Executive Summary

Customers with $100K+ in subscription ARR grew 27% YoY to 2,505 and now contribute 85% of total subscription ARR. Retention remains strong, with subscription NRR above 120%, driven by expanding data usage, adoption of additional applications, and rising demand for security functionality. Notably, 35% of NRR this quarter came from security feature adoption. CEO Bipul Sinha held over 125 customer and prospect meetings in Q2 FY26, underscoring strong engagement across industries. Wins included displacing both legacy vendors and next-gen competitors at Fortune 50 and Fortune 500 firms, government agencies, and global enterprises, often due to Rubrik’s faster recovery times, stronger cyber resilience, and lower costs.

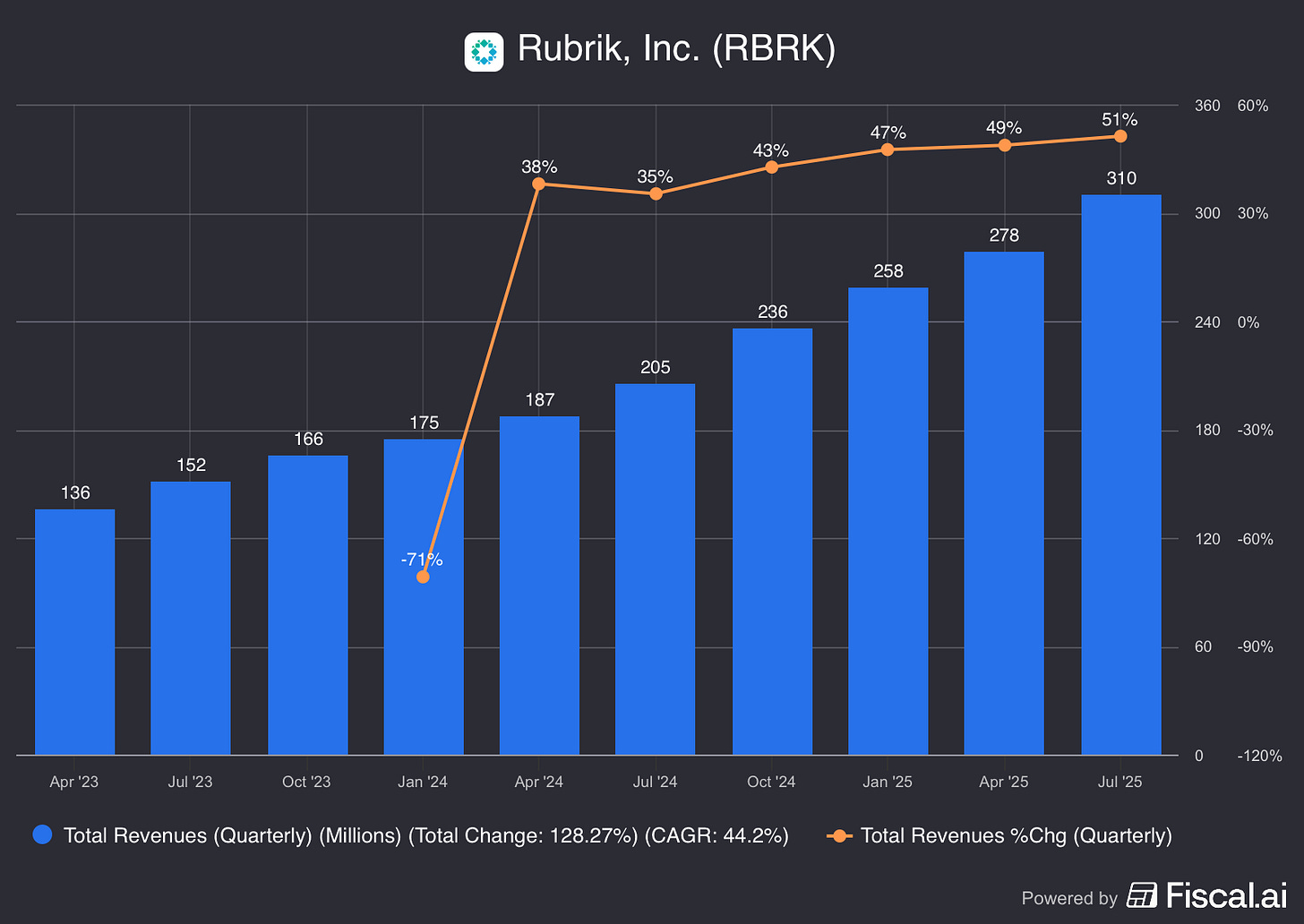

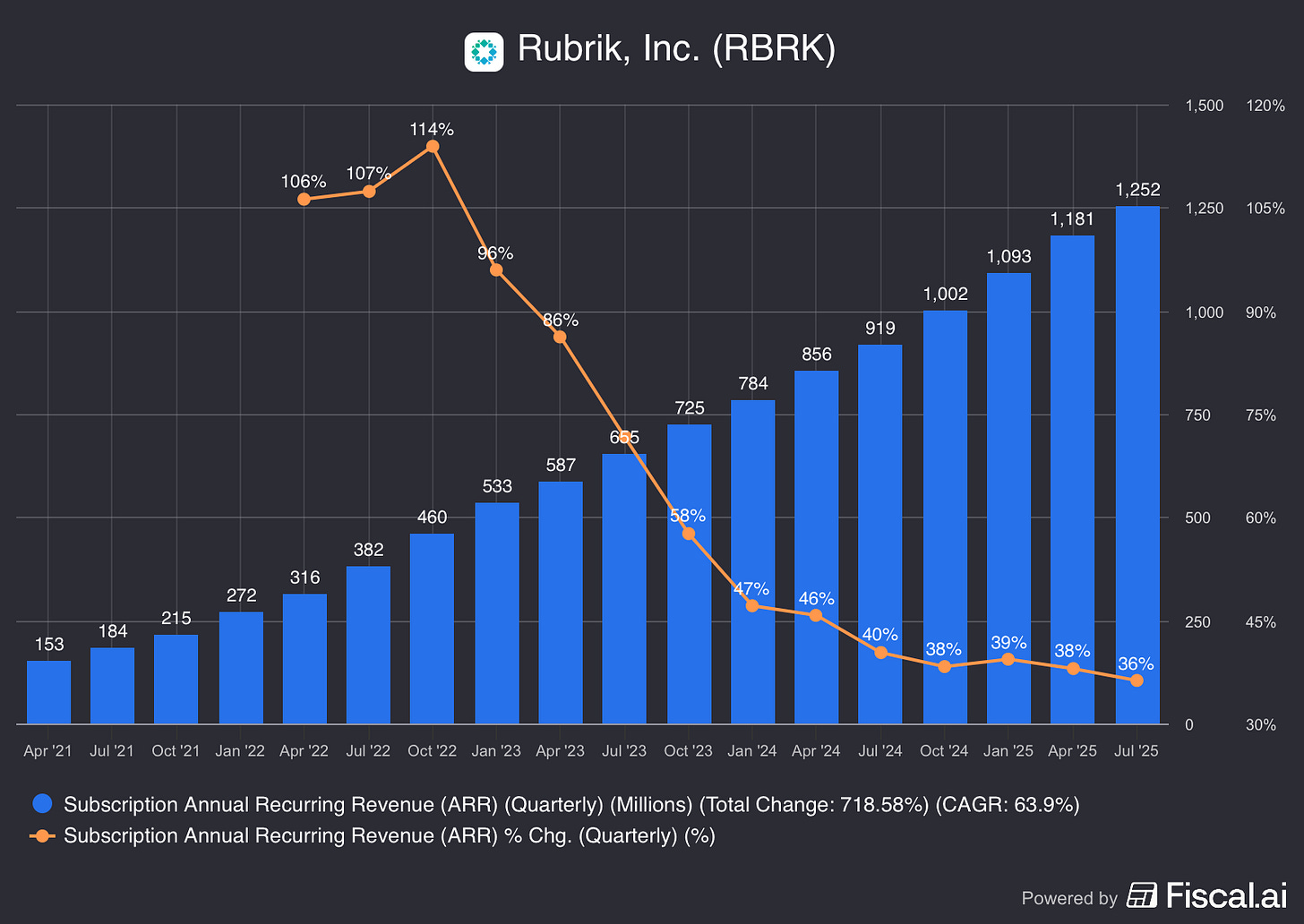

Rubrik delivered strong top-line performance with revenue of $310 million, up 51% YoY and above guidance, marking its fourth consecutive quarter of accelerating growth. Subscription revenue accounted