Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

ASML (ASML)

I added to my position in ASML, which was the most recent addition to the portfolio in February. Earlier this month, TSMC announced a $100 billion investment in U.S. chip manufacturing, involving the construction of five additional facilities. More plants mean more ASML machines will be required.

Also this month, reports emerged that China has developed its own EUV machine to rival ASML. While this headline might seem alarming at first, a deeper look suggests otherwise. First, the equipment is only scheduled for trial production in Q3 2025, with full-scale manufacturing by 2026. Unlike DeepSeek, which had a detailed research paper accompanying its release, these reports remain unconfirmed, with limited transparency, raising questions about reliability and yield rates.

Based on current information, ASML’s monopoly remains intact. The company controls ~90% of the global lithography market and remains the sole supplier of High-NA EUV systems. Even if China successfully develops a competing system in the long run, I find it highly unlikely that companies outside of China would adopt these machines due to geopolitical concerns. China is set to account for 20% of ASML’s revenue in 2025.

Meta (META)

I took advantage of the market correction to add to my position in META, which is currently down 21% from its all-time high in February. META is a high-quality business and one of the few companies already seeing tangible benefits from its investments in AI.

The stock is currently trading at 22 times forward earnings, which I believe is very reasonable for a company of this caliber.

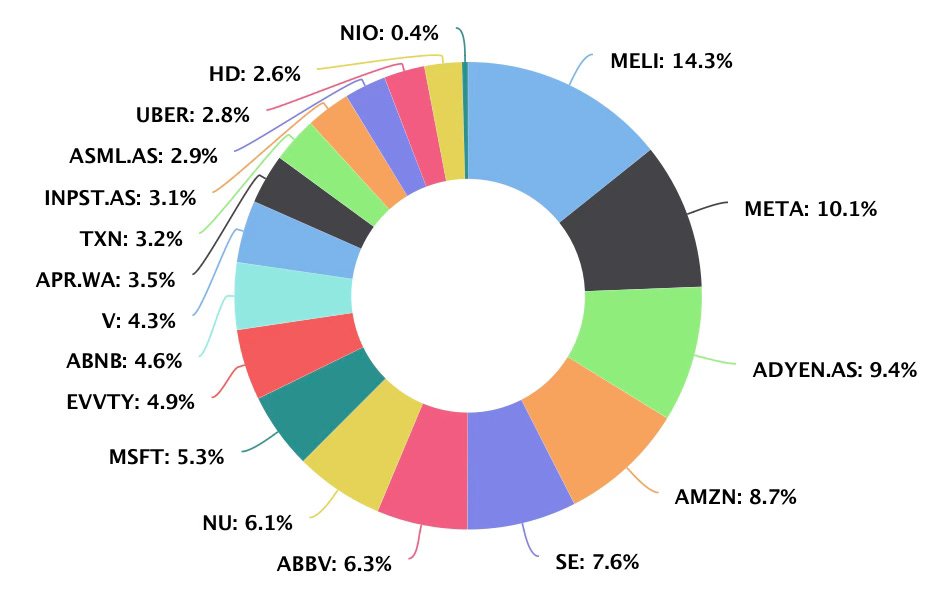

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Performance

Q1: +1.2% vs. S&P -4.6%

Top Contributors YTD:

SE: +23%

UBER: +19%

ABBV: +18%

MELI: +15%

V: +11%

Largest Detractors:

INPST: -15%

ASML: -13%

AMZN: -13%

NIO: -13%

MSFT: -11%

Buy List

Sea Limited (SE)

SE has held up exceptionally well this year and is the best-performing stock in the portfolio YTD. One reason for its resilience is that it remains immune to U.S. tariff concerns, which have weighed on broader market sentiment.

The company posted superb earnings last month, with all three business segments now profitable and self-sufficientwhile continuing to accelerate top-line revenue growth. You can read the full earnings review below.

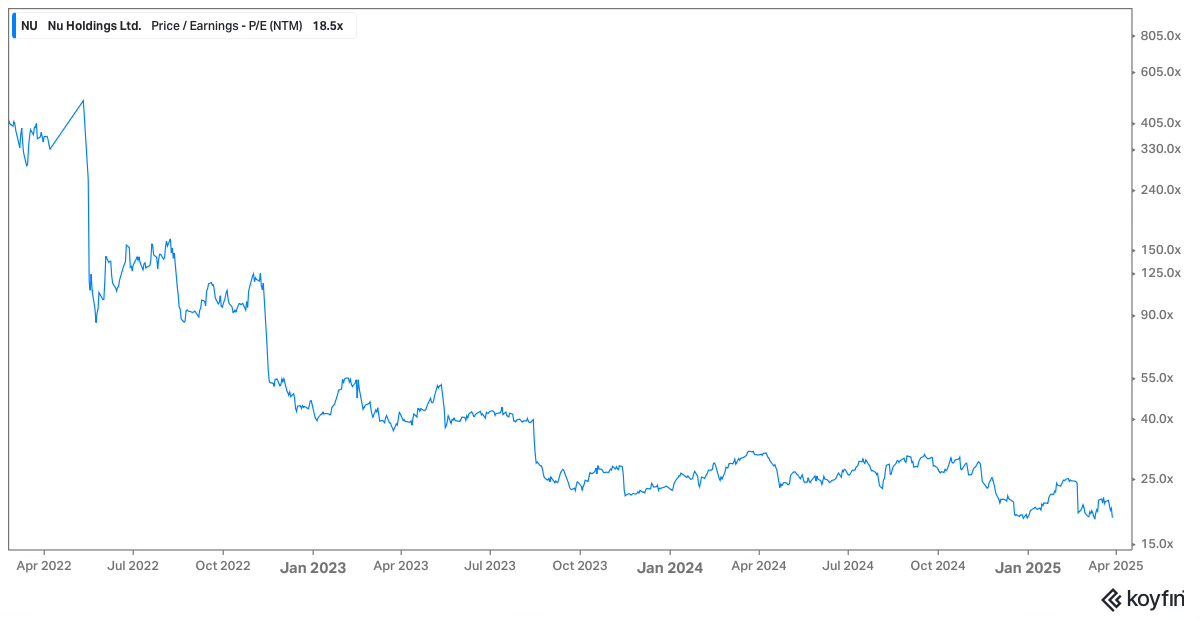

Nubank (NU)

While SE has performed well, NU is on the opposite end of the spectrum, currently down 35% from its November 2024 highs. This weakness has been driven in part by a deterioration in the Brazilian Real against the U.S. dollar toward the end of 2024. However, the currency has rebounded in Q1.

Another concern has been elevated credit risk in Brazil. While NU did not report an increase in delinquency rates in Q4, it has tightened eligibility criteria for lower-credit bands in PIX financing. As I mentioned in the earnings review, when management is cautious, investors should be too.

That said, I believe a lot of negativity is already priced in, with the stock now trading at just 18 times forward earnings.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

While Q1 was volatile for the broader market, my portfolio has held up well, delivering a positive return despite negative overall market performance. While long-term returns are what truly matter, it's satisfying to have built a portfolio that’s proving more resilient than the broader market.

This volatility has also created compelling opportunities, which I have taken advantage of and will continue to do so. While market conditions fluctuate between bullish and bearish, my focus remains on executing my strategy consistently, regardless of the prevailing sentiment.

Having a strategy you can stick to through good times and bad has been a key pillar of my investing process. This is reflected in the fact that I have only opened one new position and sold one holding so far this year.

If it ain’t broke, don’t fix it.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Nice work 👍