Investing is a game of expectations.

When a company exceeds market expectations, its stock price usually reacts positively. Conversely, when a company fails to meet expectations, its stock often sells off.

Managing an active portfolio shares some similar psychological traits. My benchmark is the S&P 500, representing the return I could earn by doing nothing as a passive investor. At the start of 2024, if someone had offered me a 15% return, I would have gladly accepted—especially following a 34% return in 2023, which I recognize is unsustainable in the long term. This is where the game of expectations comes into play.

The S&P 500 returned 23% in 2024, meaning I lagged by 8%. However, in 2023, I outperformed the benchmark by 10%. Since the start of 2023, my portfolio has doubled in value through a combination of returns and cash contributions—something I initially expected would take five years, not two.

Since inception, I’ve achieved a compounded annual growth rate (CAGR) of 14%, surpassing my target of 10%. For context, the S&P 500 has delivered a CAGR of 8% over the past 20 years. A detailed review of my current portfolio holdings and 2024 performance is available in Portfolio Review - December 2024.

Portfolio Turnover

I started and ended 2024 with 18 positions, achieving this by initiating 4 new positions and closing 4 existing ones. After exceeding my long-term turnover target in 2023, I’m much happier to have significantly reduced turnover in 2024. My aim for low turnover is best summarised by this quote:

Your portfolio is like a bar of soap. The more you touch, the smaller it'll get.

The new positions added to the portfolio were Nubank (NU), Visa (V), InPost (INPST), and Uber (UBER). Meanwhile, I exited Chevron (CVX), Brookfield Renewable (BEPC), PepsiCo (PEP), and Datadog (DDOG). I’ve covered the rationale behind these transactions in monthly portfolio reviews, so I won’t rehash them here.

Contributors and Detractors

The best-performing stock in the portfolio was Sea Limited (SE) (+162%), followed by Meta (META) (+66%), Amazon (AMZN) (+44%), PayPal (PYPL) (+39%), and Nubank (NU) (+24%).

Interestingly, Sea Limited (SE) and PayPal (PYPL), my two worst-performing stocks in 2023 (-22% and -14%, respectively), became top performers in 2024. Meanwhile, Meta (META) and Amazon (AMZN), among the strongest performers in 2023 (+194% and +81%, respectively), continued their momentum into 2024. Some winners kept winning, while some beaten-down stocks proved to be oversold.