for 96% of the total at $297 million, up 55% YoY, supported by a 36% increase in Subscription ARR to $1.25 billion. Non-recurring revenue tied to expiring material rights contributed about 7 percentage points to growth. Adjusted for this, revenue rose closer to 44% and the beat versus Wall Street narrowed from 10% to 5%.

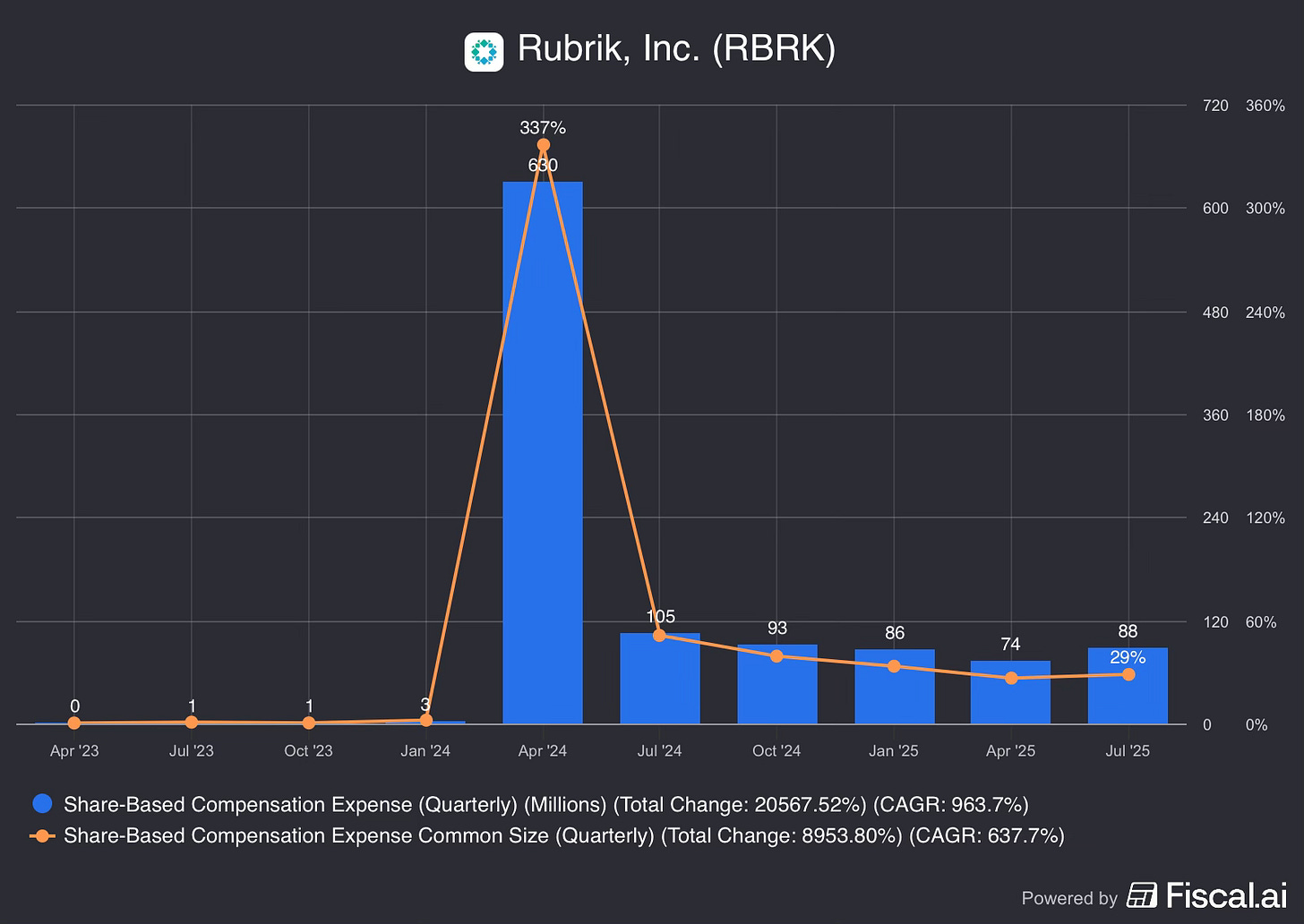

On profitability and cash flow, Rubrik showed clear progress despite remaining unprofitable. Operating loss narrowed to $95 million with operating margin improving to -30% from -82% a year ago, as operating expenses rose only 7% against 51% revenue growth. Rubrik also delivered $61 million in positive free cash flow, a sharp turnaround from negative $30 million last year, aided by early renewals, multi-year contracts, and refinancing high-cost debt with a 0% convertible. The main gap between operating losses and positive free cash flow stems from stock-based compensation of $88 million, which remains high but is trending lower as a percentage of revenue.

