Welcome back to the Wolf of Harcourt Street Newsletter.

I am excited to launch a new segment called Market Movers based on feedback from the recent subscriber survey. This segment will consist of a weekly or fortnightly digest of significant news and events related to stocks that I follow closely.

Market Movers is your time-saving guide to crucial stock news, cutting through the noise.

With all that being said, let’s dive into today’s jam-packed edition!

Todays Agenda

1. PepsiCo Q3 2023 Earnings

2. Adyen Investor Relations Update

3. Block Acquires Hifi

4. Evolution at G2E Las Vegas 2023

5. Amazon’s Next Billion Dollar Revenue Stream

6. Johnson & Johnson Q3 2023 Earnings

7. ASML Q3 2023 Earnings

1. PepsiCo (Ticker: PEP) Q3 2023 Earnings

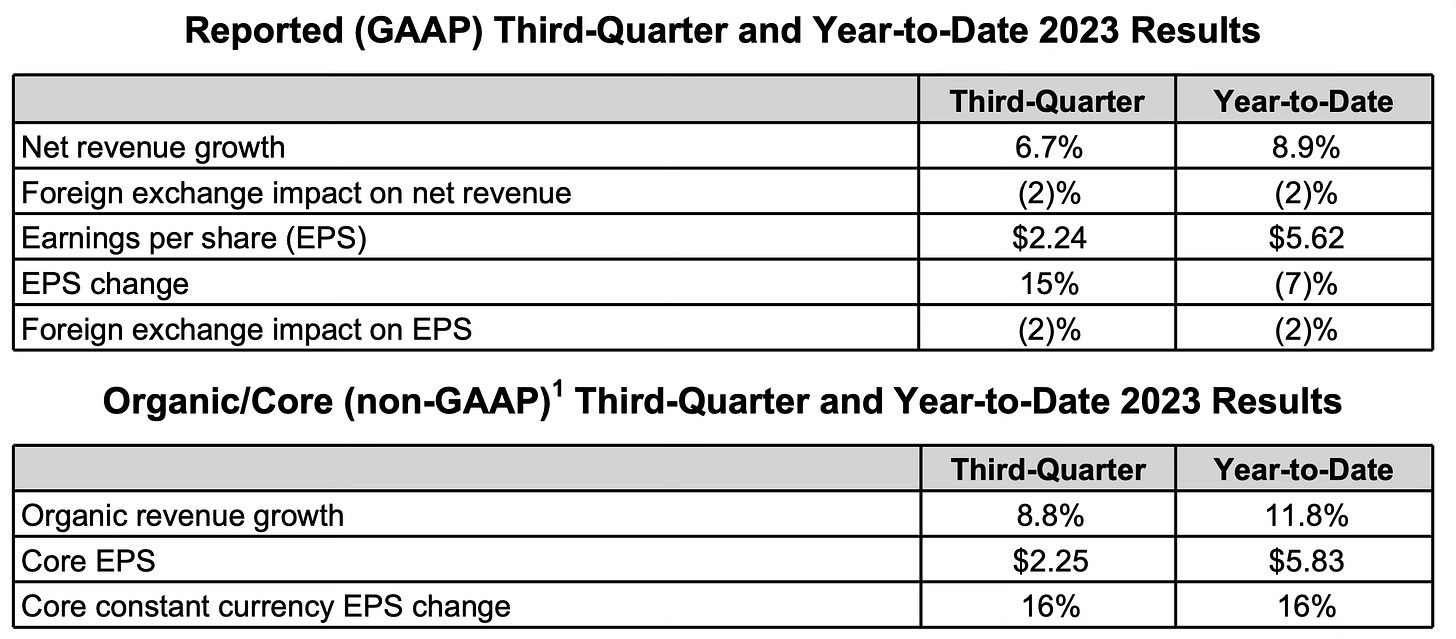

PEP posted solid results, reporting net revenue of $23.5 billion, EPS of $2.24, and organic revenue growth of 8.8% surpassing analyst estimates.

Volumes fell 1.5% in Q3 compared to -3% in Q2 with management noting a global improvement in volume over the past few quarters. PEP’s focus is on optimising consumer interaction with brands and overall margin. Evolution in consumer preferences, such as a shift to smaller packs, is addressed through pricing and mix strategies. By adjusting pricing for smaller packs, PEP can potentially enhance overall revenue and profit margins due to pricing power.

