Rather than a full investment thesis, this post serves as a 'Quick Pitch' for a new stock I’ve recently added to the portfolio.

Contents

Introduction

Moat Analysis

KPI & Financial Snapshot

Growth Opportunity

Risks

Valuation

Investment Outlook

1. Introduction

Uber is a technology platform that leverages a massive network, leading technology, operational excellence, and product expertise to facilitate movement from point A to point B. Operating as a digital aggregator, Uber connects riders seeking transportation with drivers willing to provide it. The company does not own any vehicles; instead, it charges a commission on each ride booked through its app. This asset-light model allows Uber to maintain a flexible and scalable operation without the overhead costs of owning a fleet of cars.

Key Features of Uber's Services:

Ride-Hailing: Users request rides via the mobile app, which employs an algorithm to match them with nearby drivers.

Dynamic Pricing: Uber uses a pricing strategy that adjusts fares based on real-time supply and demand conditions.

Additional Services: Beyond ride-hailing, Uber has diversified into food delivery (Uber Eats), freight transport (Uber Freight), and electric bike and scooter rentals.

Since its inception, Uber has facilitated 50+ billion trips and boasts 161 million monthly active users alongside 6 million active drivers and couriers. Uber's innovative approach has disrupted traditional taxi services and catalysed the growth of the "on-demand economy", influencing sectors far beyond transportation.

2. Moat Analysis

Recent declines in Uber's stock price reflect concerns about the durability of its competitive advantage, or moat. Below is an analysis of the key components of Uber's moat.

1. Switching Costs

Uber's switching costs are relatively weak, posing challenges but also opportunities. Riders and drivers can easily switch between competing platforms. Riders often install multiple ride-hailing apps and select based on price, while drivers frequently work across platforms like Uber, Lyft, and others, a phenomenon known as "rampant multi-tenanting."

To mitigate low switching costs, Uber has introduced loyalty programs like Uber Rewards and Uber One. Uber One, a membership program costing $9.99 per month, had 25 million members as of Q3 2024. These initiatives aim to encourage user loyalty by offering valuable perks as users accumulate points. Additionally, Uber’s strong brand recognition creates some psychological switching costs for users who associate ride-sharing with Uber.

2. Network Effects

Uber benefits primarily from indirect network effects:

More riders attract more drivers, creating increased earning opportunities for drivers.

Conversely, more drivers improve the rider experience with shorter wait times and broader service coverage.

However, Uber’s network effects face several limitations:

Local Nature: The effects are localized rather than global; a rider in one city doesn’t benefit from drivers in another.

Diminishing Returns: As driver supply increases, the marginal benefit of shorter wait times diminishes. For most users, the difference between waiting 1 minute versus 3–4 minutes is negligible.

To reinforce its network effects, Uber has expanded into adjacent services like food delivery and freight to create additional nodes in their network.

3. Cost Advantages

Uber’s asset-light business model is a significant cost advantage. By not owning or maintaining a fleet of vehicles, Uber minimizes capital expenditures and operational costs, enabling rapid scaling and a focus on technology and user experience.

Additionally, economies of scale allow Uber to negotiate favorable terms with drivers and suppliers. However, ongoing legal challenges regarding driver classification could disrupt this advantage if drivers are reclassified as employees rather than contractors.

4. Efficient Scale

Uber demonstrates efficient scale by leveraging its extensive network of drivers to provide services across more locations and times. This scale leads to higher driver utilization rates, reduced costs per ride, and the ability to spread fixed costs (e.g., technology development, marketing) over a larger user base.

Uber’s scale also supports effective cross-selling. By promoting additional offerings like food delivery and freight transportation to its large user base, Uber diversifies its revenue streams while increasing customer engagement.

3. KPI & Financial Snapshot

Monthly Active Paying Customers (MAPCs)

MAPCs represent the number of unique consumers who completed a Mobility ride or placed a Delivery order on the Uber platform at least once in a given month. As of Q3 2024, Uber reported 161 million MAPCs, a 13% increase compared to the same period in 2023.

This metric is critical for Uber as it reflects customer engagement, loyalty, and market penetration. To enhance MAPC, Uber has implemented personalized rewards to boost usage frequency and introduced tiered loyalty programs to incentivize higher spending and strengthen customer retention. Notably, 16% of MAPCs are Uber One members.

Trips

The Trips KPI measures the number of completed Mobility rides and Delivery orders during a specific period. In Q3 2024, Trips grew 17% year-over-year (YoY) to nearly 2.9 billion.

The faster growth in Trips compared to MAPCs indicates that monthly trips per MAPC increased by 4% YoY, reaching 5.9,a new all-time high. This suggests rising user engagement and satisfaction, as customers are using Uber services more frequently.

In an era where data is the new oil, Trips data is a vital strategic asset for Uber. By analyzing trip data, Uber identifies customer behavior trends, informing product improvements and new feature development. This data also optimises driver allocation, routing algorithms, and surge pricing strategies.

