the underlying business fundamentals does. In the case of IRBT, EGLX, and PTON, all three have deteriorated massively and are much worse businesses today than they were in 2022. Only ROKU continues to grow, albeit at a much slower pace than anticipated. This also serves as a reminder that stock prices can be volatile in the short term but tend to follow underlying earnings growth in the long term.

Another key takeaway for me is that improving the buy decision process would have resulted in some of the sell decisions never having to be made in the first place. My approach to stock selection is a lot more robust and disciplined today than it was a number of years ago. This can be observed in the depth and detail of any of the recent investment theses that I have shared.

Looking at all of the stocks that I sold in 2021 (6) and 2022 (4), none of them have had positive returns, let alone beat the market, apart from Walmart (WMT). The concept of "never sell" is often bandied about, but sometimes you need to recognize when fundamentals are deteriorating or admit you were wrong, learn from it, and move on.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Superb article Wolf. Many thanks.

Great post, thank you