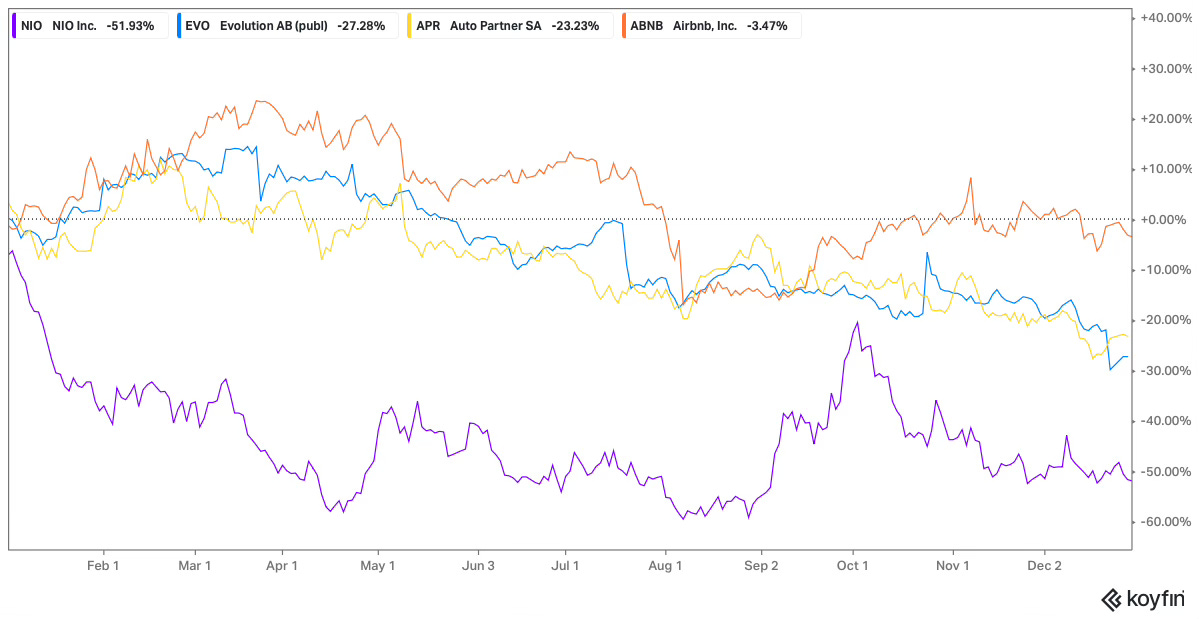

The worst-performing stock was NIO (NIO) (-52%), followed by Evolution (EVO) (-27%), Auto Partner (APR.WA) (-23%), and Airbnb (ABNB) (-3%). All other portfolio stocks achieved positive returns.

Of the worst performers in 2023, only NIO (NIO) (-7%) remains in 2024.

Looking ahead to 2025, which of 2024’s worst performers might replicate the turnaround seen by Sea Limited (SE) and PayPal (PYPL)? I believe Evolution (EVO) and Auto Partner (APR.WA) have the best chance, driven by valuation. Despite challenges in 2024, both companies grew revenue by double digits and now trade at low-teens forward earnings multiples due to multiple compression.

