I first pitched Uber back in December 2024, and since then, the stock is up 38% in less than six months. You can read the original write-up below.

After such a strong start to 2025, what is Uber’s fair value today, and is it still a buy?

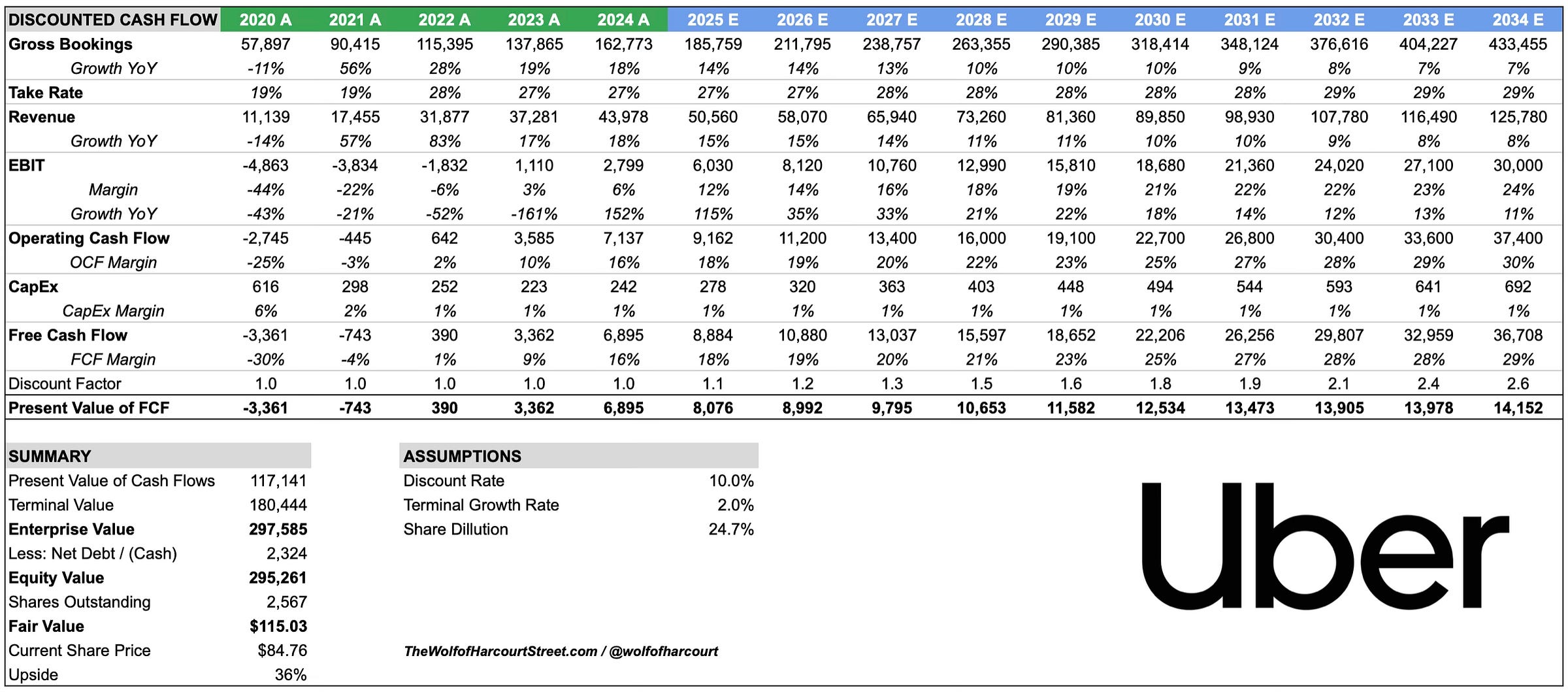

In this update, I present a financial model and fair value assessment, using the 2024 financial results as a starting point. I’ve already shared a detailed Q4 2024 earnings analysis, which can be accessed via the link below.