Management anticipates a strong end to 2023, with an upgraded expectation of 13% core constant currency EPS growth (previously 12%). They maintained projections for 10% organic revenue growth and total cash returns to shareholders of around $7.7 billion. Looking ahead to 2024, management anticipates higher inflation, leading to elevated price mix relative to previous years. Consumers are currently more selective, showing some trade-down behaviour and an orientation toward value.

In the lead-up, much discussion has centred around the impact of GLP-1 weight-loss drugs on food stocks, with PEP, in particular, down 10% over the past month. Management noted minimal impact on their business from GLP-1 thus far:

So far, the impact is negligible in our business. Overall, if you take global consumption, there's obviously a lot of question marks with regards to this – obviously, the drugs when it comes to medical testing or scalability of the usage of this or what is the impact really on consumer choices. So a lot of question marks.

Has the impact of GLP-1 been overblown, or is it still too early to be sure? Time will tell.

2. Adyen (Ticker: ADYEN) Investor Relations Update

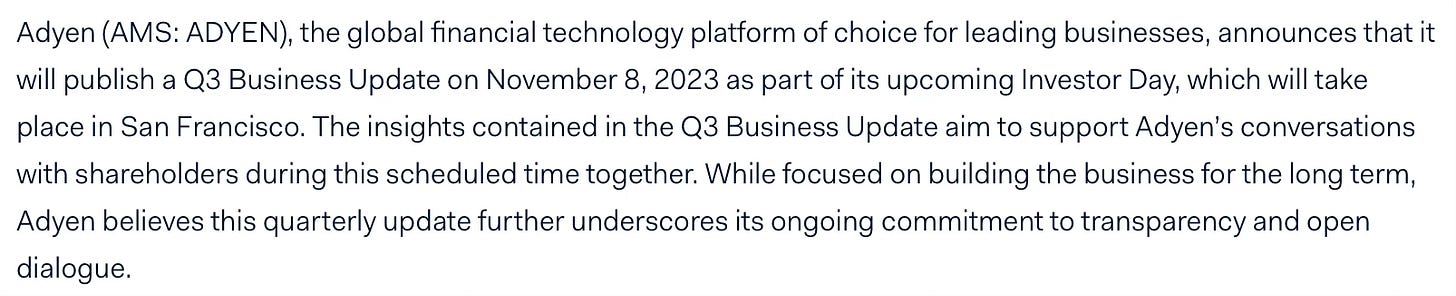

Adyen announced that it will publish a Q3 business update as part of the Investor Day on 8 November.

I was already looking forward to the Investor Day, but even more so now. Adyen is only required to disclose its earnings semi-annually, so my suspicion is that the Q3 earnings they are voluntarily choosing to disclose might be quite good. Otherwise, why would they bother disclosing them?

Adyen also shared news that it is introducing Tap to Pay on iPhone for its Australian retailer customers through a partnership with NewStore. Retailers can now accept contactless payments using only an iPhone and the NewStore Associate iOS app. This terminal-less payment method accepts various contactless payment forms, including credit/debit cards, Apple Pay, and digital wallets. The process is seamless, requiring customers to hold their contactless payment near the merchant's iPhone at checkout. The technology, utilizing Apple's Tap to Pay on iPhone, prioritizes privacy and security by not storing card numbers on the device or Apple servers.

As I highlighted in the Adyen Investment Thesis, Adyen's swift adaptation to industry trends and customer needs is one of the ways it can continue to differentiate itself through value-added services.

3. Block (Ticker: SQ) acquires Hifi

Block, formerly known as Square, has announced the acquisition of Hifi, a fintech start-up focused on musicians. Hifi, launched in 2020, provides music artists with a transparent overview of their royalty earnings and offers a royalty acceleration service that pays artists and rights holders in real time.