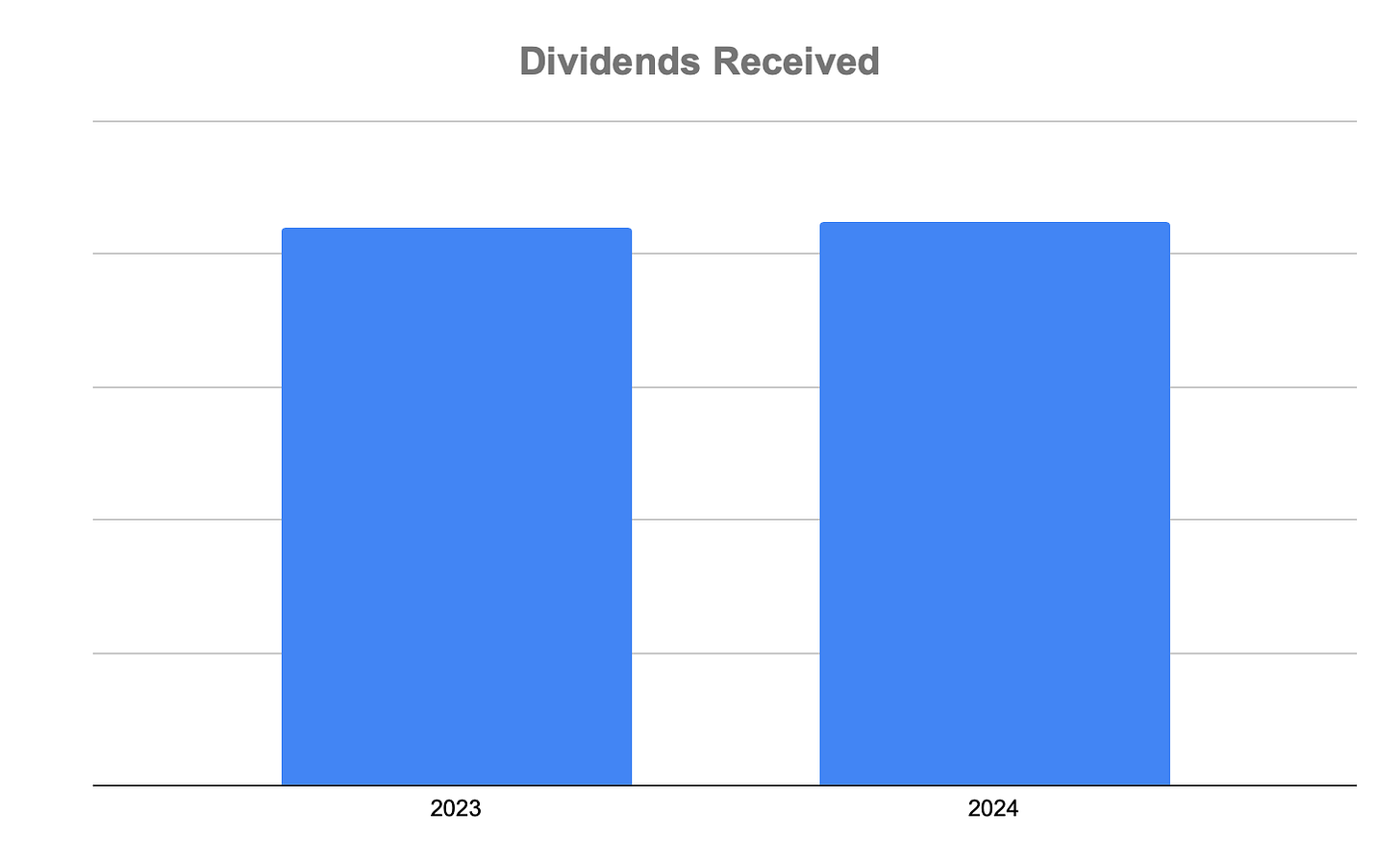

Dividends Received

Dividends received in 2024 increased by 1% year-over-year, compared to a 76% increase in 2023. This modest growth reflects my focus on total return rather than dividend optimization. Of the four positions I sold in 2024, three paid dividends (yields of 3%–5%), which were not replaced, as Nubank (NU), InPost (INPST), and Uber (UBER) don’t pay dividends, and Visa (V) has a yield below 1%.

Offsetting this were notable dividend hikes from Evolution (EVO) (+25%), Microsoft (MSFT) (+11%), and Home Depot (HD) (+8%). Remaining hikes were in the 5%–6% range. I pool dividends with cash contributions and reinvest opportunistically.

Fees

I focus on fees as a percentage of new deposits because this metric best reflects costs regardless of portfolio size. To calculate this, add up all fees incurred during the year and divide them by total cash deposits, which can be easily obtained from your brokerage account.

In 2023, fees as a percentage of new deposits more than doubled from 0.34% in 2022 to 0.84%. This spike set off alarm bells, as fees can severely hinder the compounding process.

The increase was driven by DEGIRO's hikes in commissions and handling fees. By the end of 2023, I took action by opening an account with Trade Republic, which offers a much lower fee structure. As a result, I’m pleased to report that this ratio dropped to 0.69% in 2024.

Monitoring fee structures will remain a priority in 2025 as I aim to reduce this ratio to as close to zero as possible.

