Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Sea Limited (SE)

At the end of Q1, SE was one of the best-performing stocks in the portfolio year-to-date. Then, in early April, the stock dropped to as low as $104, following the Trump tariff tantrums.

This sell-off made little sense to me, as SE was unaffected by these trade tensions. Its e-commerce platform, Shopee, operates entirely within Southeast Asia, meaning it doesn’t depend on cross-border trade of physical goods with the U.S.

This proved to be an opportunistic move, as the stock has already returned +25% in less than a month since the purchase.

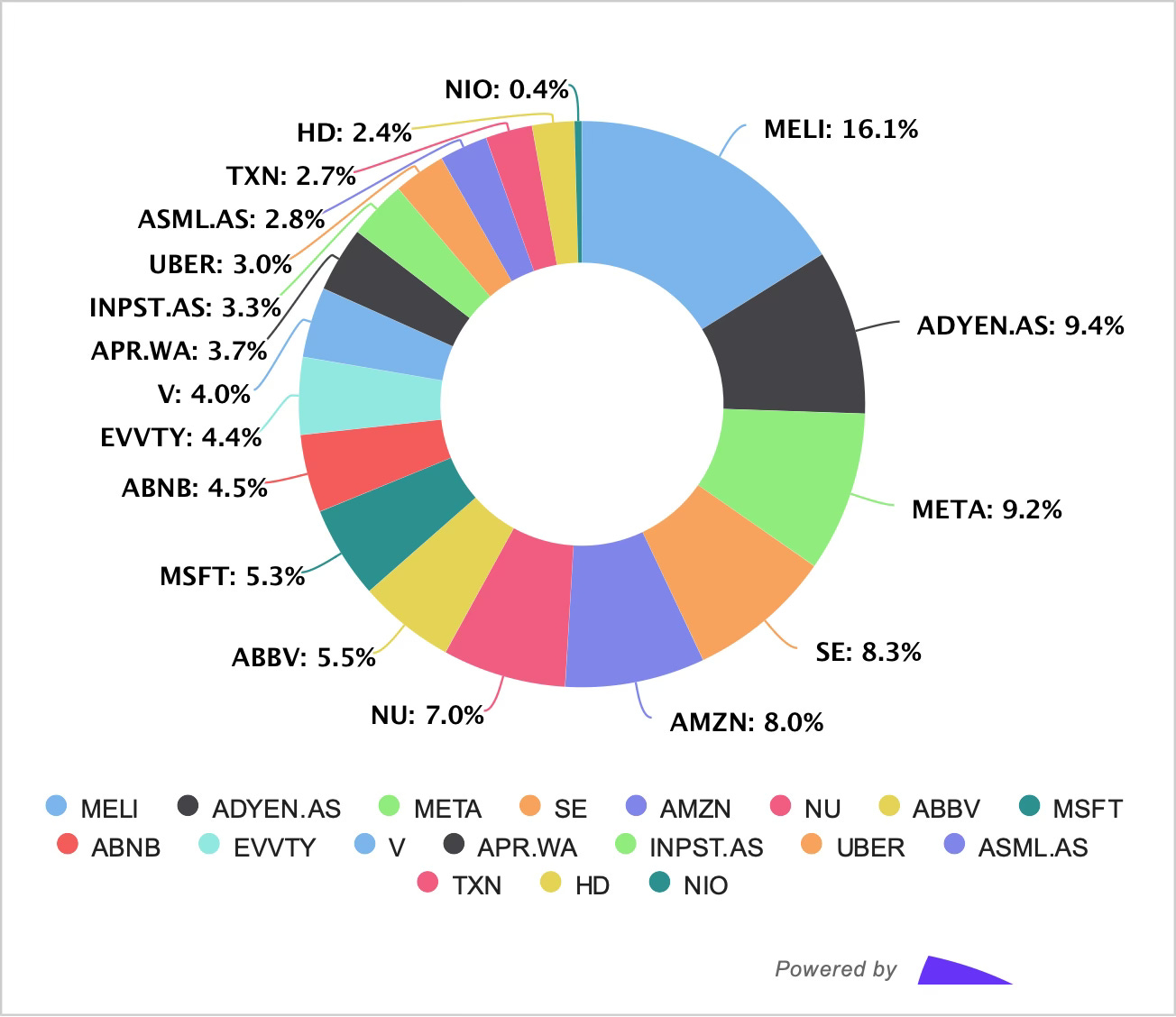

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Buy List

Stocks on my radar to add this month:

ASML (ASML)

ASML is a relatively new position, added to the portfolio in February, and one I’d like to build into a larger weight. The company reported solid Q1 earnings earlier this month:

Total net sales: €7.7 billion (+46% YoY), in line with guidance.

Gross margin: 54.0%, exceeding expectations due to a favourable EUV product mix and performance milestone achievements.

Net income: €2.4 billion (+92% YoY), representing 30% of net sales, or €6.00 in EPS.

Net bookings: €3.9 billion, including €1.2 billion in EUV bookings.

Q2 guidance: Net sales between €7.2–€7.7 billion; gross margin between 50–53%.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

If you're part of the subscriber chat community, you’ll know I was on vacation for most of April, so newsletters were less frequent than usual. I took a full detox from the markets, something I haven’t done in a while. It’s easy to burn out if you don’t take time to recharge, so I highly recommend building that space in.

I was in Southeast Asia for this trip, and while I wasn’t actively checking the market, I couldn't help but spot due diligence opportunities. One example was Grab, often referred to as the "Uber of Southeast Asia."

From my experience, the business appears to be under-earning. On a few occasions, the wait time for a ride was so long that I cancelled the trip entirely. My takeaway: they don’t have enough driver supply to meet demand. That’s a good problem to have and may reflect lower vehicle ownership in the region.

While I don’t own Grab directly, I do have exposure via Uber, which holds a 27.5% stake in Grab following the merger of its Southeast Asian operations in 2018.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great portfolio!

$MELI are also among my largest and highest-conviction positions.

I think Uber reduced its stake in Grab to roughly 15% over time