This week, I sold my entire position in Texas Instruments (TXN), a 2.5% weight in the portfolio and a stock I’ve held for over three years since building the position in Q3 2022. I locked in a 22% gain including dividends. Thats an annualised return of 6.4%, well above the risk free rate of return. By the most basic measure of investing success, I followed Warren Buffett’s Rule Number 1: don’t lose money.

While I achieved a profit in absolute terms, TXN underperformed the S&P 500 by roughly 60% during my holding period. In a portfolio management context, it was a drag on performance and an opportunity cost.

As I work to consolidate my portfolio to a maximum of 15 high-conviction positions, TXN emerged as an obvious candidate for exit. More importantly, as I reflected on the Investment Philosophy I recently articulated, it became clear that this position falls outside the framework that should guide my capital allocation decisions.

The Original Thesis

When I initiated my position in Q3 2022, the decision seemed straightforward. I had no exposure to the semiconductor industry, a critical sector in the modern economy. TXN, with its leadership in analog and embedded processing chips, appeared to offer a way to gain that exposure through a quality business.

The valuation seemed compelling: TXN traded at roughly 18 times forward earnings. For a company with TXN’s market position and reputation for operational excellence, that multiple looked reasonable, particularly during a broader market selloff.

But here’s where my analysis fell short: that forward earnings multiple was not a true representation of the business’s normalised earning power. The cyclical nature of the semiconductor industry meant I was looking at a temporary snapshot, not a reliable baseline. I thought I was buying quality at a discount. In reality, I was buying cyclicality at what turned out to be an inflated earnings base.

Being Early Is the Same as Being Wrong

One of the core assumptions in my thesis was that I was buying near the trough of TXN’s cycle. The semiconductor industry had begun showing signs of inventory corrections and demand softness. My intention was to position for the recovery, benefiting from the eventual upturn while collecting a reasonable dividend in the meantime.

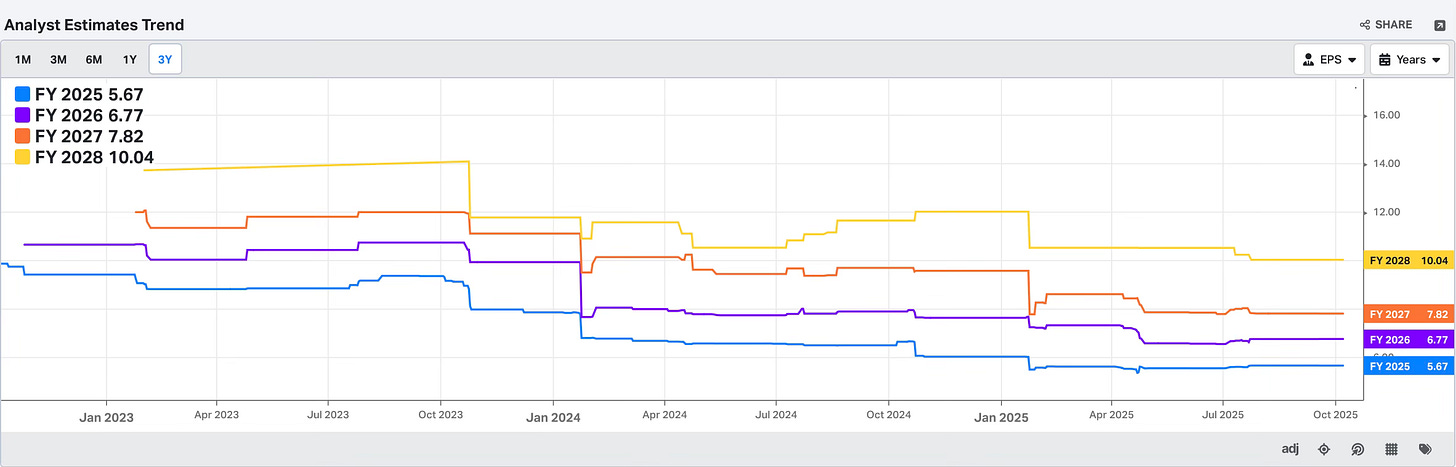

The problem? That trough has lasted far longer than I anticipated. The downcycle has been deeper and more prolonged than my initial analysis (and Wall Street analysts) suggested. In the subsequent years, TXN’s EPS declined by 25% in 2023 and 26% in 2024.

In investing, being early looks identical to being wrong, at least in terms of portfolio performance. The opportunity cost of capital sitting in a position that goes sideways, or worse, declines, while the broader market advances is very real.

This experience reinforces a lesson every investor eventually learns the hard way: cyclical industries are extraordinarily difficult to time. Even with a solid grasp of business fundamentals, predicting the inflection point requires near-perfect foresight of macroeconomic conditions, supply chain inventory dynamics, and end-market demand across multiple sectors.

