MercadoLibre: 2024 Financial Model and Valuation Update

What is the fair value of MercadoLibre?

Twelve months ago, I released my initial investment thesis for MercadoLibre (MELI), providing a comprehensive analysis of the business, including a 5-year projected P&L and discounted cash flow valuation. At that time, my analysis indicated that the company was trading 39% below its fair value, and since the report's publication, the stock has returned 25%. The full report is linked below.

In this update, I present a revised financial model and a fair value assessment. The starting point for this analysis will be the 2023 financial results. I have already shared a detailed Q4 2023 earnings analysis, which can be accessed via the link below.

Discounted Cash Flow Analysis

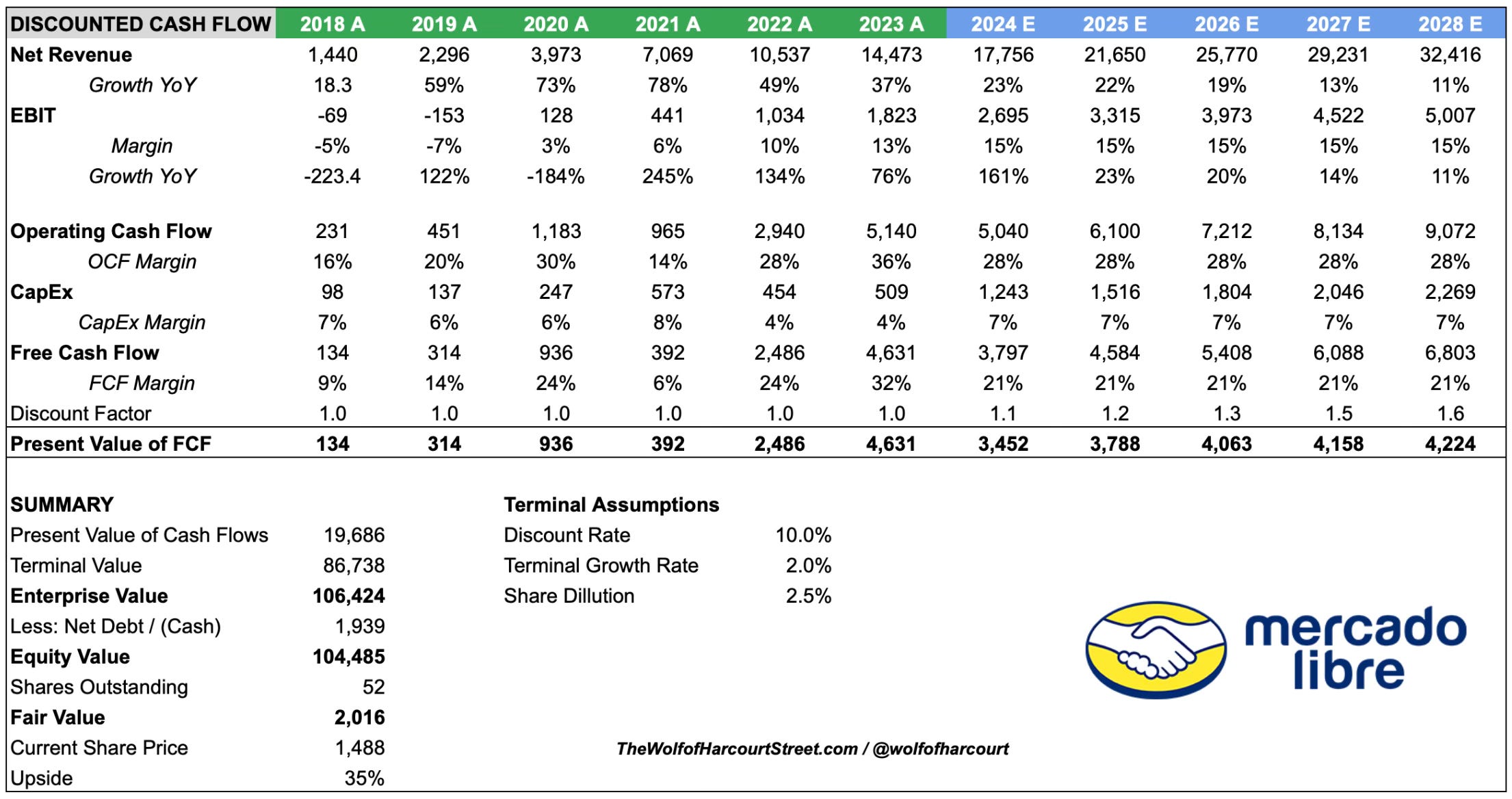

Future cash flows have been projected over five years using a discount rate of 10%. A terminal growth rate of 2% has been assumed, which is at the lower end of the range, given the region that MELI operates in, where there are inherently more geopolitical risks than in other developed markets.

A revenue CAGR of 18% is projected from 2023 to 2028. Research from Payments and Commerce Market Intelligence indicates that Latin America e-commerce volume will reach $903 billion, representing a CAGR of 22% between 2023 and 2026. In 2023, MELI reported revenue growth of 37% compared to the consensus estimate of 23%. Between 2018 and 2023, MELI’s revenue grew at a CAGR of 59%.

The EBIT margin has been forecasted to be 15% between 2024 and 2028. In 2023, MELI reported an EBIT margin of 13% compared to 11% that I assumed in my previous analysis. It is also worth noting that without the one-off tax expenses experienced in Q4, MELI would have achieved an EBIT margin of 15%. I did not expect MELI to achieve higher levels of operating leverage this early and have revised my estimates upwards in line with this performance. MELI has done an exceptional job of expanding the business and diluting fixed costs, while at the same time, continuing to invest in growth opportunities.

In 2023, MELI achieved an operating cash flow (OCF) margin of 36%. Similar to before, I have normalized the 2023 figure to account for the reduction due to provision for doubtful debts - NPLs greater than 90 days. Excluding the provision for doubtful debts ($1 billion), MELI would have achieved an OCF margin of 28% in 2023, which is what I have assumed as the starting point for 2024 and the entire forecast period.

