Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Be greedy when others are fearful.

Meta once dropped 70%. Netflix: 50%. Amazon:40%. Every investor had ruled them out, citing “the companies were done”.

But they all rebounded - Meta: 690%. Netflix: 540%. Amazon: 153%.

Every world-class company suffers deep drawdowns. Rebound Capital identifies high-quality companies undergoing drawdowns to capitalise on their eventual rebound.

In the last few months, they have identified ASML (up 23%), Google (up 52%), and AMD (up 61%) as ideal rebound prospects. Subscribe today to unlock their exclusive Black Friday offer.

Transactions

Visa (V)

I added to my position, as flagged in last month’s Buy List. Nothing complicated here. Visa remains a proven long term compounder and the mid 20s forward earnings multiple is reasonable for a business of this quality.

Uber (UBER)

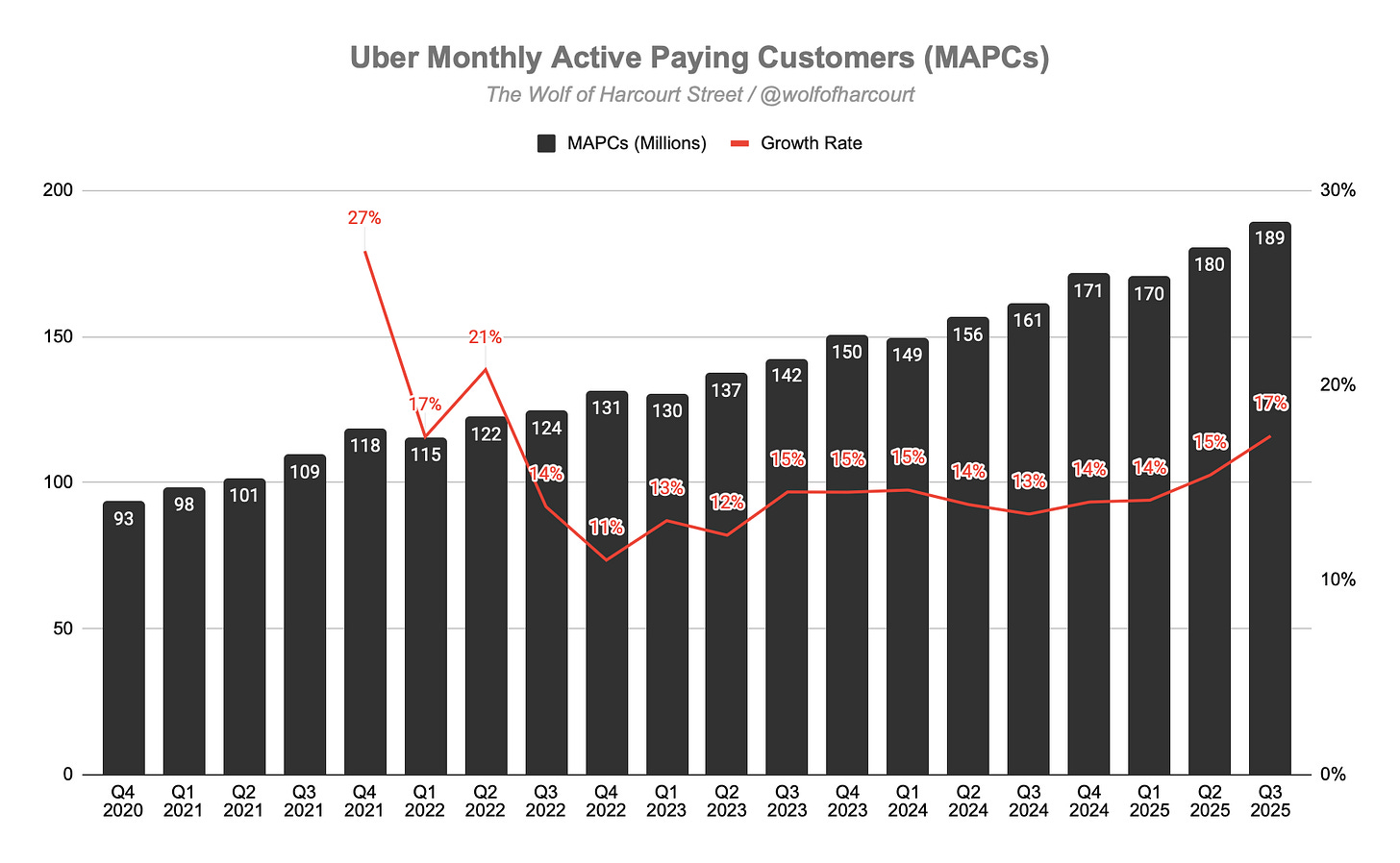

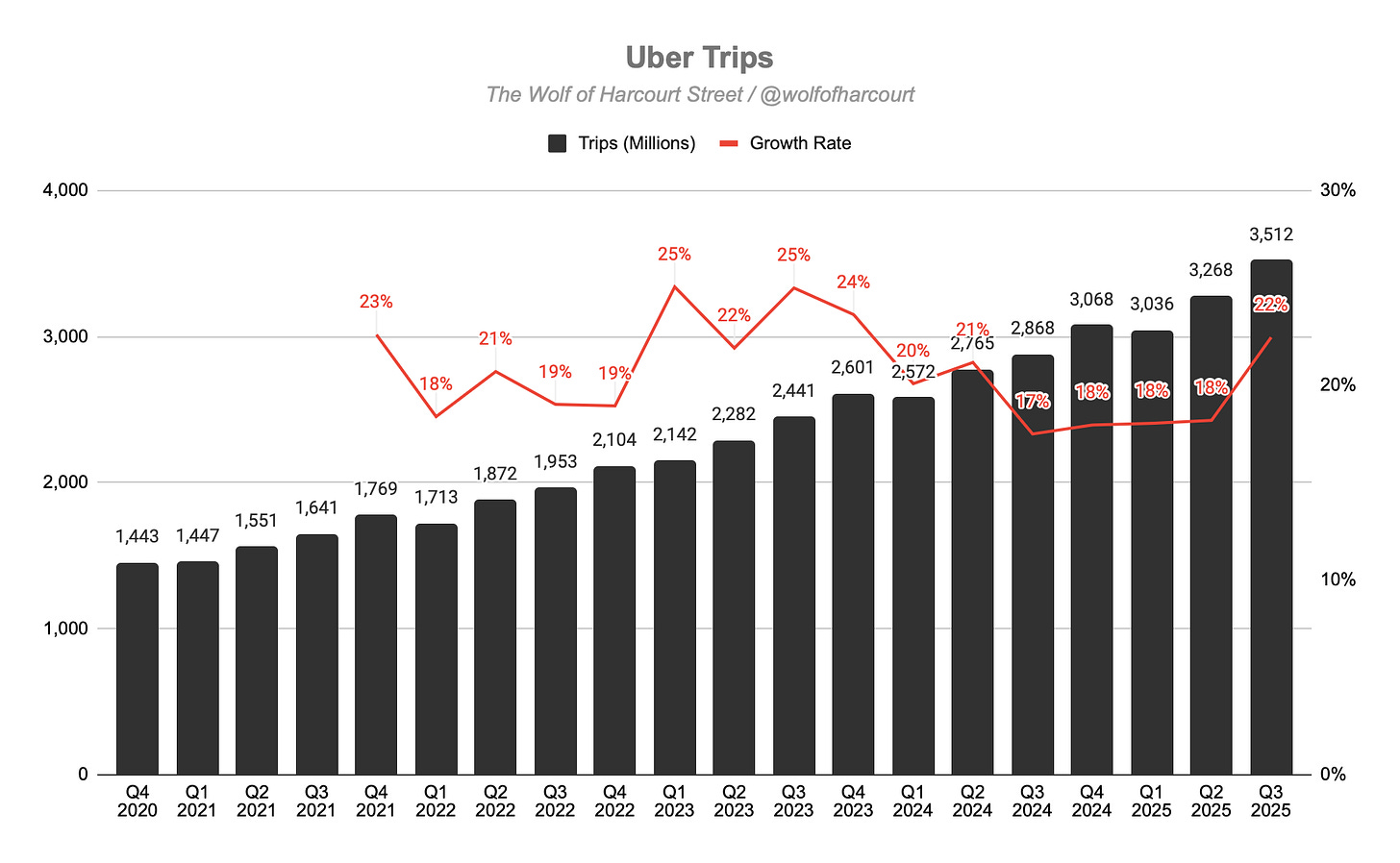