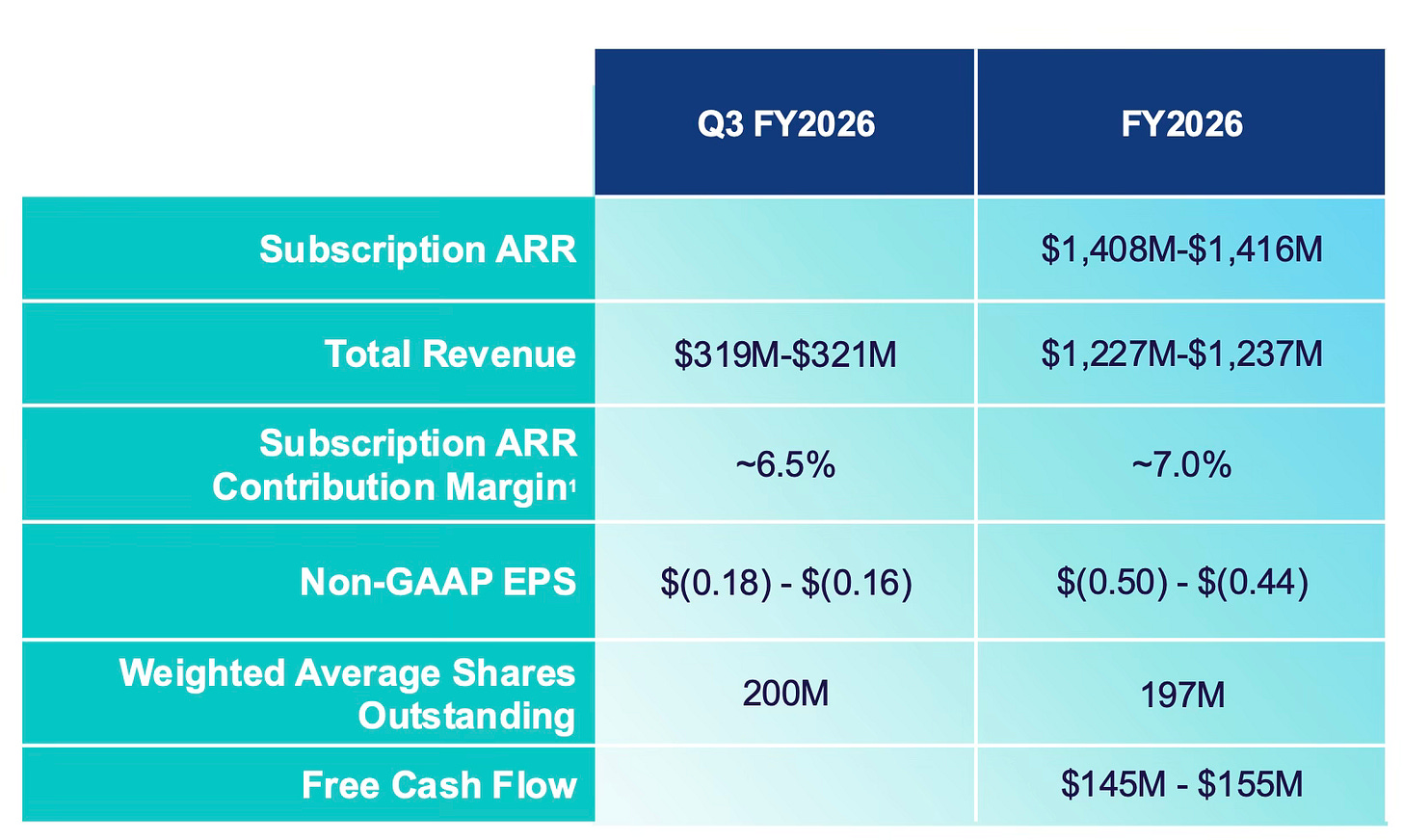

Management raised guidance across all major metrics for Q3 and FY26. Full-year expectations now call for subscription ARR of $1.408–1.416 billion (+29–30% YoY), total revenue of $1.227–1.237 billion (+38–40% YoY, or +32–34% excluding material rights), and free cash flow of $145–155 million, more than double prior expectations. Non-GAAP EPS guidance also improved sharply to ($0.50) to ($0.44), versus earlier guidance of ($1.02) to ($0.96).

Contents

Financial Highlights

Wall Street Expectations

Business Activity

Financial Analysis

Guidance

Conclusion

1. Financial Highlights

Revenue: $310 million (+51% YoY)

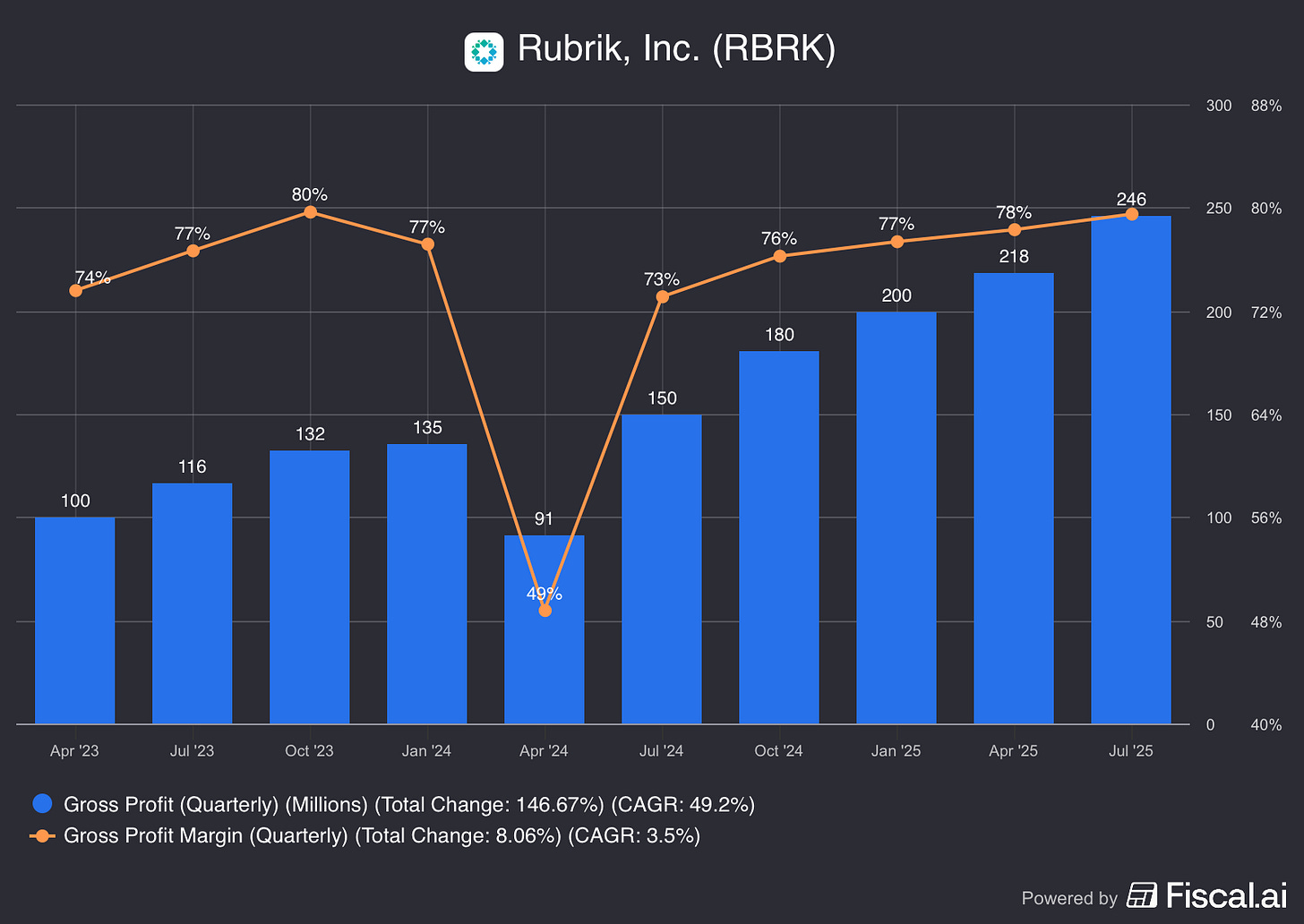

Gross Profit: $246 million (+64% YoY)

