This week, I sold my full position in Auto Partner (APR.WA), which represented a 3.5% portfolio weighting at the time of sale. In this article, I’ll walk through the rationale behind this decision. Before diving in, let’s first review Auto Partner’s Q1 2025 earnings, released on 22 May 2025.

Financial Analysis

Revenue

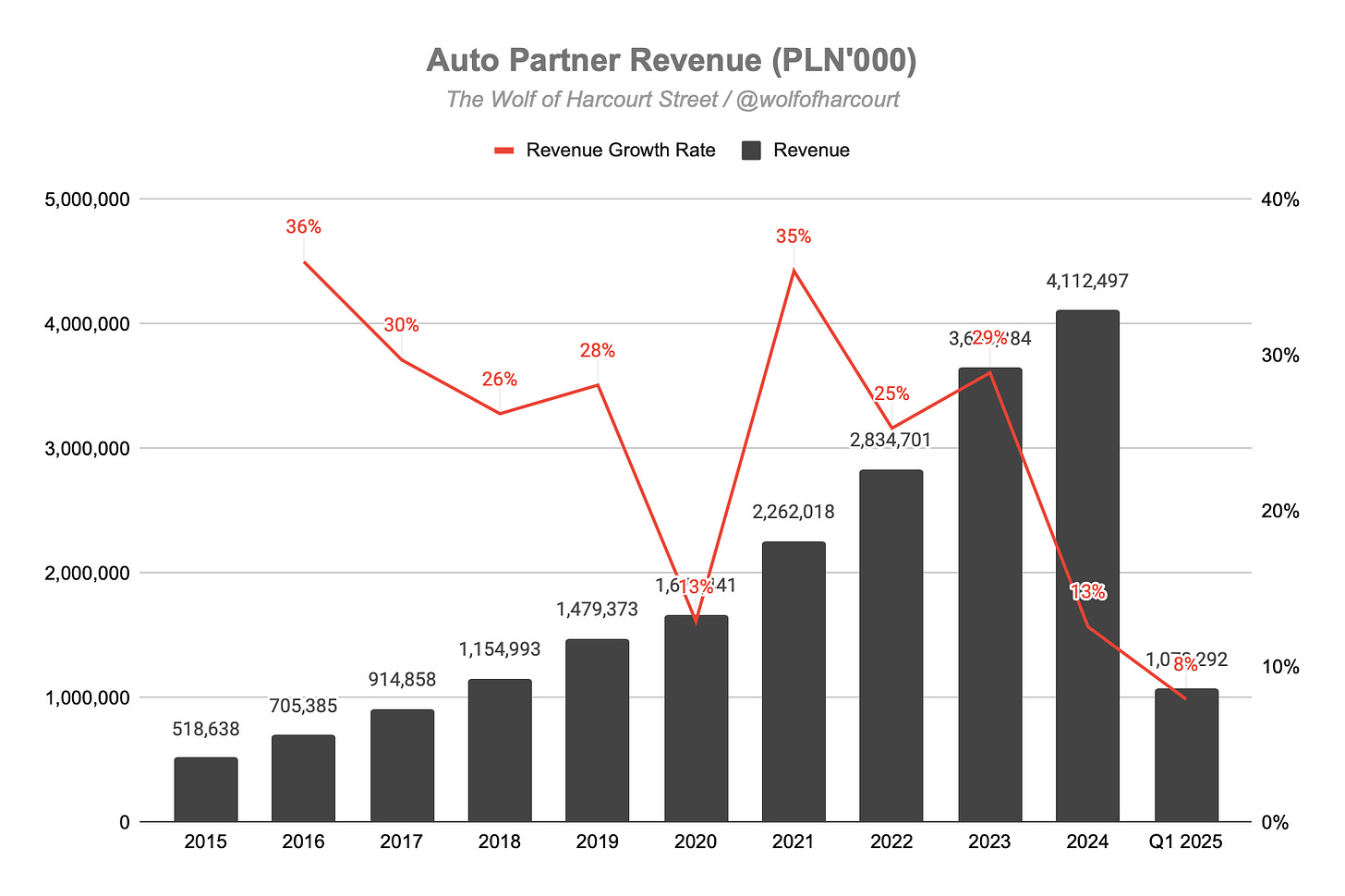

Auto Partner achieved 8% revenue growth in Q1 2025, reaching PLN 1.073 billion. This marks a continued deceleration from its 33% peak in Q2 2023.

