This week, I sold my full position in Airbnb (ABNB), which represented a 4.5% portfolio weighting at the time of sale. In this article, I’ll walk through the rationale behind this decision. Before diving in, let’s first review Airbnb’s Q1 2025 earnings, released on 1 May 2025.

Business Activity

Nights and Experiences Booked

After strong momentum in Q4, when growth accelerated to 12%, Nights and Experiences Booked slowed to 8%, reaching 143.1 million. Management cited the unfavourable comparison to Q1 2024, which included Leap Day. This was the slowest growth rate since the COVID lockdowns.

Gross Booking Value

Gross Booking Value (GBV) reached $24.5 billion, up 7% YoY or 9% on an FX-neutral basis. The increase in bookings was partially offset by a slight decline in Average Daily Rate (ADR), due to FX headwinds. Even excluding FX impacts, GBV growth remained the lowest since the COVID period.

Average Daily Rate

ADR was $171 in Q1 2025, down 1% YoY. Excluding FX, ADR increased by 1% and was up across all regions, largely due to price appreciation.

Take Rate

The implied take rate was 9.3%, slightly down YoY. This was due to the benefit from additional cross-currency service fees being offset by the timing of Easter in Q1 2024.

Financial Analysis

Revenue

Airbnb reported revenue of $2.23 billion, a 6% YoY increase, representing a clear sequential deceleration. Management noted that excluding FX and calendar effects (Leap Day, Easter), revenue growth would have been 11%. Still, even adjusting for those, growth momentum was lacking.

Management guides Q2 2025 revenue between $2.99 to $3.05 billion, implying 10% growth at the midpoint. After adjusting for the Easter benefit, underlying growth is just 8%.

Operating Margin

Operating income came in at $38 million, equating to a 2% operating margin, down from 5% in Q1 2024.

What caused the 3-point margin contraction? Primarily, an increase in Product Development (PD) and Sales & Marketing (S&M). PD rose from 22% to 25% of revenue, and S&M ticked up from 24% to 25%. Both increases were tied to the 2025 Summer Release, which I’ll discuss shortly.

Net Margin

Net income was $154 million, for a 7% net margin, down from 12% YoY.

A key driver of net income is interest income which was $173 million in Q1 2025, down from $202 million in Q1 2024 due to lower interest rates. Without this, Airbnb would not have been profitable in the quarter.

Cash Flow Analysis

Airbnb generated $1.79 billion in operating cash flow. With just $8 million in CapEx, free cash flow (FCF) was $1.78 billion representing a 78% margin. Due to Airbnb’s role as the Merchant of Record, FCF is seasonally strongest in Q1.

