Welcome back to the Wolf of Harcourt Street Newsletter.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

While the newsletter will continue to remain free, a number of you have expressed a desire to support the work of an independent research analyst. Your appreciation for the quality of research and the results achieved recently is humbling. If you'd like to support my work, you can buy me a coffee using the button below.

With all that being said, let’s dive into today’s edition!

Todays Agenda

1. Adyen Investor Day

2. Datadog Q3 2023 Earnings

3. Evolution approve Warrants

1. Adyen (Ticker: ADYEN.AS) Investor Day

The highlight of the week wasn't any earnings release; instead, Adyen Investor Day stole the spotlight. In response to the market's reaction to the H1 results in August, where Adyen's stock price was halved, management decided to voluntarily provide a Q3 business update during the investor day.

In Q3 2023, Processed Volume, a key performance indicator for Adyen, rose by 21% to €243.1 billion. This is slightly lower than the growth of 23% in H1 2023.

Net revenue saw a 22% increase in Q3 2023, reaching €413.6 million. This indicates a reacceleration of revenue growth from 21% in H1 2023. Management pointed out that net revenue growth would have been 4% higher on a constant currency basis, showing that the underlying business revenue actually grew by 26%.

How did Adyen increase its net revenue faster than processed volume?

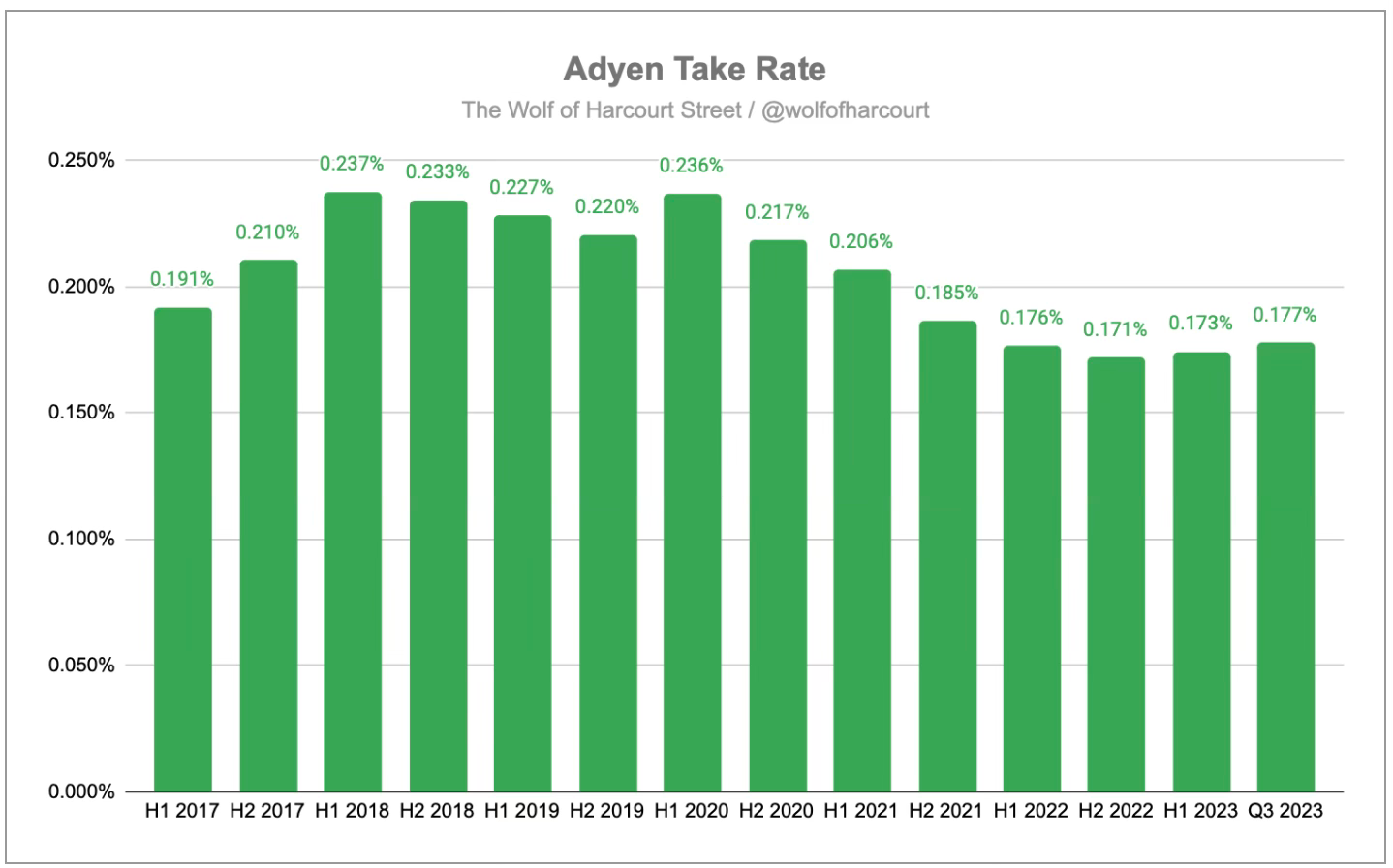

The answer lies in Adyen's take rate, which, on a constant currency basis, improved to 17.7 basis points in Q3 2023, up from 17.3 in H1 2023. The consistent take rate throughout 2023 indicates that Adyen has maintained discipline in prioritizing sustainable pricing and profitability.

When we reflect on Adyen's history, its tiered pricing model has led to a declining take rate over the years, dropping from its peak in 2018.

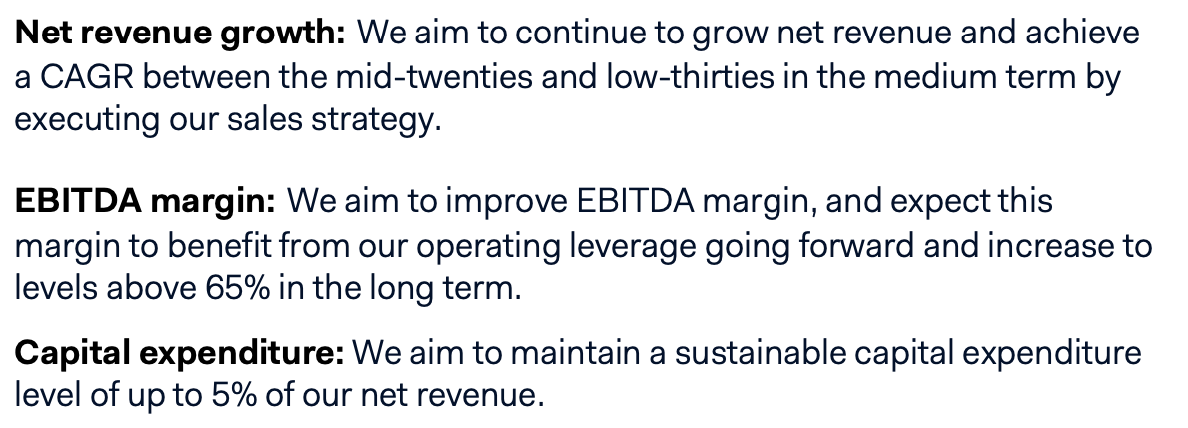

Adyen has established fresh objectives for annual net sales growth, aiming for an average in the "low 20s to high 20s" until 2026. Additionally, they aim to achieve an EBITDA margin surpassing 50% by the year 2026.

These numbers are notably lower than Adyen's earlier projections, which indicated anticipated revenue growth ranging from the mid-20s to the low 30s, along with an EBITA margin surpassing 65%. Nevertheless, the updated expectations provide a more precisely defined time frame compared to the previously employed "medium term."

Considering the market's response to the Q3 earnings, with a stock increase of +37%, it seems the market lacked confidence in the achievability of H1 2023 guidance and objectives. The revised expectations and a clearer timeline have effectively addressed previous communication shortcomings that unsettled investors.