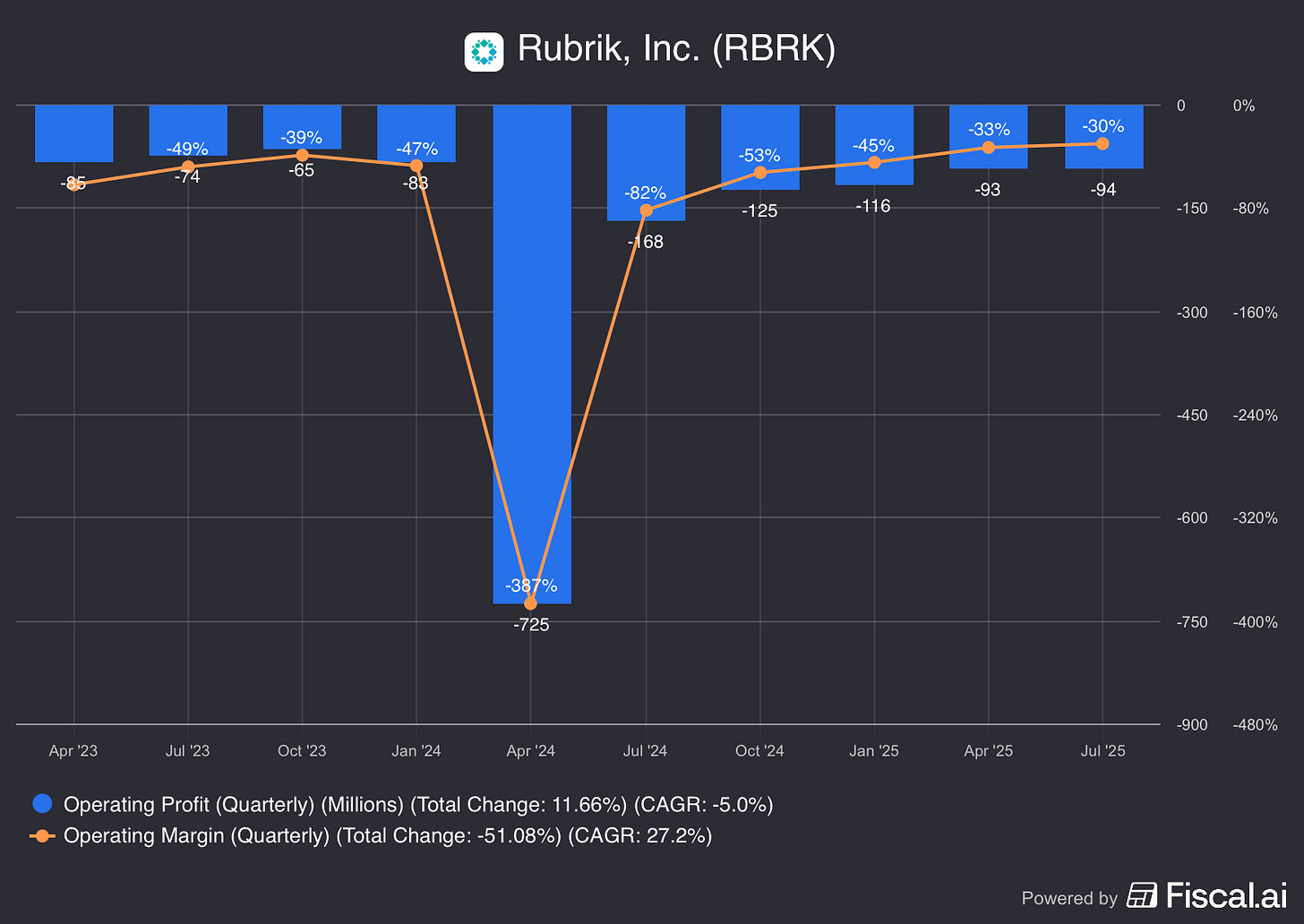

Operating Loss: ($94 million) vs ($164 million) YoY

2. Wall Street Expectations

Revenue: $282 million (beat by 10%)

EPS: ($0.74) (beat by 33%)

3. Business Activity

Customers with $100K+ in Subscription ARR

Rubrik’s customers with $100K or more in Subscription ARR reached 2,505, representing 27% YoY growth. These larger customers have become increasingly strategic partners, contributing 85% of total subscription ARR, up from 82% in the prior year.

