Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Airbnb (ABNB)

I sold my full position in Airbnb, which had a 4.5% portfolio weighting at the time of sale. My average cost basis was $134, and I sold at $137, resulting in a modest 2% return, just above breakeven.

I’ve already shared a comprehensive article explaining my rationale (linked below), but in short: after a mediocre series of earnings reports and a lacklustre Summer Release, I have serious doubts about Airbnb’s ability to reaccelerate revenue growth toward 20%.

While I don’t believe Airbnb is wildly overvalued at current levels, I’m simply not interested in holding a growth stock that isn’t growing at above-average rates. That said, if the company’s new initiatives prove successful, I would be open to reentering the stock. I admire CEO Brian Chesky and believe the underlying business model remains a cash-generating machine.

ASML (ASML)

I began building a position in ASML earlier this year and continued adding this month. I find the stock attractive below €700, and it has mostly traded between €600 and €700 over the past six months.

Nubank (NU)

NU reported Q1 2025 earnings this month. Key highlights include:

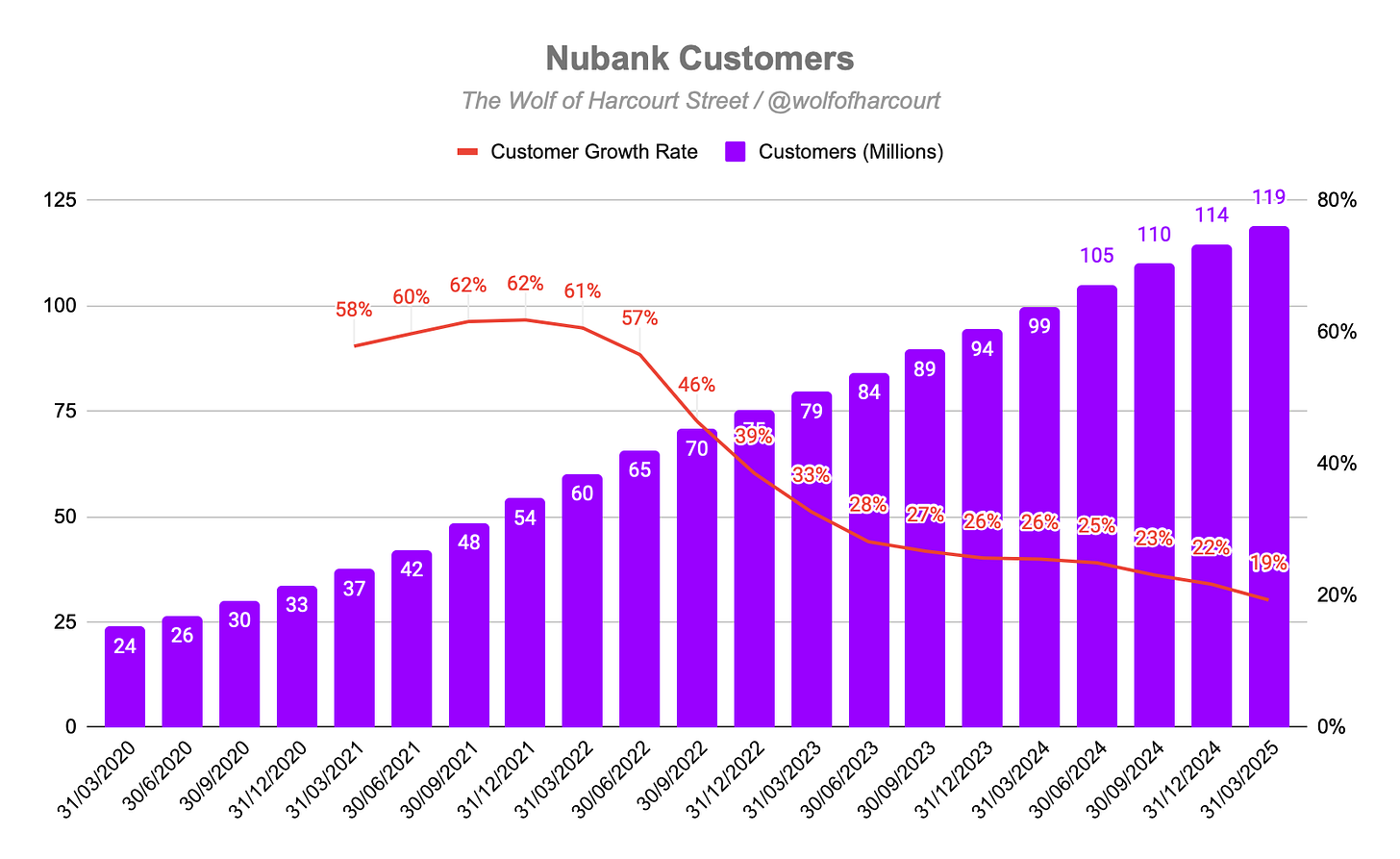

Total Customers: Reached 118.6 million, up 4.3 million in Q1 and 19.3 million year-over-year (YoY).

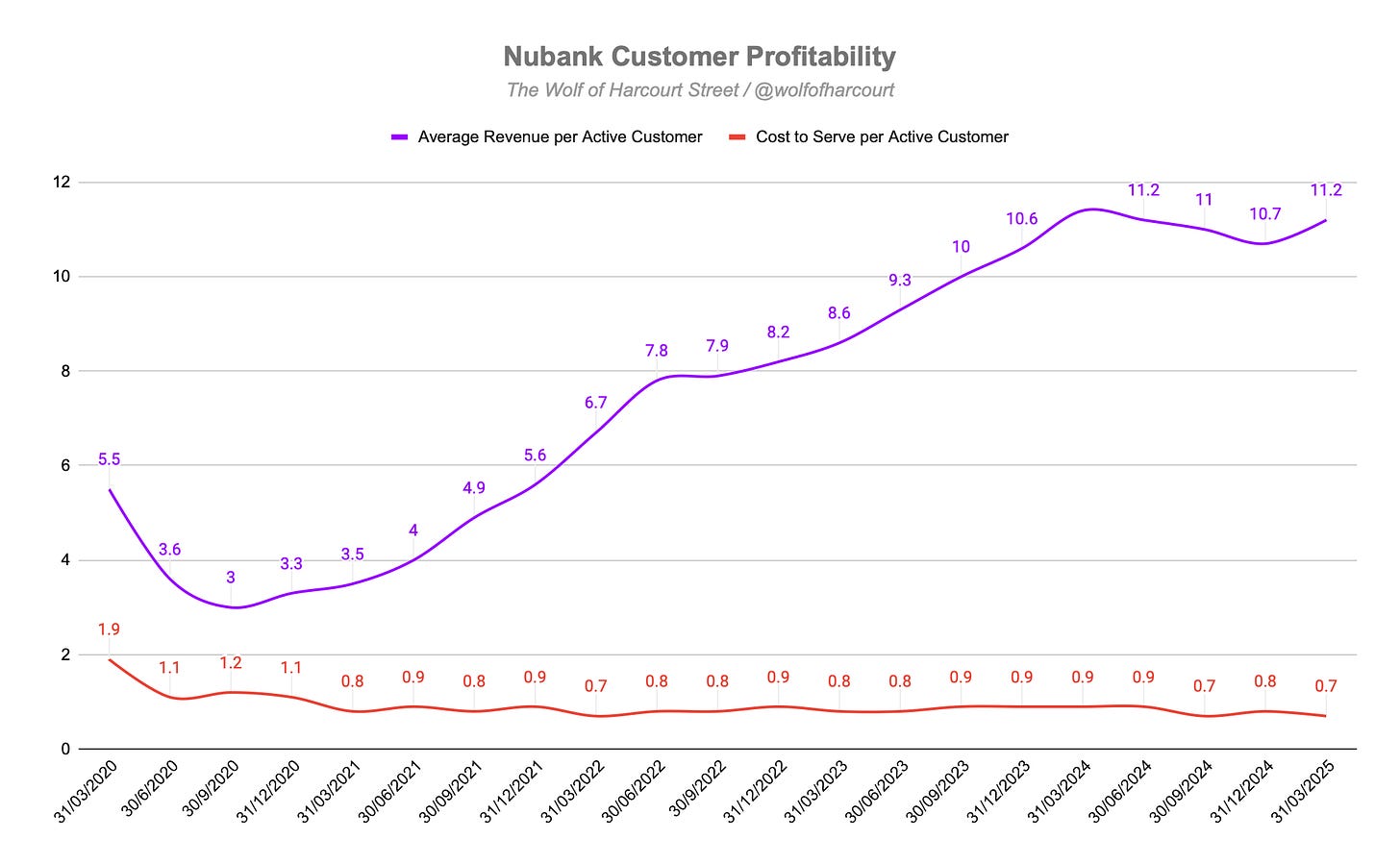

Customer Profitability: Monthly ARPAC rose 5% QoQ and 17% YoY (FX-neutral) to $11.20. Cost to Serve Per Active Customer remained under $1, at $0.70, down 4% YoY and 12% QoQ (FXN).