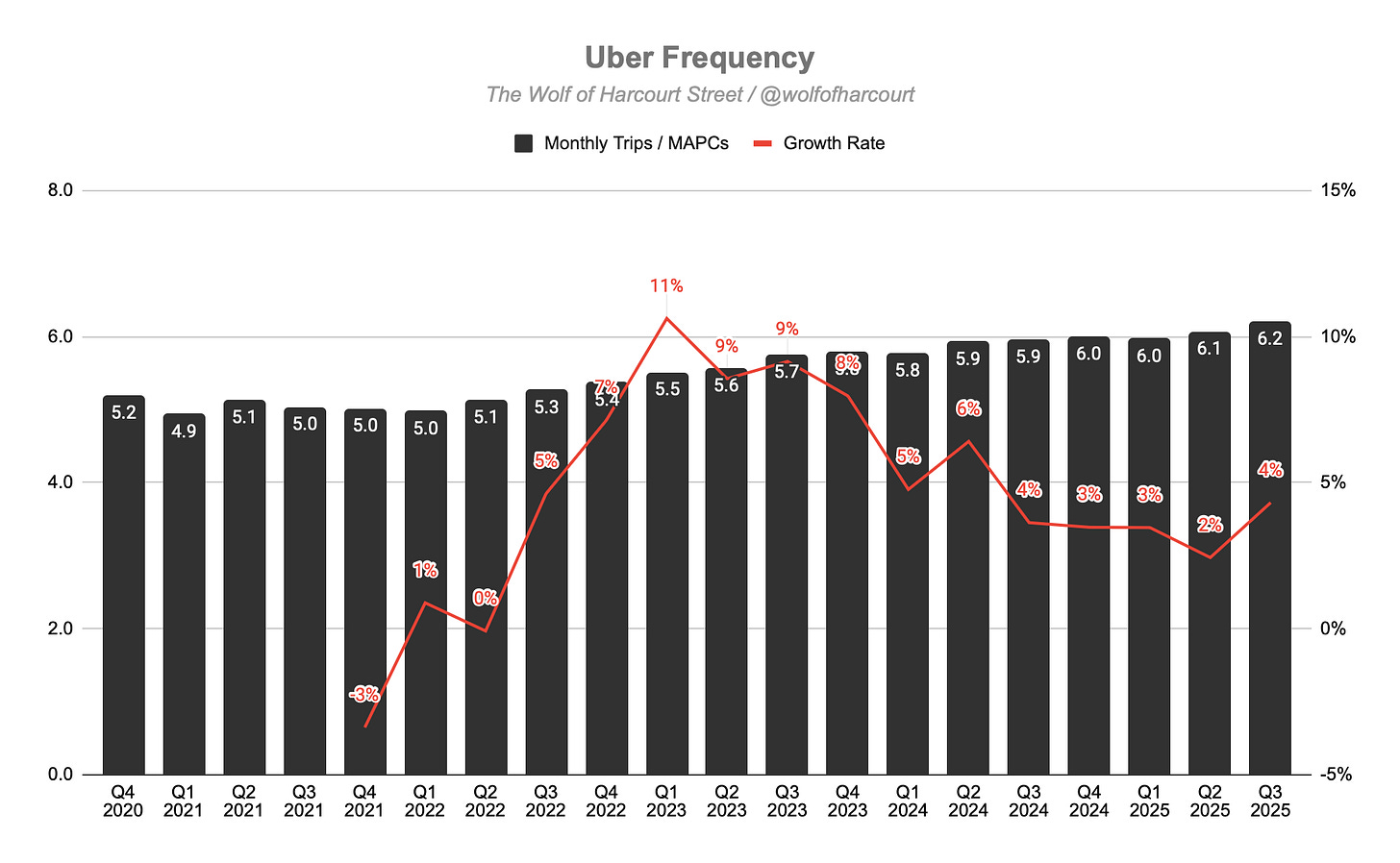

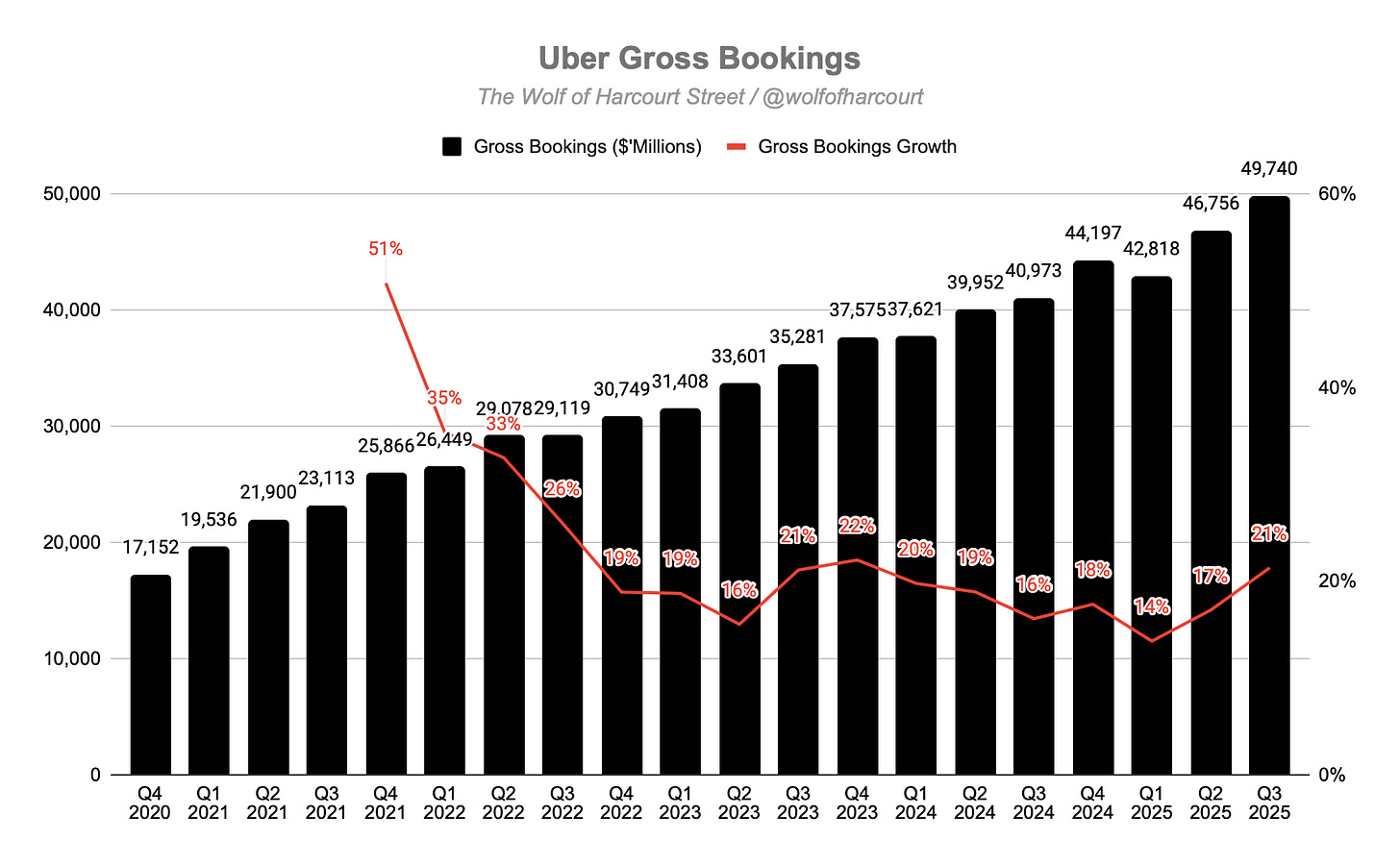

I increased my position after the stock sold off alongside the broader market this month. Earlier in the month, Uber delivered another strong quarter with acceleration across all key operating metrics.

Charts tell the story better than words. As you can see from the visuals, the business is performing exceptionally well and the thesis is unfolding exactly as expected.

Sea Limited (SE)

I added to my SE position following another exceptional quarter. Despite a strong revenue beat, the stock fell 8% due to an EPS miss. When a company is growing at this pace, you actually want it to reinvest as much profit as possible into future opportunities.

Even with heavy investment, SE still posted a healthy 8% operating margin, which shows it is scaling in a sustainable way. A few standout highlights from the quarter:

GMV growth continues with no signs of slowing.

Monee remains the fastest growing segment.