Newsletter Performance

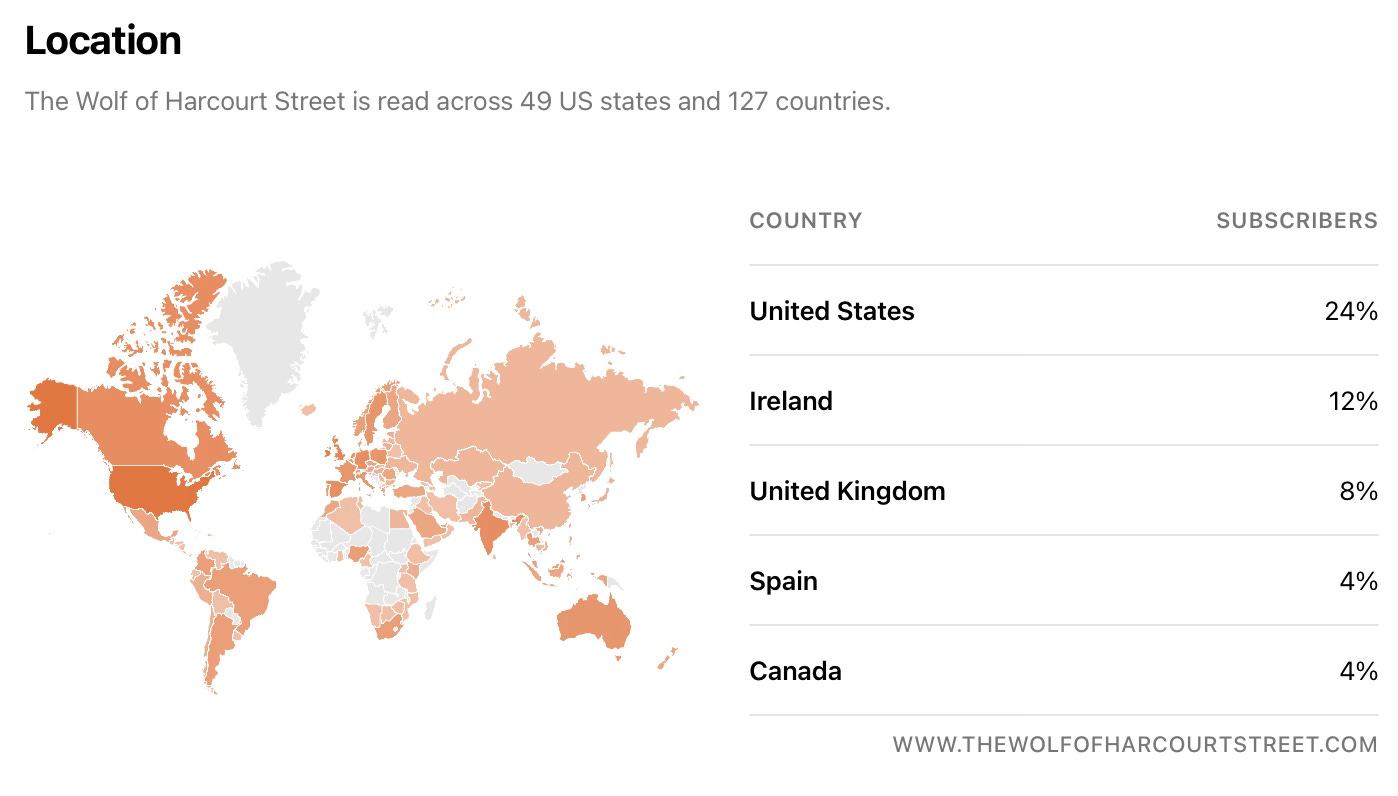

2024 marked the best year yet for the newsletter. After doubling from 1,826 to 3,710 subscribers in 2023, momentum carried into 2024, with 3,396 new subscribers joining the community. By year-end, the subscriber count had reached 7,106. To put this in perspective, nearly as many new subscribers joined in 2024 as had joined since the newsletter's inception in November 2020.

The newsletter continues to grow into a truly global community, now with subscribers from 127 countries and counting.

Several key factors have driven this success.

Flexible Publishing Schedule

In 2023, I shifted from a fixed cadence to an opportunistic schedule, publishing only when the timing felt right. This approach has resulted in more comprehensive, detailed material, which has resonated strongly with readers.Credible Track Record

The newsletter has established a credible and verifiable track record in public. New readers now have access to over four years of archived content, which can be explored at their own pace. Each article includes time stamps, portfolio transactions, and performance data.Unlike many newsletters that flame out after a short run, this one has been consistently delivered for four years while maintaining a high level of transparency. Compounding applies in many areas of life, and this newsletter exemplifies the rewards of persistence and quality output.

Community Chat

The Community Chat, launched in the second half of the year, has been a personal highlight for me. Its aim was to create an environment where knowledge is shared, strategies are discussed, and we all grow together. This community comprises many highly knowledgeable investors with unique experiences (yes, you!), and tapping into this collective wisdom has already added immense value for me. The great debates and discussions taking place here simply wouldn’t have happened otherwise.