The Slow Compounder That Wasn’t Predictable Enough

My initial vision for TXN was that it would serve as a steady compounder, a business that might not deliver explosive growth but would generate consistent double-digit returns through a combination of modest growth, margin expansion, and shareholder returns.

The challenge is that this characterisation doesn’t align with reality. While TXN has strong advantages in analog chips and a record of solid execution, the inherent cyclicality of its business makes it far less predictable than a true compounder should be.

Consider Visa, another holding that plays a similar “steady compounder” role in my portfolio. Visa currently trades at around 28 times forward earnings, while TXN trades near 30 times. On the surface, valuations look similar. But the critical difference lies in earnings predictability.

Visa’s model, taking a small percentage of payment transactions, is remarkably stable and predictable. I can forecast Visa’s earnings several years out with reasonable confidence because consumer spending, while cyclical, is far more consistent than semiconductor demand.

TXN, by contrast, serves markets including industrial, automotive, personal electronics, enterprise systems, and communications equipment, all subject to inventory cycles, capital expenditure swings, and economic sensitivity. When I try to forecast TXN’s earnings three to five years out, the error bars are dramatically wider. Given that uncertainty, does it make sense to pay a similar multiple to a business like Visa? I’ve concluded that it doesn’t.

Outside My Investment Philosophy

In my recent article outlining my investment philosophy, I emphasised several core principles:

1. Understanding the business comes first.

Every investment should begin with deep research into the business model, revenue and margin drivers, competitive advantages, and key risks. While I understood TXN’s business at a high level, I underestimated how the cyclicality would dominate other considerations.

2. Platform businesses with structural advantages.

The most compelling long-term opportunities tend to operate as platforms or ecosystems, benefiting from network effects, switching costs, and large under-penetrated markets. TXN doesn’t fit this profile. While it has advantages in analog chips, it’s not a platform business with winner-take-most dynamics.

3. Long-term mindset with conviction.

My edge lies in holding through volatility when the long-term thesis remains intact. But with TXN, my conviction eroded rather than strengthened.

The consolidation of my portfolio to 15 positions isn’t just about reducing position count, it’s about ensuring every holding represents a business I truly understand, believe in, and can hold through volatility. TXN no longer meets that standard.

Why ASML Stays While TXN Goes

Some readers might wonder: if you’re exiting TXN due to semiconductor cyclicality, why continue holding ASML?

The answer lies in the quality and uniqueness of ASML’s business model. ASML holds a complete monopoly on Extreme Ultraviolet (EUV) lithography machines, essential for manufacturing the most advanced semiconductor nodes. Every leading-edge chipmaker, TSMC, Samsung, and Intel, depends on ASML’s machines.

This monopoly means that while ASML’s revenue fluctuates with semiconductor capital expenditure cycles, its market share and pricing power remain unassailable. The company essentially serves as a toll gate for advanced chip manufacturing.

TXN, though in a strong position, doesn’t have this degree of competitive insulation. It competes across markets with players like Analog Devices, and its profitability depends on whether customers choose TXN’s chips over others.

Quality matters enormously in investing. While both businesses are cyclical, ASML’s structural position is simply superior, which justifies maintaining exposure despite volatility.

Key Lessons

Every investment, whether successful or not, offers lessons. Here’s what I’m taking away from TXN:

Cyclical industries are exceptionally hard to value and time.

The margin for error is thin, and being early costs real money. The market doesn’t reward patience if the opportunity cost is high.

Predictability is worth paying for.

A business that generates consistent, visible earnings can be more valuable than higher but volatile returns.

Investment philosophy should be a filter.

Writing down your investment principles is only valuable if you use them. When a position no longer fits, acknowledging that reality is the disciplined choice.

Final Thoughts

Selling TXN wasn’t a decision I made lightly. Three years of holding creates a certain attachment, even when the analytical case weakens. But discipline in investing means making decisions based on current facts and forward-looking analysis, not sunk costs or emotion.

My understanding of what belongs in the portfolio has evolved, and my investment philosophy has become more defined. Articulating why TXN no longer fits has strengthened my conviction in the framework I’m applying.

For those building their own portfolios, periodically evaluate whether each position still aligns with your philosophy. Markets evolve, businesses evolve, and your own understanding deepens. What made sense three years ago may not today. The key is having the intellectual honesty to recognise it and the discipline to act on it.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

This was an intriguing read. Personally I believe TXN's competitive ROIC indicates that its CAPEX will be put to good use and that its current downcycle has been overstated by investors. Frontloading their CAPEX, to me, is a strategic move by management. I will continue holding this in my personal portfolio and maintain faith that future earnings will reflect their competitive advantages.

I've made the same decision a while ago and luckily got out over $200. It's s great business but needs to reinvest massively right now for future growth. That's a painful transition during a downtown. It's also just not cheap enough for what they'll be able to deliver.