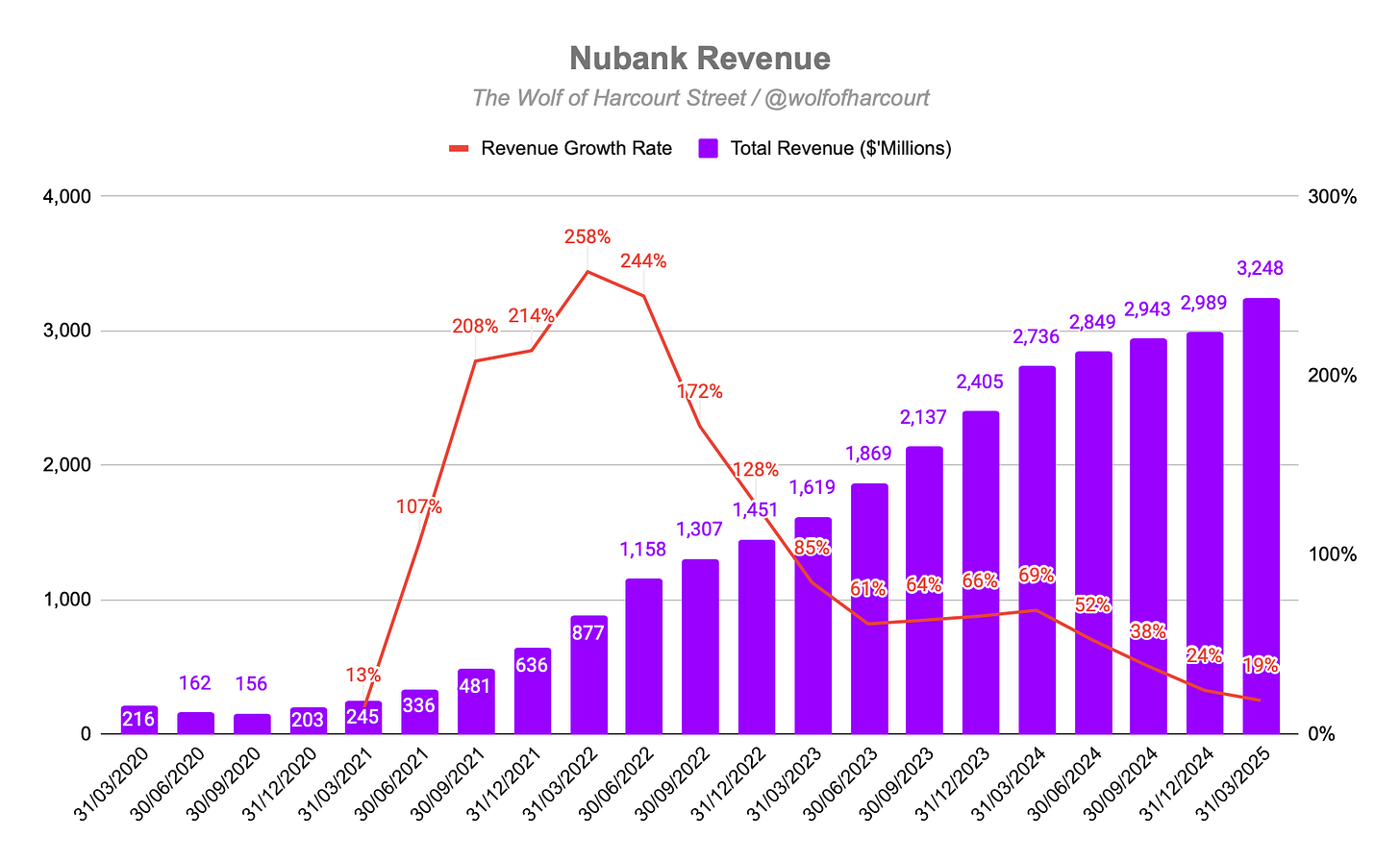

Revenue: Grew 40% YoY FX-neutral to a record $3.2 billion. On a reported basis, growth was 19%, impacted by the depreciation of the Brazilian Real, despite a rebound in Q1.

