Executive Summary

Adyen reported Processed Volume of €620 billion in H2 2023, marking a 45% year-over-year growth, the fastest since H1 2022. Over the past five years, Adyen has achieved a compound annual growth rate of 43% in Processed Volume. The take rate decreased to 14.7 basis points in H1 2024, down from 16.3 bps in H2 2023 and 17.3 bps in H1 2023. This decline is attributed to changes in the merchant mix and Adyen’s tiered pricing strategy, which aims to extract more value from customers via its land-and-expand model.

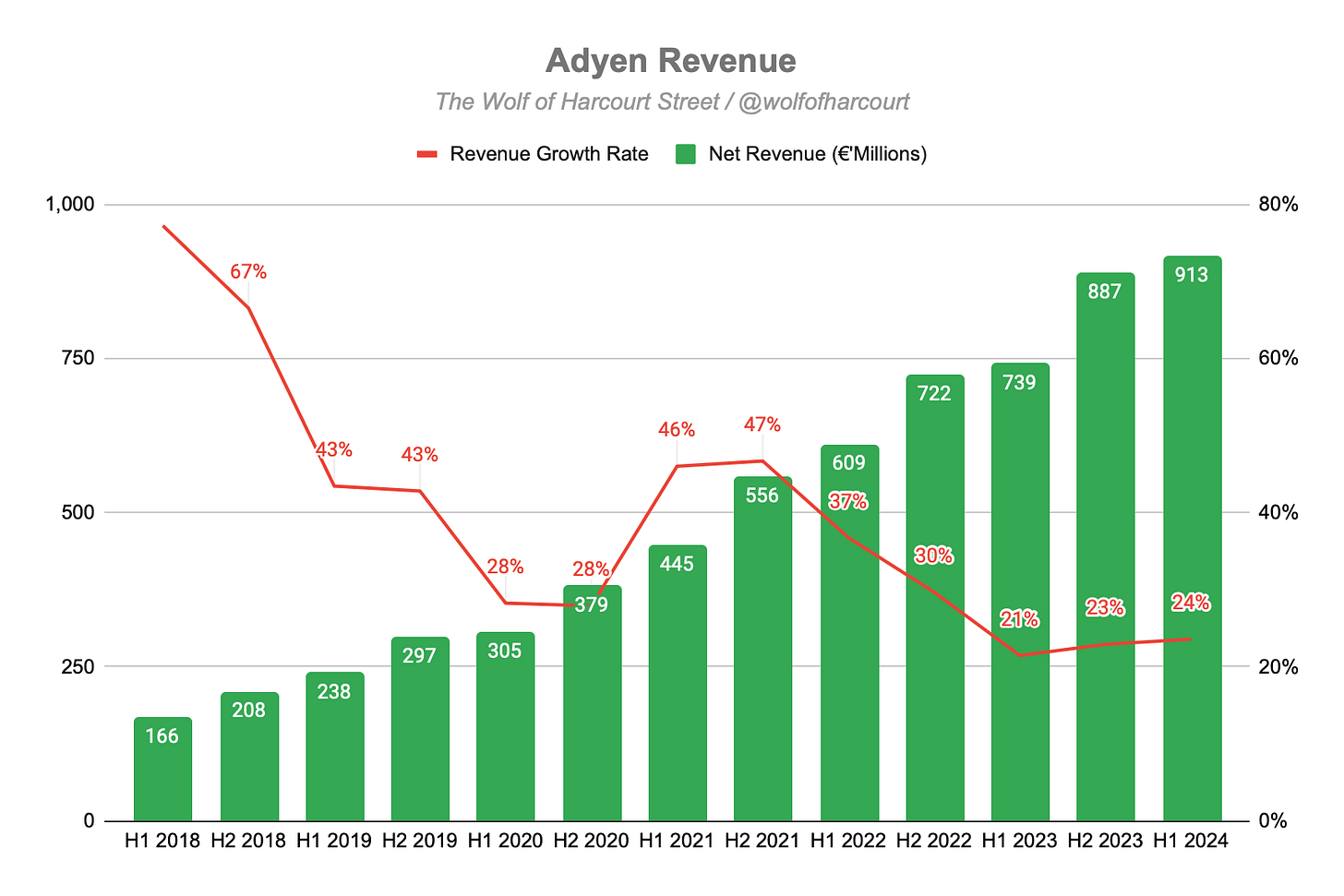

Adyen's net revenue reached €913 million, marking a 24% year-over-year increase and representing the second consecutive period of accelerated growth. This growth was primarily driven by existing customers as Adyen expanded its share of wallet and secured new business. The revenue distribution remained consistent, with EMEA contributing the largest share (57%), followed by North America (27%), Asia-Pacific (11%), and Latin America (6%). North America led in regional growth with a 30% increase year-over-year, while EMEA grew by 25%, Asia-Pacific by 15%, and Latin America by 2%.

