Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

The best opportunities exist in uncertain times.

Meta once dropped 70%. Netflix: 50%. Amazon:40%. Every investor had ruled them out, citing “the companies were done”.

But they all rebounded - Meta: 690%. Netflix: 540%. Amazon: 153%.

Every world-class company suffers deep drawdowns. Rebound Capital identifies high-quality companies undergoing drawdowns to capitalise on their eventual rebound. It’s a contrarian philosophy so precise that even Michael Burry is a subscriber.

In the last few months, they have identified ASML (up 33%), Google (up 52%), and AMD (up 61%) as ideal rebound prospects. Subscribe today to unlock their exclusive End of the Year Offer.

Transactions

Visa (V)

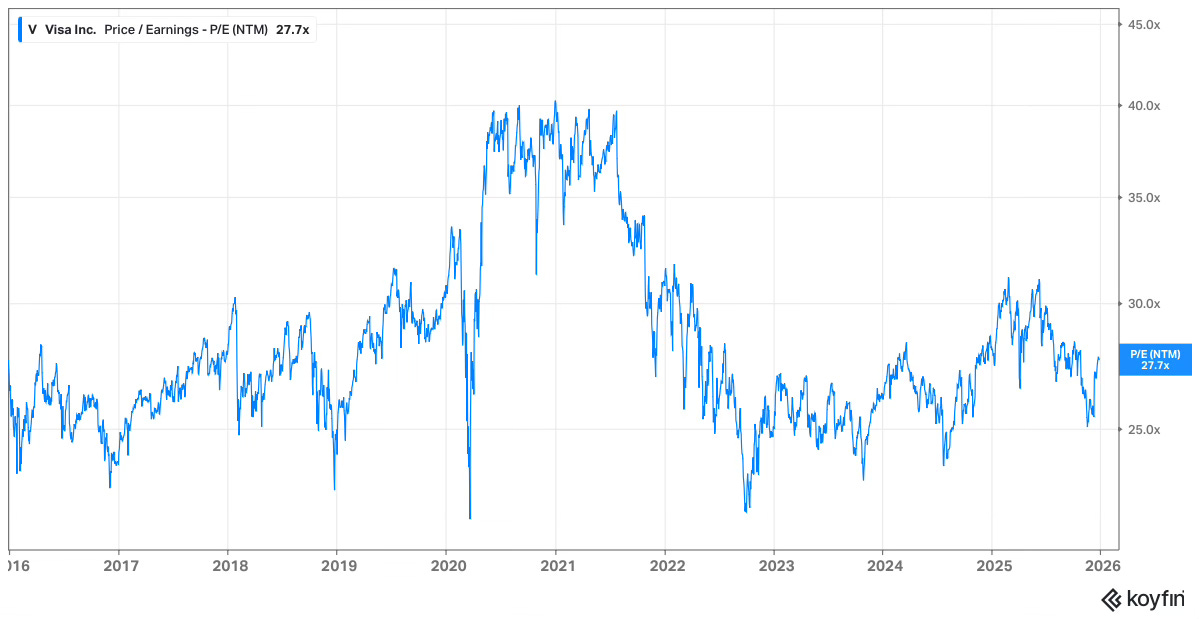

I added to my position in Visa for the second month in a row. Paying 25x forward earnings for a business of this quality feels very reasonable. The multiple has already expanded to almost 28x in a relatively short period.

With stable, high quality businesses like this, I try to add near the lower end of their historical valuation range. Sometimes there is no need to overcomplicate things.

Uber (UBER)

I went a step further with Uber and added to my position for the third consecutive month.

For much of 2025, I regretted the size of my initial position, which I opened in December 2024 shortly before the stock moved sharply higher. While Uber is now in a roughly 20% drawdown over the past two months, the fundamentals remain as strong as ever.

The narrative that autonomous vehicles pose an existential threat to Uber has resurfaced, and this is where my view diverges from the market. I believe autonomous vehicles will evolve into a highly fragmented market with multiple winners rather than a single dominant player. In that scenario, Uber is well positioned to leverage its global distribution network and infrastructure.