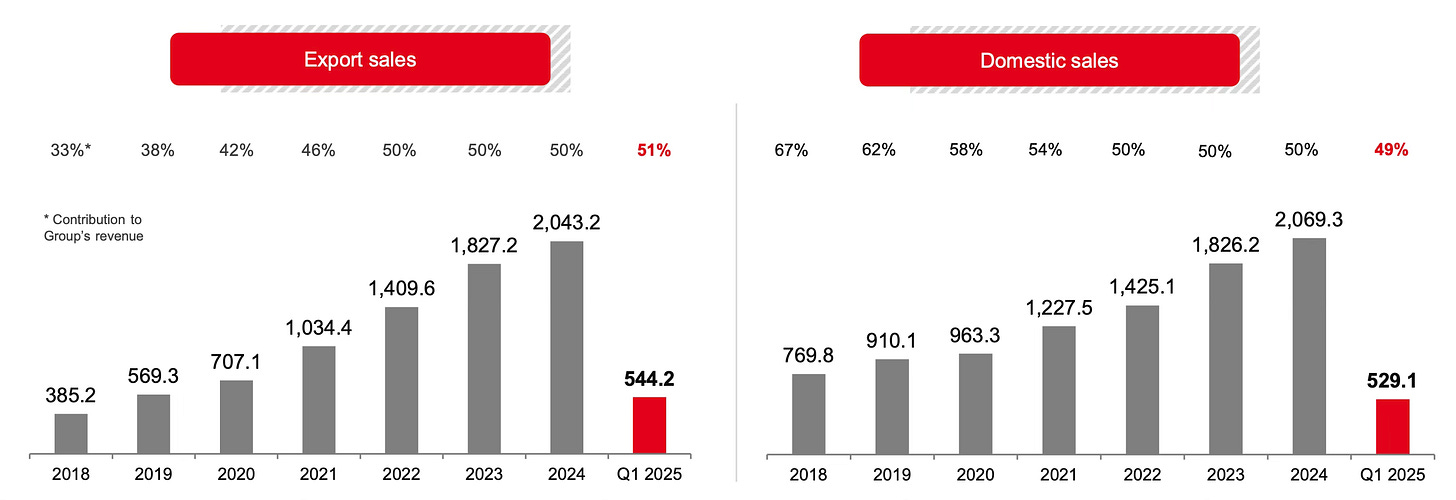

The contribution from domestic and export sales remains balanced, with Domestic sales up 8.1% and Export sales growing 7.9%. Export sales now account for 51% of total revenue, up from 50% previously. The company is currently establishing a new logistics and storage center in Zgorzelec, expected to be completed in early 2026. This expansion in western Poland is designed to support future export growth. While this may explain the recent export slowdown, the weakness in domestic sales is more concerning.