Operating income increased by 34% year-over-year to €374 million, with an improvement in the operating margin from 38% to 41%. Operating expenses saw a rise, primarily due to a 22% increase in employee benefits as Adyen expanded its global workforce by 9% YoY. However, the overall recruitment pace in 2024 is slower than in previous years, aligning with a counter-cyclical hiring strategy. This strategy emphasizes maintaining a unique company culture and high standards without setting strict hiring targets or quotas.

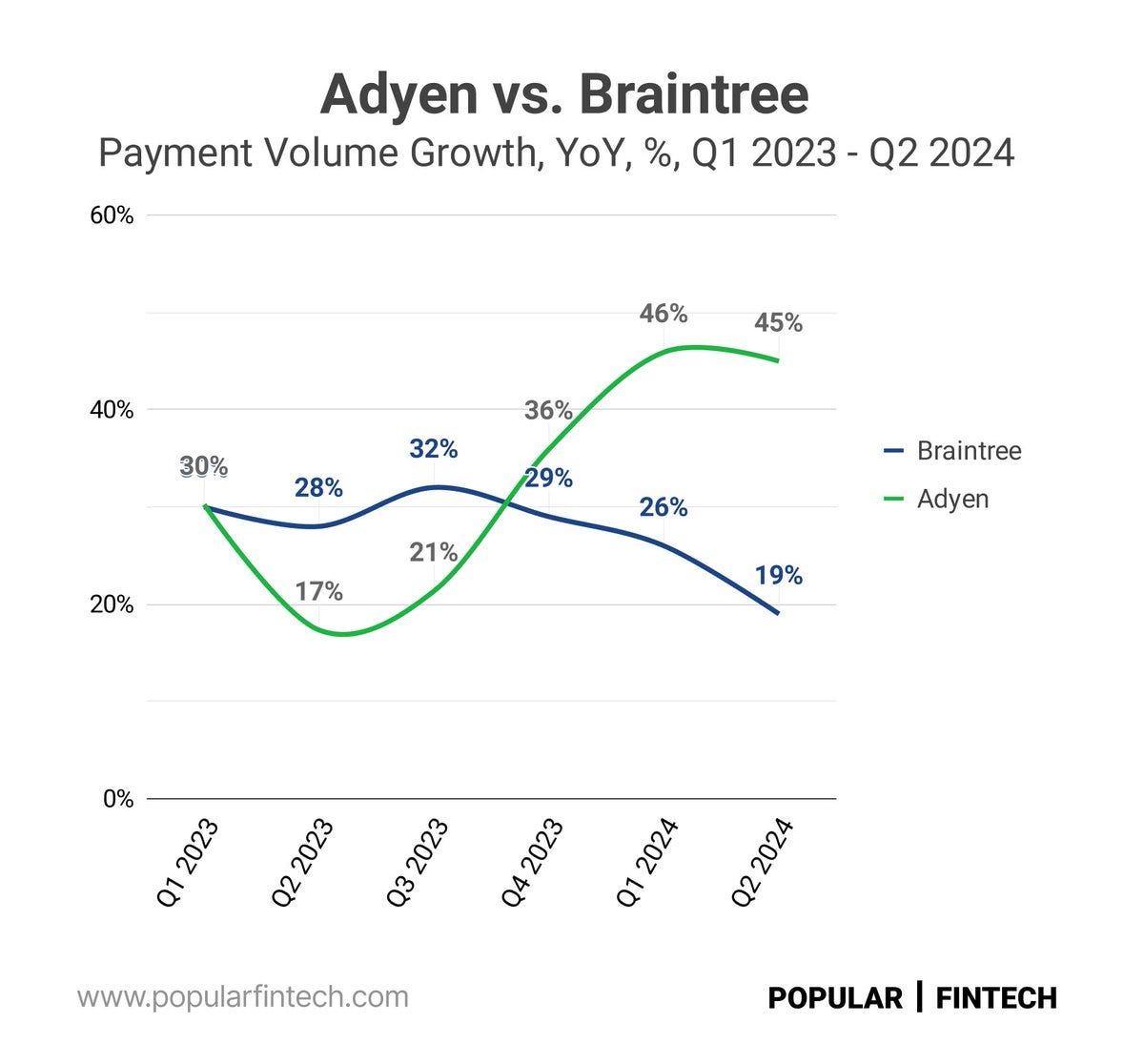

Adyen has demonstrated strong performance, particularly in North America, where it is rapidly gaining market share and surpassing expectations. This growth has come partly at the expense of competitors like PayPal's Braintree, which struggled after aggressive price cuts failed to maintain profitability. Adyen's strategy of focusing on value rather than competing on price has been key to its success. By showing how its services can reduce the total cost of ownership for customers, Adyen has justified charging premium prices. This value-driven approach, especially in areas like debit routing, has led to significant increases in transaction volumes, reinforcing its market position.

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: €913 million +24% year-over-year (YoY)

Operating Income: €374 million +34% YoY

Net Income: €410 million +45% YoY

2. Wall Street Expectations

Revenue: €913 million (in line).

EBITDA: €411 million (beat by 3%)

3. Business Activity

Processed Volume

Adyen reported Processed Volume (PV) of €620 billion in H2 2023, reflecting accelerated growth of 45% YoY, the fastest growth since H1 2022. Adyen has compounded PV at a CAGR of 43% over the past five years.

Digital Segment: The largest contributor, particularly strong in North America, processed €400 billion (65% of total volume) with 50% YoY growth.

Unified Commerce: Processed €141 billion (23% of total volume) with a 29% YoY growth, showing a diverse industry base.

Platforms: The fastest-growing segment, processed €79 billion (13% of total volume) with a 59% YoY growth. Excluding eBay, growth was 91% YoY.

Point-of-Sale: Processed €96 billion (15% of total volume) with a 43% YoY growth, highlighting the rapid evolution of in-person payment solutions.

Full-Stack Volumes: Accounted for 82% of total processed volumes, up from 79% in H1 2023, reflecting Adyen's strategy to enhance customer value through its full-stack capabilities.

Take Rate

