Executive Summary

MercadoLibre Marketplace reported GMV of $11.4 billion, growth of 20% YoY. Brazil and Mexico both achieved robust FX-neutral GMV growth of 30% YoY, reflecting solid market performance. In contrast, Argentina's FX-neutral GMV growth was below the country's inflation rate, due to a decline in items sold and slower growth in average selling prices.

Mercado Envíos shipments delivered on the same or next day grew by 16% YoY, with same-day shipments slightly outpacing next-day shipments. The MELI Delivery Day initiative, which allows buyers to consolidate shipments for delivery on one day, surpassed management's expectations. It offers compelling shipping benefits to loyalty program members and enhances customer control and convenience.

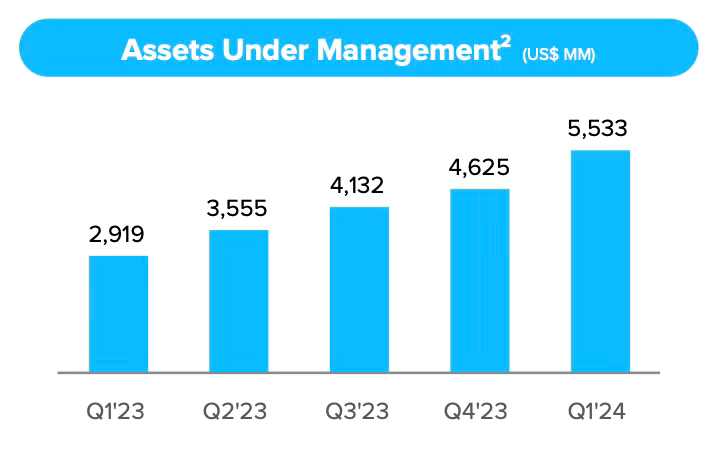

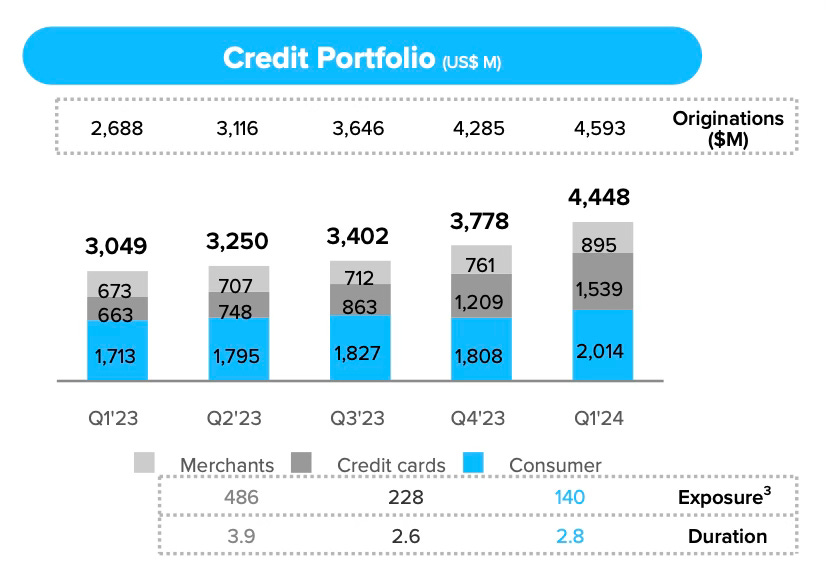

Mercado Pago saw a substantial increase in monthly active users reaching 49 million, reflecting a YoY growth rate of 38% and higher user retention rates. AUM grew by 90% YoY, led by Brazil and Mexico doubling their AUM, while Argentina achieved 64% growth despite currency devaluation. The launch of Conta Turbinada in Brazil enhanced AUM growth and boosted Mercado Pago's NPS in the country. Mercado Crédito experienced strong growth, with originations up 71% YoY and a portfolio of $4.4 billion at the end of the quarter, up 46% YoY. Credit cards play a key role in expanding the platform's reach, while cross-selling to merchants continues to enhance overall business performance.

