The Secret Behind Nubank and Mercado Libre’s Rise to Market Dominance

How Technological Leapfrogging Transformed Latin America's Digital Economy

Nubank and Mercado Libre dominate Latin America's FinTech and e-commerce landscapes by riding the wave of technological leapfrogging. But what exactly is technological leapfrogging, and how has it helped these two companies reshape entire industries?

What is Technological Leapfrogging?

Technological leapfrogging is a phenomenon where markets skip intermediate stages of technological development and jump straight to advanced solutions. It often occurs in emerging markets or outdated industries, bypassing legacy systems that would otherwise slow progress.

Think of it like skipping DVDs and going straight from VHS to streaming services.

Here are two examples of technological leapfrogging in Latin America:

Computing: Bypassing desktop computer adoption to embrace mobile phones as the primary computing platform.

Payments: Adopting mobile payments directly, skipping the widespread use of credit and debit cards.

Though technological leapfrogging is rare, it creates seismic shifts when it happens.

Conditions for Technological Leapfrogging to Occur

Why is the U.S. still swiping credit cards while Latin America has leapfrogged into faster, borderless payment systems? The answer lies in legacy infrastructure. Countries like the U.S. built robust payment networks from the 1950s to the 1980s, making it nearly impossible to replace them due to high switching costs. By contrast, Latin America’s underdeveloped infrastructure allowed it to embrace modern solutions from the start.

Here are the three key conditions required for leapfrogging to occur:

1. Non-Transactors to Transactors

This condition involves turning people who’ve never used a service into enthusiastic adopters of new technology.

Characteristics:

Large untapped market of potential users

No entrenched habits or legacy systems

Openness to new technologies

In Latin America, a significant portion of the population was unbanked before mobile banking arrived. This allowed companies like Nubank to bypass traditional banking and offer financial services directly through smartphones.

2. Low Switching Costs

With minimal legacy infrastructure, users can adopt new technologies without financial or logistical hurdles.

Factors driving low switching costs:

Limited existing infrastructure

Absence of sunk costs in outdated systems

Flexible regulatory environment

Latin America’s limited landline infrastructure, for example, made it easy to transition directly to mobile networks, bypassing traditional telephone infrastructure.

3. Compelling Value Proposition

New technologies must offer clear benefits that solve real problems in the target market.

Elements of a strong value proposition:

Solves critical inefficiencies

Offers tangible improvements over old systems

Aligns with local needs and preferences

Mobile payments in Latin America exemplify this. They provide accessible, convenient financial services to populations excluded by traditional banks, driving mass adoption.

Nubank Case Study

Nubank identified the inefficiencies of Brazil’s banking system and took a bold mobile-first approach. This allowed it to capitalize on smartphone adoption and sidestep the complexities of traditional banking.

Non-Transactors to Transactors

In 2014, when Nubank launched, only 68% of Brazilian adults had a bank account. By 2024, 90% do—largely thanks to Nubank’s influence. Today, 95 million Brazilians, or 56% of the adult population, have a Nubank account. The company successfully tapped into a vast unbanked population, particularly among younger demographics.

Low Switching Costs

Brazil’s traditional banks were known for long queues, high fees, and cumbersome processes. When Nubank’s CEO David Vélez moved from Colombia to Brazil in 2008, it took him five months just to open a bank account. This frustration inspired him to create Nubank.

Without entrenched infrastructure to block innovation, Nubank’s mobile-first strategy quickly gained traction. Setting up an account became fast, free, and online—no branches, no fees, and no red tape.

Compelling Value Proposition

Nubank revolutionized banking by offering essential services through a digital-only model. With no need for physical branches, Nubank can deliver services at a cost of just $0.90 per customer.

The company's focus on customer experience and financial inclusion was a game-changer. For many users who had never accessed banking services, Nubank became the first bank they could carry in their pocket. Customers gained access to accounts, credit cards, and investments—all through an intuitive smartphone app.

Learn more about Nubank in our deep dive.