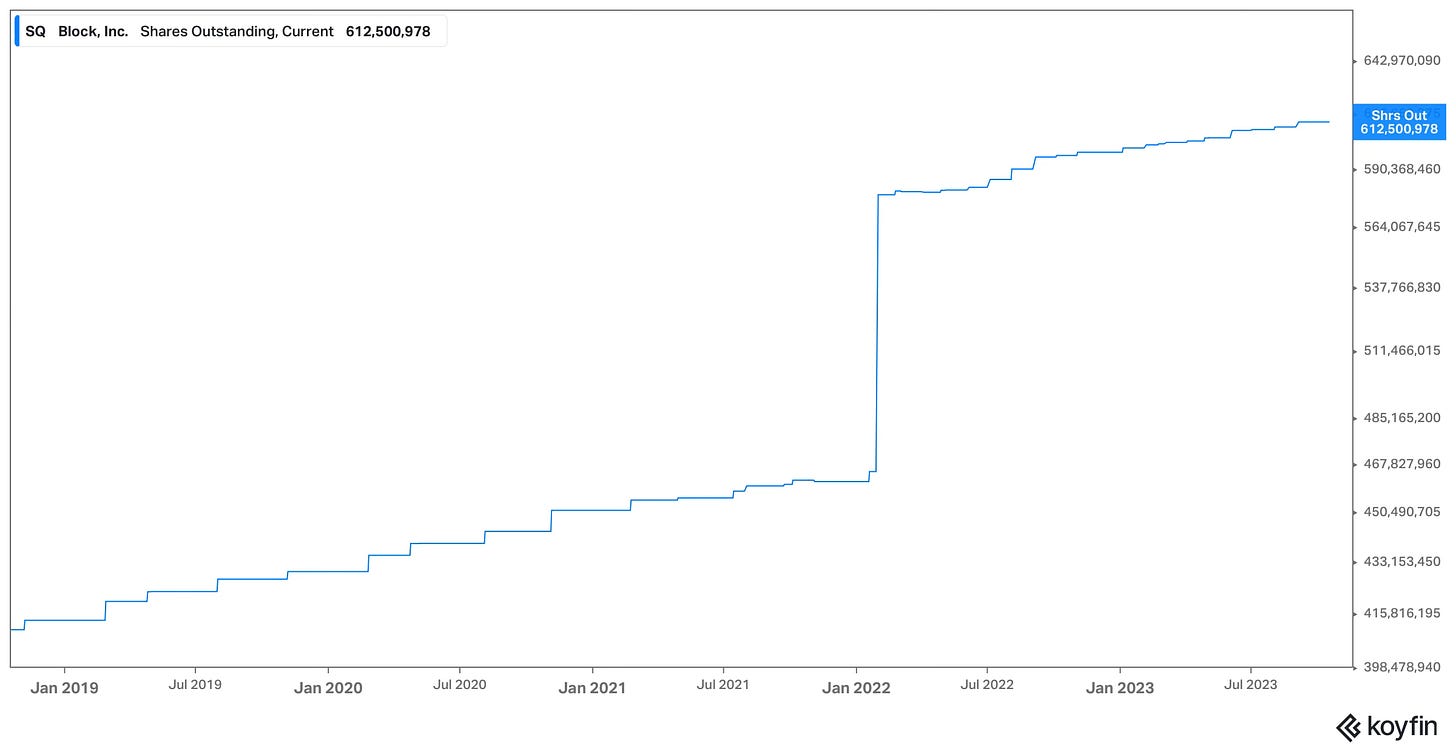

While we do not know the acquisition cost, this marks another questionable capital acquisition decision from CEO Jack Dorsey. In 2021, Block completed the acquisition of the music streaming service Tidal, owned by rapper Jay-Z, for $300 million. A subsequent shareholder lawsuit stemming from the acquisition concluded that it was "by all accounts, a terrible business decision". At the time of the purchase, Tidal was financially struggling and under investigation in Norway for allegedly manipulating its streaming numbers.

Later in 2021, Block completed the acquisition of the Buy Now Pay Later (BNPL) provider Afterpay for $29 billion. While the deal did not result in any cash outlay as it was financed in an all-stock deal, it was considered a massive overpayment and resulted in significant dilution for existing shareholders. BNPL has proven to be a feature rather than a standalone company and could have been built internally for a fraction of the cost, as others have done.

While Jack Dorsey has proven to be a phenomenal founder and entrepreneur, his capital allocation strategy has been very destructive for shareholders. Today, the market value of Block is $27 billion, which means it is worth less than the amount it cost to acquire Afterpay.

4. Evolution (Ticker: EVO.ST) at G2E Las Vegas 2023

Evolution showcased its diverse portfolio of online casino products at G2E Las Vegas 2023. During this event, Inside Asian Gaming held an interview with Evolution’s Chief Product Officer, Todd Haushalter.

Haushalter expressed concerns about the declining interest in traditional baccarat among younger players. To address this, Evolution has introduced new formats like Lightning Baccarat and Golden Wealth Baccarat, aiming to offer faster gameplay and more significant win opportunities. The company recognizes the need to adapt to changing player preferences, with a focus on speed across its entire suite of games. Evolution is also expanding into the U.S., particularly emphasising the introduction of game shows to the American market. Looking ahead, Haushalter sees the convergence of live and slots business as a significant trend, aiming to infuse the trust and social elements of live gaming into the solitary slot experience, considering the evolving landscape of short attention spans in the gaming world.