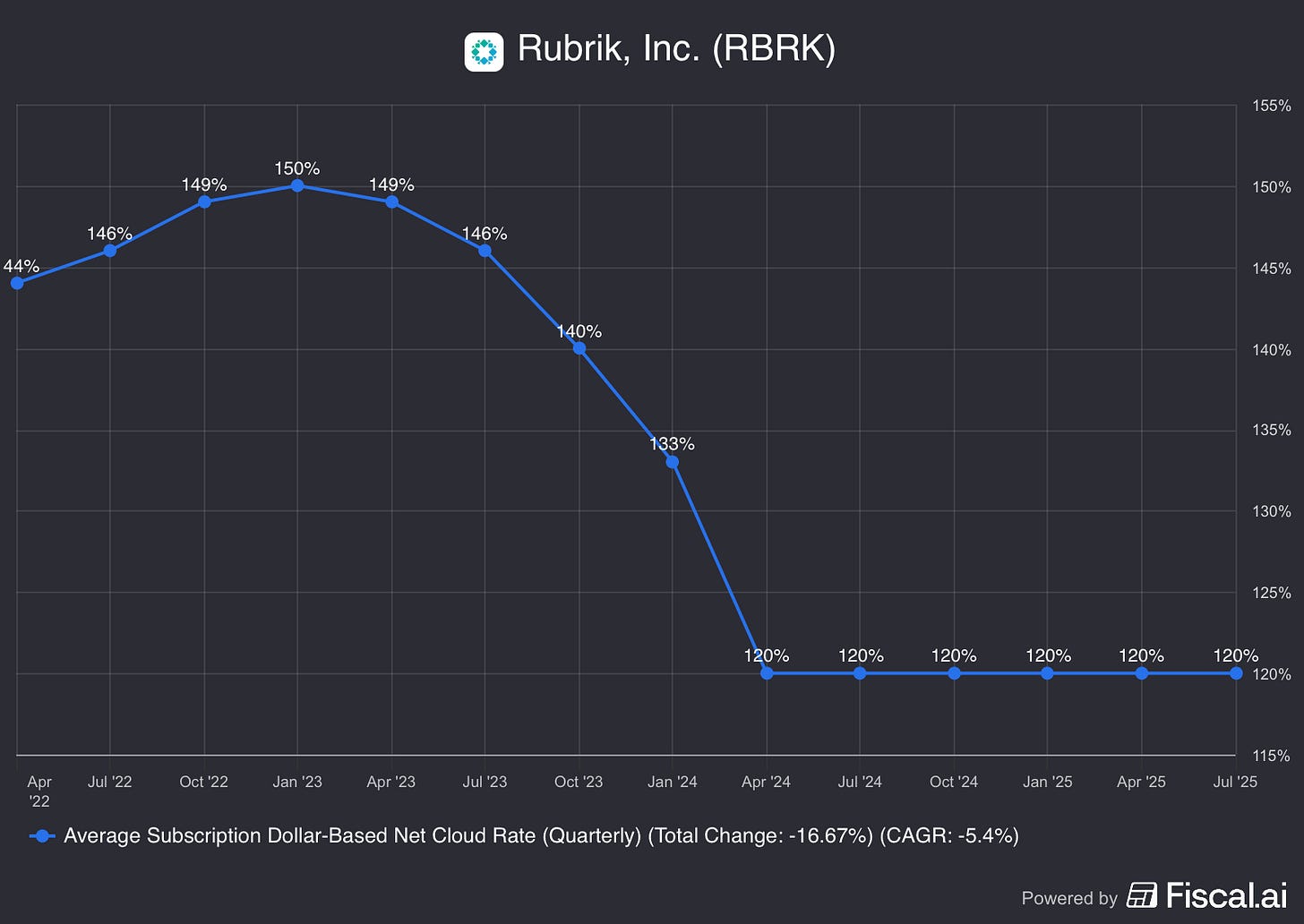

Average Subscription-Based Net Retention Rate

Rubrik’s subscription Dollar-Based Net Retention Rate (NRR) remained above 120%, underscoring the strength of its land-and-expand model.

Expansion drivers included:

Growing data within existing applications

Securing additional applications or identities

Adding more security functionality

Notably, 35% of subscription NRR came from adoption of additional security features this quarter.

Customer Wins

CEO Bipul Sinha noted he held 125+ meetings with customers and prospects during Q2 FY26, signaling strong market engagement. Highlights include:

A major North American oil and gas company selected Rubrik after a cyber-attack exposed the limitations of its legacy backup provider. Rubrik was chosen for faster recovery times and simplified, comprehensive cyber recovery across workloads.

A Fortune 50 pharma leader replaced a 20-year legacy vendor and cloud-native backup tools with Rubrik, citing greater cyber resiliency and lower cloud storage costs.

A global Fortune 500 transportation company expanded its Rubrik investment, adding M365 protection for Azure, cold-based recovery for GitHub and Azure DevOps, and broader cloud protections. This enhanced cyber resilience and shortened recovery times.

A Fortune 500 logistics firm expanded protection to Azure and M365 apps and added identity recovery functionality, reducing Active Directory and Entra ID recovery from weeks to hours. This potentially prevented $65 million in daily downtime losses.

A leading U.K. financial services company consolidated data and identity protection with Rubrik after industry attacks raised concerns over Active Directory. Rubrik is now one of its top three IT vendors.

A U.S. Fortune 500 financial institution adopted identity recovery after an audit showed seven-day recovery times for Active Directory. Rubrik reduced this to under two hours.

A U.S. federal agency replaced a new-gen competitor to protect mission-critical databases, citing Rubrik’s faster recovery.

A European multinational replaced a legacy vendor after a third-party audit flagged poor cyber-attack recovery readiness.

Rubrik continues to win the majority of deals against both legacy and new-gen competitors thanks to its Rubrik Security Cloud and preemptive recovery engine.

Product Expansion and Innovation

Cyber Resilience and Cloud Data Protection: Expanded coverage for AWS RDS and DynamoDB, plus new protection for GCP and OCI. Rubrik now offers multi-cloud simplicity with a single pane for IaaS, PaaS, and SaaS workloads.

Identity Resilience: Over 200 customers have adopted Rubrik’s Identity Recovery since launch. Rubrik remains the only vendor offering rapid recovery of both Active Directory and Entra ID in hybrid environments. The general availability of Rubrik Identity Resilience integrates data security context with identity intelligence.

GenAI Acceleration: Acquired Predibase to enhance secure, efficient GenAI. Predibase specializes in fine-tuning AI models and optimizing inference. Rubrik also launched Agent Rewind, a solution that lets customers undo AI agent mistakes without full rollbacks, enabling safer large-scale AI adoption.

4. Financial Analysis

Revenue

Total revenue for the quarter was $310 million, up 51% YoY. This exceeded management’s guidance and marks the fourth consecutive quarter of accelerating revenue growth.

Subscription revenue reached $297 million, a 55% increase YoY, and now accounts for 96% of total revenue. Growth was driven by strong Subscription ARR, which rose 36% YoY to $1.25 billion. Net new subscription ARR added in the quarter was $71 million. If we look for weaknesses in the report, this metric has decelerated for two consecutive quarters and is now growing slower than total revenue. So what else is driving growth?

A significant factor this quarter was non-recurring revenue from material rights, which added ~7 percentage points to total revenue growth, a few points above management’s expectations. Material rights relate to subscription credits offered to qualified customers with "Refresh Rights" in exchange for giving up their entitlement to next-generation Rubrik appliances at no cost. As these credits expired, customers either used them to purchase new products or let them lapse, impacting accounting treatment and driving variability.

Adjusting for this benefit, total revenue grew ~44%. While Rubrik beat Wall Street’s revenue estimate by 10%, excluding this non-recurring boost, the beat would have been 5%. This is important given Rubrik’s ongoing shift toward subscription-based offerings.

Gross Margin

Rubrik reported gross profit of $246 million, up 65% YoY, far outpacing revenue growth. Gross margin expanded to 80% from 73% a year ago.

Key drivers of margin improvement included:

Revenue outperformance, including higher non-recurring revenue.

Reduced hosting costs from new cloud contracts (including a one-time hosting credit).

Improved efficiency in customer support.

Based on these factors, the margin expansion appears more one-off than structural.

Operating Margin

Rubrik reported an operating loss of $95 million, an improvement from a $168 million loss YoY. Operating margin improved to -30% from -82% YoY, and from -33% in the prior quarter.