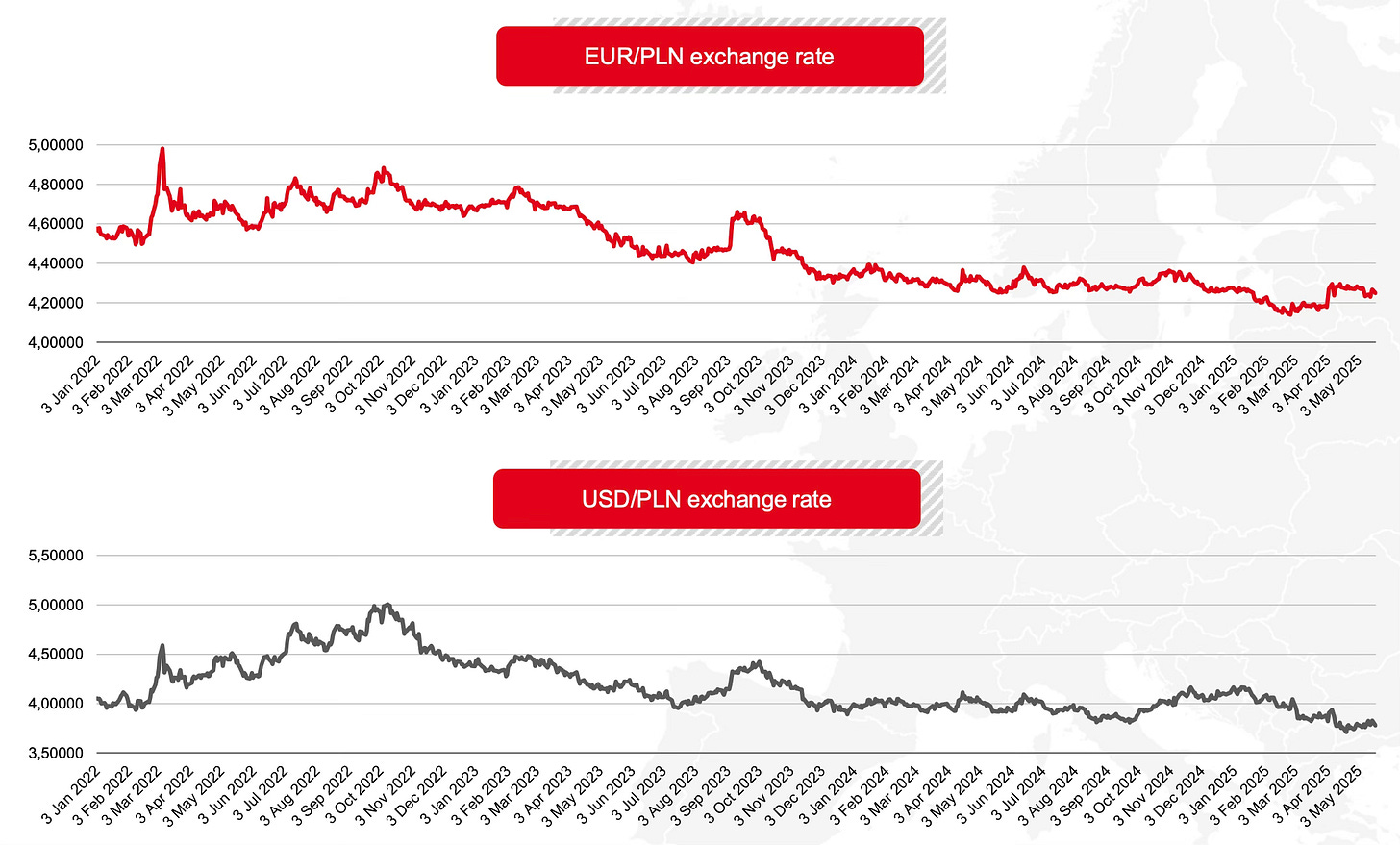

Management has cited a challenging environment, marked by ongoing deflation and an unfavorable exchange rate, which is placing downward pressure on euro-denominated sales.

A key strength of Auto Partner's business model has been its branch network, with products distributed from central warehouses to branch offices, which then deliver to customers. Up until 2023, most of the company’s revenue growth came from better utilisation of the existing network. For example, in 2023, branch count rose only 2%, yet average monthly revenue per branch jumped 27%.

However, that trend has reversed. In 2025, the branch count again increased by 2%, but average revenue per existing branch rose just 6%. Has Auto Partner squeezed all the efficiencies it can from its existing network? If so, future growth may now depend on opening new branches, a far more capital-intensive strategy than increasing existing branch utilisation.