Haushalter’s comment about the how “the U.S. has become our biggest slots market, which has sort of happened overnight” would suggest that the European region has lost significant market share since the €2 billion acquisition of NetEnt. At the time of acquisition in 2020, the U.S. only accounted for 10% of slot revenue. It seems extremely likely that the Goodwill balance related to the NetEnd acquisition will have to be impaired, which was something I highlighted in the Evolution AB Investment Thesis.

Hat-tip to Ali Gündüz for drawing my attention to this.

5. Amazon’s (Ticker: AMZN) Next Billion Dollar Revenue Stream

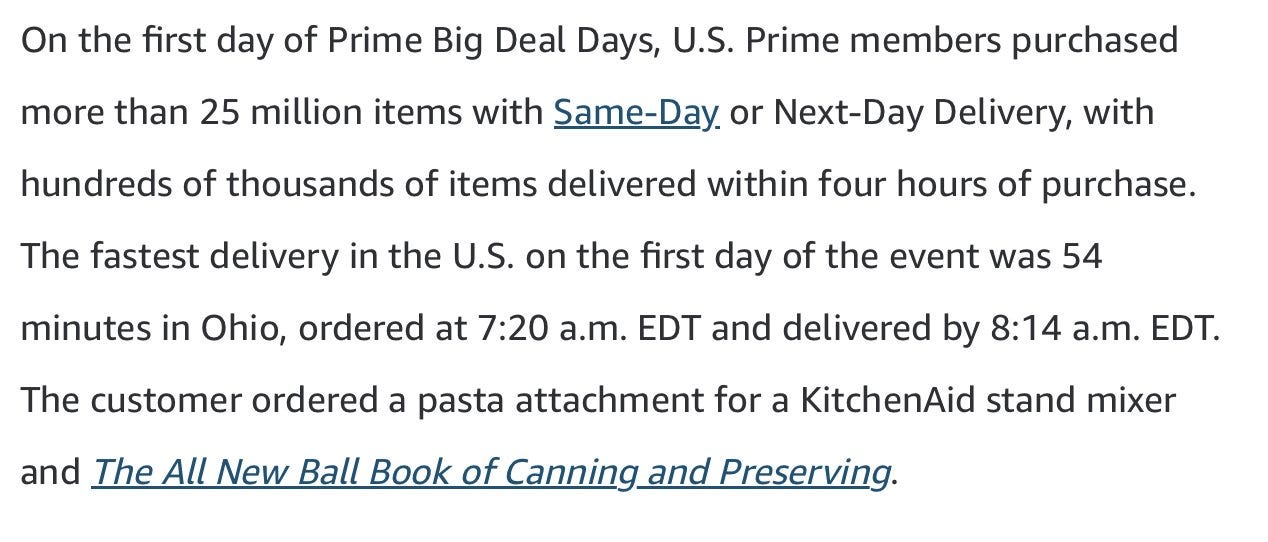

Amazon Prime members saved more than $1 billion across millions of deals during Prime Big Deal Days on October 10 and 11. What struck me, however, was the fastest delivery taking only 54 minutes from the moment it was ordered.

This highlights the monstrous fulfilment and logistics network that Amazon has built and leads me towards uncovering the next billion-dollar revenue stream for Amazon. The Supply Chain by Amazon service offering for off-Amazon merchants could potentially generate tens of billions in revenue, transforming Amazons logistics network from a cost centre into a profit centre. Parallels can already be drawn with Amazon's success in cloud services, and turning its logistics into a service for external merchants mirrors its approach with Amazon Web Services.

