Welcome back to the Wolf of Harcourt Street Newsletter

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Disposals

Dole plc (DOLE) was a 3% position when I sold it in February for a 45% gain. The original thesis was a pure value play. When I initiated the position in Q3 2022, the stock was trading at significantly lower multiples than its peers. The forward P/E for Dole at the time was 7 compared to the sector median of 20. The stock yielded a dividend of close to 4% at the time meaning investors could get paid to wait as the thesis played out. I was happy to bank the gains and move on. 45% was a significant return in less than 6 months given the thesis was always around valuation.

Acquisitions

I added to my positions in the following:

MercadoLibre (MELI)

Brookfield Renewable Corporation (BEPC)

Johnson & Johnson (JNJ)

Texas Instruments (TXN)

Datadoog (DDOG)

New Positions

I opened three new position during the quarter:

Chevron (CVX) and the theme of an energy crisis is something I have been analysing over the past number of months. Research from Morgan Stanley suggest that the under-investment in energy is at historical lows. Meanwhile, Europe in particular faces an ongoing energy crisis stemming from the war in Ukraine.

Oil exposure is not something I had in my portfolio but Chervon now rectifies this. The company recorded record free cash flow of $37.6 billion in 2022 representing a FCF yield of 11.2%. The price of oil may have fallen over the past month or so but as Ned Stark once said:

Winter is coming

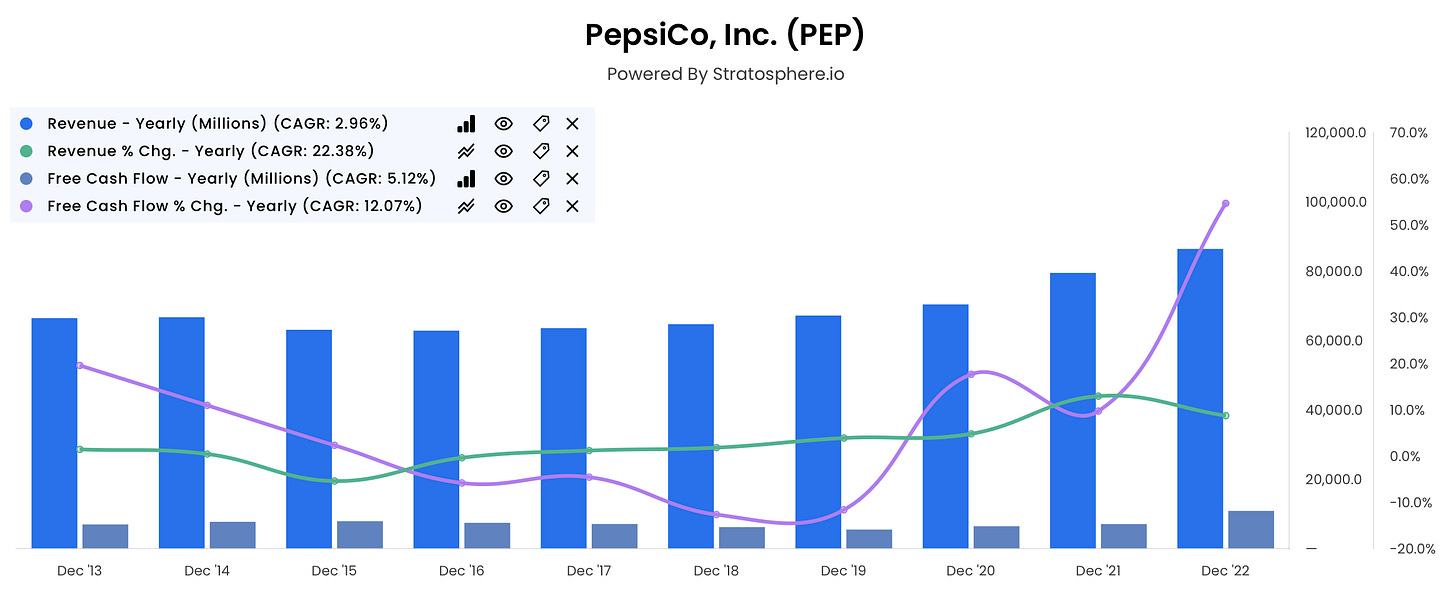

PepsiCo (PEP) is the direct beneficiary of the proceeds from the sale of Dole. By selling Dole, I no longer had any Consumer Staple exposure. After analysing a number of stocks in this area I sided with Pepsi because it has got all the characteristics of a slow compounder. The company has a ten year revenue growth CAGR and FCF growth CAGR of 3% and 5% respectively. In addition, the company trades at a forward P/E of 25.

Home Depot (HD) was the last but by no means least stock to be added to the portfolio. This is a stock that I have followed for many years but could never justify its valuation. This is a quality business with an insanely high return on capital of 31%. The company has achieved this by pivoting away from growth by building new stores to growth by making each existing store more profitable. The stock traded above $400 a share in January 2021 but is now sub $300. Reasonably valued in my opinion.

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Performance

Q1: +11% vs S&P +5.4%

Buy List

Stocks that are on my radar to add this month:

Chevron (CVX)/ Home Depot (HD)/PepsiCo (PEP) - All new additions to the portfolio that I am looking to build out.

Airbnb (ABNB) - The numbers that this company posted in 2022 were extremely impressive. You can read my full thoughts below. This stock has earned a higher weight in the portfolio.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

I was more active with new positions this quarter than I have been in quite some time. I spend most of 2022 travelling with the portfolio on auto pilot mode. With 2022 in the rear view mirror and after reviewing all of the year-end reports for my holdings, I have been able to reflect and make some adjustments.

MELI is my largest position for the first time. The reason for this is two fold: I made an opportunistic add to my position at the start of January coupled with the stock running +48% YTD. On a cost basis the allocation is 7% compared to the current market value of almost 11%.

Growth stocks were very hot during the quarter with many looking extended from a technical point of view. As a result, I focused my attention on increasing and opening new positions in some of the value stocks that I have been tracking.

The portfolio return this quarter was better than the market. This is not something I pay much heed to. This portfolio is built for decades rather than quarters.

On a side note, I am in the process of switching brokers at the moment. I have been made aware of a new broker which I have been testing out over the past couple of weeks. I will share my thoughts in due course.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com