Adyen’s take rate decreased to 14.7 basis points in H1 2024, down from 16.3 bps in H2 2023 and 17.3 bps in H1 2023. The decrease is mainly due to changes in the merchant mix and is a natural outcome of Adyen’s tiered pricing model, which extracts more value from its customers through its land-and-expand business model.

4. Financial Analysis

Revenue

Adyen's net revenue reached €913 million, a 24% increase YoY and the second consecutive period of accelerated growth. Most revenue growth was driven by existing customers, with Adyen expanding its share of wallet and winning new business.

Adyen’s tiered pricing model focuses on customer growth, which explains why the 45% increase in processed volumes didn't directly translate to the same level of revenue growth. Adyen has achieved a five-year compounded annual growth rate (CAGR) of 31% in net revenue.

Net revenue distribution remained stable YoY, with EMEA contributing the most (57%), followed by North America (27%), Asia-Pacific (11%), and Latin America (6%).

North America led growth at 30% YoY, with EMEA growing 25%, Asia-Pacific 15%, and Latin America 2%. Despite strong growth, Adyen still holds a single-digit market share in EMEA and North America, indicating significant potential for expansion in these regions as the company continues to steal market share from the incumbents.

Management sees significant opportunities in both established and emerging markets. Their global acquiring capabilities expanded with new licenses in India and Mexico, emphasising their strategy to build and control their platform in-house, ensuring high reliability, scalability, and minimal third-party dependencies. This is the Adyen advantage in a nut shell.

Operating Margin

Operating income increased by 34% YoY to €374 million, with the operating margin improving from 38% to 41%. The main component of operating expenses, employee benefits, increased 22% to €348 million. This reflects the ongoing investment in team expansion and maintaining high talent standards. Additionally, IT costs grew by 19% to €22 million, mainly due to data centre expenses and IT equipment investments.

Adyen continued to expand its global team in the first half of the year with FTE increasing 9% YoY. Most of these hires are in North America, focused on tech and commercial roles. While hiring in 2024 is concentrated in the second half of the year, the overall recruitment is lower compared to the previous two years of rapid growth during which the overall headcount doubled.

