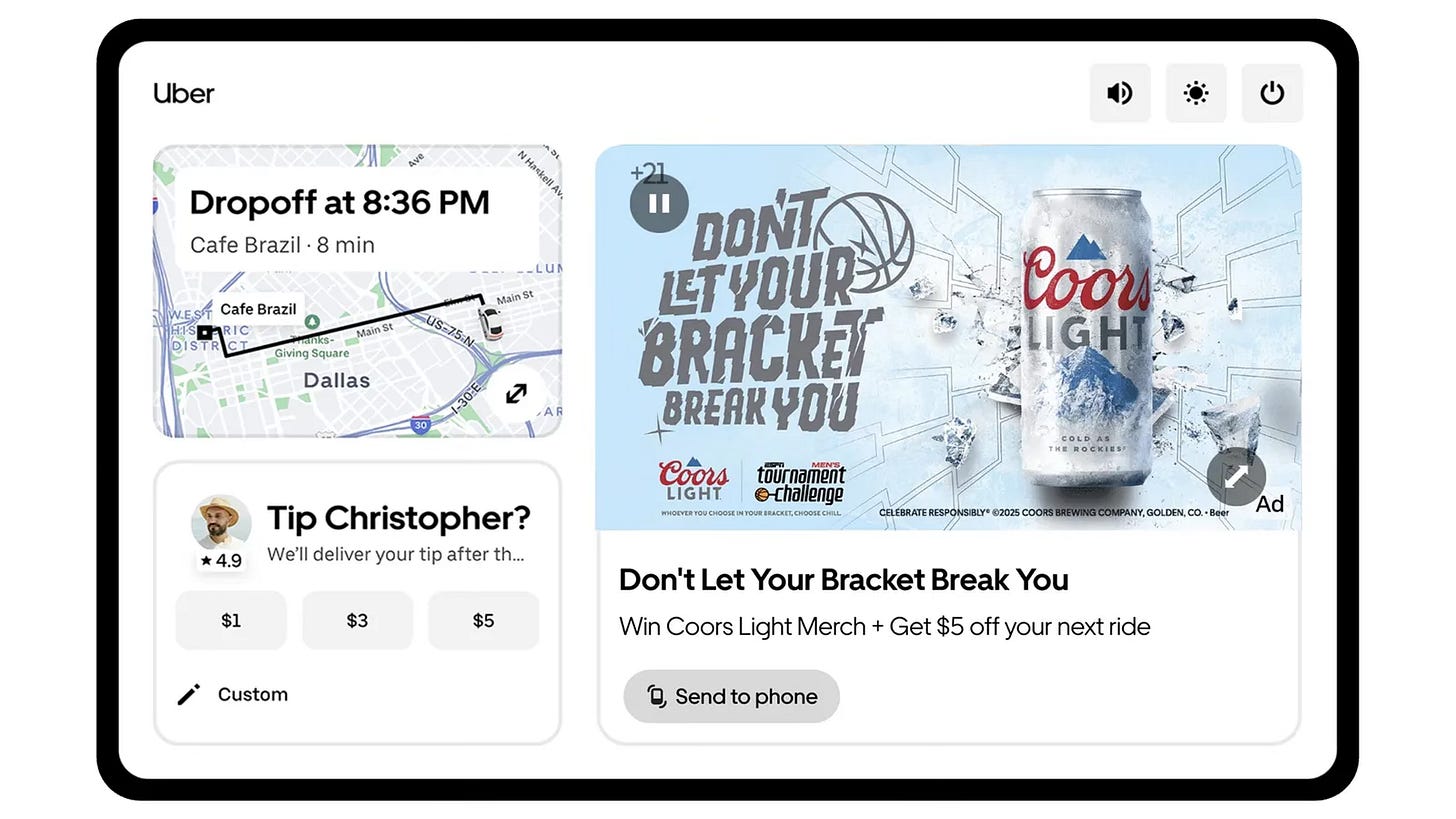

Uber has quietly turned its rider app into a mobile billboard, and the latest tool in its ad arsenal is called Ride Offers. Announced at Cannes Lions 2025, Ride Offers is an interactive ad format that lets brands sponsor discounts on riders’ next trips in exchange for attention. For example, a Coors Light ad might pop up on your screen while you wait for your driver, offering you $5 off your next ride if you watch the ad or engage. It’s essentially a real-time coupon tied to an ad: brands pay Uber to deliver a discount code to selected riders, turning an “idle” moment (when you’re checking your ETA) into a promotional opportunity. After pilots in the U.S., the format has expanded internationally and is now live in markets from the UK and Mexico to Australia.

