Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Uber (UBER)

I recently opened a new position in Uber, the digital aggregator that connects riders with drivers. I shared a Quick Pitch explaining why I believe the stock presents an interesting opportunity right now. If you missed it, you can read it for the full details. In summary, I think concerns about the existential risk from autonomous vehicles are overblown. Additionally, Uber's growth potential remains compelling, driven by the expansion of the global ride-hailing market, diversification into new services, and the remarkable success of the Uber One membership program.

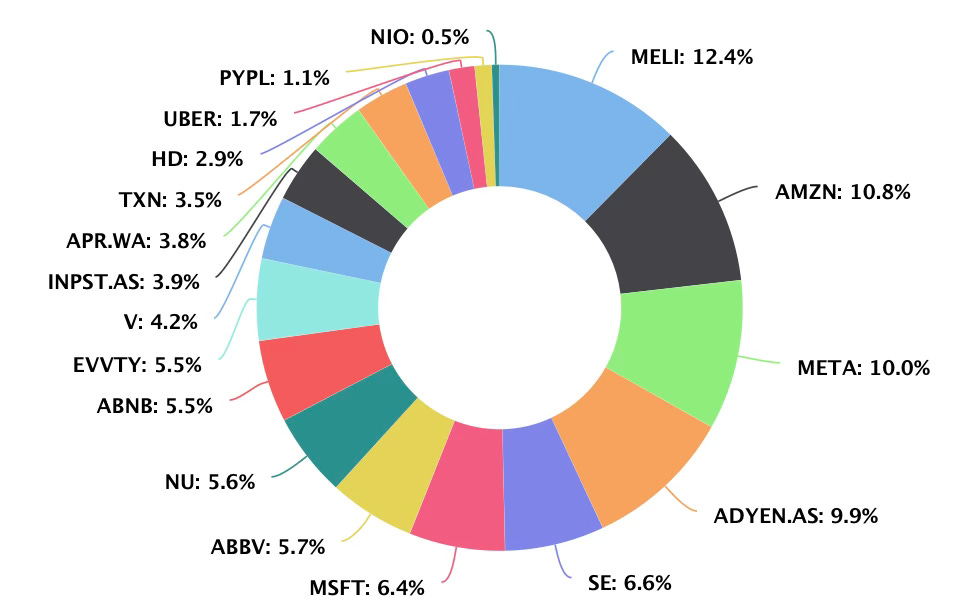

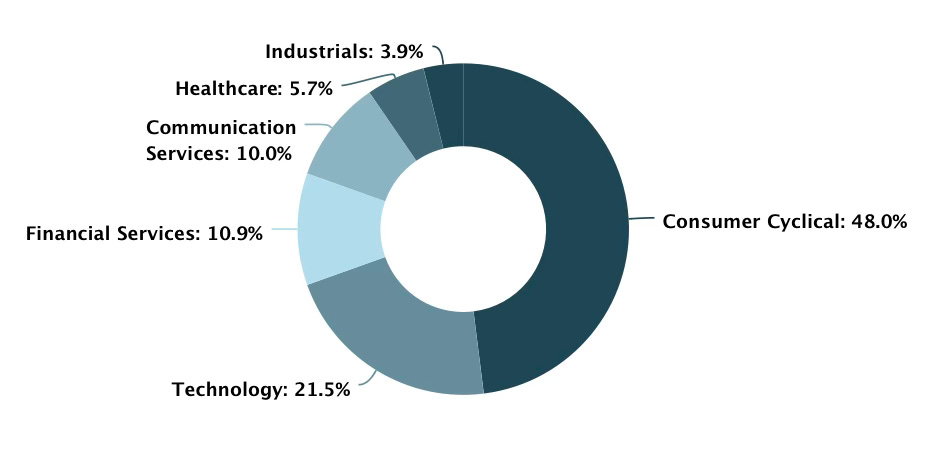

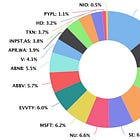

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualization and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

