The Adyen investment thesis shared last year was one of the most popular newsletter articles ever, having received over 12,000 views and generated hundreds of new subscribers. This analysis provided a comprehensive overview of the business, including a 5-year projected P&L and discounted cash flow valuation. The analysis suggested that the company was trading well below its fair value, and since the report's publication, the stock price has more than doubled, returning 108%. The full report is linked below.

In this update, I present a revised financial model and a fair value assessment. The starting point for this analysis will be the 2023 financial results. I have already shared a detailed H2 2023 earnings analysis, which can be accessed via the link below.

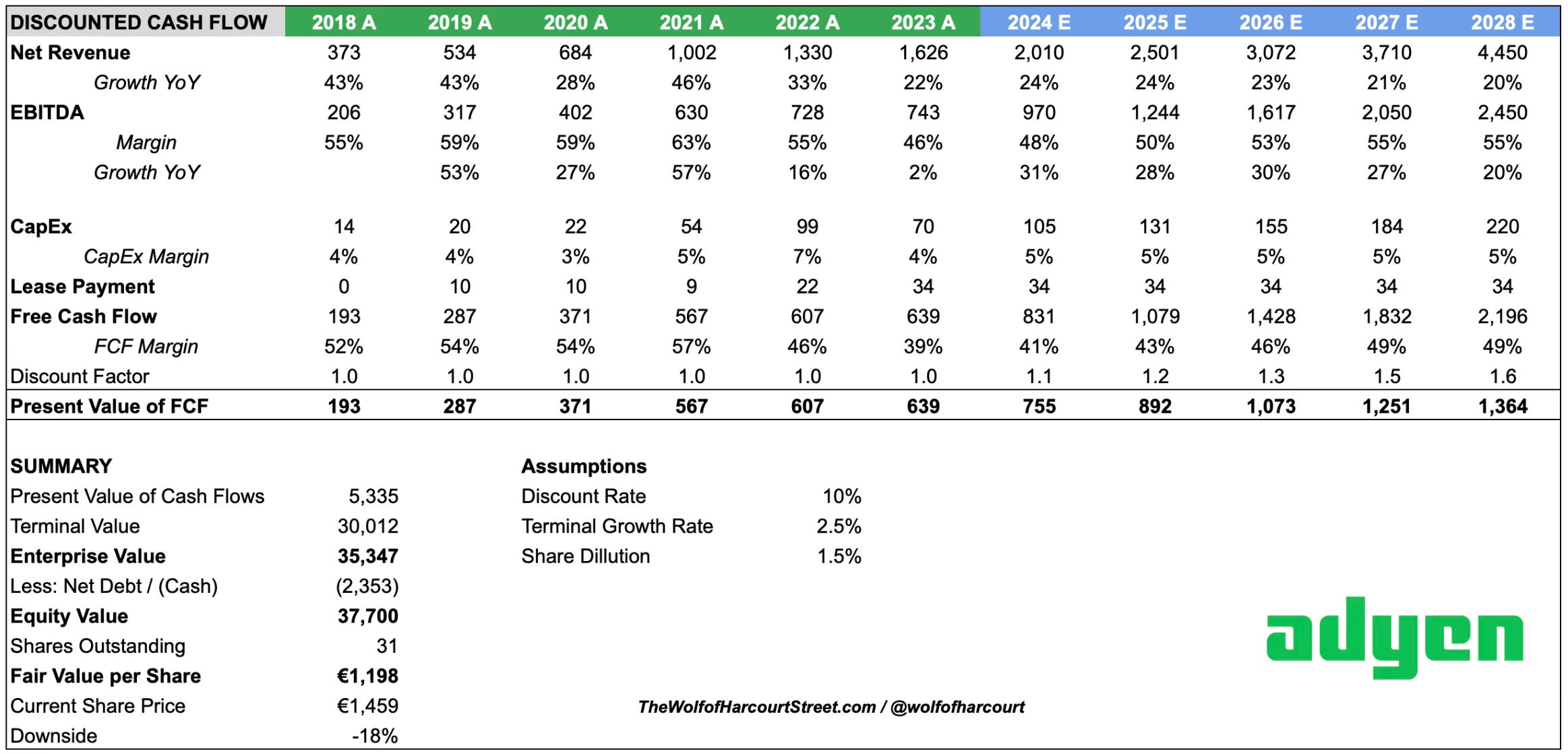

Discounted Cash Flow Analysis

Future cash flows have been projected over five years using a discount rate of 10%. A terminal growth rate of 2.5% has been assumed based on Adyen's ability to benefit directly from inflation. Adyen's revenue is a product of the payment volume it processes multiplied by its take rate.