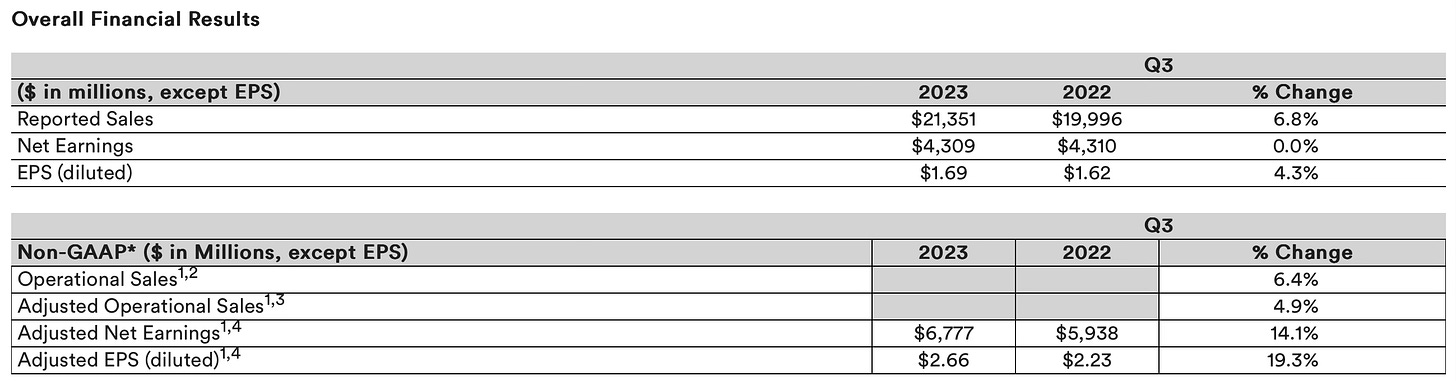

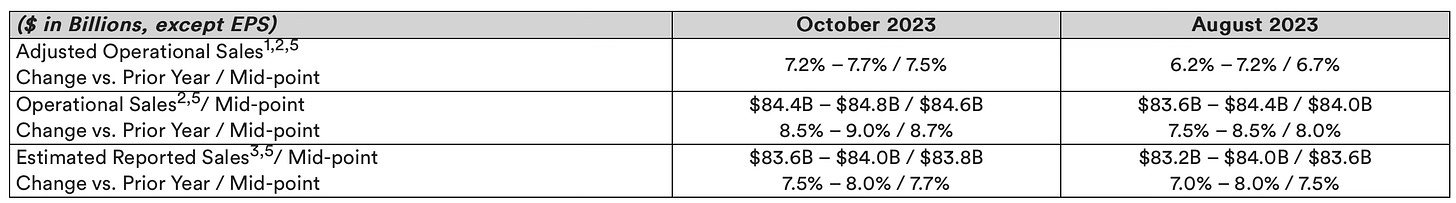

6. Johnson & Johnson (Ticker: JNJ) Q3 2023 Earnings

JNJ reported solid results, surpassing analyst estimates for revenue and EPS. This marks the first quarter of earnings reported by JNJ since the Kenvue spinoff. The Q3 2022 comparatives above do not include Kenvue. If we include Kenvue, JNJ sales would have declined by 10% year-over-year (YoY), and net earnings would have declined by 3% YoY.

Management noted that U.S. sales experienced significant growth of 11.1%. However, outside the U.S., reported growth was 1.6%, with operational sales growth at 0.7%, impacted by factors such as the COVID-19 vaccine and Zytiga exclusivity loss in Europe.

Business sales performance varied across segments. Innovative Medicine sales of $13.9 billion increased by 5.1%, driven by U.S. growth and new product launches, offset by a decline outside the U.S. MedTech sales of $7.5 billion increased by 10%, impacted by international sanctions but showing growth in Interventional Solutions and Vision. Operational growth in Surgery and Vision was notable, while Orthopedics saw a 2.6% operational growth.

Management raised the 2023 full-year guidance for revenue and adjusted EPS, citing strong results delivered in the quarter and the first 9 months of this year, balanced with planned investments in the fourth quarter.

While the earnings outlook for the remainder of the year appears promising, I have real concerns about the growth prospects over the next five to ten years. The existing growth is entirely driven by the U.S., with the rest of the world, which accounts for 44% of revenue, only growing by 1.6%. This growth rate is significantly below the inflation rate and suggests that market share is being lost outside of the U.S.