We saw further evidence of this fragmentation recently, as Baidu announced plans to launch driverless taxi trials in the UK next year in partnership with Uber and Lyft. As part of the agreement, Baidu’s Apollo Go RT6 vehicles will join the London networks of both platforms in 2026. This marks the first direct competition between U.S. and Chinese autonomous players in a European capital, following Waymo’s recent supervised testing in the city.

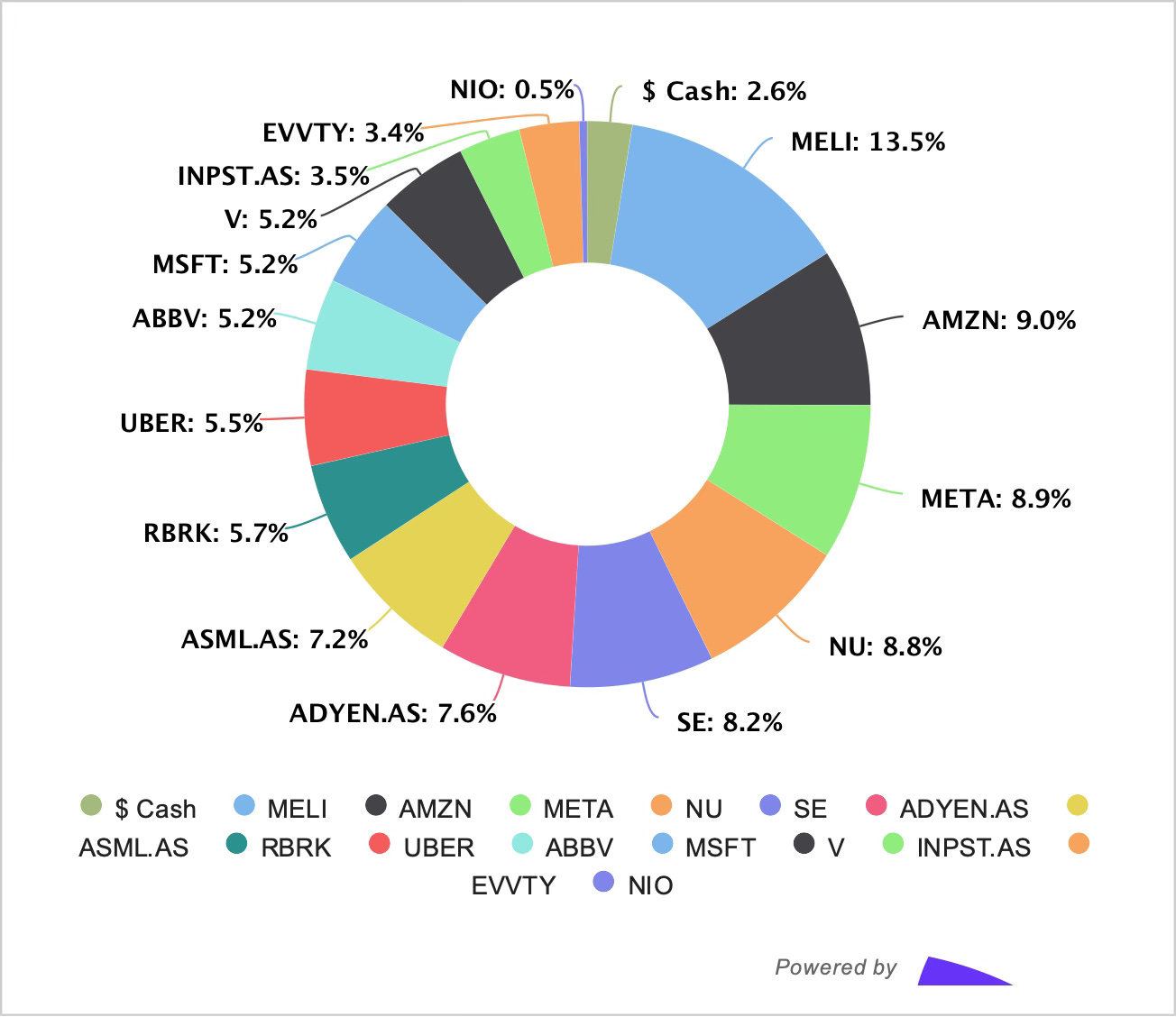

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns.