Reporting updates, including the reclassification of Mercado Pago interest lines and changes to Mercado Envios' role, should be considered when reviewing the financial results. One such example is net revenue, which reached $4.33 billion—a 36% year-over-year increase but 30% when excluding reporting updates. While reported gross profit and operating margins experienced declines due to reporting changes, the underlying performance showed improvement. Concerns from Q4 2023 regarding one-off expenses have been addressed and did not present a long-term issue.

Contents

Financial Highlights

Wall Street Expectations

MercadoLibre Marketplace

Mercado Envíos

Mercado Pago

Mercado Credito

Financial Analysis

Conclusion

1. Financial Highlights

Revenue: $4.33 billion +36% year-over-year (YoY)

Operating Income: $528 million +26% YoY

Net Income: $334 million +71% YoY

Earnings per Share: 6.78

2. Wall Street Expectations

Revenue: $3.87 billion (beat by 12%)

Earnings per Share: 5.95 (beat by 14%)

3. MercadoLibre Marketplace

MercadoLibre (MELI) reported a Gross Merchandise Volume (GMV) of $11.4 billion, representing growth of 20% YoY. Both Brazil and Mexico posted robust YoY FX-neutral GMV growth of 30%, demonstrating solid market performance and resilience even against high comparison bases. In Argentina, FX-neutral GMV growth was below the country's inflation rate. This was attributed to a decline in items sold YoY and growth in Average Selling Prices (ASPs) that failed to keep pace with inflation due to shifts in category mix and consumer behaviour.

MELI’s consistent investment in technology has resulted in a world-class user experience and a leading e-commerce value proposition. Competitive Net Promoter Scores (NPS) reached record levels in Q1 2024, demonstrating strong customer satisfaction and loyalty. Record retention levels after six, nine, and twelve months from 2023 cohorts indicate successful customer acquisition and engagement strategies.

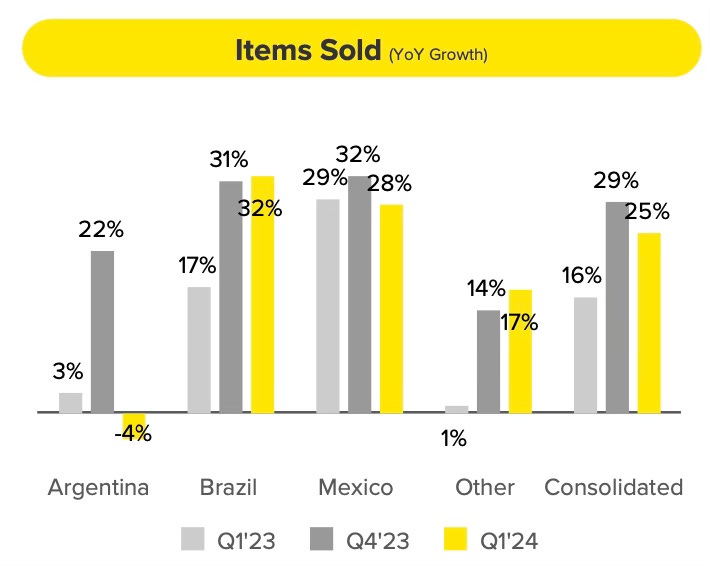

Items sold by MELI grew by 25% YoY, with the company selling 385 million items in Q1. This marks an increase of 76 million items compared to the same period the previous year. In Brazil, items sold grew by 32% YoY, marking the fastest pace of growth since Q4 2021. Chile also experienced its fastest growth rate since Q4 2021, showcasing strong performance in these markets. Items sold in Argentina decreased by 4% YoY due to a challenging macroeconomic environment following the devaluation of the Argentine Peso in December 2023.

