Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

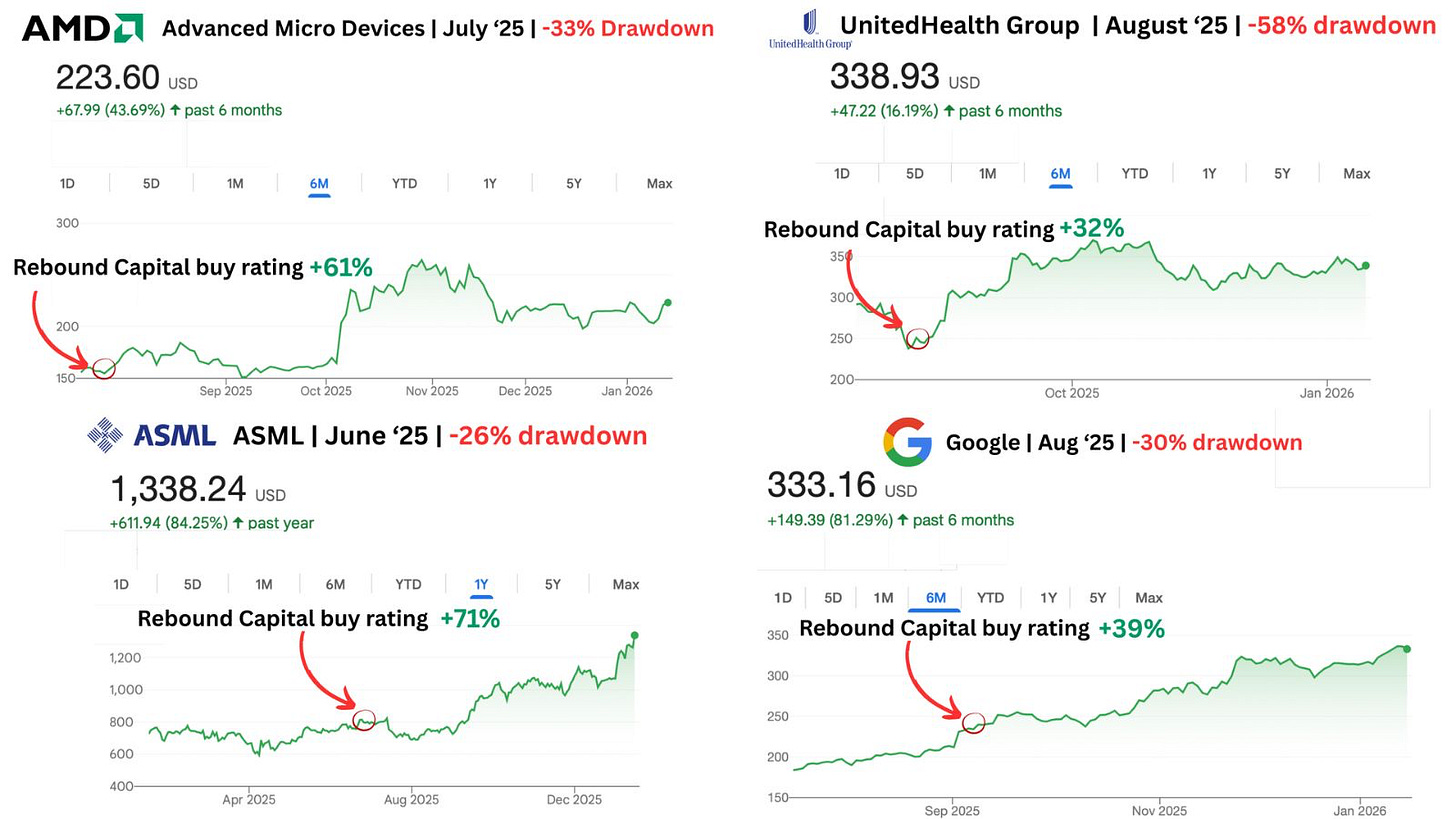

Top 10 Rebound Stocks for 2026

Meta once dropped 70%. Netflix: 50%. Amazon: 40%. Every investor had ruled them out, citing “the companies were done”.

But they all rebounded - Meta: 690%. Netflix: 540%. Amazon: 153%.

Every world-class company suffers deep drawdowns. Rebound Capital identifies high-quality companies undergoing drawdowns to capitalize on their eventual rebound.