Gross Margin

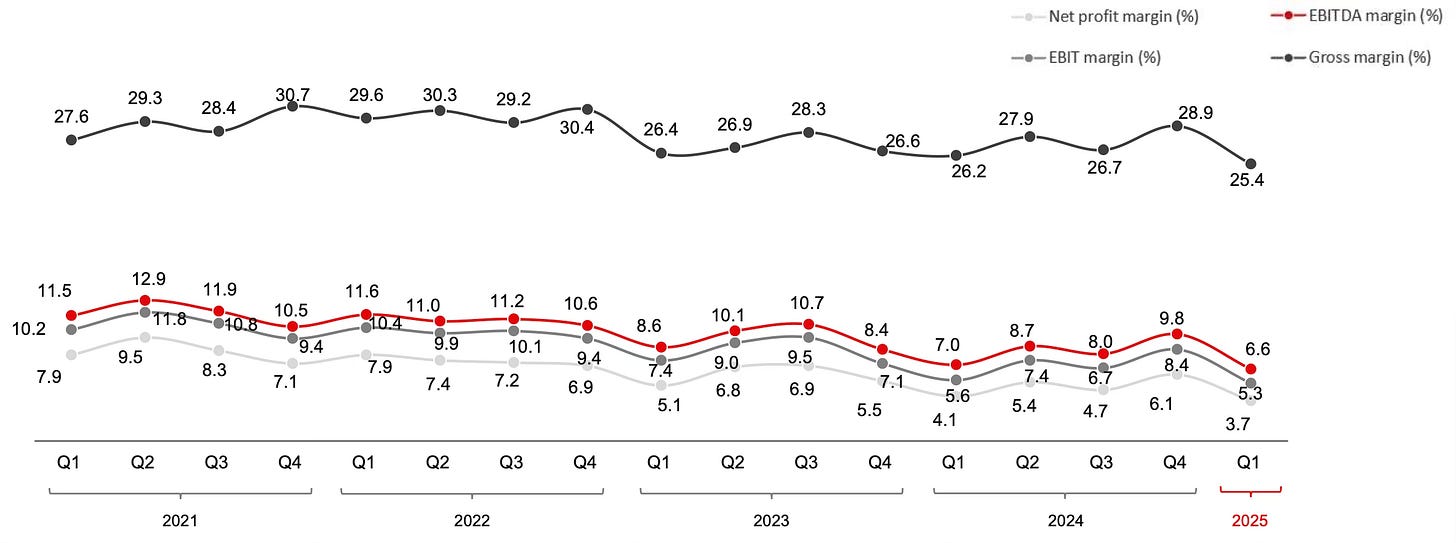

Gross margin declined to 25.4% in Q1 2025, compared to 26.2% in Q1 2024 and 28.9% in Q4 2024. This represents a record low, with margins steadily deteriorating since peaking above 30% at the end of 2021.

Management attributed the decline to the weakened EUR/PLN exchange rate, which reduced the value of euro-denominated sales when converted into PLN. Additionally, deflation meant goods purchased last year were sold at lower prices, further compressing margins.

Operating Margin

Operating margin also fell, echoing the gross margin trend. It dropped to 5.3% in Q1 2025, down from 5.6% in Q1 2024 and 8.4% in Q4 2024.

This margin pressure was primarily driven by sharp increases in the minimum wage: up 20% in 2024 and another 8.5% in January 2025. These hikes raised salary expectations for a large portion of employees and pushed up external service costs. Management noted that Q1 margin was further impacted by the absorption of lease and training costs related to the new Zgorzelec hub, which is not expected to be operational until late 2025 at the earliest.

To counteract these rising costs, the company halted workforce expansion at the beginning of 2024. In fact, headcount declined by 3% in Q1 2025. This raises an important question: Has revenue growth slowed because headcount hasn’t grown, or has headcount been cut because revenue isn’t growing as fast anymore?

One likely driver of the hiring freeze is the 17% rise in cost per FTE in 2024, followed by another 8% increase in Q1 2025, bringing the average to PLN 8,400. These increases align closely with the minimum wage hikes. Looking ahead, cost pressures are set to continue, with the Polish government proposing a further 3% increase from January 2026.

Cash Flow Analysis

Operating cash flow dropped to PLN 106 million in Q1 2025, down from PLN 151 million in Q1 2024. This decline was driven by increased working capital needs, especially in inventory. While closing inventory rose 18% YoY, inventory turnover worsened from 127 days at the end of Q1 2024 to 132 days in Q1 2025, meaning more cash is tied up in stock.

Guidance

Auto Partner doesn’t provide formal guidance but does release monthly sales updates. Preliminary revenue for Q2 2025 was PLN 1,140 million, indicating further growth deceleration to 7% YoY.

Why I Sold

I’ve held Auto Partner shares since November 2023, adding a couple of times, most recently in September 2024. My average cost basis was PLN 22.90, resulting in a 8% loss on the overall position. Over the same period, the market returned 43%.

My original thesis was based on three expectations:

Sustained high-teens revenue growth for the next 3 to 5 years

Stable or improving margins with operating leverage

Efficient scaling through existing infrastructure

However, several developments have since undermined this thesis:

1. Revenue Growth Stagnation

Management cited the new distribution center and export strategy as reasons for soft growth, but this doesn’t explain why both domestic and export growth have stalled. Explanations like deflation and currency effects were vague. Management’s 2023 target of 20% revenue growth has not been met. Given the broader inflationary backdrop, I find it counterintuitive that auto parts prices are falling while other input costs are rising.

2. Realization of Over-Earning

It’s now clear that 2021 and 2022 were outlier years, boosted by inflation. The company benefited from selling older, lower-cost inventory at higher prices, inflating margins. That tailwind has vanished.

3. Margin Compression Due to Wage Inflation

The company is more labor-intensive than I anticipated. Costs per FTE have jumped 23% in just 15 months. Staff reductions may offer temporary relief, but are unlikely to be a long-term solution if the company intends to grow.