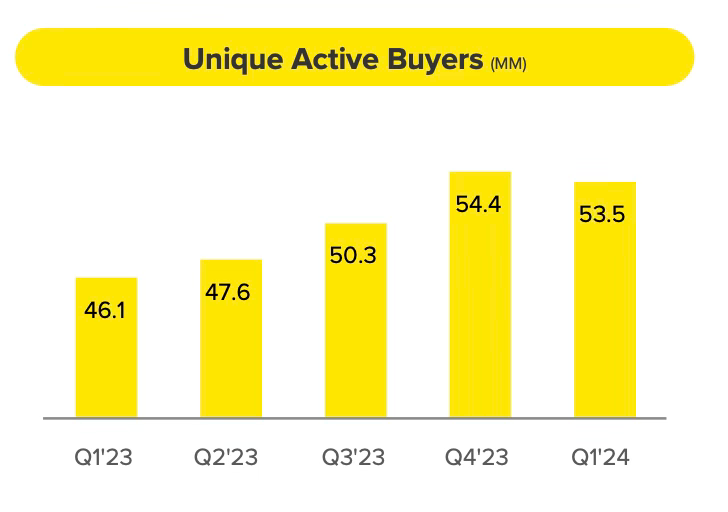

Unique buyers grew by 16% YoY overall, consistent with prior quarters. Brazil saw 18% YoY growth, while Mexico experienced a notable increase of 25% YoY, matching the trends from Q4 2023. However, Argentina's growth rate slowed to just 1.5% YoY.

The number of items sold per buyer increased by 7% YoY, showing positive growth in Brazil, Chile, and Mexico. The growth in items sold per buyer in Brazil, Chile, and Mexico was sufficient to offset a decline in the same metric in Argentina.

4. Mercado Envíos

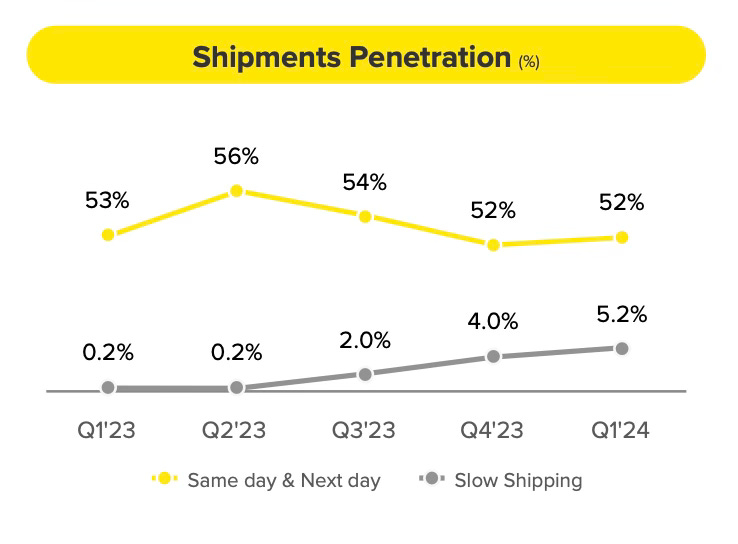

Shipments delivered on the same or next day grew by 16% YoY, with same-day shipments growing slightly faster than next-day shipments. This reflects the company's ongoing focus on quick delivery services, particularly in Brazil.

The penetration of same and next day shipments remained stable YoY, despite an increase in slow shipments. Slow shipments occur when buyers opt for MELI Delivery Day, allowing them to consolidate multiple shipments from a single order for delivery on one day, or when they choose a slower delivery than is otherwise available. This flexibility in delivery choices is seen as a positive aspect of the value proposition, offering customers more control and convenience in their delivery experience. MELI Delivery Day has surpassed managements expectations, offering compelling shipping benefits to loyalty program members. This strategy helps maintain competitiveness in lower ASP ranges while ensuring P&L discipline.