Just last year, they identified ASML (up 58%), Google (up 40%), and AMD (up 61%) as ideal rebound prospects. The Wolf of Harcourt Street readers can now unlock their exclusive 25-page report on the top 10 rebound opportunities for 2026 for free!

Transactions

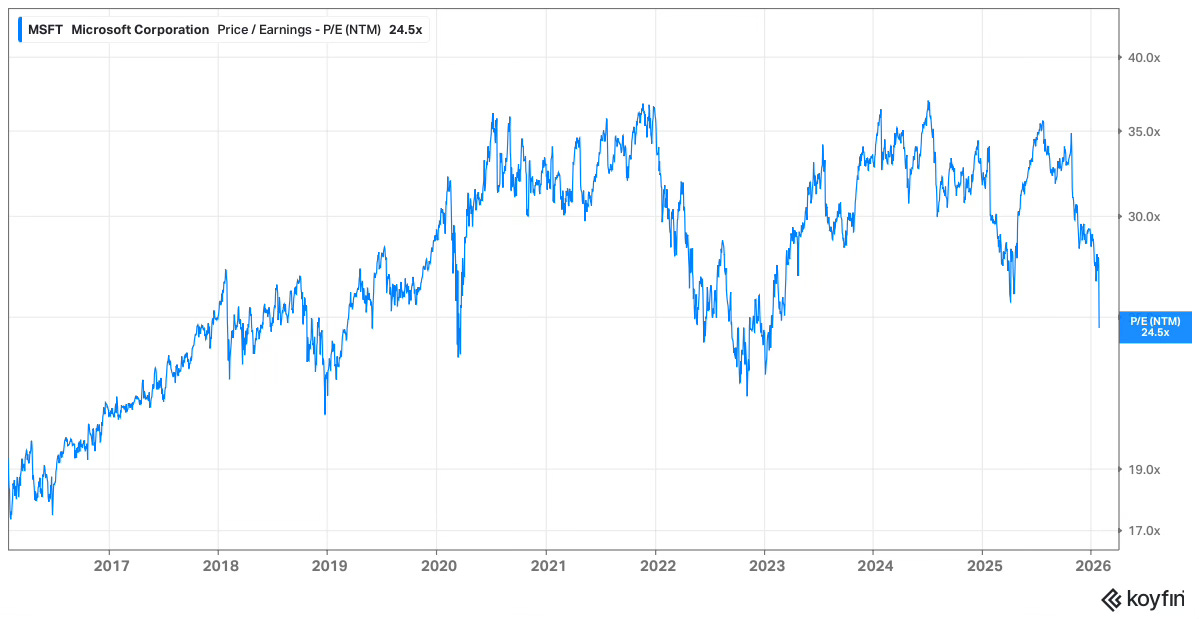

Microsoft (MSFT)

I finally added to my MSFT position for the first time since 2022. MSFT is one of the anchors of my portfolio but is currently materially underweight.

In the past, I have been too greedy waiting for a lower multiple. The stock recently fell to ~24x forward earnings, which I believe is very reasonable for a business that can continue to grow earnings at double digit rates for at least another decade, supported by powerful secular tailwinds in cloud and AI.

Rubrik (RBRK)

Rubrik was a new addition to the portfolio in 2025 and, in my view, offers a compelling opportunity below $60.

At $56, an inverse DCF implies ~19% annual growth over the next decade. I believe this is entirely reasonable given Rubrik is currently growing revenue by ~50%, even allowing for a deceleration into the ~30% range in coming years. On top of that, the business should benefit from meaningful operating leverage, with expanding free cash flow margins as it scales and matures.

The stock has been under pressure over the past couple of months, largely due to the broader “AI disrupts SaaS” narrative. However, cybersecurity is one of the most insulated areas of SaaS. Backup relies on immutable, offsite, air gapped copies, making third party platforms a necessity for security and compliance.

Backup is subtractive risk management, requiring independence. AI tools are additive. Even with internal AI solutions, enterprises still need trusted third party backup providers, which is exactly what RBRK offers. Importantly, RBRK integrates AI and machine learning for threat detection without introducing substitution risk.

Visa (V)

Last month, I added to Visa and noted the following:

“I added to my position in Visa for the second month in a row. Paying 25x forward earnings for a business of this quality feels very reasonable. The multiple has already expanded to almost 28x in a relatively short period.

With stable, high quality businesses like this, I try to add near the lower end of their historical valuation range. Sometimes there is no need to overcomplicate things.”