The management team presented a clear pathway to achieve revenue growth in the low 20s to the high 20s. This was the first time they laid it out in an easily digestible format. The pathway includes gains in share of wallet, new victories, and the ramp-up of the previous year's cohort. These factors are partially offset by the tiered price impact mentioned in relation to the take rate.

Now, I'd like to revisit my investment thesis shared in September. You'll notice that I adopted a more conservative stance on revenue growth and EBITDA margin, aligning with the updated guidance provided by management.

Since I shared the Adyen investment thesis, the stock has appreciated +47% in less than two months. Being contrarian pays off especially when it is evident that the price action is disconnected from the reality of the underlying fundamentals. Using conservative assumptions in a valuation appraisal is essential in providing the necessary margin of safety.

The full Adyen investment thesis is linked below for new subscribers or anyone that missed it.

2. Datadog (Ticker: DDOG) Q3 2023 Earnings

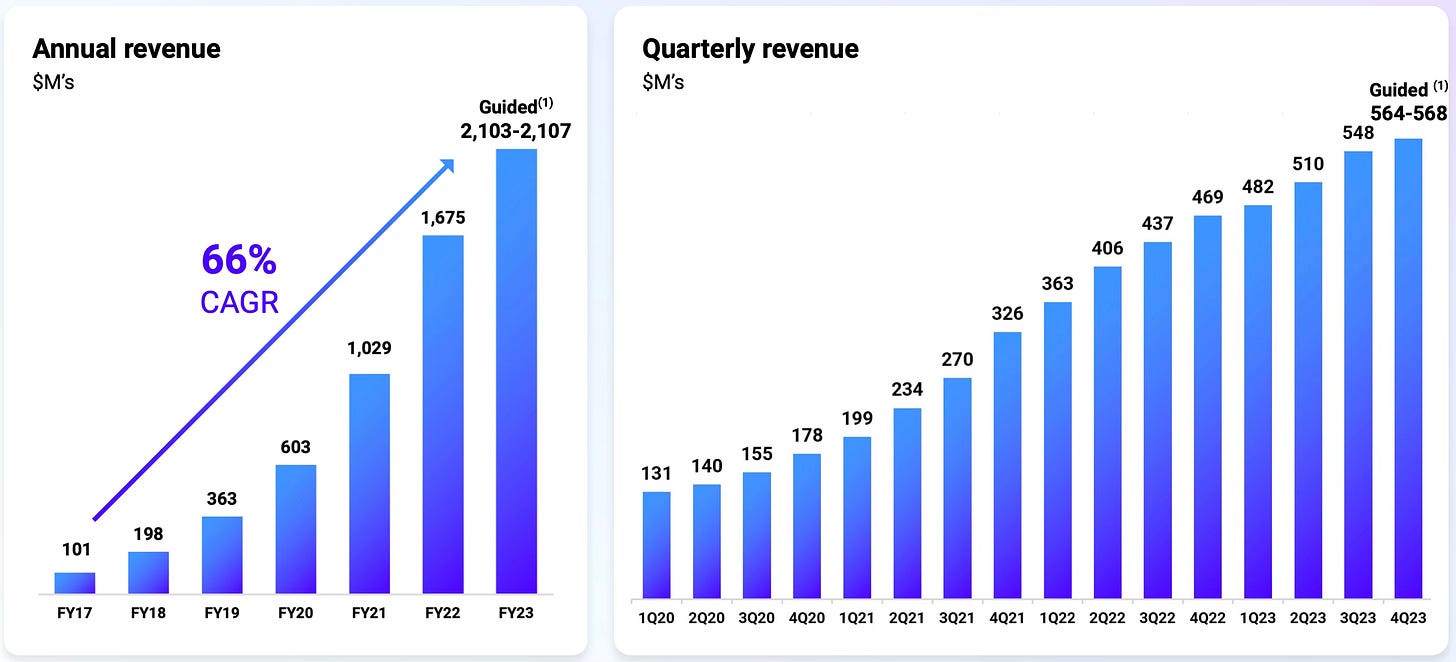

DDOG reported a strong financial performance with revenue reaching $548 million, an increase of 25% year-over-year (YoY), surpassing the high end of their guidance range of $525 million by over 4%.