Late deliveries reached record lows, and the average speed of delivery promises was close to record highs in Q1. Despite the MELI Delivery Day initiative slowing down average delivery speed, the increase in fulfillment penetration to 52% helped maintain efficiency. The cost per package of fulfilled orders remained broadly stable YoY. The gap between fulfillment and other delivery types is narrowing due to ongoing efforts in productivity, efficiency, and scale gains.

5. Mercado Pago

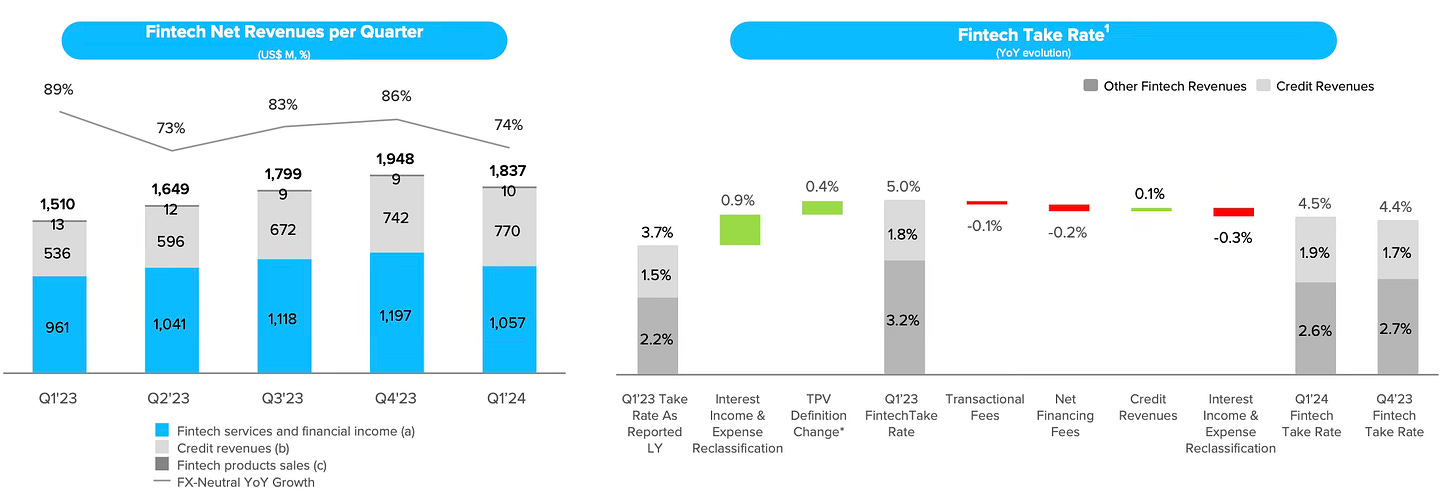

MELI made some reporting updates in Q1 the first of which included removing internal Mercado Pago peer-to-peer (P2P) transfers from its Total Payment Volume (TPV), amounting to approximately $7 billion in Q1 2024. By excluding internal P2P transfers, the TPV metric now provides a more accurate representation of the actual business performance, focusing on the platform's core fintech services and its growth beyond just a payments wallet.