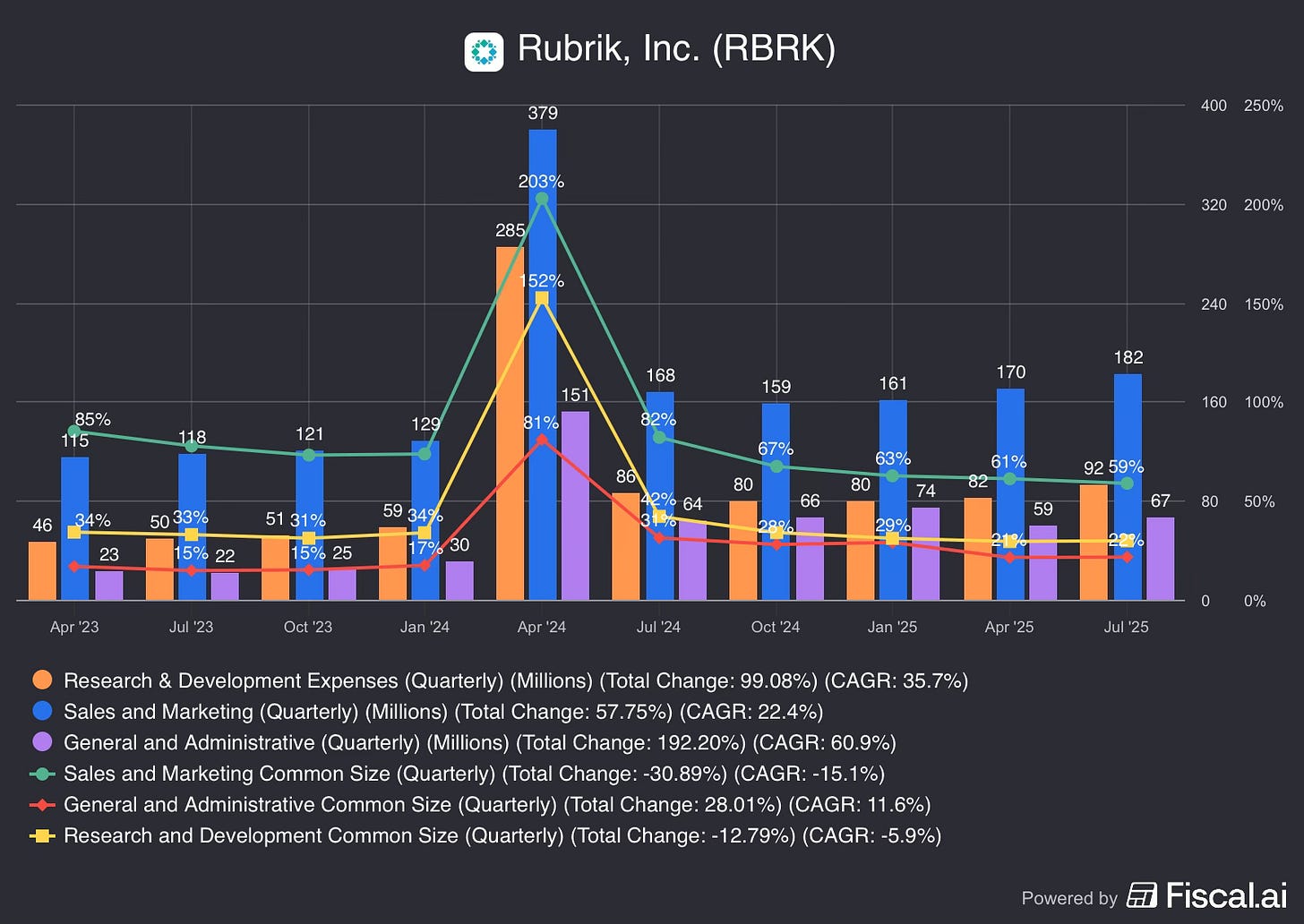

Despite still being in the red, these improvements show Rubrik’s ability to scale profitably over time. Total operating expenses increased only 7% YoY, compared to 51% revenue growth. Sales & Marketing (S&M) remains the largest expense, accounting for more than half of total opex. S&M expenses rose just 8% YoY, reducing the S&M ratio from 82% to 59%. These ratios should continue trending downward as the business matures.

Another encouraging sign is the Subscription ARR Contribution Margin, which reached 9.4% over the past 12 months, up from (8.2%) YoY. This ~1,800 basis point swing highlights operating leverage, a metric management views as critical in its cloud transformation.