Sign up using my affiliate link here.

Performance

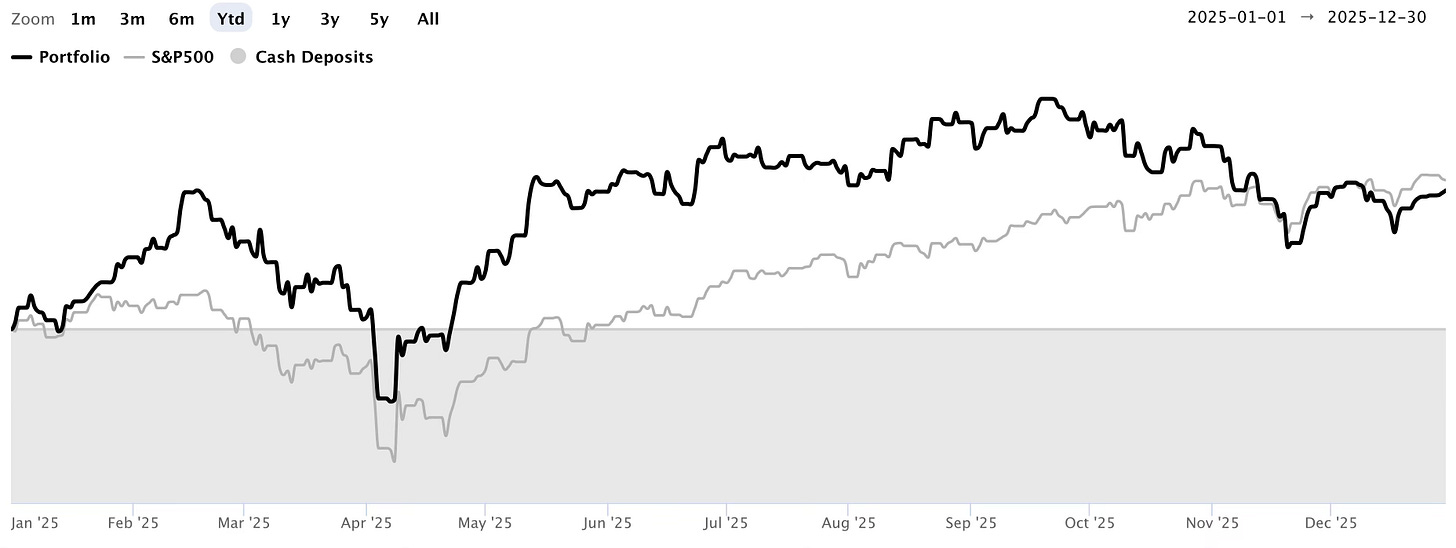

Q4: -6.0% vs. S&P +3.1%

YTD: +16.0% vs. S&P +17.2%

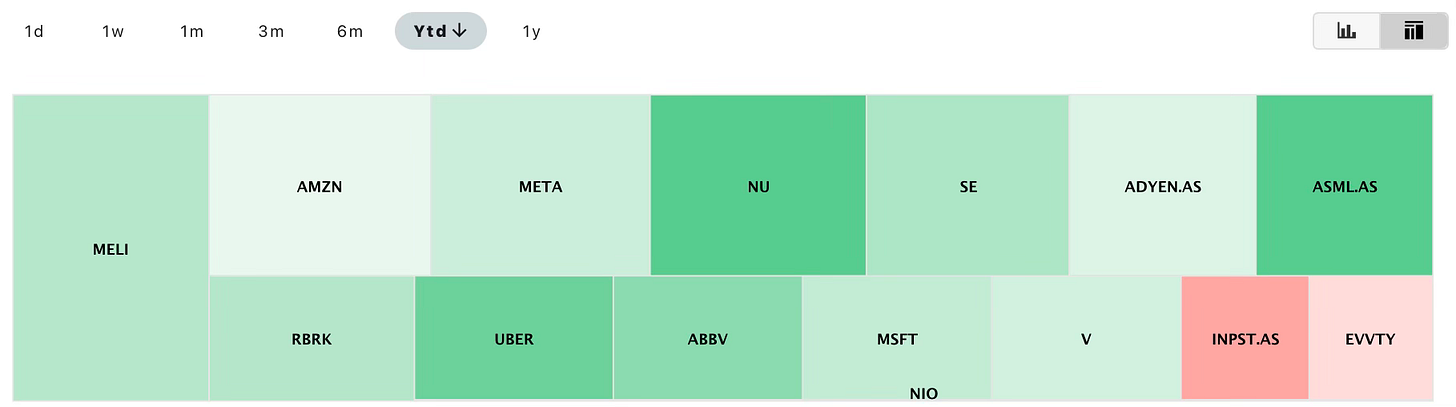

Top Contributors YTD:

NU: +63%

ASML: +54%

UBER: +36%

ABBV: +29%

NIO: +26%

Largest Detractors:

INPST: -28%

EVO: -11%

Buy List

Microsoft (MSFT)

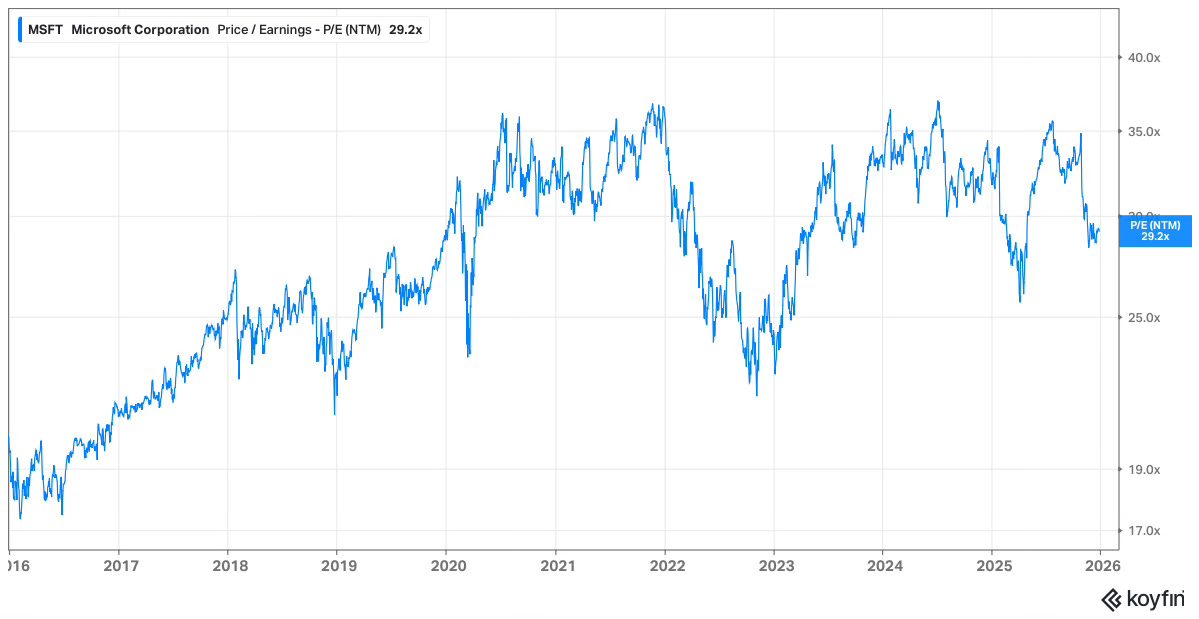

I highlighted Microsoft last month but did not take action, as I felt Visa and Uber offered more attractive opportunities at the time.

Microsoft continues to trade at around 29x forward earnings, a level that has historically provided reasonable entry points since the stock re rated higher. I remain underweight Microsoft in the portfolio despite significant appreciation from my original cost basis, and it is a name I am watching closely as we head into 2026.