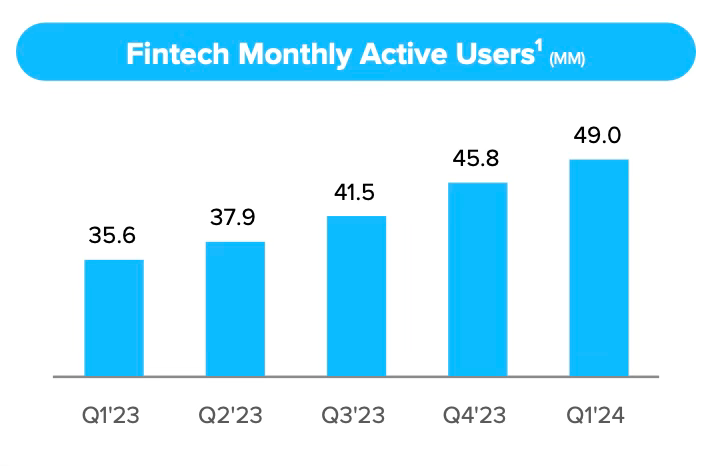

Mercado Pago experienced significant growth in monthly active users (MAUs) in Q1, reaching 49 million MAUs with a YoY growth rate of 38%, up from 32% in Q4 2023. Recent user cohorts show better retention rates and an increase in the average number of products used, indicating the strength of Mercado Pago's value proposition and the company's ability to cross-sell products. Brazil showed particularly strong user growth and engagement trends, reflecting the success of Mercado Pago's strategy in the region.

Assets Under Management (AUM) grew by 90% YoY in Q1, with Brazil and Mexico more than doubling their AUM and Argentina achieving 64% growth despite currency devaluation. Asset management products serve as an entry point to the fintech platform, with users doubling YoY in Argentina and tripling in Mexico. Brazil's AUM growth was supported by the launch of Conta Turbinada. The Conta Turbinada product, offering the highest remuneration in the market with a monthly deposit of at least R$1,000, helped improve the NPS of Mercado Pago in Brazil. The insurtech sector saw positive outcomes, with over 11 million active policies and 8.1 million users, demonstrating potential for further growth in this area.

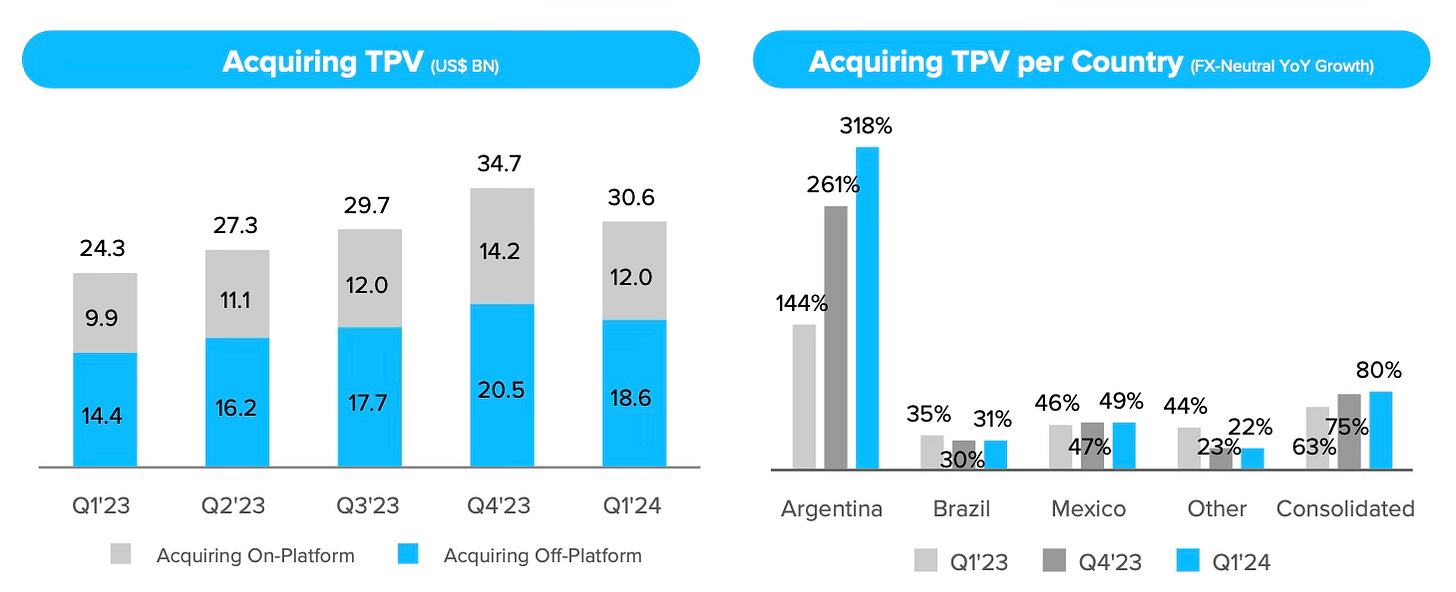

The Acquiring business experienced significant growth, with Total Payment Volume (TPV) increasing by 26% YoY to $30.6 billion. This was primarily driven by strong performance in Brazil and Mexico, which compensated for headwinds in Argentina.