A revenue CAGR of 22% is projected from 2023 to 2028. This is unchanged from the previous analysis in which I correctly forecasted 22% revenue growth in 2023. Between 2018 and 2023, Adyen's revenue grew at a CAGR of 34%.

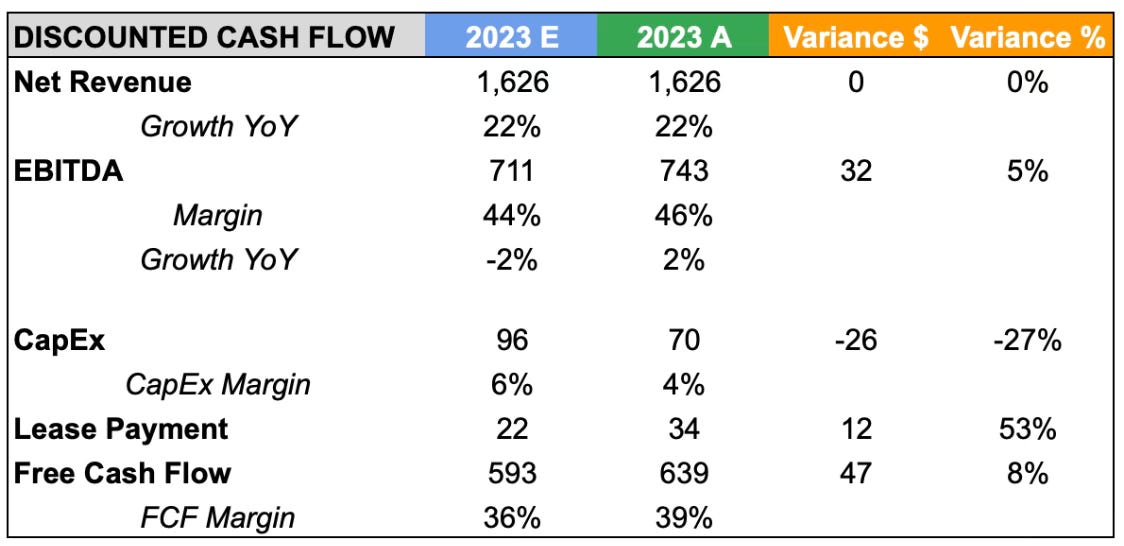

The EBITDA margin is projected to reach 48% in 2024 before creeping back up to 55% by the end of year 5, in line with previous analysis. At the beginning of 2023, management's long-term guidance was for an EBITDA margin of 65%. However, as part of my analysis last year, I did not see the company achieving this target and used more conservative assumptions. Later in 2023, management issued new guidance with an EBITDA margin above 50% in 2026. Management's guidance is now consistent with my expectations.

The Capital Expenditure (CapEx) margin has been assumed to be 5% over the entire forecast period, which is in line with management guidance. Adyen’s average CapEx margin over the past six years has been 5%. This results in a Free Cash Flow (FCF) margin of 41% in 2024 before rising to 49% by the end of 2028. It is worth noting that Adyen posted a FCF margin of 39% in 2023, but the average FCF margin between 2018 and 2023 was 50%.

In the previous analysis, a dilution rate of 3% was assumed. However, this was overly conservative, as the total dilution over the past two years combined was just 0.25%. I have reduced the total dilution to 1.5% in line with this trend. Adyen pays very little share-based compensation due to the 20% bonus cap in the Netherlands.

Based on these assumptions, the fair value of Adyen is approximately €1,198 per share, indicating a potential downside of -18% compared to the share price on April 11, 2024, which was €1,459.

Conclusion

Last year, the analysis suggested that Adyen was undervalued with a large margin of safety. This proved correct as the stock has more than doubled since. Underpinning this analysis were a set of rather low expectations, which Adyen ultimately comfortably surpassed, particularly in EBITDA and FCF.

Adyen remains the same quality company it was last year, but the valuation now reflects this. A lot more is now priced into the stock than it was last year. The company’s growth prospects remain strong as it continues to take market share from the incumbents, with new partnerships being announced on an almost weekly basis. Looking at my own expectations, very little has changed from last year’s set of assumptions apart from the dilution rate being halved and a more robust terminal value assumption.

While I have no plans to sell Adyen and it remains a firm hold given the underlying business quality, the opportunity to deploy new capital into the stock today is less appealing than it was last year, particularly given the other market opportunities that I have shared in recent weeks.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Are you sure about the net cash balance? Looks off to me