The exact same logic applied again this month.

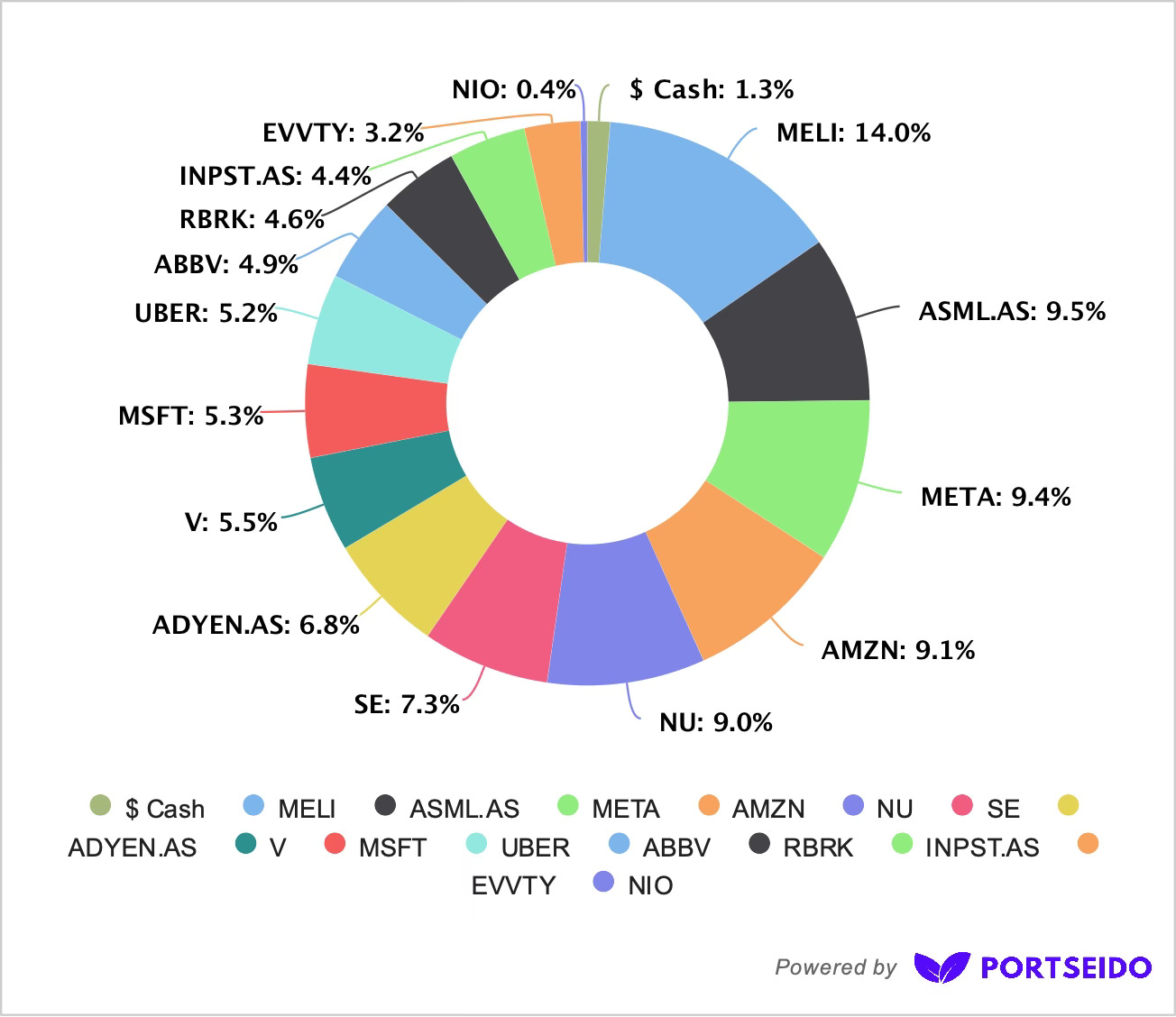

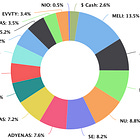

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns.

Sign up using my affiliate link here.