Brazil saw FX-neutral Acquiring TPV growth improve to 31% YoY, indicating re-acceleration in both online and offline TPV. Mexico delivered another quarter of triple-digit FX-neutral growth in point-of-sale (POS) transactions, demonstrating the company's successful execution in the market. Despite a challenging macroeconomic environment, Argentina's FX-neutral Acquiring TPV grew by 318% YoY, showing strong traction and leveraging the company's established brand in the country.

MELI launched the Point Smart 2 in Brazil, featuring longer battery life and faster processing to better serve larger merchants. Additionally, the Point Tap solution saw a 63% increase in the number of sellers using it during Q1, highlighting the adoption of device-free options. In Online Payments, the number of logged payers grew by 35% YoY, leading to record high NPS from payers in Brazil, Mexico, and Argentina.

6. Mercado Crédito

The Mercado Crédito business showed robust growth, with originations up 71% YoY and a portfolio of $4.4 billion at the end of the quarter, up 46% YoY. This performance was supported by robust asset quality indicators and solid outcomes from new use cases among existing users.

The credit card plays a strategic role in expanding the fintech platform's market by appealing to higher income demographics and enhancing user frequency and engagement. In Q1, over 1.5 million new cards were issued in Brazil and Mexico, and credit card TPV grew 173% YoY (FX-neutral).

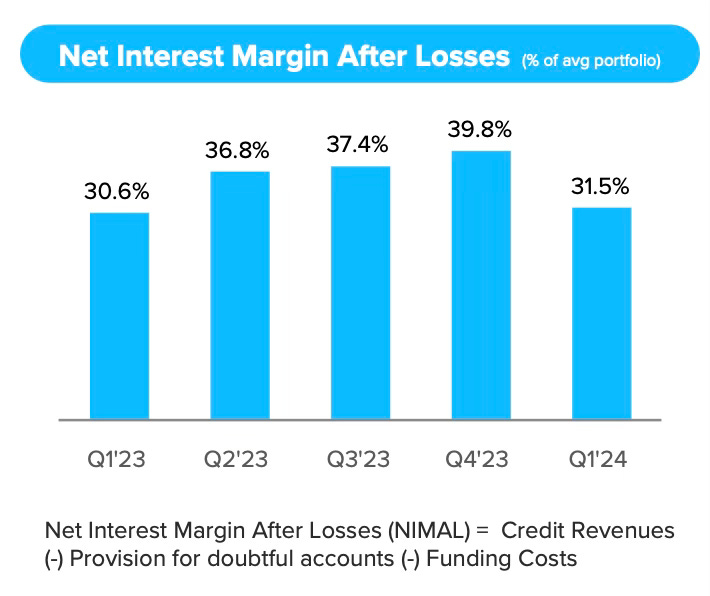

The Net Interest Margin after Loan Loss Provisions (NIMAL) spread rose to 31.5% in Q1, despite a larger share of lower-NIMAL credit cards in the portfolio (35% in Q1 2024 vs. 22% in Q1 2023), highlighting the credit business's profitability.

Asset quality remained strong, with 90+ day NPLs decreasing by 80 basis points from the previous quarter and 10 percentage points from a year ago. The rise in the 15-90 day NPLs from 8.2% in Q4 2023 to 9.3% in Q1 2024 is attributed mainly to the timing of Easter, which caused a reduction in collection activity. Additionally, a shift in the mix of risk cohorts, which was appropriately priced, contributed to this increase. Provision coverage remains >100% for all buckets.