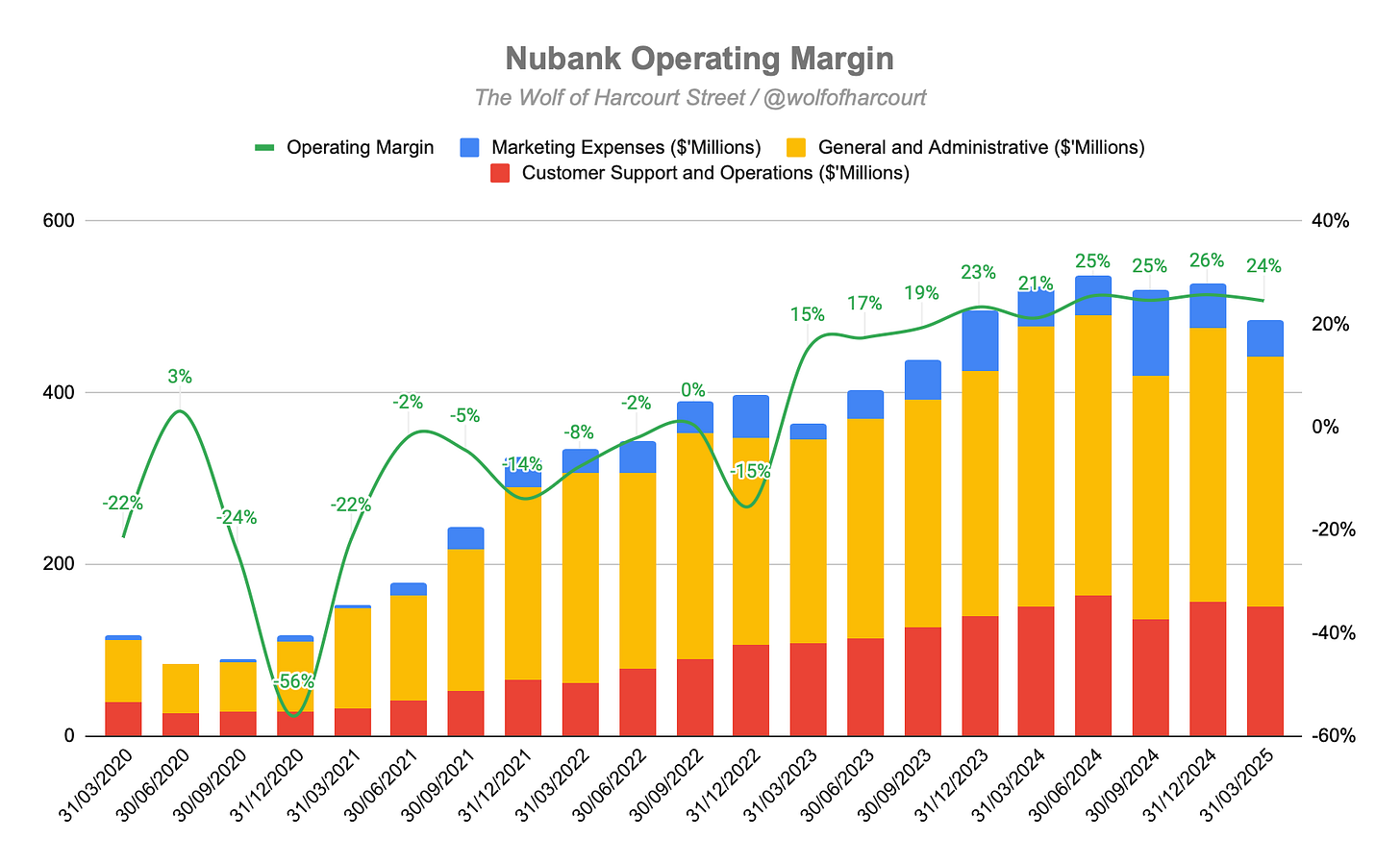

Operating Margin: NU achieved an operating margin of 24%, up from 21% YoY but down from 26% QoQ. Margin pressure from higher interest rates and international expansion is considered strategic and temporary.