Sea Limited (SE)

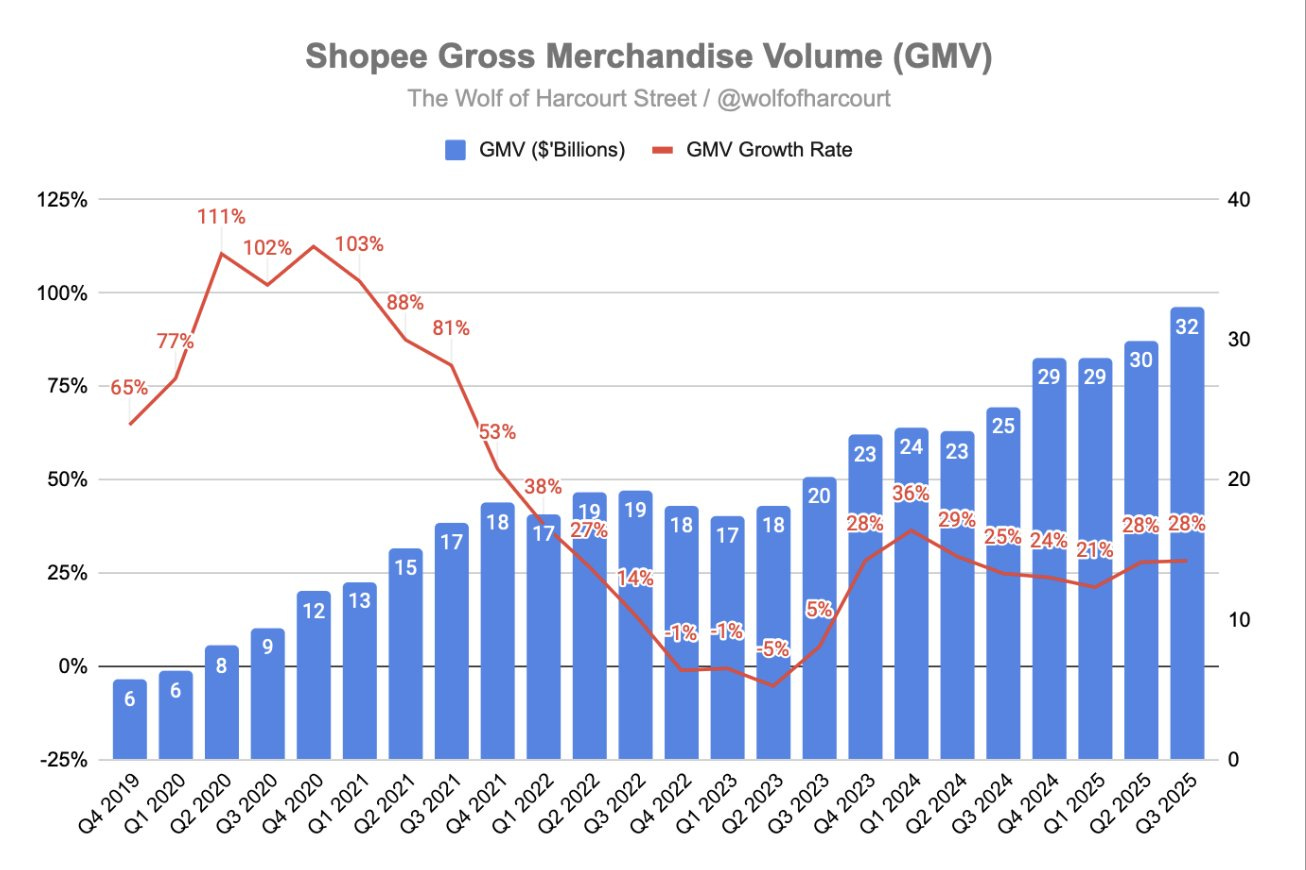

2025 has been a rollercoaster year for Sea Limited. At one point in September, the stock was up 85% YTD. At the time of writing, it sits in a 33% drawdown, yet still shows gains of 22% for the year, comfortably outperforming the broader market.