Cross-selling additional services to merchants is a key part of leveraging the MELI ecosystem and enhancing overall business performance. The proportion of merchants taking advantage of cross-sold credit services increased in Q1, demonstrating the growing adoption of these offerings.

7. Financial Analysis

The other reporting updates made by MELI this quarter impact the financial results.

Reclassification of Mercado Pago Interest Lines

Mercado Pago's interest income and expense lines were reclassified to be reported above income from operations instead of below, aligning its reporting with fintech industry standards and peers. This reclassification increased net revenue by $99 million and cost of revenue by $44 million, resulting in a net positive impact of $55 million on gross profit and income from operations.

Change in Mercado Envios Role

The update to Mercado Envios terms & conditions redefines MELI's role to "Principal" in most shipping transactions. This change requires shipping revenues to be booked on a gross basis, impacting financial statements. This shift to "Principal" had a $293 million positive impact on net revenue and a $308 million negative impact on cost of revenue, resulting in a small net negative impact of $15 million on gross profit and income from operations, and $10 million on net income.

Revenue

MELI's net revenue reached $4.33 billion, growing 36% YoY on a reported basis (30% excluding reporting updates above). If we exclude the reporting updates, MELI beat analysts revenue estimates by 2% rather than 12% on a like for like basis.

Commerce revenue growth accelerated 113% YoY on an FX-neutral basis to $2.50 billion, driven by enhanced commerce monetization, primarily due to an increase in advertising penetration.

Advertising revenue grew by 64% YoY with advertising penetration reaching 1.9% of GMV, an increase of 50 basis points YoY. While most advertising revenue comes from product advertising, management sees significant long-term growth opportunities in brand and display advertising, as well as video advertising through the increasing popularity of Mercado Play.

Fintech revenue was $1.8 billion, an increase of 74% YoY on an FX-neutral basis supported by a higher take rate in Mexico and Brazil on an annual basis, offset by Argentina.

Gross Margin

The reported gross profit margin for Q1 2024 was 46.7%, down from 50.7% in the same quarter the previous year. However, this is not a smart way to analyse the earnings given the reporting changes. On a comparable basis, Gross Profit Margin for Q1 2024 was 50.3%, relatively stable compared to 50.6% in the same period the previous year, despite facing pressure from the Argentine market.