Financial Model

Future earnings are projected over ten years using a 10% discount rate. This reflects Uber’s strong cash-generation capabilities as a mature technology platform, while also accounting for execution risks, particularly around autonomous vehicle deployment and regulatory challenges. A terminal growth rate of 2% has been applied.

Between 2019 and 2024, Uber’s Gross Bookings grew at a 20% CAGR. This forecast assumes Gross Bookings will grow at a 10% CAGR, reaching $433 billion by 2034. This growth trajectory reflects:

Market expansion: The global ride-hailing market is expected to grow at a 15.1% CAGR from 2025 to 2035.

Service diversification: Continued growth in delivery and emerging mobility services.

Geographic penetration: Expansion into underserved markets and continued international growth. Uber currently operates in over 10,000 cities, and I expect this to continue increasing.

Uber’s overall take rate was 27% in 2024. I anticipate it will rise to 29% by 2034, driven by two key growth levers:

Uber One membership: As of the end of 2024, Uber had 30 million Uber One members, representing just 18% of monthly active customers. Membership grew 60% in 2024, and I expect continued penetration as users recognize the value proposition.

Advertising: In Q1 2025, Uber’s advertising revenue surpassed a $1.5 billion annual run rate, growing 60% YoY. The company is expanding its offerings, such as Journey Ads and Sponsored Items on Uber Eats. High-margin advertising has the potential to materially boost the take rate.

The combination of Gross Bookings growth and take rate expansion results in a projected 11% revenue CAGR from 2024 to 2034. For context, Uber grew revenue at a 28% CAGR between 2019 and 2024.

The EBIT margin is forecast to expand from 6% in 2024 to 24% in 2034, as Uber continues to benefit from operating leverage, having transitioned from a cash-burning start-up. Key drivers include:

Economies of scale: Leverage of fixed costs as the platform scales globally.

Operational efficiency: Tech investments reducing per-transaction costs.

Autonomous vehicle impact: As driver expenses, Uber’s largest cost component decline, margins will expand.

Free cash flow is forecast to grow from $6.9 billion in 2024 to $36.7 billion by 2035, with FCF margins improving from 16% to 29%. Uber’s asset-light model keeps capital expenditure requirements low.

One factor contributing to higher FCF margins relative to net income is Uber’s significant stock-based compensation (SBC). In 2024, Uber incurred $1.8 billion in SBC. A 2% annual dilution rate is assumed, consistent with recent trends, resulting in ~24.7% total shareholder dilution over the forecast period.

Based on these assumptions, Uber’s fair value is approximately $115.03 per share, implying a 36% upside compared to its $84.76 share price on 17 June 2025.

Conclusion

This analysis suggests Uber is undervalued, offering an attractive margin of safety. The biggest existential risk remains the emergence of autonomous vehicles. However, I believe this will ultimately act as a tailwind, not a threat. The AV market is likely to remain fragmented, with many players, not just one or two dominant ones. Uber’s distribution network and infrastructure position it to benefit in this scenario.

As CEO Dara Khosrowshahi put it: "AV technology is the single greatest opportunity ahead for Uber." My research shows Uber has already established partnerships with 18 autonomous vehicle companies, including WeRide and Waymo, a number I expect will only grow.

Let’s consider a thought experiment: what if AVs completely disrupt Uber’s mobility business, which currently accounts for half of Gross Bookings? Even then, I don’t expect a full replacement of human drivers for at least another 10 years. If we cut the terminal value in half, from $180 billion to $90 billion, this would still leave Uber’s delivery business untouched, a segment often overlooked by analysts.

In that scenario, Uber’s fair value would be around $80, suggesting the market today is already pricing in most of this risk.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Awesome job Wolf. Appreciate the work on this. One question: the company is buying back stock and have stated they expect durable share count reduction going forward. Does that change how you model out the value per share result? Am I not thinking of that in the right way or are you modeling it with extra conservatism? Thanks!

Great analysis Wolf!