Cash Flow

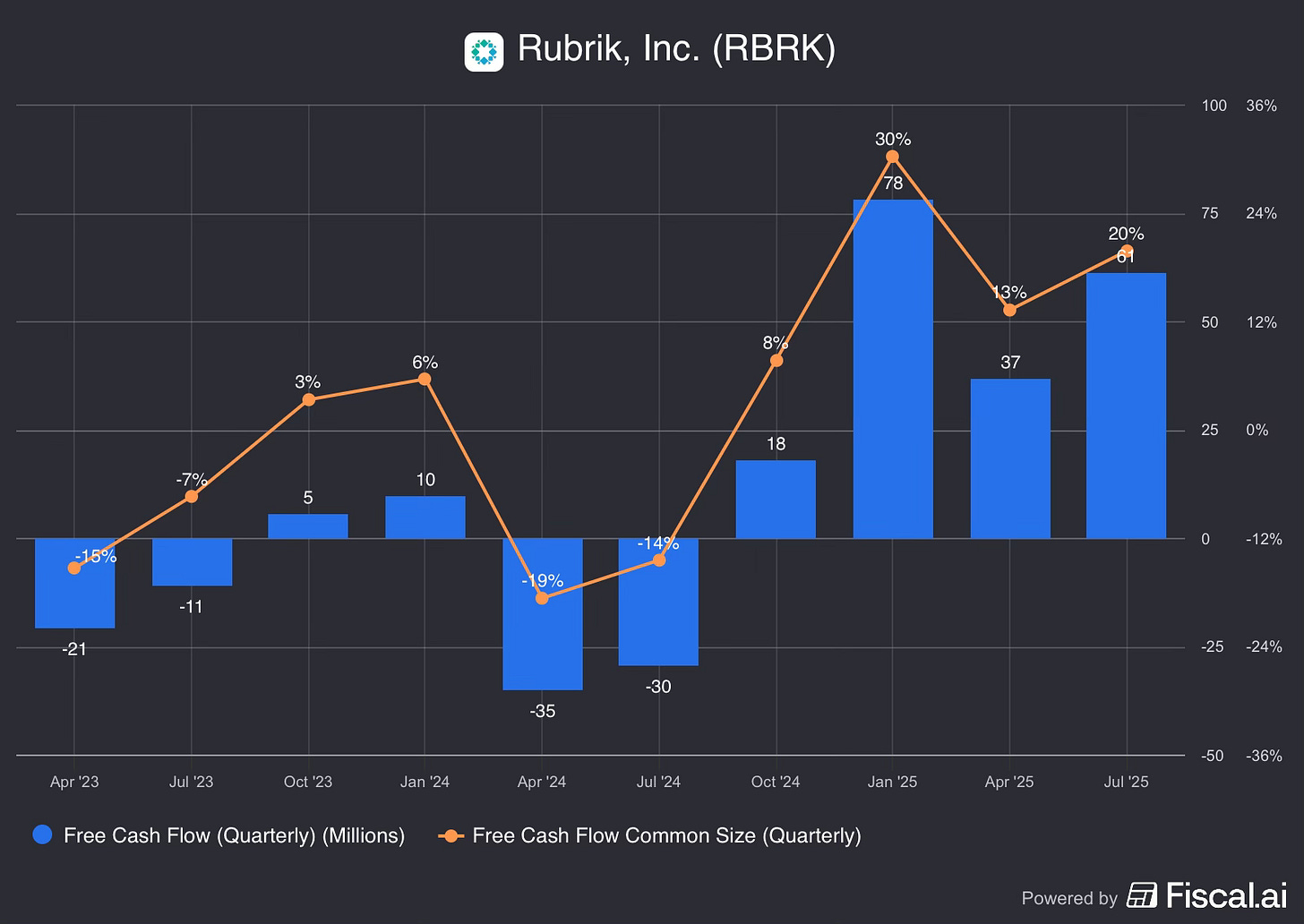

Rubrik turned free cash flow (FCF) positive, generating $61 million compared to ($30 million) YoY. FCF margin improved from -14% to 20%, marking the fourth straight quarter of positive FCF.

Key drivers included:

Early renewals, including multi-year contracts, often co-termed with customer expansions.

Capital structure optimisation, where Rubrik refinanced higher-cost private debt with a 0% convertible, boosting cash and reducing interest expense.

The gap between negative operating margin and positive FCF is largely due to stock-based compensation (SBC). Rubrik recorded $88 million in SBC, down from $105 million YoY, reducing SBC as a share of revenue from 51% to 29%. While still high, this was inflated by IPO-related equity awards and should moderate over time.

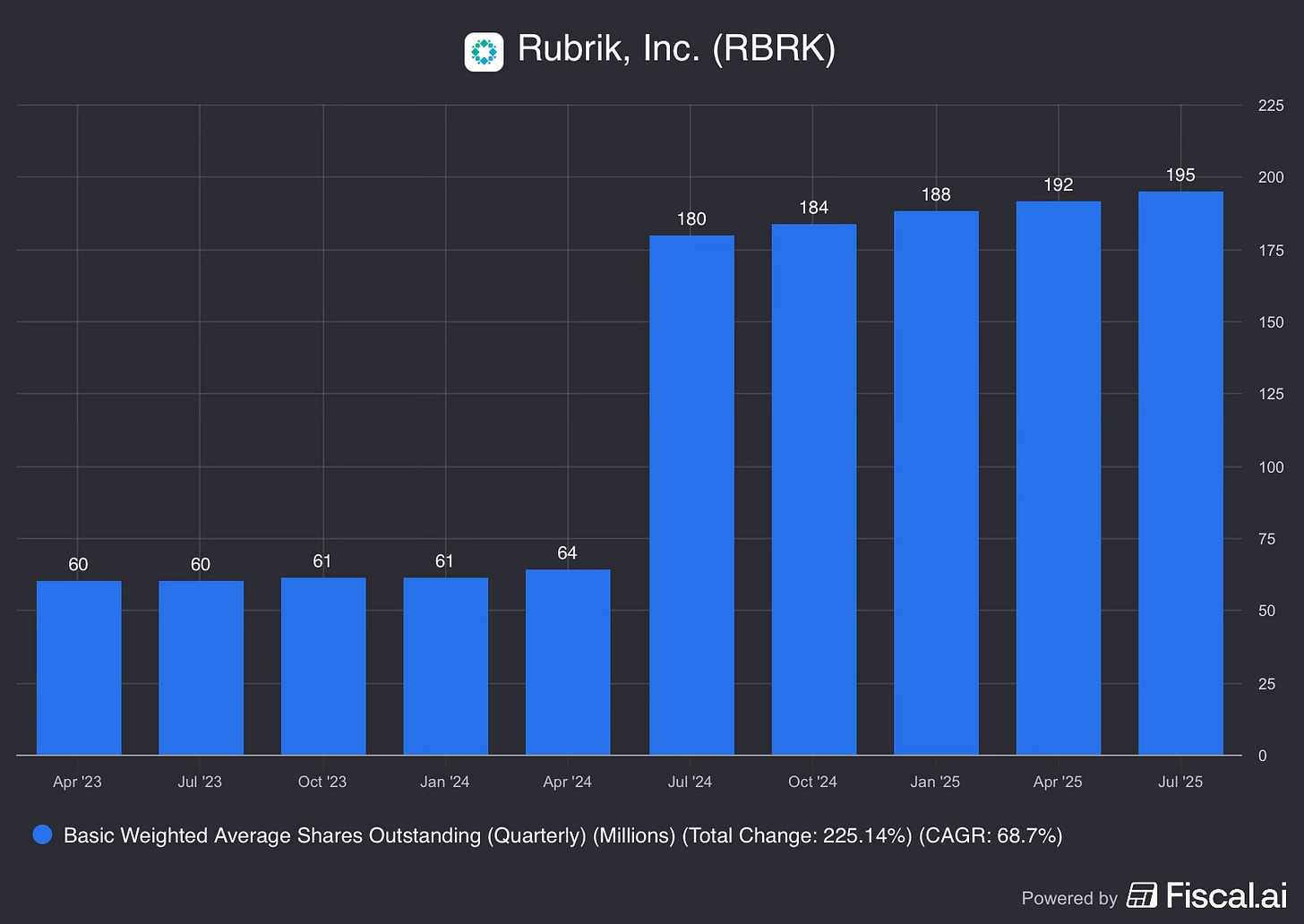

As a result of SBC, weighted-average shares outstanding rose 8% YoY to 195 million. In other words, shareholders from 12 months ago now own 8% less of the company. However, with shares up over 200% during the same period, most investors are unlikely to complain.

5. Guidance

Rubrik’s strong quarter led management to raise guidance across several metrics.

Q3 FY26

Revenue: $319–321 million (+35–36% YoY), including a slightly higher material rights benefit.

Subscription ARR contribution margin: 6.5%, seasonally lowest in Q3 due to expense timing and Predibase integration.

Non-GAAP EPS: ($0.18) to ($0.16).

Weighted-average shares outstanding: 200 million.

Full Year FY26

Subscription ARR: $1.408–1.416 billion (+29–30% YoY), raised 2% from prior guidance.

Total Revenue: $1.227–1.237 billion (+38–40% YoY, or +32–34% ex-material rights), raised 4% from prior guidance.

Subscription ARR contribution margin: 7.0%, raised 100 bps from 6.0%.

Non-GAAP EPS: ($0.50) to ($0.44), up sharply from prior ($1.02) to ($0.96).