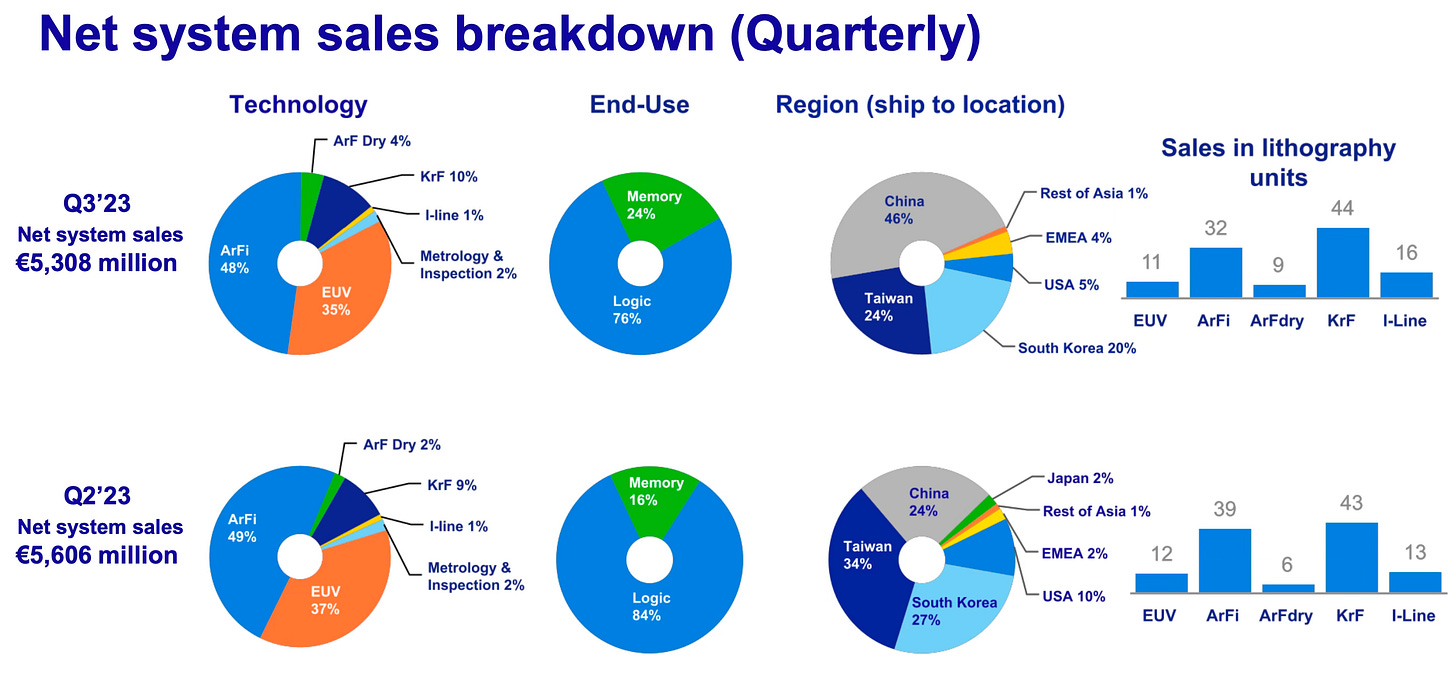

7. ASML (Ticker: ASML) Q3 2023 Earnings

ASML reported weaker-than-expected results, with net sales of €6.7 billion and bookings of €2.4 billion falling short of analyst estimates. However, ASML posted higher-than-expected EPS, attributed to the product mix and one-off cost benefits.

Bookings were the lowest since Q2 2020, with management noting that customers are exercising caution regarding CapEx. Additionally, the semiconductor industry is currently navigating a low point in the cycle, with customers anticipating a turning point by year-end. Bookings serve as a Key Performance Indicator (KPI) for ASML, predicting future demand. ASML maintains an order backlog of €35 billion, which is a reason why customers can afford to have low purchase orders in a particular quarter.

Net sales to China increased from 24% in Q2 to 46% in Q3, but this growth was driven by purchase orders received in 2022. It is also worth noting that the order-fill rate for China over the past couple of years has been quite low, below 50%. The timing of demand in other geographies has allowed past Chinese orders to be fulfilled.

For Q4, management projects net sales of €6.7 billion at the mid-point. This confirms strong growth expectations for 2023, anticipating a net sales increase of around 30% and a slight improvement in gross margin compared to 2022. ASML foresees 2024 as a transition year with revenue flat YoY, down from the previous guidance of 8% revenue growth in 2024. Management reiterated the significant growth expectations for 2025 and 2030 articulated during the capital markets day last year.

The day after ASML reported its earnings, Taiwan Semiconductor Manufacturing Company (Ticker: TSM) shared its own, and some comments from the CEO are worth highlighting, considering ASML is a major supplier of chipmaking equipment to TSM:

"We can expect 2024 to be a healthy growth year for TSMC”

“Right now, do we see the bottom? Very close”

ASML remains high on my watchlist.

I hope you enjoyed today’s Market Movers. There are quite a few companies that I follow closely reporting earnings next week. With that in mind, would you prefer another instalment of Market Movers where I cover the key elements of each earnings report or a detailed analysis of one of the following?

If you have any specific feedback about the structure of Market Movers, please reply to this email or leave a comment below.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com