Buy List

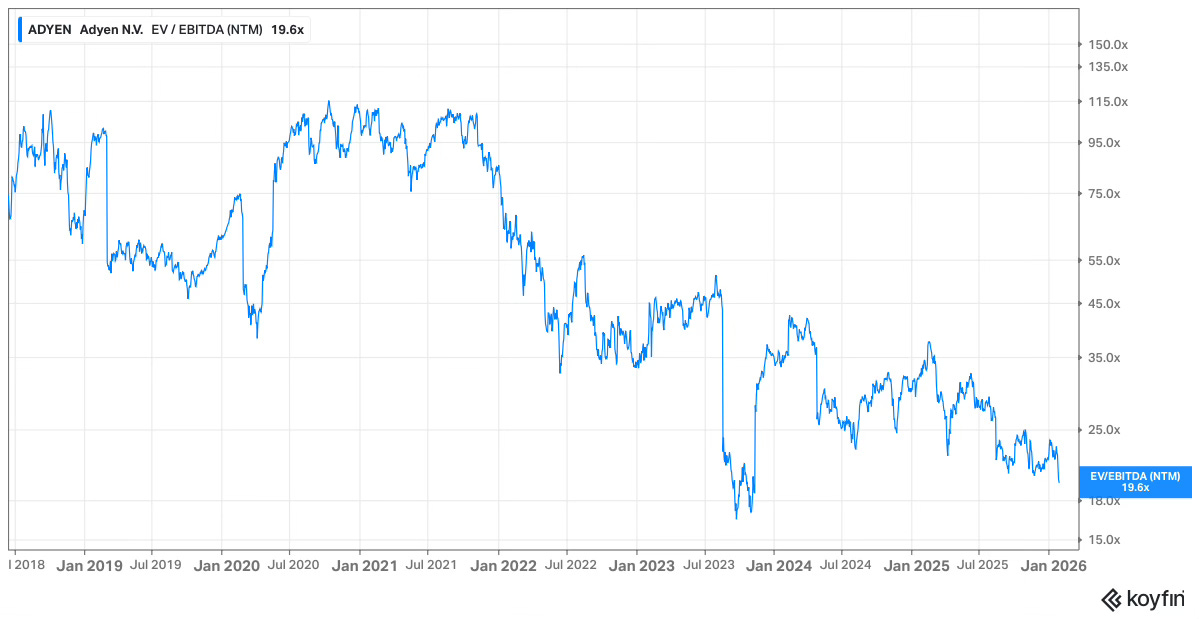

Adyen (ADYEN)

Payments has been under pressure over the past few months and Adyen has not been immune. The stock is down ~15% over the past three weeks, yet nothing has fundamentally changed.

I built the majority of my position in 2023 when the stock was cut in half and traded below €700. At that point, the forward EV/EBITDA multiple fell to ~16x. Enterprise Value is the appropriate metric for Adyen given the large amount of cash it holds on behalf of merchants.

While the share price is almost double today, the multiple has once again compressed below 20x for the first time since. This is a high quality business and, at this valuation, I believe it offers an attractive opportunity. I continue to expect >20% top line growth over the next three to five years.

Sea Limited (SE)

It has been a tough three to four months for Sea Limited, with the stock down almost 40% since October 2025.

Fundamentally, little has changed. Sea continues to fire on all cylinders, as shown in its most recent Q3 earnings report towards the end of 2025. I have nothing further to add here that I have not already written, but I would draw your attention to this excellent piece from GabGrowth, which aligns closely with my own view.

The current drawdown appears driven far more by sentiment than fundamentals

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

The portfolio got off to a very strong start to the year, reaching a new all time high. Interestingly, beneath the surface, several themes have been getting hammered, particularly enterprise SaaS and payments.

On one end, ASML and INPST are both up ~30% year to date. On the other, RBRK and MSFT are already down double digits.

This is a great example of how sector diversification creates opportunity. Readers will know that I was buying ASML and INPST throughout 2025 when they were widely disliked. Now that they are back in favour, I am doing nothing.

Conversely, RBRK and MSFT are currently out of favour, and I am buying. There will almost always be one or two sectors under pressure at any given time. That is typically when I aim to do the majority of my buying.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

For InPost, can you clarify why you didn't at least trim your position? From my maths, the supposed offer would be below the stock price at one point. Or do you think it won't go anywhere and the stock should go much higher? Just curious to read your thoughts. Thanks

I do make a difference between Total cash en Adyens own cash. I expect 4-4,5B in own cash end of 2025. But no need for that if u use Ebitda multiple… We will have to see how Adyen capital changes this in the future.. 28x FCFyield on market cap