Revenue

Uber generates revenue through diverse streams, leveraging its technology platform and global network:

Mobility: Uber takes a commission of 15–30% per ride, contributing 57% of total revenue.

Delivery: Commissions and delivery fees (15–30%) are charged to restaurants and customers.

Freight: Uber earns a percentage of fees paid by shippers for each load.

Subscription Memberships: Programs like Uber One provide recurring revenue.

Margins

Uber’s transformation from a cash-burning startup to a profitable enterprise is a standout success in the tech industry. After years of substantial losses, totaling nearly $32 billion between 2014 and 2022, Uber reported its first annual operating profit in 2023, with a net income of $1.9 billion. Margins have continued to improve in 2024.

What drove this turnaround?

Cost Control and Operational Efficiency: Economies of scale from revenue growth, combined with disciplined expense management, have significantly reduced expense ratios. For example, sales expenses fell from 38% of revenue in Q1 2021 to 10% in Q3 2024.

Business Diversification: The pandemic accelerated Uber's diversification. While Mobility services declined, Uber Eats thrived, helping the company weather the crisis. Cross-promotion between Mobility and Delivery enables Uber to acquire customers at a lower cost and generate higher lifetime value compared to competitors.

Subscription Model: The Uber One subscription program has proven to enhance user engagement and spending across services.

4. Growth Opportunity

Uber's future growth opportunities are significant, driven by several key factors and market trends:

1. Expanding Market Size

The global ride-hailing market is projected to reach $141.5 billion by 2028, growing at a compound annual growth rate (CAGR) of 15.2% from 2024 to 2028. This growth is fuelled by factors such as integration with multimodal transportation, environmental sustainability initiatives, and expansion into rural and suburban areas.

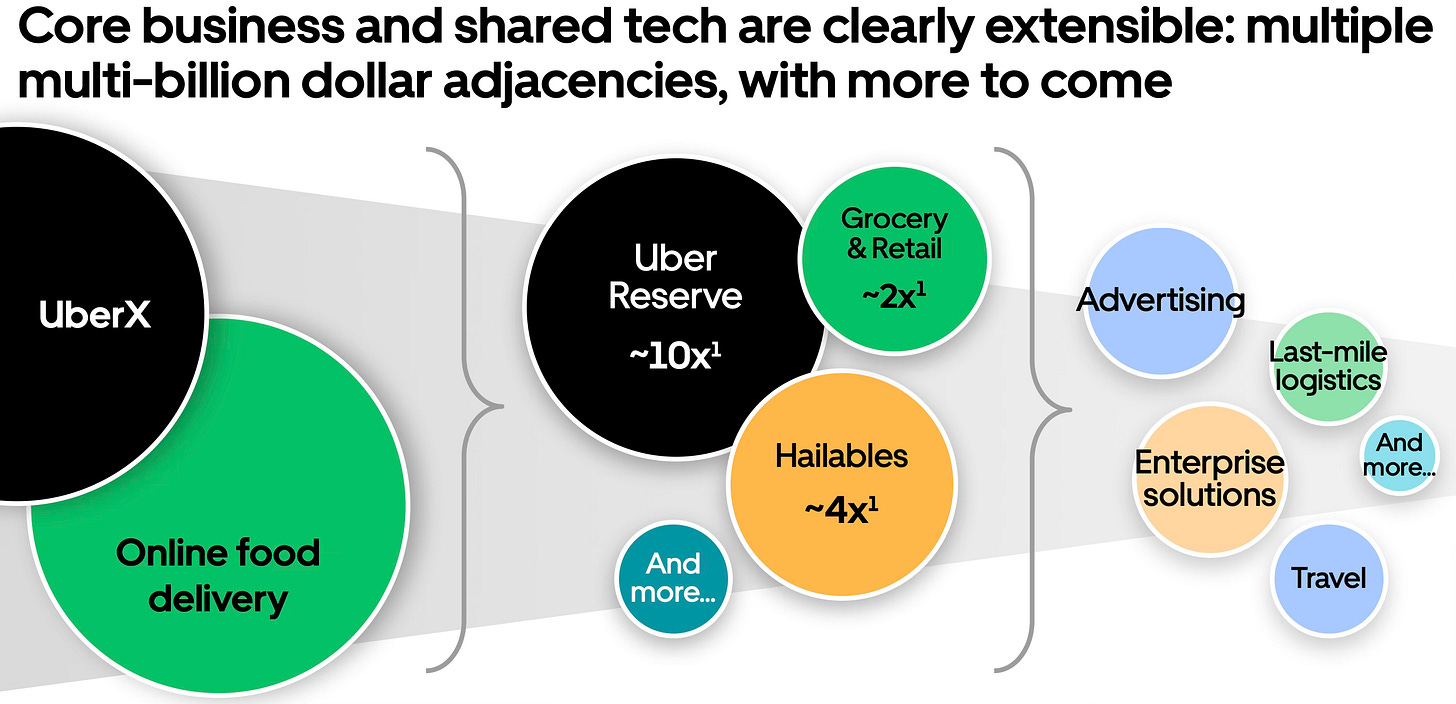

2. Diversification of Services

Uber is well-positioned to capitalize on this growth through diversification. The company's New Verticals segment, which includes advertising and last-mile delivery, provides opportunities to tap into new revenue streams. Notably, Uber's advertising business has shown robust growth, with revenue increasing nearly 80% YoY in Q3 2024.