Another unique aspect of Adyen is its strong commitment to preserving the company's culture while maintaining high standards for both new and existing employees. The company doesn't set hiring targets or fill roles just to meet quotas. Adyen’s counter-cyclical hiring strategy exemplifies this approach. In 2020 and 2021, when most technology firms were rapidly expanding their workforce, Adyen held off to avoid overpaying. Then, in 2022 and 2023, when those firms were initiating layoffs, Adyen ramped up hiring. Zig when others zag.

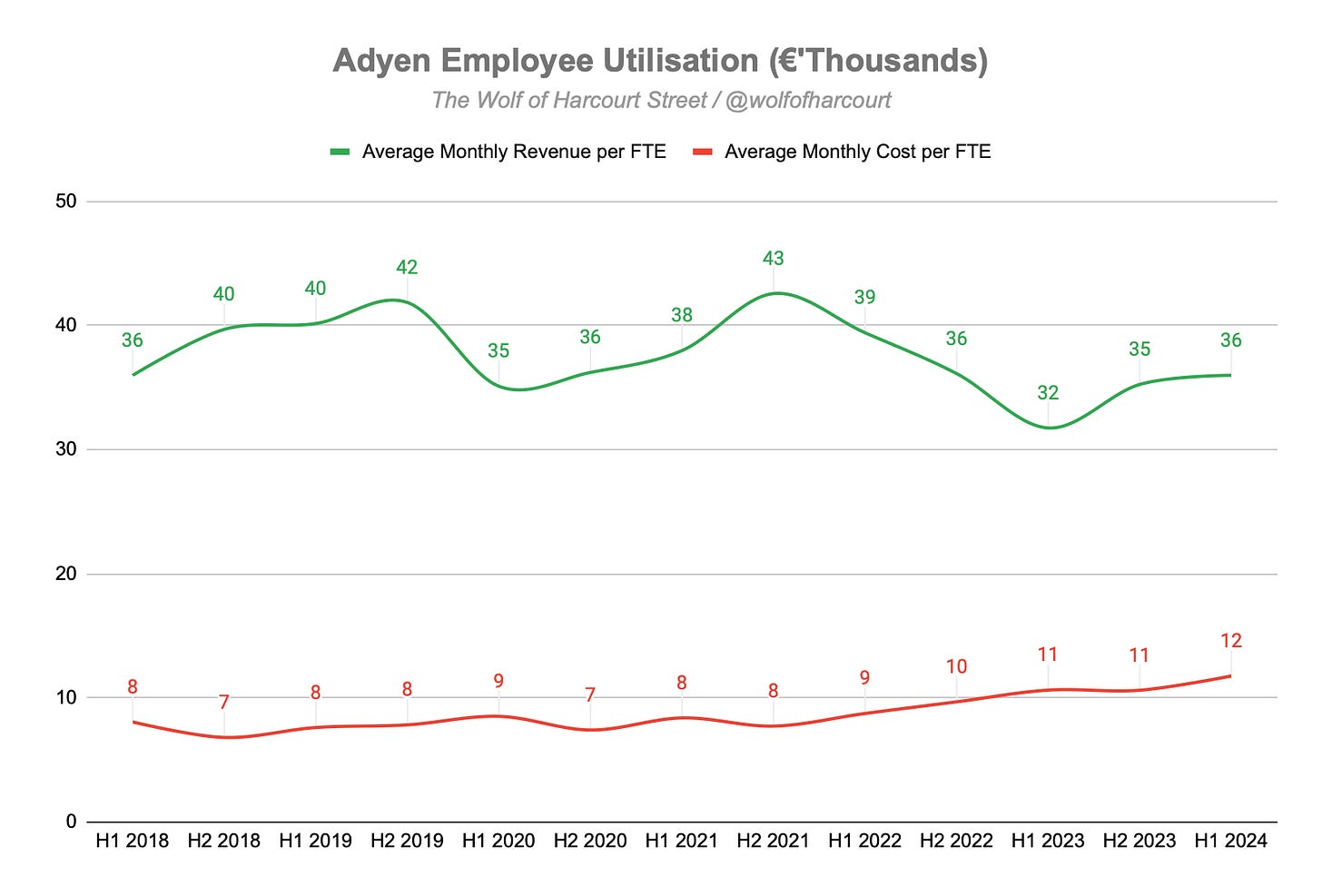

The period of rapid hiring caused the average monthly revenue per FTE to fall to €32k in H1 2023, as new hires required time and training to gradually get up to speed. Over the past year, we have seen this metric increase, reaching €36k in H1 2024. Conversely, the average monthly cost per FTE has been gradually rising over the past couple of years, primarily because most of the FTE growth occurred in North America, where the cost of talent is higher compared to Europe.