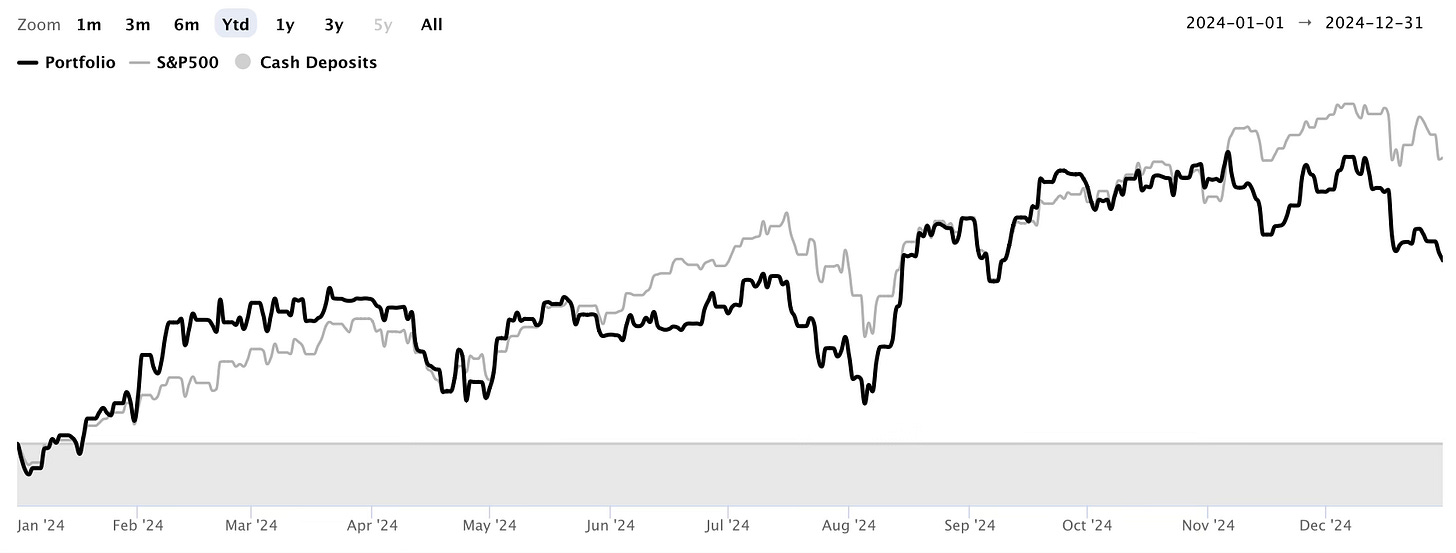

Performance

Q4: -6.0% vs S&P +2.3%

YTD: +15.6% vs +23.1% S&P

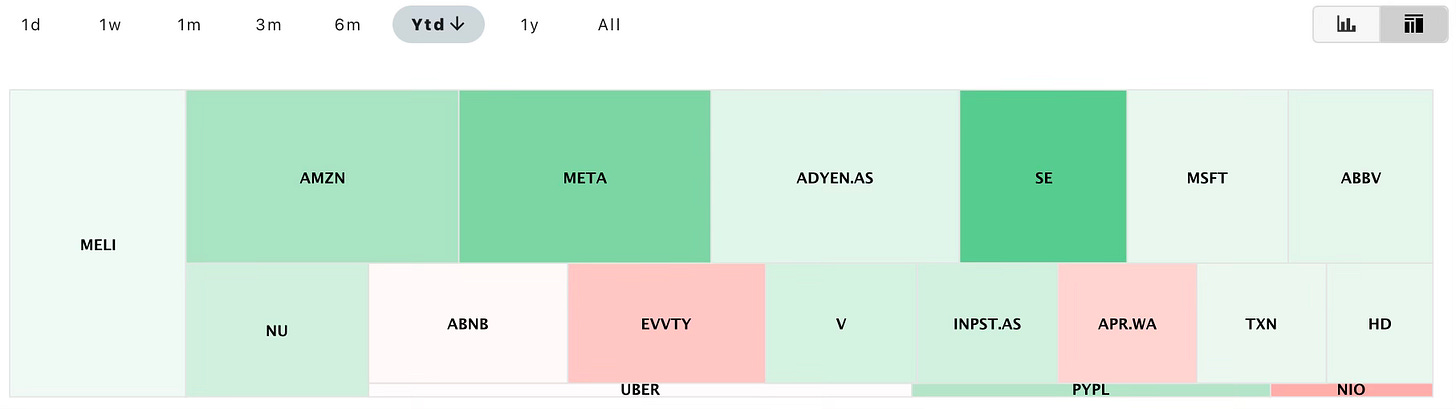

The biggest contributors to the YTD portfolio performance have been:

SE: +162%

META: +65%

AMZN: +44%

PYPL: +39%

NU: +24%

The largest detractors to the performance have been:

NIO: -52%

EVO: -36%

APR: -27%

ABNB: -3%

Buy List

Stocks on my radar to add this month:

Nubank (NU)

In early November, NU was trading above $15, but it has since dropped to just over $10. The sell-off stems from concerns about Brazil's macroeconomic situation. Global factors—such as higher U.S. interest rates, a stronger USD, and tariff threats—combined with worries about fiscal accounts, have heightened tensions in Brazilian financial markets. This has weakened the Brazilian Real and driven up local interest rates.

While these factors present short-term headwinds for NU, they are not new challenges. NU has consistently navigated these dynamics in the Latin American market. After regretting missing the opportunity to buy earlier in 2024, now seems like an opportune time to start accumulating shares again.

Mercado Libre (MELI)

Like NU, MELI’s stock has been impacted by similar macroeconomic concerns. However, MELI's 25-year track record provides a level of resilience compared to NU's 10-year history.

Despite MELI already being my largest position, I still see this as an attractive opportunity to add to my long-term holding. Short-term challenges aside, the company’s long-term prospects remain compelling.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

Q4 proved to be a weaker end to the year than I had anticipated at the close of Q3, but overall, it was still a very positive year. The negative performance in Q4 was primarily driven by MELI and NU, which together account for 18% of my portfolio. These holdings delivered negative returns, as I mentioned earlier, despite a strong year overall.

Additionally, the weak performance of my European holdings, EVO and APR.WA, which together represent 9% of the portfolio, continued a trend that has persisted throughout 2024.

While I underperformed the market this year, it’s important to maintain a long-term perspective. If you had offered me a 15% return following a 34% gain in 2023, I would have gladly accepted.

I will share the 2024 Annual Report in the coming weeks, so stay tuned for deeper insights into the overall portfolio and reflections on this year’s performance. In the meantime, you can revisit the 2023 Annual Report.

Roll on 2025!

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thank you, bud!