Overall, it was a solid report, though not as spectacular as some recent quarters. Despite short-term headwinds, the long-term thesis remains intact. My fair value remains around $15 per share, so I was happy to add below $12.

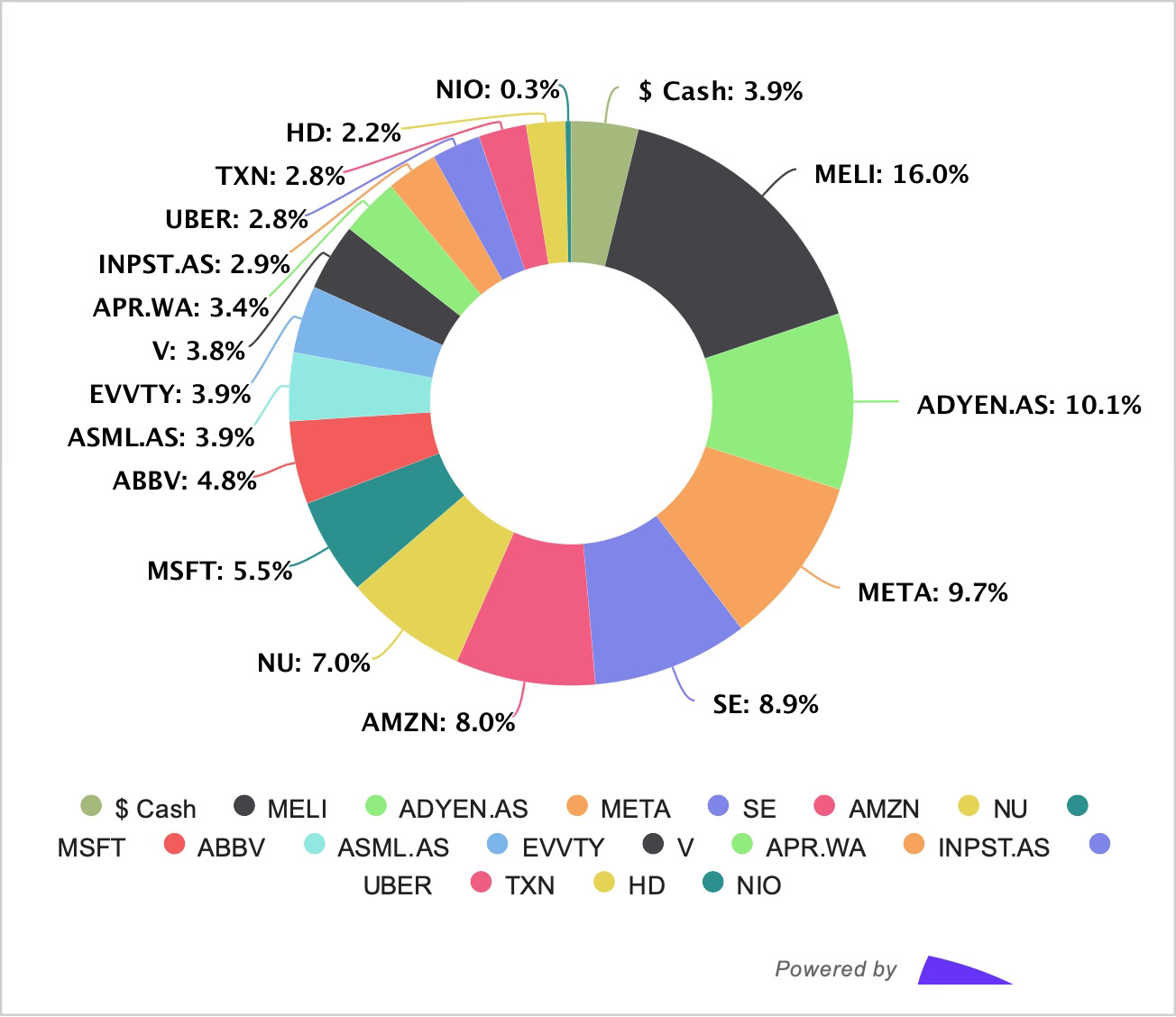

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Buy List

Stocks on my radar to add this month:

ASML (ASML)

I plan to continue accumulating shares of ASML if it stays below €700. A boring but simple strategy.

