The Succession: What’s Next for Mercado Libre

Lessons from the climbers & scalers podcast — Part 3

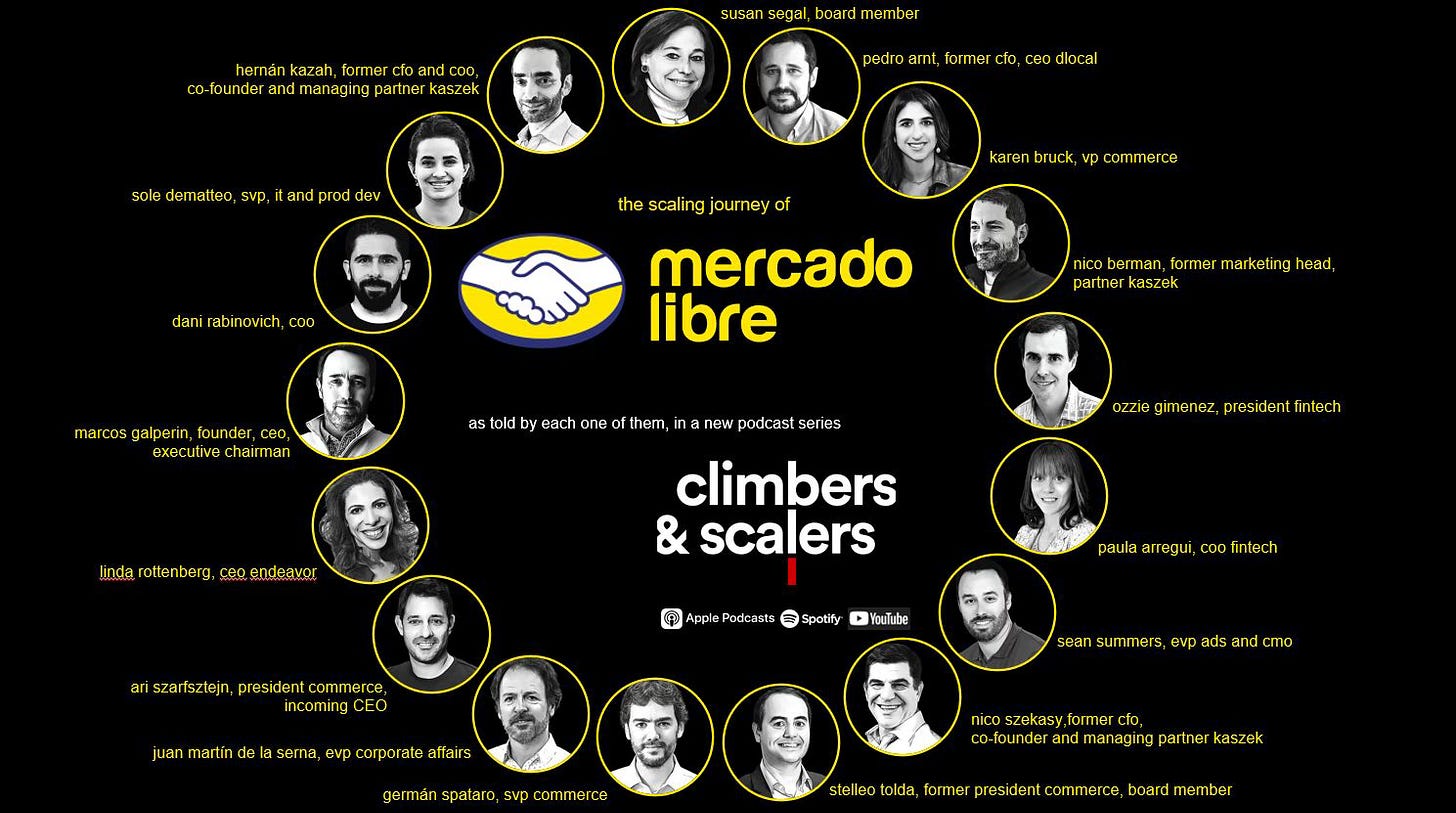

Over 28 episodes of the climbers & scalers podcast series, we’ve heard directly from Mercado Libre’s founders and leaders about how they built Latin America’s most dominant e-commerce and fintech platform.