How big could Ubers advertising business get, and what would it mean for Uber’s financials?

Uber’s Ad Empire

Ride Offers plugs into Uber’s Journey Ads suite (launched in 2022), which already runs video and display ads inside the Uber and Uber Eats apps. By dangling tangible value (ride discounts) in ads, Uber aims to boost engagement and attention. According to Uber, 65% of riders say discount ads stand out and make them feel more positive toward the sponsoring brand. Uber’s global head of sales touts Ride Offers as “more than just a discount, it’s a gesture that builds trust, loyalty, and lasting brand impact.”

Brands like Molson Coors have already tested Ride Offers and report double- or triple-digit lifts in click-throughs and video views compared to static ads. In short, Ride Offers is a coupon-driven ad format designed to deepen Uber’s growing advertising ecosystem.

Since formally launching its advertising division in late 2022, Uber has marketed itself as a platform to reach riders and eaters at high-value moments (on the way home, on break, etc.). That push is working: Uber’s ad business surpassed a $1.5 billion annual run rate as of Q1 2025, up 60% year-over-year.

Today, Uber serves ads in-app, in rider emails, on car-top displays, and in-car tablets. It has also launched a creative studio for custom campaigns (e.g. Uber-branded cars at an F1 race), and is experimenting with off-platform targeting using its unique location and transaction data. In short, Uber is acting like a full-fledged ad network, leveraging first-party data to sell access to attention.

Advertising adds high-margin revenue on top of Uber’s core ride and delivery business. Already, Uber Eats sees meaningful contributions from ads, with Uber a potential “sleeping giant” in advertising thanks to its scale.

The Numbers: Uber vs. Amazon and Booking

To assess Uber’s ad potential, compare it to other platforms whose core business isn’t advertising:

Amazon, primarily a retailer, earned about $56.2 billion in ad revenue in 2024, roughly 9% of its $638 billion in sales.

Booking Holdings, a travel marketplace, generated around $1.1 billion from "advertising and other" revenue in 2024.

Uber, with a ~$1.5 billion ad run rate, is just getting started. Today, Uber’s ad revenue is less than 1% of Gross Bookings. If Uber doubled that penetration, it would still trail Amazon but would surpass Booking.

Using business model comparisons:

Amazon’s $530 billion in net sales (ex-AWS) and an assumed 15% take rate implies ~$3.5 trillion in gross bookings. Its ad revenue would be about 1.5% of gross bookings, and rising fast.

If Uber’s ad unit reaches just 2% of gross bookings, and assuming Uber’s bookings grow from $166 billion in 2024 to $318 billion by 2030, its ad revenue could reach ~$6 billion by 2030.

Booking, by contrast, has ad revenue of just ~0.6% of gross bookings.

Uber has more runway than Booking but a long way to go before matching Amazon’s scale.

Impact on Take Rate and Margins

Advertising would show up in Uber’s financials as a higher take rate and better margins. In 2024, Uber’s take rate was 27%, meaning it kept $27 of every $100 booked, after paying drivers and restaurants. Because ads aren’t tied to rides, every ad dollar directly lifts the take rate.

More importantly, ad dollars are far more profitable. Uber’s operating margin (EBIT) was just 6% in 2024, as scale efficiencies began to kick in. If we assume a 50% EBIT margin for ads, then $0.50 of every $1 in ad revenue drops to the bottom line.

Let’s play out two 2030 scenarios:

$4.5 billion in ad revenue (1.5% of Gross Bookings)

$6 billion in ad revenue (2% of Gross Bookings)

In either case, Uber’s take rate and operating margin rise significantly, without factoring in the natural operating leverage that comes from scaling the rest of the business.

The Bottom Line

Ride Offers signals Uber’s evolution from a pure transportation company to a data-driven media platform. In a saturated ad market, Uber’s wildcard is context: it knows where you’re going and when, data that allows for more relevant, better-timed ads than nearly any other platform.

And the results are impressive:

6.6x more attentive seconds than online video, social in-feed, or mobile display

50% ad recall after just 2.5 seconds of exposure

27% average lift in brand consideration post-exposure

Ride Offers is a strategic wedge into the $1 trillion global ad market. If Uber succeeds, it won’t just be a better transport company, it will be a more profitable one too.

Zooming out further, over the next decade, Uber could build a $10 billion run-rate, high-margin advertising business. For perspective, Uber’s total revenue was $11 billion as recently as 2018.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great read, do you see a scenario where Waymo will use Uber to make the public comfortable with autonomous ride sharing before then flipping the switch once they feel comfortable as the dominant player in the space?

Nice read