Mercado Libre Case Study

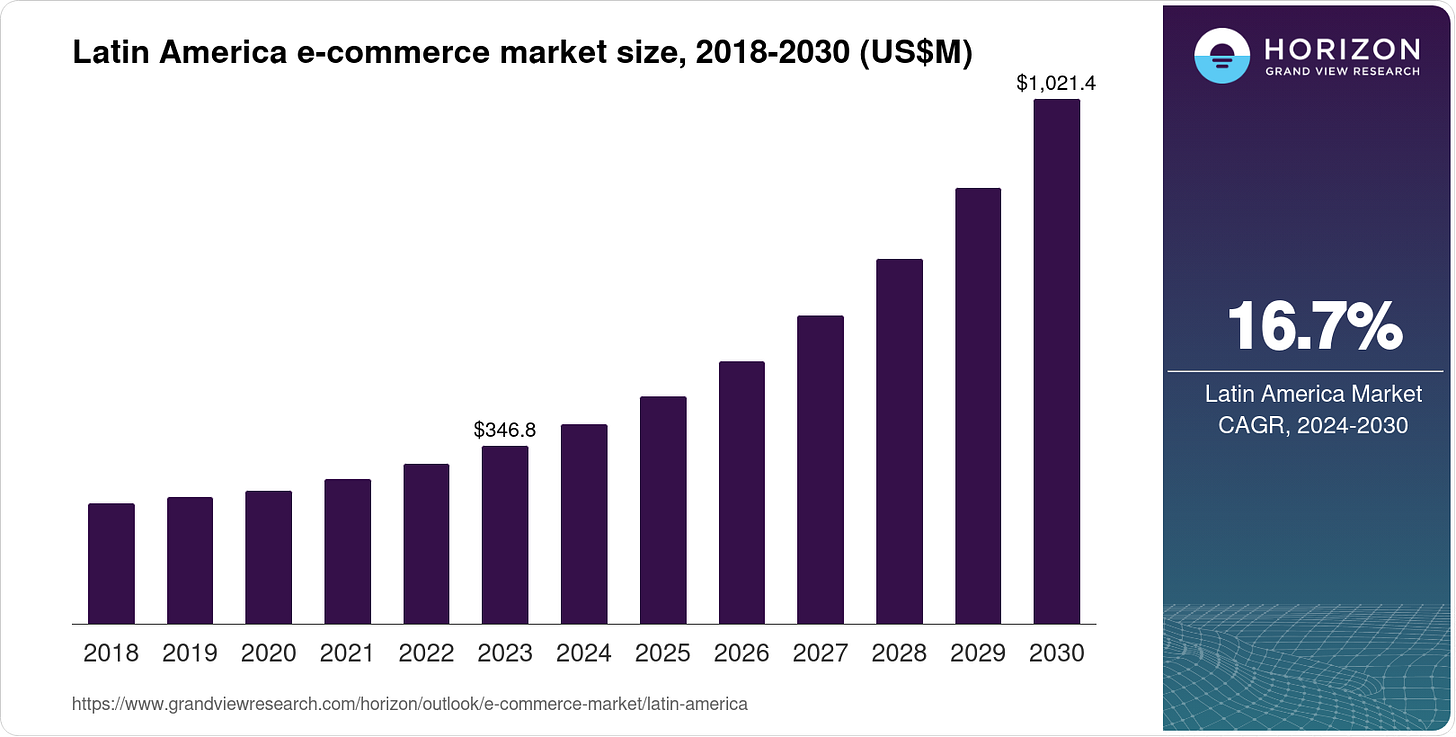

Mercado Libre leveraged mobile computing and digital payments to create a comprehensive ecosystem that transformed retail and finance in the region.

Non-Transactors to Transactors

Founded in 1999, Mercado Libre drew inspiration from eBay. But unlike eBay, Mercado Libre faced a major hurdle: Latin America was still a cash-dominated economy with limited payment infrastructure.