Part 1 explored how early competitive advantages and founder mentality became organisational DNA.

Part 2 traced how culture scaled, from marketing and logistics infrastructure to ecosystem building.

Part 3 examines the company’s response to existential competition, the deliberate succession from founder to professional management, and what happens when an organisation becomes bigger than any individual leader.

It’s the conclusion to understanding not just Mercado Libre, but what their model reveals about building companies that endure.

When Marcos Galperin Stepped Back

When Marcos Galperin announced his departure as CEO on 21 May, 2025 (26 years after founding Mercado Libre), he did something unexpected: he made it look like the most rational decision possible.

Not a victory lap. Not a retirement announcement. A deliberate step back, taken precisely because the company had matured enough that it no longer needed him in that specific role.

This moment represents the culmination of everything Mercado Libre has built. And it reveals truths about scaling, competition, and leadership that extend far beyond one company.

Mercado Libre Specific Insights

Why This Transition Works

Marcos didn’t leave because he was bored or because Mercado Libre had plateaued. He left because the organisational design patterns his team built over 26 years made it possible and necessary.

The succession to Ari Szarfsztejn wasn’t improvised, it was architected. Three years before stepping down, Marcos moved Stelleo Tolda, his Brazilian co-pilot of 20+ years, aside to give Ari broader visibility in an executive role. This wasn’t a demotion; it was strategic positioning.

Ari proved himself managing Mercado Envíos through the pandemic (when volumes grew 5x overnight) and its subsequent expansion into logistics, technology infrastructure, and supplier relationships. He had already been making company-wide decisions. The CEO title simply formalised what was already true.

But here’s the deeper pattern: Marcos built an organisation where the founder’s departure doesn’t create a vacuum. Sean Summers describes walking into Mercado Libre and being shocked by how “leaderless” decisions felt, not because no one was leading, but because leadership was distributed. Ideas mattered more than titles.

The Board challenged Marcos (Henrique Dubugras explicitly questioned why he was leaving at all). The management team operated with founder mentality even as the company scaled to $30 billion in revenue.

This is organisational design working at scale. Most succession failures happen because founders build cults of personality. Marcos built something different: a culture where the founder is systemically replaceable, even as his imprint remains.

The Paranoia Mechanism

One quote from Marcos crystallises everything: “Only the paranoid survive.” This isn’t motivational fluff, it’s a design principle embedded in quarterly reviews, NPS obsession, and strategic planning.

Mercado Libre has dominated Latin America. They’ve beaten Amazon in multiple markets. Yet when Chinese competitors entered Brazil, Marcos didn’t defend conservatively, he doubled down. The company announced a 76% reduction in free shipping costs (from R$79 to R$19 in Brazil) during his final act as CEO.

A massive investment in a market they already led. Why? Because in their view, the moment you defend a position is the moment you lose it.

Quarterly business reviews focused not on what went well, but on what could go wrong. NPS was a forcing function to uncover root causes. When customer satisfaction stalled, they rebuilt technology infrastructure for years. When logistics depended on a single provider and that provider struck, they diversified aggressively.

This isn’t paranoia as pathology, it’s paranoia as operational discipline. It’s what prevents a $30 billion company from behaving like one.

Strategic Trade-offs That Reveal Hidden Logic

Marcos and team made a striking decision about content: they said no. Amazon built original series and created lock-in through entertainment. Mercado Libre looked at that and concluded it wasn’t in their DNA. Instead, they partnered with Disney and local producers, maintaining focus on commerce and fintech.

The insight: the biggest companies sometimes win by not doing everything competitors do. When mobile came, they built apps, not studios. When AI emerged, they focused on agent-based commerce and cost reduction, not robotics.