The most popular posts in 2024 were:

Nu Holdings Investment Thesis - 13.0k views

Evolution: Revenue Growth Slows, but Shareholder Returns Set to Soar - 8.1k views

Uber Quick Pitch - 8.0k views

Portfolio Review - November 2024 - 7.7k views

Mercado Libre: Investing For The Long-Term - 7.4k views

One underrated aspect of the archive is the continued relevance of evergreen posts, which still attract readers years later. For instance, the Evolution AB Investment Thesis remains the most-viewed post of all time, with over 15.4k views.

Lessons Learned

1. Error of Omission

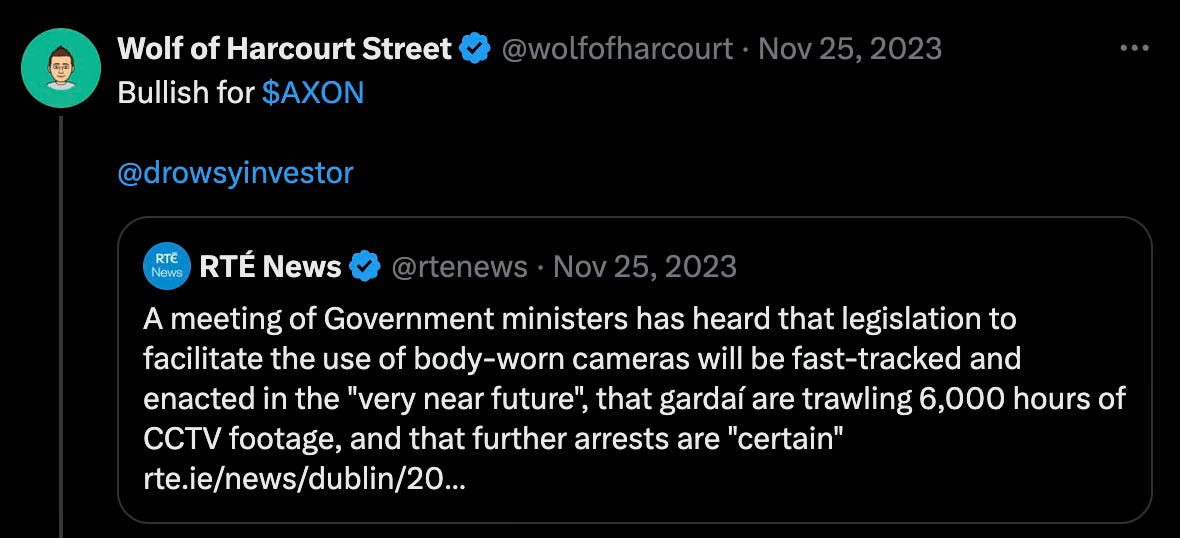

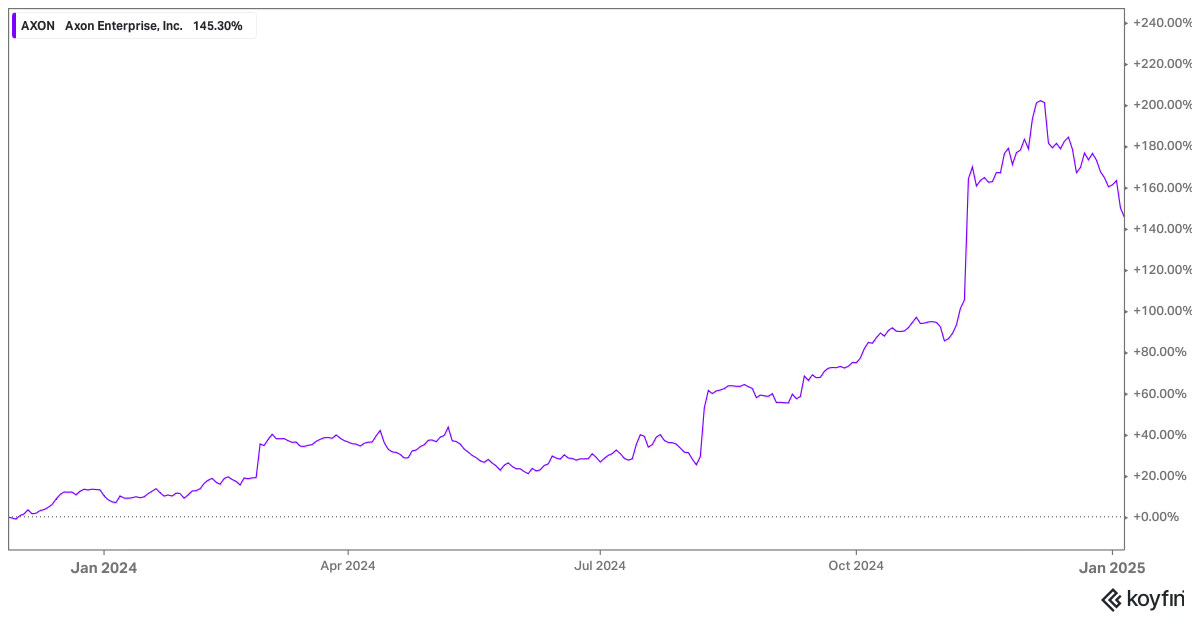

An error of omission occurs when a stock we analyzed outperformed but wasn’t added to the portfolio. My biggest error of omission in recent memory was Axon Enterprise (AXON). It came onto my radar toward the end of 2023 after the Irish government fast-tracked legislation to enable the use of body-worn cameras for the police force (Gardaí).

Since this tweet alone, the stock has risen +145%. In hindsight, this was an obvious opportunity staring me in the face.

AXON enjoys a near-monopoly in a sector with extremely high switching costs. Once a government department chooses a vendor, transitioning to another is enormously challenging. At the time, however, I got sidetracked by other research and priorities, which caused me to pause my work and miss the chance to study the company enough to get comfortable with its valuation.

As investors, we spend so much time turning over rocks to find that one fat pitch. When an opportunity lands in your lap, don’t pass it up.

2. Market of Stocks, Not a Stock Market

The stock market isn’t a monolithic entity; it’s a market of individual stocks. While general market commentary often painted a picture of overvaluation in 2024, my portfolio’s performance told a different story.

Despite widespread concerns about inflated market valuations, my modest returns reflected a more nuanced reality. Core holdings like Mercado Libre (MELI), Amazon (AMZN), Meta (META), and Adyen (ADYEN) are trading at lower EV/EBITDA multiples now than they were three years ago.