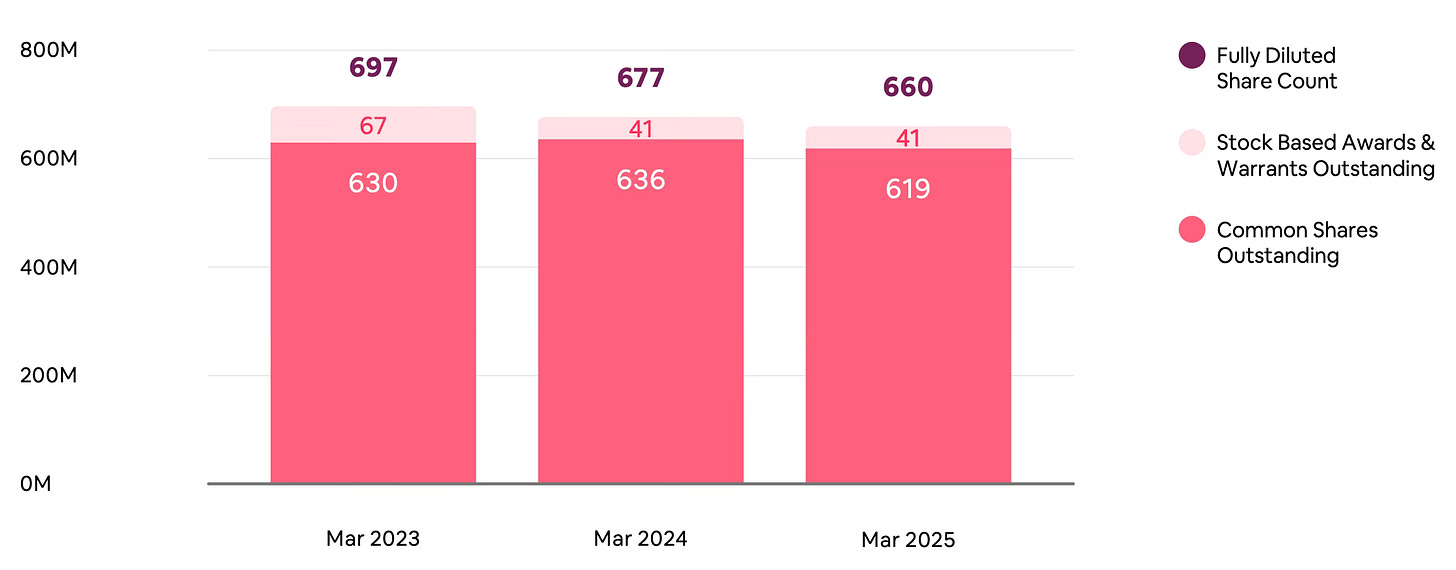

TTM FCF reached $4.4 billion, with an FCF margin of 39%. This allowed for $807 million in share buybacks in Q1 2025. The diluted share count dropped from 677 million (Q1 2024) to 660 million.

2025 Summer Release

After a mediocre Q1, I was eager for the 2025 Summer Release on 13 May. Airbnb announced an expansion beyond home rentals, launching:

Airbnb Services: Professional offerings (chefs, photographers, massages, hair/makeup) in 260 cities.

Reimagined Airbnb Experiences: Local-led tours and classes in 650 cities.

All-New Airbnb App: Redesigned to integrate homes, services, and experiences.

Overall, I found the updates underwhelming. Nothing here was new, Brian Chesky had hinted at all of this earlier 2024. What I was really hoping for was a loyalty program, something that’s driving strong results for Booking.com, Uber, and Amazon. Airbnb appears to be missing a major opportunity here.

Why I Sold

I’ve owned shares of Airbnb since July 2021, adding to the position several times, most recently in July 2024. My average cost basis was $134, and I broke even on the position. Over the same period, the market returned 45%.

The decision to sell wasn’t easy. I admired how Chesky reshaped the business during COVID. I gave him the benefit of the doubt throughout 2024, despite persistent deceleration in key growth metrics.

After Q1 and the lacklustre Summer Release, my optimism faded. Is Airbnb a bad business? Absolutely not. It’s a cash-generating machine. But I now have serious doubts about its ability to accelerate revenue growth toward 20%.

The rebranded Experiences might make strategic sense, but they were originally launched in 2016. If they haven't meaningfully moved the needle since, why would they now?

The Airbnb Services segment seems even more questionable. I personally can't imagine booking a haircut via Airbnb. And once someone finds a good local service provider, Airbnb is easily cut out. Unlike short-term stays, local services don’t benefit from repeat, location-agnostic usage. Ben Thompson has an excellent take on this that I recommend reading.

From a margin standpoint, I suspect these new verticals are lower-margin than the core homestay marketplace. Airbnb intends to vet service providers, incurring overhead it doesn't face with hosts (where reputation is community-driven via ratings).

While the TTM FCF margin is 39%, this is inflated by stock-based compensation (SBC). Adjusting for SBC, the margin is closer to 28%. Long-term, I think Airbnb can push this to 45%, but that’s not a huge leap from where it is today.

In short, future returns will need to come primarily from revenue growth, not margin expansion. Given continued deceleration and my skepticism about the new initiatives, I decided to exit the position.

While I don’t believe Airbnb is wildly overvalued at these levels, I’m simply not interested in holding a growth stock that’s not growing at above-average rates.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great recap Wolf. We're on the same page. Unfortunately, even great companies can disappoint if the entry price isn’t right, as we both experienced (we exited Airbnb in January 2025).

While it's a strong cash flow generator, we favor Booking over Airbnb due to stronger recent execution. When we first invested back in 2022, Booking also appeared significantly undervalued.

That said, we still view Airbnb as a solid company with long-term potential, but at present, we see more attractive opportunities elsewhere.

I agree with the rationale. Will you use the funds for a new stock? If so I recommend Palantir, trading for P/S of just 100 its a bargain of the century 🤣.