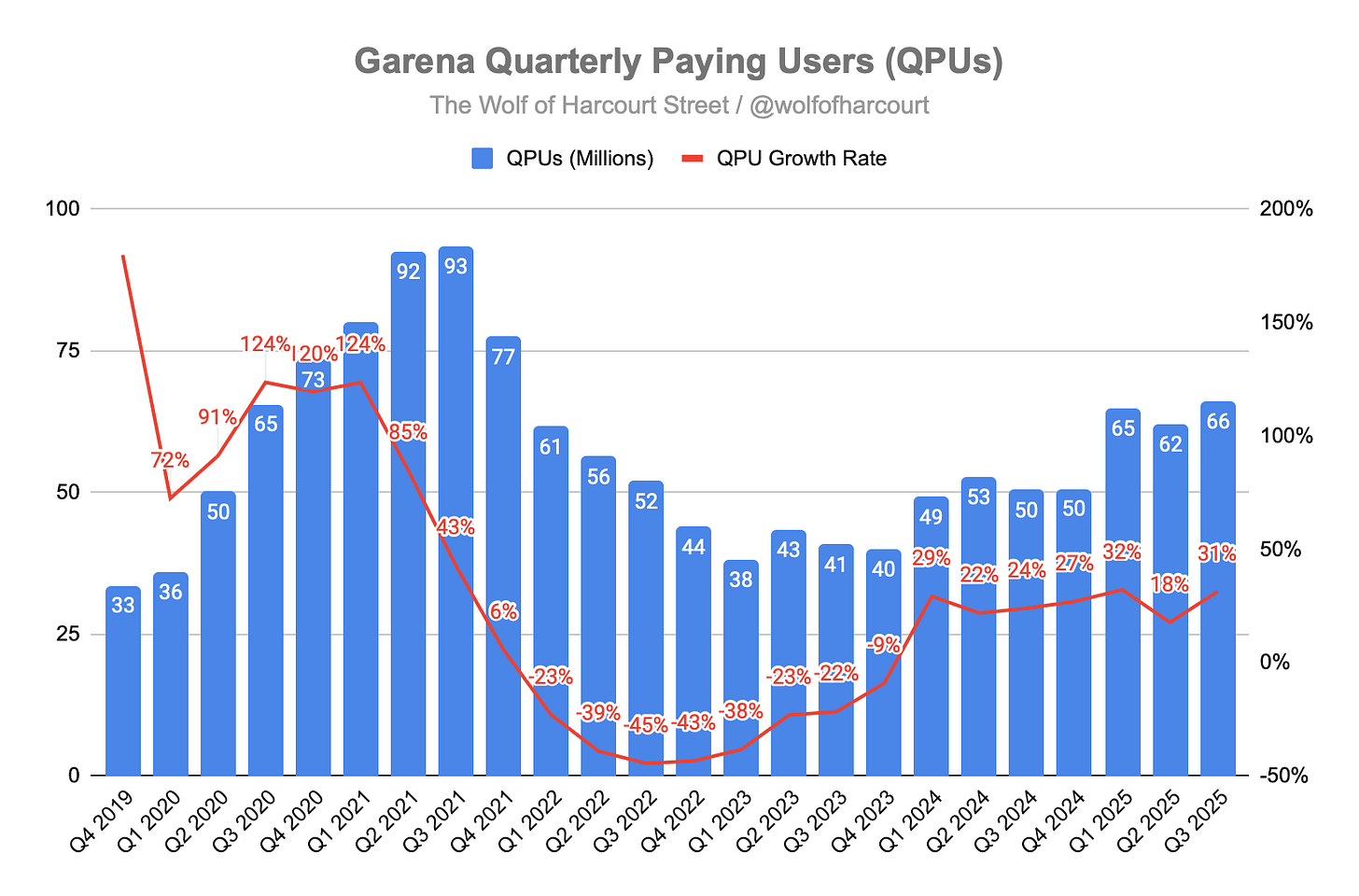

Garena QPUs accelerated and reached their largest cohort since Q4 2021.

Revenue growth has exceeded 30% for five consecutive quarters.

Sales and Marketing efficiency hit new highs, with an extra $141 million driving $727 million in incremental revenue, a 5x ROI.

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns.

From 26 November to 1 December, Portseido are offering a huge Black Friday sale with up to 40% off for new customers for three months.

Sign up using my affiliate link here.

Buy List

Microsoft (MSFT)

Microsoft is the longest held position in my portfolio and one of my largest winners. I have not added since May 2022. The stock still is not cheap, but it now trades below 30 times forward earnings, which has historically been a good entry zone since the multiple rerated.

Given the position is only 5% of the portfolio, and much of that weight is due to price appreciation rather than capital invested, I would like to increase it.

Meta (META)

If Microsoft might still look a little expensive, Meta appears far more reasonable at roughly 22 times forward earnings.

Much of the debate around Meta concerns its CapEx and whether the returns will justify such eye watering investment. CapEx has risen from about $2 billion ten years ago to over $62 billion in 2025, with even higher expected in 2026. Yet over the same period, Meta’s return on invested capital has tripled from 8% to almost 23%. Few, if any, would have predicted this a decade ago.

I cannot say exactly how the future will play out, but Mark Zuckerberg remains one of the strongest founder CEOs in the industry. He has better visibility into potential and early returns than any outside observer. Meta’s revenue acceleration in recent quarters is no coincidence and is clearly being supported by these investments.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

I have been less active on the newsletter this month as I have been travelling in Japan. It is my first time here and it has been an incredible experience. The people are respectful and polite, the food is fresh and affordable and the public transport system is unlike anything I have seen elsewhere. It is also a great time to visit with a relatively weak yen.

Trips like this remind me of my why. I invest to buy back time. Being able to take trips like this while I am still (relatively) young and healthy, rather than waiting until formal retirement, matters a lot to me. Without my investment portfolio, I would be more constrained by an employer and might not have the flexibility to travel like this.

Keeping your why front and centre helps maintain discipline and a long term mindset, especially when markets get noisy.

What is your why?

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great to see InPost and Evolution in the mix. I feel like those European compounders fly under the radar for too many investors compared to US tech.

22 years old from Argentina. Just looking to buy time. I just want to travel and do sports until my body say no more. Cheers and happy for you, seeing people living the live i want helps a lot.