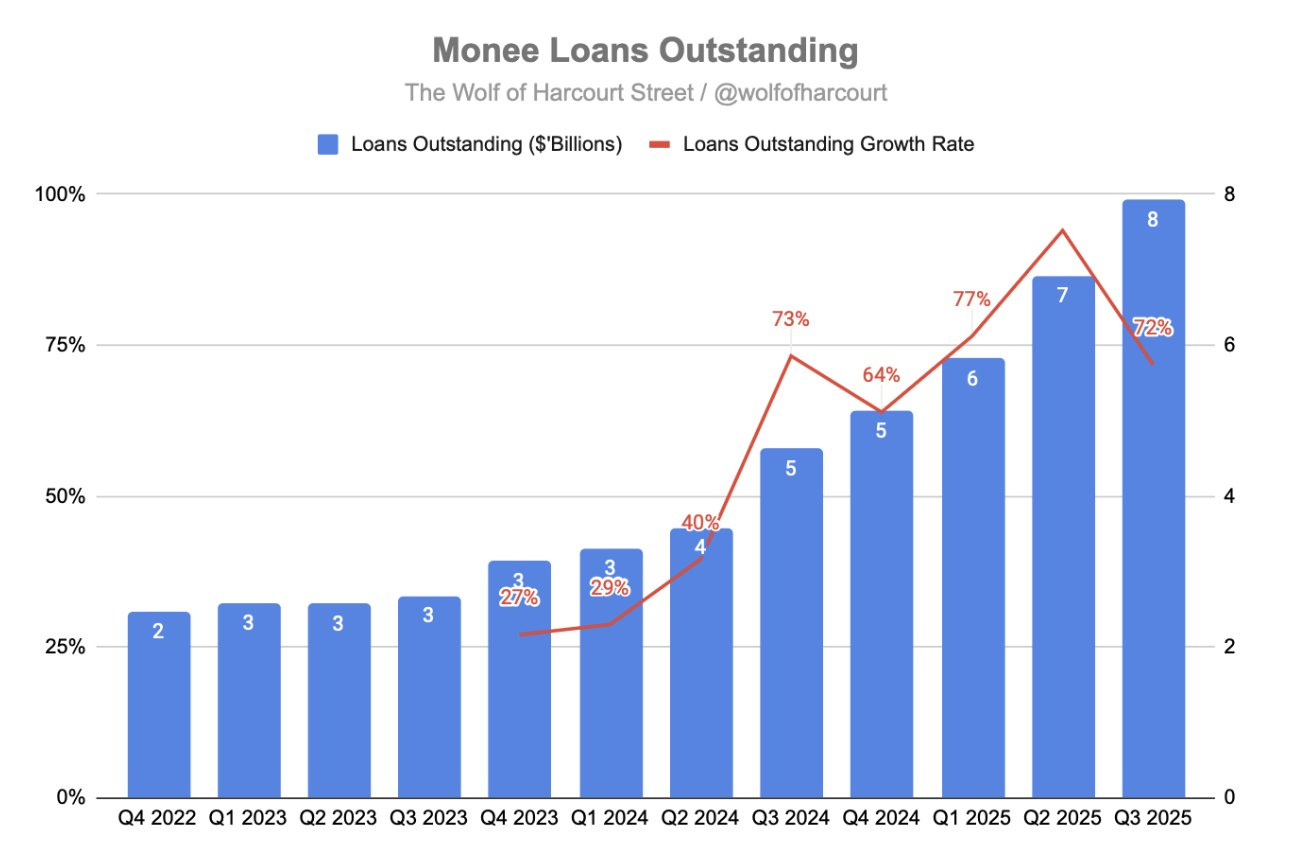

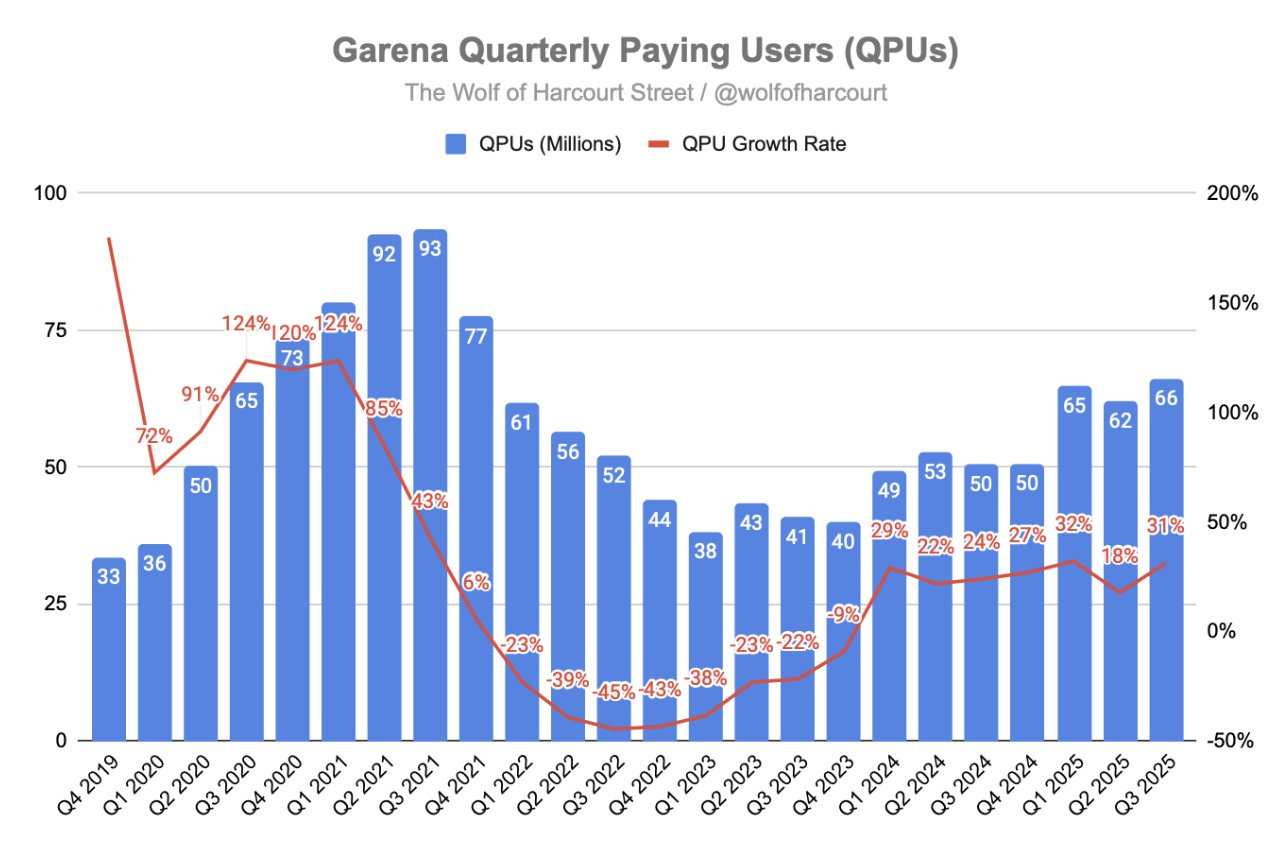

I believe SE is one of the more compelling opportunities within the existing portfolio. The company delivered strong revenue growth and meaningful margin expansion in 2025, with all three business segments accelerating key performance indicators.