Operating Margin

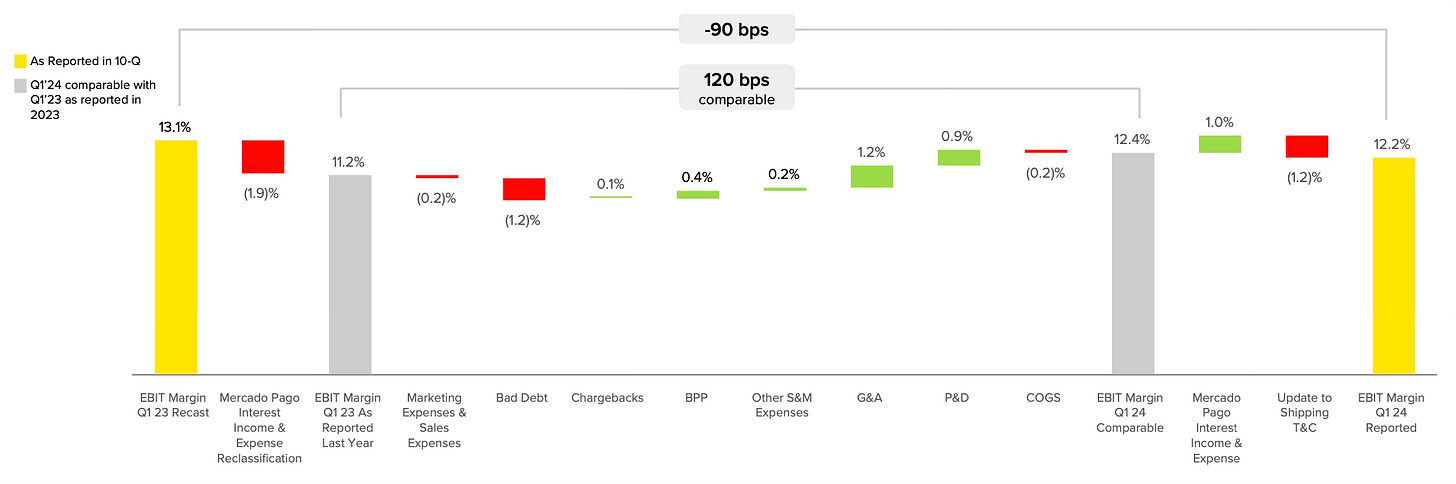

The Q1 operating margin of 12.2% declined by 90 basis points (bps) YoY when compared to Q1 2023 recast figures. This includes headwinds from reporting updates:

120 bps from the increase in shipping revenue booked on a gross basis.

90 bps due to the YoY decline in reclassified Mercado Pago interest income and expenses.

On an underlying basis—excluding reporting updates and comparing with figures disclosed last year—the margin would have improved by 120 basis points YoY. This 120 basis points margin improvement is a combination of a 620 basis points gain from strong performance in geographies outside Argentina, which more than offsets the 500 basis points compression from Argentina.

In Q4 2023, MELI’s operating margin was negatively impacted by one-off expenses equivalent to 8.2 percentage points. This development alarmed many investors and dominated the headlines. During the earnings analysis from that quarter, I indicated to subscribers that this was not a long-term concern, and this quarter has confirmed that the worries from last quarter were indeed a once off.

Cash Flow Analysis

MELI reported $1.51 billion of cash flow from operating activities in Q1 2024 compared to $859 million in Q1 2023, an increase of 765 YoY. This growth was fuelled by higher profitability partially offset by an increase in working capital investments. For the same periods MELI recorded free cash flow of $1.37 billion compared to $770 million.

8. Conclusion

In 2024, MELI will celebrate its 25th anniversary and released a creative advertisement titled '25 Years of Little Boxes' to mark the occasion. The production process took eight months, reflecting the meticulous attention to detail that brings the boxes to life.

Even after 25 years, MELI continues to achieve above-market growth despite challenging conditions in Argentina. Here’s a mind-blowing statistic: MELI has not reported a quarter of revenue growth below 30% since 2018.

If the past 25 years have been a success for the company and its shareholders, there is every reason to be optimistic about the next 25 years. In Latin America, e-commerce is far from mature, and financial services are ripe for disruption. As the leading e-commerce platform in the region, MELI offers the fastest delivery network, the widest assortment, and the best user experience, making it a natural destination for buyers and sellers. The company's network effect is powerful, as sellers maximize sales by leveraging MELI's traffic, and buyers benefit from an ever-improving value proposition, driving growth. MELI is building one of the largest retail media platforms in the region, leveraging first-party data for advertisers to offer unique audience targeting and complete full-funnel strategies.

MELI continues to challenge the status quo in financial services and has become one of the region's leading fintech companies by offering a wide array of easy-to-use services for individuals and merchants. The company's ecosystem provides a competitive advantage in fintech services. MELI's impact on the people it serves encourages entrepreneurship and promotes financial inclusion.

In the run-up to earnings, MELI was punished by the market for the one-off expenses in Q4. I viewed this weakness as a great opportunity to add to my position. The analysis I shared in April indicated that the stock was undervalued by as much as 35%. This week, the stock popped 16%. The full analysis is linked below for anyone that missed it.

Management continues to reiterate that their long-term ambition is to deliver both growth and profit. Let’s see what the next 25 years bring.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you for this update, much appreciated.

Great work