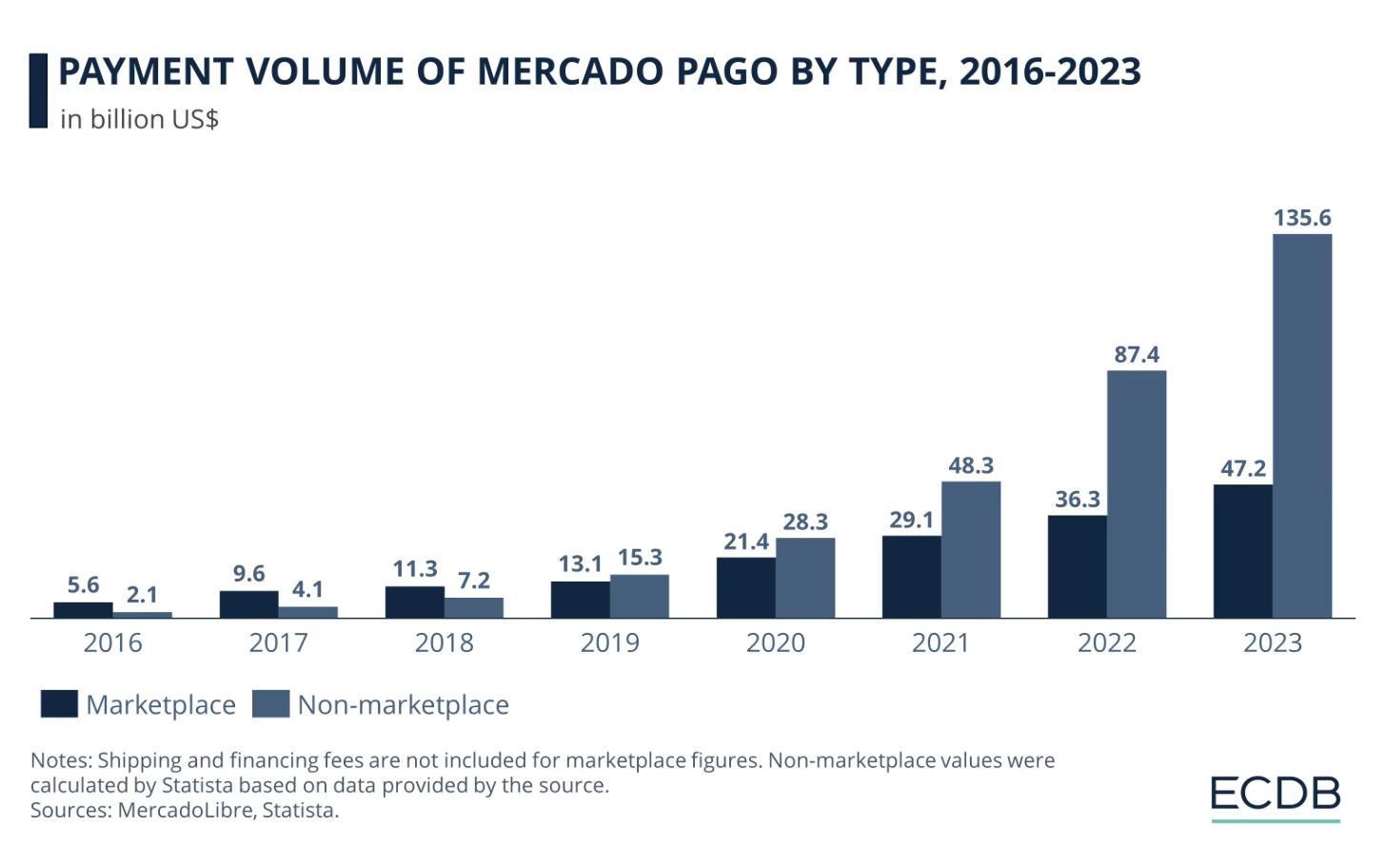

In response, Mercado Libre launched Mercado Pago in 2003 to provide digital payment solutions. This not only enhanced transactions on its marketplace but also met the needs of an unbanked population. Fast forward to 2024 and Mercado Pago serves 52 million monthly active users, while the marketplace boasts 56 million active buyers per quarter.

Low Switching Costs

Mercado Libre foresaw the shift toward mobile computing and began overhauling its technical infrastructure in 2009. As consumers in Latin America adopted mobile devices, the company’s early investment in mobile technology gave it a significant advantage.

Its mobile-first strategy made it easy for new users to navigate the platform, while the seamless integration of e-commerce and financial services lowered barriers to entry for small businesses. With data from both its marketplace and fintech platforms, Mercado Libre offers personalized experiences that keep users engaged.

Compelling Value Proposition

Mercado Libre’s ecosystem combines e-commerce, digital payments, and financial services into a one-stop solution. This comprehensive approach gave it an edge over competitors like Amazon, which struggled to succeed in Latin America without addressing the region’s payments gap.

By lowering barriers to entry, Mercado Libre empowered small businesses to access financial tools and expand their reach. Its ability to tailor services to local needs—while operating with in-house technology—has made it the dominant digital platform in Latin America.

Learn more about Mercado Libre in our deep dive.

Conclusion

Nubank and Mercado Libre show how technological leapfrogging can transform emerging markets. By offering mobile-first, user-friendly solutions that address significant market gaps, these companies have reshaped Latin America’s financial and e-commerce landscapes.

Their success highlights the potential for digital solutions to unlock financial inclusion and create new paradigms in business and technology. As their journeys continue, Nubank and Mercado Libre stand as shining examples of how emerging markets can become global leaders in innovation with the right strategy.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for the breakdown. I was certainly late to the Mercado Libre party (started building a position a month ago) but everything I read suggests they’ve developed a real moat and should continue their strong growth.

You see similar situations in other industries, BYD goes straight to EV production while other players are stuck with legacy industrial systems for construction of traditional vehicles