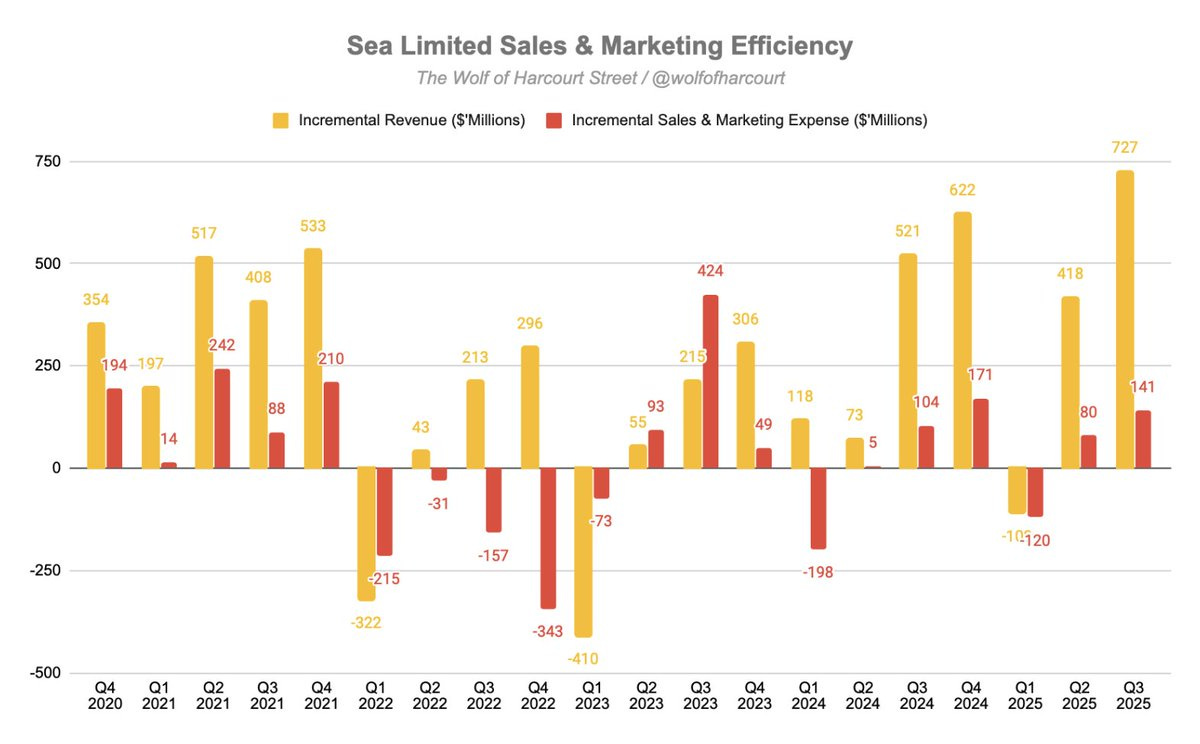

The metric that stood out most to me was Sales and Marketing efficiency. Historically, SE was often criticised for subsidising growth, with incremental S&M spend exceeding incremental revenue. Over the past five quarters, that dynamic has flipped decisively.

In Q3 alone, SE invested an additional $141 million in S&M and generated $727 million in incremental revenue, a roughly 5x return on investment. When I see a business with a reinvestment runway like this, I want management to reinvest aggressively.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

From both a portfolio management and newsletter perspective, I was less active in Q4 as I spent much of the period travelling. As an active investor, I view this as an important part of my long term process.

While investing is highly enjoyable, it can also be mentally draining. Stepping away to recharge is not optional, burnout is real, and if left unaddressed it eventually catches up with you. To finish first, you must first finish.

From a performance standpoint, Q4 was a weaker quarter, especially compared to the exceptionally strong start to the year. At the end of Q3, the portfolio was on track for returns of 23%, but we ultimately finished the year at 16%.

Investing is all about expectations. If you had told me at the end of Q3 that I would finish the year at 16%, I would have been a little disappointed. But if you had told me in January that I would deliver that return after 34% in 2023 and 16% in 2024, I would have taken it without hesitation.

Looking ahead to 2026, I continue to believe that some of the best opportunities in the market are already among the portfolio’s largest positions, particularly SE and MELI.

As always, I will share the Annual Report in January, with deeper insights into the portfolio and reflections on the year. In the meantime, readers can revisit the 2024 Annual Report.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Very solid portfolio, Wolf! High-quality companies + growth at a reasonable price

Got it. Yep I'll maybe aim some now and some after earnings. Thanks and happy new year 2026!!