Management observed that usage growth showed improvement compared to Q2, resembling Q1 patterns. Early trends in Q4 suggest a stronger performance than the previous year. While the growth of larger spending customers trailed behind that of smaller spending customers, overall usage growth improved across all customer sizes.

The customer base expanded to around 26,800, up from 22,200 the previous year. Notably, 3,130 customers generated an Annual Recurring Revenue (ARR) of $100,000 or more, contributing to 86% of the total ARR. In Q3, DDOG accelerated growth for this metric to 5% QoQ, up from 3% in Q2. The quarter saw the addition of 140 new $100K+ ARR customers, the highest since Q4 2022.

The company achieved notable customer successes:

7-figure deal was secured over 5 years with a leading dental care provider, addressing performance issues and ensuring a smooth migration to Azure through the adoption of 6 Datadog products.

South American fintech company opted for Datadog to reduce costs and enhance innovation.

8-figure renewal over 3 years was obtained from a major American convenience store chain, consolidating various tech systems on the Datadog platform for substantial time and cost savings.

7-figure expansion with a U.S. federal agency.

7-figure expansion with a Fortune 500 industrial company.

7-figure expansion with a tech hyperscaler's software business.

The trailing 12-month net revenue retention slightly fell below 120%, in line with Q2 guidance. Despite this churn, the trailing 12-month gross revenue retention remains stable in the mid to high 90s, indicating that customers find value in the product and consider it important for their operations.