Most large companies suffer from “me-too” strategic dilution. Mercado Libre’s discipline, its refusal to chase categories outside its competitive advantage, is why it remains dominant.

Universal Business Principles

Founder Departure as Strength, Not Ending

The conventional narrative says founder departures signal decline. Mercado Libre inverts this. Marcos stepping down signals something more radical: an organisation confident enough to outlast its founder, and a founder secure enough to step away from what he loves most.

This only works when three conditions exist:

The successor shares the founder’s values but brings different capabilities. Ari is a strategist with logistics expertise.

The organisation has codified culture, not just lived it. Leadership behaviors, debate protocols, and decision-making principles are documented.

The founder transitions, not disappears. Marcos remains Chairman, engaged but not in daily execution.

Most founder transitions fail because they’re treated as binary (founder stays or leaves). Mercado Libre shows a third path: founder transforms.

Competing Without Imitation

When Amazon entered Latin America in 2013, Mercado Libre’s Board debated closing Mexico. The conventional move would have been retreat. Instead, under pressure from Micky Malka and Javi Oliván, they multiplied marketing spend sevenfold. Their message: “Every square metre of Latin America will cost you.”

Most companies, when facing stronger competitors, either imitate or retreat. Mercado Libre did neither. They played harder at what they were already good at.

When Chinese competitors arrived, the same pattern repeated. Marcos didn’t panic. He adapted, building supply chains from Asia, adjusting pricing but stayed true to Mercado Libre’s model.

Leadership as Saying No

Marcos doesn’t attend quarterly earnings calls. He skips nearly all conferences, investor meetings, and media appearances. This might seem counterintuitive for a public company CEO, but his logic is clear: every hour spent externally is an hour not spent learning internally.

He divides his time roughly three ways: one-third with his teams, one-third studying Mercado Libre, one-third on family and learning. The remaining time is blocked and unavailable.

The lesson: leadership bandwidth is finite. The best companies protect it ruthlessly. They say no to the good to preserve time for the critical.

The Role of Uncomfortable Board Members

When Henrique Dubugras questioned Marcos’s succession decision, he wasn’t being contrarian for effect. He was doing exactly what a Board should do: create friction and force clarity.

Marcos’s reaction? Relief. Not because Henrique changed his mind, but because a Board willing to challenge him, respectfully and rigorously, is exactly what’s needed during major transitions.

Boards add most value not through approval but through calibrated skepticism. Marcos’s most trusted Board members, like Micky Malka and Javi Oliván, understood tech deeply and weren’t afraid to contradict him. Henrique played the same role here.

The Unfinished Mountain

Marcos closes his narrative with a reflection on climbing. On Aconcagua, there’s a base camp every 2,000 metres. You reach what feels like a summit, only to look up and see 25 more peaks ahead. “It never ends,” he says. “That’s the truth.”

Mercado Libre faces Chinese competitors with relentless execution, AI reshaping commerce, and volatile regional economies. The company isn’t resting, it’s competing perpetually.

But the infrastructure they’ve built, distributed leadership, a culture that treats complacency as an existential threat, and a proven succession model, positions them better than most for what’s next.

The lesson isn’t that they’ve figured everything out. It’s that they’ve figured out how to keep learning, adapting, and evolving as an organisation, not just as individuals. What makes Mercado Libre worth watching is that they’ve built the tools to navigate whatever comes.

This is the final instalment of a three-part series on the climbers & scalers podcast.

If you’ve followed along from the beginning, I hope you enjoyed it. There are few case studies that reveal as much about scaling, leadership, and resilience as Mercado Libre’s story.

I’ll personally be referring back to this series in the future because the lessons here about organisational design, discipline, and founder evolution are timeless.

If you’d like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today’s edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you very much for sharing your research and insights with us, and keep it up!

Thanks for these posts! Amazing content🔥. I've invested in MELI recently and the management is one of the aspect I admire more about the company. Rationality and common sense is not something wide spread nowadays (sadly)