4. Low Margin Sensitivity

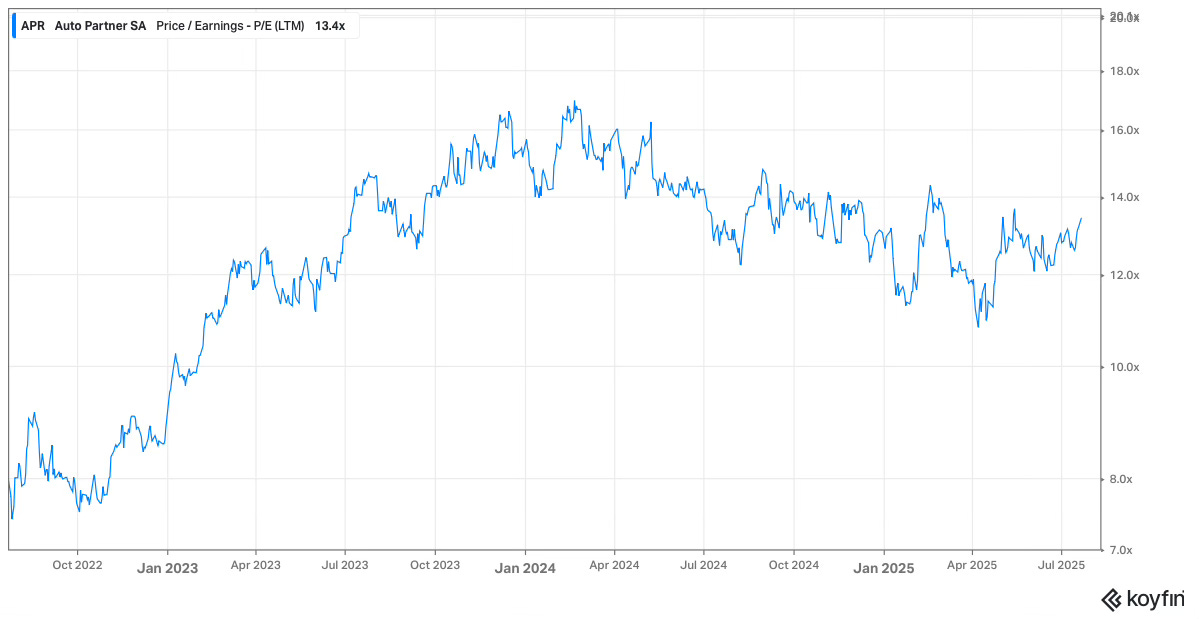

This is a low-margin business, so even minor contractions are significant. For example, while net income margins falling from 25% to 23% might be minor for a high-margin company, a drop from 7% to 5% here was material. Despite a 45% revenue increase between 2022 to 2024, net income remained flat due to this margin squeeze. Today, the stock trades at a similar earnings multiple to when I first bought it, despite weaker margins and lower future growth expectations. Theoretically, these factors should warrant a lower multiple, all else being equal.

5. Insufficient Management Communication

The company only holds two earnings calls per year, and they aren’t recorded. As an active participant, I’ve found this increasingly problematic. If I miss a call, I lose timely access to management’s insights during uncertain periods.

Conclusion

The underlying fundamentals have deteriorated to the point that I no longer believe Auto Partner can meet the expectations of my original investment thesis. I can’t say with any degree of certainty that the company will return to high-teens revenue growth or restore net income margins to 2021’s 8% level.

I now believe that what we’re seeing is a reversion to the mean. Holding onto the company despite this shift would require thesis creep, something I’ve been actively reflecting on, not just with Auto Partner, but across my entire portfolio.

I would consider reentering the stock if revenue growth decisively reaccelerates to the mid-teens and there is clear evidence of renewed operating leverage, potentially driven by a successful ramp-up of the new distribution centre. However, I do not expect either of these catalysts to materialize before mid-2026. Given this uncertainty, I believe there are better opportunities to deploy capital elsewhere.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Your original thesis didn't prove to be correct. The important thing is that you realised that, sold and moved on. It happens. No big deal when your winners are big.

The market wants uninterrupted growth. This is what creates a lot of opportunity.

5 year cagr of 15% steady: PE of 35

5 year cagr of 15% front loaded first 3 years: PE of 8

(just some random numbers, but probably not too far from what usually happens)

The question is always only one of course: what about the next 5-10 years. I still think the price vs potential is very solid in this (don't actually own it, had thought for a while but too many opportunities out there)