EBITDA

EBITDA increased by 32% YoY, reaching €423 million in H1 2024, up from €320 million in H1 2023. The EBITDA margin also improved from 43% to 46%. The margin expansion is attributed to operating leverage, which is due to a reduced pace in hiring and fewer one-off operational expenses.

Net Income

Net income rose by 45% YoY, totalling €410 million. An additional driver of this increase was finance income which nearly doubled from €93 million to €177 million. This increase is due to a higher interest rate environment and an increase in average deposits held in central banks and other banks.

Cash Flow Analysis

Adyen reported free cash flow of €361 million, marking a 46% increase compared to the previous year, with a free cash flow conversion ratio of 85%. Capital expenditures (CapEx) were €42 million, representing 4.6% of net revenue, down from 7.6% in the same period last year. The company aims to keep CapEx at or below 5% of net revenue going forward.

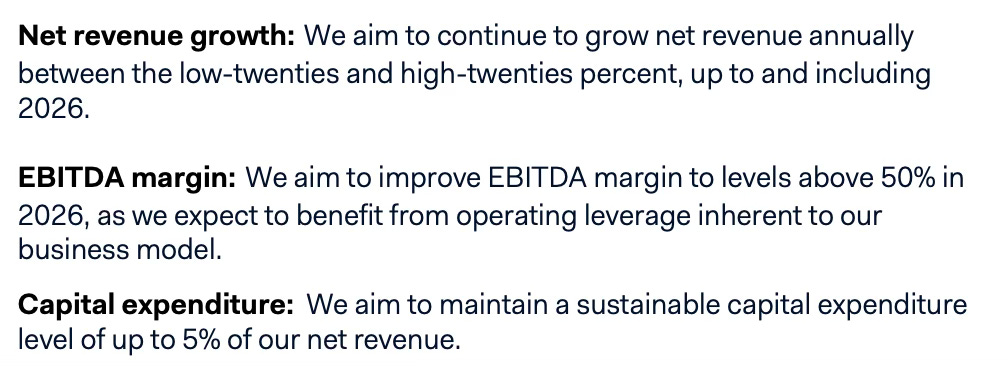

5. Guidance

Management once again reported no significant business developments in the first half of 2024 that would prompt a change in its guidance. Therefore, the established financial objectives, including achieving net revenue growth in the low to high twenties percent until 2026, improving EBITDA margin to above 50% in 2026, and maintaining a sustainable capital expenditure level of up to 5% of net revenue, remain unchanged.

6. Conclusion

The report highlights Adyen's impressive performance, with accelerated volume growth, particularly in North America, indicating it is rapidly gaining market share, outpacing expectations. This growth is largely at the expense of competitors like PayPal, specifically its Braintree unit, which has lost ground after aggressively cutting prices to gain volume but failing to sustain profitability.

Of course, also there are competitive dynamics. If you look at last year, we heard some noise around other competitors being very aggressive on price. We always kept focusing on value, and I think that starts to pay off.

Ingo Uytdehaage, Co-CEO

Credit to Popular Fintech for this chart.

Adyen's strategy focuses on value over price competition. Despite being a low-cost operator, Adyen charges premium prices by demonstrating how its services reduce the total cost of ownership for customers. This approach has resonated well with digital customers, especially in North America in the first half of the year. The company’s success in areas like debit routing has reinforced its position in the market, reflecting in increased transaction volumes.

And I think we have very successfully showed what we can do, for instance, with debit routing how we can help them to lower the total cost of ownership. And that's what you see reflected in increased volumes in the U.S.”

Ingo Uytdehaage, Co-CEO

It has been almost a year since I released the initial Adyen investment thesis in September 2023, and it has performed extremely well, returning 84% to date. At that time, market expectations were low as analysts focused on a single report rather than the company's long-term strategy and execution. Since then, Adyen's execution has been superb, and shareholders have been handsomely rewarded. I remain confident that finding good businesses with low expectations can lead to outsized returns.

The full Adyen investment thesis is linked below for new subscribers or anyone that missed it.

Rating: 4 out of 5 Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

What is the point of the cash on the balance sheet? Can you expect a special dividend or a buyback if the valuation drops?