MELI’s Capital Expenditure (CapEx) margin over the past two years has been 4%. However, over the past six years, the average CapEx margin has been 6%. For the purposes of this analysis, I have assumed a CapEx margin of 7% over the entire forecast period. It is worth noting that most of the logistics spend by MELI is treated as operating expenditure (OpEx) rather than Capex so it flows through the Income Statement. MELI recently announced a significant investment into Mexico which should be funded through a combination of OpEx and CapEx.

The average dilution over the past three years has been 0.5% per year. I have assumed this trend will continue resulting in a total dilution of 2.5%.

Based on these assumptions, the fair value of MELI is approximately $2,016 per share, indicating a potential upside of 35% compared to the share price on April 4, 2024, which was $1,488.

Conclusion

As regular subscribers will be aware, I use conservative assumptions to provide the necessary margin of safety. The revenue CAGR assumption is slightly less than the expected Latin America market CAGR. It is probable that MELI will at least grow in parallel with the overall market.

The EBIT margin projection assumes no further operating leverage based on the adjusted 2023 EBIT margin. MELI has improved its EBIT margin in each of the last four years, from -7% in 2019 to 13% in 2023. It is probable that MELI can continue to demonstrate operating leverage.

The FCF projection assumes an OCF margin adjusted for the impact of the provision for doubtful debts, as well as a CapEx margin higher than that of the previous two years and the six-year average.

Based on MELI’s proven track record of flawless execution and future prospects, the DCF analysis suggests that the market's growth assumptions are far too conservative based on the current valuation. MELI presents an attractive asymmetric risk vs reward opportunity.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Hello. I see you expect the FCF of 2024 to be 3797. However the LTM FCF after the H1 2024 results is already 5628. Does that make you rethink your estimations for the FCF in the coming years? Or do you think that the 5628 LTM FCF is somehow special and won't be replicated in the coming years?

Really nice piece of analysis. Thanks for sharing!