3. Subscription Model

The Uber One membership program is driving customer loyalty and engagement. Membership has grown by over 70% YoY in Q3 2024, surpassing 25 million members. Uber One subscribers now account for 35% of total bookings, highlighting strong potential for recurring revenue.

5. Risks

Despite these opportunities, Uber faces significant risks, particularly from the disruption posed by autonomous vehicle (AV) manufacturers:

1. Reduced Barriers to Entry

The advent of AVs could lower barriers to entry in the ride-hailing industry. Competitors might deploy fleets of autonomous vehicles without needing to recruit and manage human drivers, increasing competition and potentially reducing profit margins across the industry.

2. Loss of Network Advantage

Uber's competitive advantage partly relies on its extensive network of drivers. AV manufacturers could bypass platforms like Uber by offering their own ride-hailing services. Companies such as Waymo and Tesla, which lead in AV technology, have the potential to capture market share. Recent YipitData reveals that Waymo holds a 22% market share of taxi journeys in San Francisco, surpassing human-driver taxi company Lyft.

6. Valuation

Price-to-Earnings Ratio

Uber is currently trading at 30 times its LTM earnings. However, I believe this ratio carries limited weight for Uber due to its historical nature. As we know, markets are forward-looking, and Uber has only been profitable since 2023. This multiple does not account for the operating leverage Uber is expected to realize in the coming years. Over the past 12 months, Uber’s operating margin has been 6%, but consensus estimates suggest this will more than double to 14% by 2026.

Reverse DCF

By reverse-engineering Uber's current share price of $61.79 (equivalent to a $130 billion market cap), the market appears to be pricing in a growth rate of just 9.4% annually over the next 10 years. This assumption seems conservative given Uber’s market growth potential and the operating leverage it is beginning to achieve.

Consensus estimates project that Uber will reach $115 billion in revenue by 2033, reflecting a CAGR of 12% over the next decade. While this is a long-term estimate, it far exceeds the growth rate currently implied by the market. If Uber’s revenue grows at a 12% CAGR over the next 10 years, free cash flow (FCF) will likely grow at an even faster rate due to the benefits of operating leverage.

7. Investment Outlook

The Uber investment thesis hinges on whether AVs will completely disrupt its business model. The primary risk from AVs lies in Uber's Mobility revenue stream, which currently accounts for 57% of total revenue, down significantly from 81% in 2019. I expect Uber to continue diversifying its revenue streams through the new verticals it is targeting.

In a worst-case scenario where AVs completely disrupt Mobility, Uber could lose half of its existing business. However, I believe it will take at least ten years, likely longer, for a fleet of AVs to replace human-driven taxis entirely. Under this scenario, Uber would continue generating FCF during this period, though its terminal value could be cut in half.

Next, let's assess the likelihood of AVs fully disrupting Uber. For this to occur, one or two dominant players, such as Waymo or Tesla, would need to monopolize the market and bypass Uber entirely. While this is a possibility, I believe an alternative scenario is more probable: AV technology becomes commoditized, leading to a market with numerous competitors.

Currently, Waymo and Tesla are leading the race, but once full autonomy is achieved, the technology may lose its uniqueness and become widely accessible. In such a commoditized market, brand differentiation would diminish, and customers would prioritize the lowest price and most reliable service. Smaller providers would struggle to compete independently and would likely need to partner with Uber to leverage its extensive network and infrastructure for distribution. Uber is already well-positioned in this potential future, having formed strategic partnerships with multiple AV companies, including Waymo, Cruise, and WeRide, to serve as a demand aggregator for autonomous rides.

In conclusion, while there are genuine risks to Uber's business model, the potential impact seems overstated. Much of the risk appears to be priced in, creating a favourable risk-reward scenario for investors.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hi, this is a very good article, thank you. Do you think it’s possible for Uber to mitigate the risk associated with AVs by acquiring a stake in an existing AV manufacturing company? I believe Uber could and should consider deploying its growing FCF into such a venture to strengthen its position.

Hi Wolf,

Revisiting your quick pitch on Uber, I’ve been digging into Lyft - and I think it now offers a very similar risk/reward setup to what Uber had in the $60s.

Lyft recently reported its first full year of GAAP profitability and strong free cash flow (~$766M), with margins expanding and rides and active riders at all-time highs.

Of course there are risks (competition, AV disruption), but the setup feels very similar: an underappreciated turnaround with operating leverage just starting to show - plus near-term catalysts like upcoming earnings.

Have you looked at Lyft while analysing Uber?