Weighted-average shares outstanding: 197 million, improved from 198 million prior.

Free cash flow: $145–155 million, more than double prior guidance of $65–75 million.

Wall Street FY 26 estimates:

Revenue: $1.217 billion

Non-GAAP EPS: $(0.97)

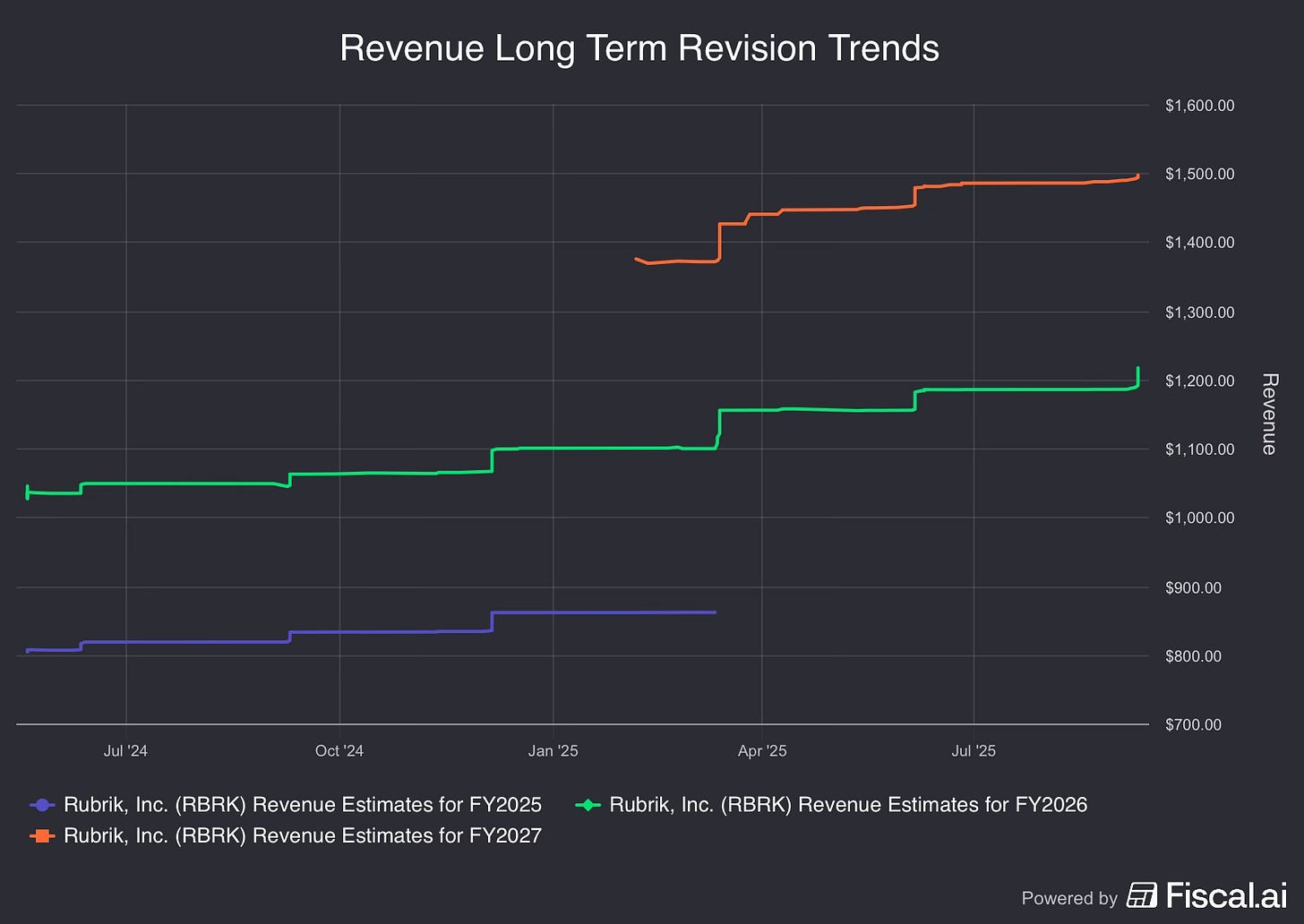

Given the beat-and-raise quarter, analysts will likely revise estimates higher, continuing the quarterly trend since Rubrik went public.

6. Conclusion

This was the first earnings release from Rubrik that I observed as an investor. I pitched the stock as a new idea in August, and it had run hot into this report, up almost 20% in less than a month. After the sell off yesterday, it’s back to where it was a month ago. In the Rubrik Quick Pitch link below, you will find my original investment thesis if you missed it.

Appraising management can be difficult and subjective, but one approach I use is comparing what management say they will do to what they actually deliver. In this quarter, Rubrik handsomely exceeded all guided metrics and raised forward guidance.

While it is hard to find fault in this report, there are some structural improvements and temporary tailwinds that merit attention.

Exceptional Free Cash Flow Performance (with a caveat): Rubrik’s 20% FCF margin is a standout metric despite the impact of SBC. The quarter benefited from favorable contract duration and more early renewals, including multi-year contracts often co-termed with active customer expansions. While positive for current cash flow, these timing benefits may not be consistently repeatable at the same magnitude in future quarters. Understanding the one-time vs. recurring nature of these drivers is crucial for projecting future FCF quality.

Non-Recurring Material Rights Revenue Tailwind: Q2 revenue was boosted by strong ARR growth, the cloud transformation journey, and higher non-recurring revenue accounted for as material rights. These contributed roughly 7 percentage points to revenue growth this quarter. Investors should strip out this non-recurring benefit when modelling organic revenue growth. While positive now, this tailwind will disappear in FY27, making YoY comparisons tougher and potentially slowing reported revenue growth. Subscription ARR growth is the more sustainable top-line indicator, though it showed minor deceleration.

Sales Compensation Changes and Seasonality Shift: Rubrik moved from half-yearly to annual sales compensation plans at the start of FY26. As a result, Q2 and Q3 should look more alike in terms of net new ARR contribution, without the Q2 accelerator seen previously. Q4, however, is projected to be seasonally strong, meaning investors should adjust quarterly expectations and watch closely how the new structure impacts Q4 performance.

While Rubrik trades at a premium valuation on conventional metrics, this may prove less demanding if the company continues to execute its beat-and-raise playbook over the coming quarters. With a differentiated platform, high win rates in cyber resilience, and a clear vision to evolve into a security and AI company, Rubrik’s long-term story is just beginning.

Rating: 4 out of 5. Exceeds expectations.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you, always!

Real nice and incisive write-up on Rubrik. Its not the most popular stock, so not much written on it. Always good to find someone analysing this company.

With more than 50% sales growth and Price to sales lower than some other comapnies in Cybersecurity, it kept intriguing me, as to whether or not I should invest.

So I did a detailed research, and captured it on this link.

Have a read and let me know if there is anything that I am missing in your opinion.