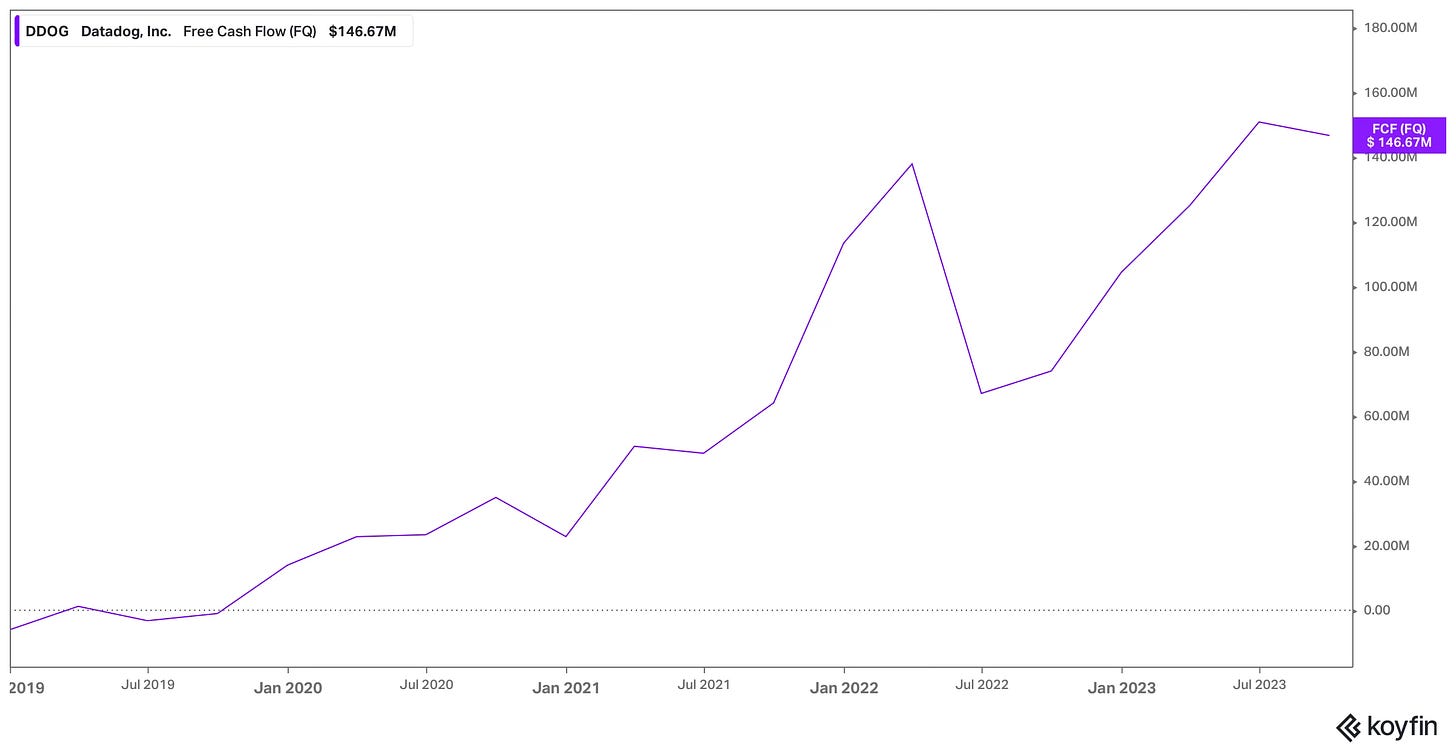

The gross profit margin increased from 79% to 81% YoY, reflecting efficiency in cloud costs. Q3 Operating Expenses (OpEx) grew 17% YoY, representing a decline from the previous quarter's opex growth rate of 31% and 50% in Q1, reflecting a more controlled approach to spending. Net income reached $23 million, and the company ended the quarter with $2.3 billion in cash, achieving a free cash flow (FCF) margin of 25%.

Management has increased the fiscal year 2023 revenue guidance to a range of $2.103 billion to $2.107 billion, indicating 26% YoY growth. This adjustment is up from the earlier guidance of $2.05 billion to $2.06 billion. The adjusted EPS guidance has been established at $1.52 to $1.54, reflecting an increase from the prior guidance range of $1.30 to $1.34.

DDOG had a stellar quarter, and the market responded quite positively, witnessing a nearly 30% surge in the stock post the earnings release. After reviewing my investment thesis shared in April, I observed that my forecast of 25% revenue growth and $399 million in FCF for 2023 may have been conservative. Considering the Q3 earnings and management guidance, it appears DDOG is poised to achieve revenue growth of at least 26% and surpass $530 million in FCF.

Since I shared the DDOG investment thesis, the stock has yielded a +47% return. In this ideal scenario, extensive research coupled with conservative valuation assumptions uncovers an appealing risk/reward proposition, and the company exceeds expectations.

The full Datadog investment thesis is linked below for new subscribers or anyone that missed it.

3. Evolution (Ticker: EVO.ST) approve Warrants

On 9 November, Evolution convened an extraordinary general meeting (EGM) to vote on the 2023/2026 incentive program through the issuance and transfer of warrants.

The incentive program received approval for a maximum of 300 group employees, including the CEO, current and future senior management, and key personnel. Board members are ineligible to receive warrants. A total of 2.5 million warrants will be issued to the company or its subsidiary. Participants can exercise these warrants to subscribe for shares starting from November 16, 2026 (or the day after the publication of the company’s January–September 2026 interim report) until 14 calendar days thereafter. The exercise price is fixed at 130% of the volume-weighted average price of Evolution’s share on Nasdaq Stockholm from 26 October, 2023, to 8 November, 2023.

This development is welcomed news, as it concludes a protracted saga dating back to February 2023. The incentive program had faced rejection twice but was finally approved after amendments on the third attempt. The issuance of 2.5 million warrants will result in a maximum dilution of 1.16%, a reduction from the initial proposal's 2.32%. Based on the share price action during the above period, the exercise price will be around SEK 1,300 instead of SEK 1, 800+ per the earlier versions of the program. Hat tip to Ali Gunduz for this calculation. For context, the share price today is SEK 1,022.

Given Evolution's substantial cash reserves, I anticipate the company will announce a buyback program in the near future. This expectation is based on a quote shared by Pedro Leon Garcia during an investor call.

Dividends are a one off buybacks are forever

The Evolution investment thesis is well on track, and this approved incentive program should enable management to concentrate on expanding the business and creating value for shareholders. The full Evolution investment thesis is linked below for new subscribers or anyone that missed it.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com