This reminds us that while overall market valuations may appear stretched, opportunities still exist in individual stocks. Broad market indices don’t always reflect the potential of specific companies or sectors.

Don’t let general market sentiment overshadow your research and analysis. A portfolio of carefully selected stocks can perform differently from the overall market, and what seems overvalued at first glance may reveal undervalued gems upon closer inspection

Goals for 2025

1. Grow Community to 11,000 Subscribers

Last year, I set a goal to reach 6,000 subscribers by the end of 2024. I’m delighted to have surpassed this goal by more than 1,000 subscribers! This year, my aim is to grow the community to 11,000 subscribers, with passing the 10,000 mark as a key milestone along the way.

You can help me reach this goal by sharing the newsletter with family, friends, and colleagues who might find it valuable.

2. Concentrate Portfolio to 15 Positions

At one point, my portfolio held 24 different positions—far beyond what I could effectively track. Fast forward a few years, and I’ve trimmed this down to 18. One of the most impactful results of this process has been the increased clarity of thought it has brought. By focusing on fewer positions, I’ve freed up mental bandwidth, which has significantly improved other aspects of my investment process.

My goal for 2025 is to further concentrate the portfolio to 15 positions. Currently, I have four positions that each account for less than 3% of the portfolio. These smaller positions are unlikely to meaningfully impact performance. For example, a 2% position that doubles only adds 2% to the portfolio, whereas a 5% position that appreciates by 50% has a larger impact.

A Note of Gratitude

Thank you for your continued support and engagement. A newsletter is only as strong as its readership, and I’m truly grateful for you being part of this journey. Wishing you a healthy and profitable 2025!

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great summary and congrats on a strong 2024. Always a highlight to read your updates. The number of names in your portfolio, and target to bring this down further has given me food for thought.

Keep up the great work, always a pleasure reading your newsletter