InPost (INPST)

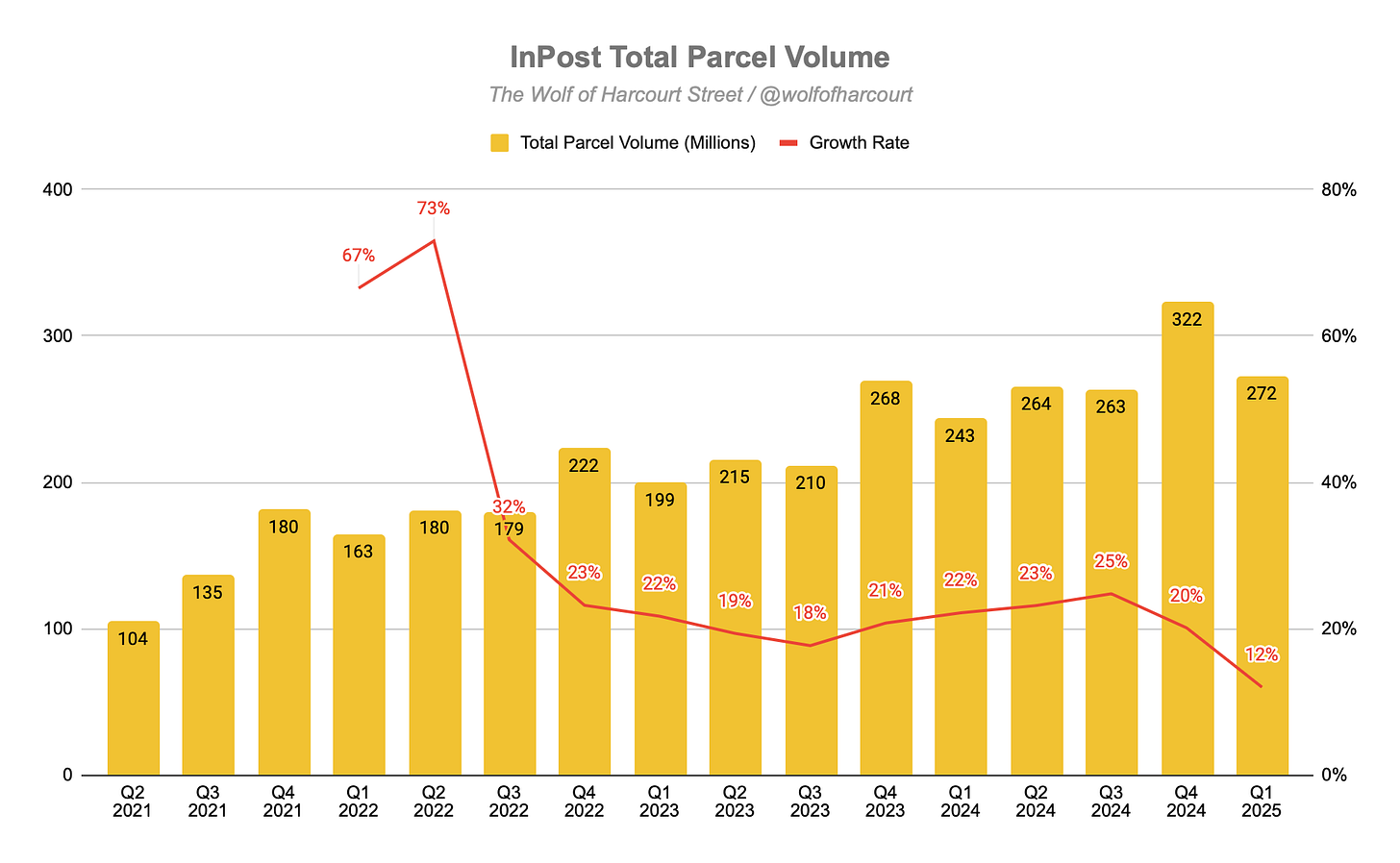

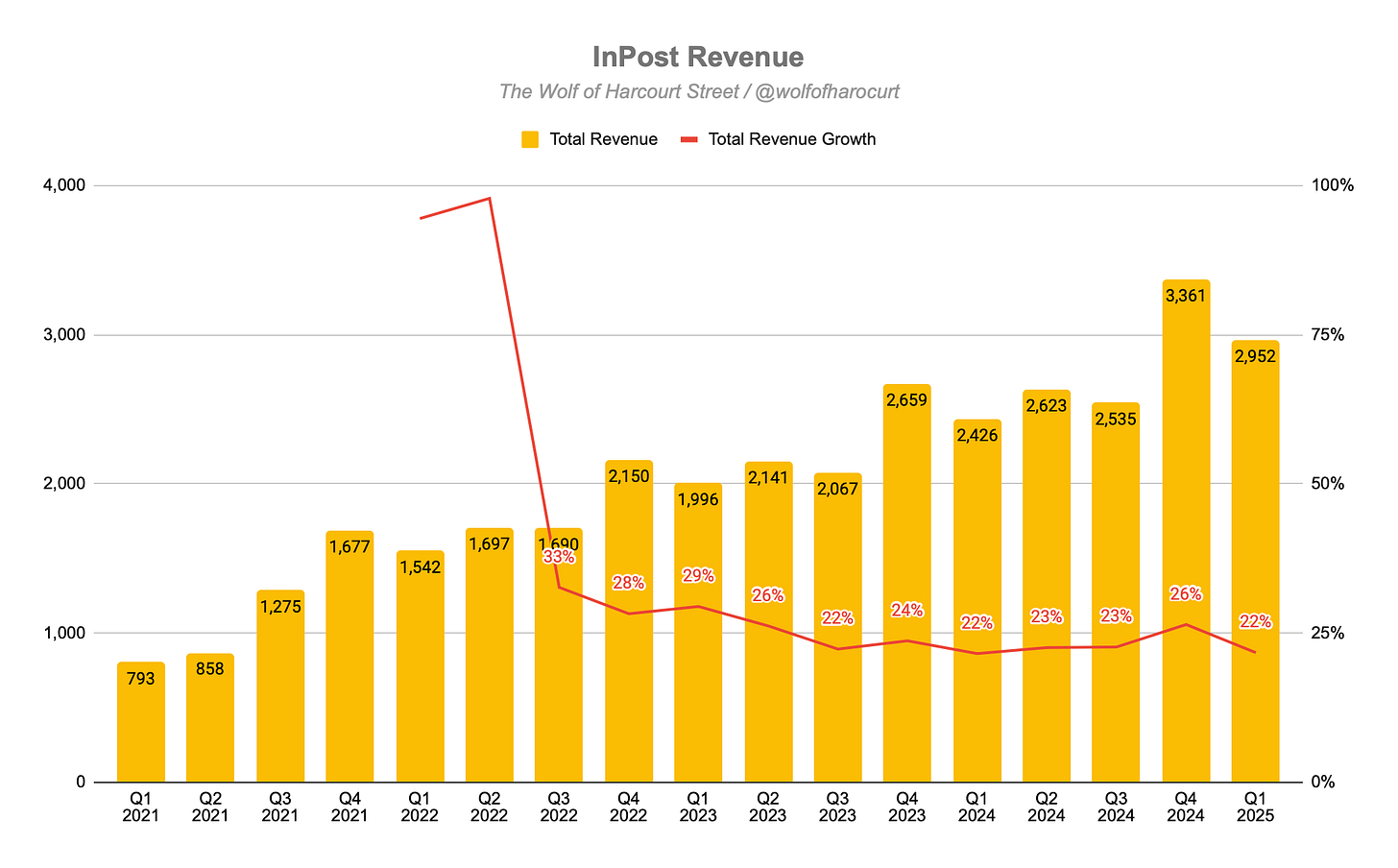

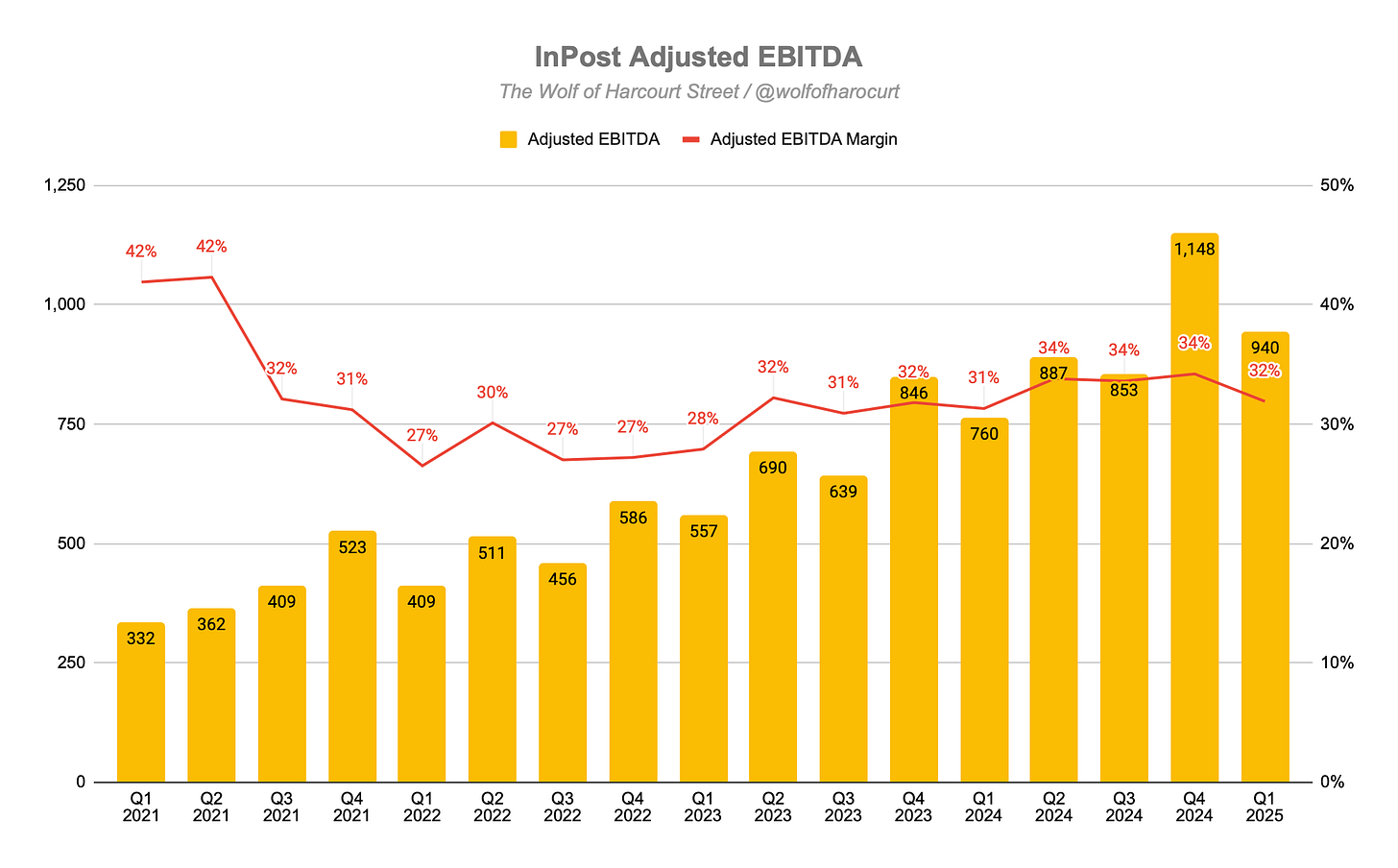

InPost also reported Q1 2025 earnings this month. Key highlights:

Parcel Volume: 272 million parcels, up 12% YoY, outpacing e-commerce growth in key regions.

Revenue: Total revenue reached PLN 2,951.9 million, up 22% YoY, driven by exceptional UK & Ireland growth (+145%), with Poland and the Eurozone growing 11% and 14%, respectively.

Adjusted EBITDA: Rose to PLN 940.2 million, up 24% YoY. The margin improved 52 basis points to 31.9%, supported by strong performance in Poland and expanding margins in the Eurozone and UK & Ireland.

I find InPost attractively priced at the moment. It trades at a forward P/E of under 20, and I expect earnings to compound in the high teens over the next five years.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

After a 19% drawdown in April, the portfolio rebounded strongly in May to reach a new all-time high.

The sale of Airbnb was opportunistic, coinciding with the portfolio hitting this milestone. As a result, I am now holding a cash position of nearly 4% alongside a record portfolio value. If opportunities arise in the form of a meaningful pullback, I have the dry powder to act. If they don’t, I’ll deploy capital gradually over the coming months.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Are you considering buying a bit more of Evolution with this cash? Or are you expecting more decline?

Congratulations, we both had a great month! Hitting all time high as well for PA and Sleep Well Portfolio.