Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Portseido Black Friday Sale

As many of you know, I’ve been using Portseido to track and monitor my portfolio for over four years now. Being a visual person, I love the detailed charts and graphs it produces. The team is launching a huge Black Friday sale for new customers, offering up to 40% off for 3 months. This will be their only sale of the year, so I highly recommend taking advantage of the discount while it’s available.

Transactions

InPost (INPST)

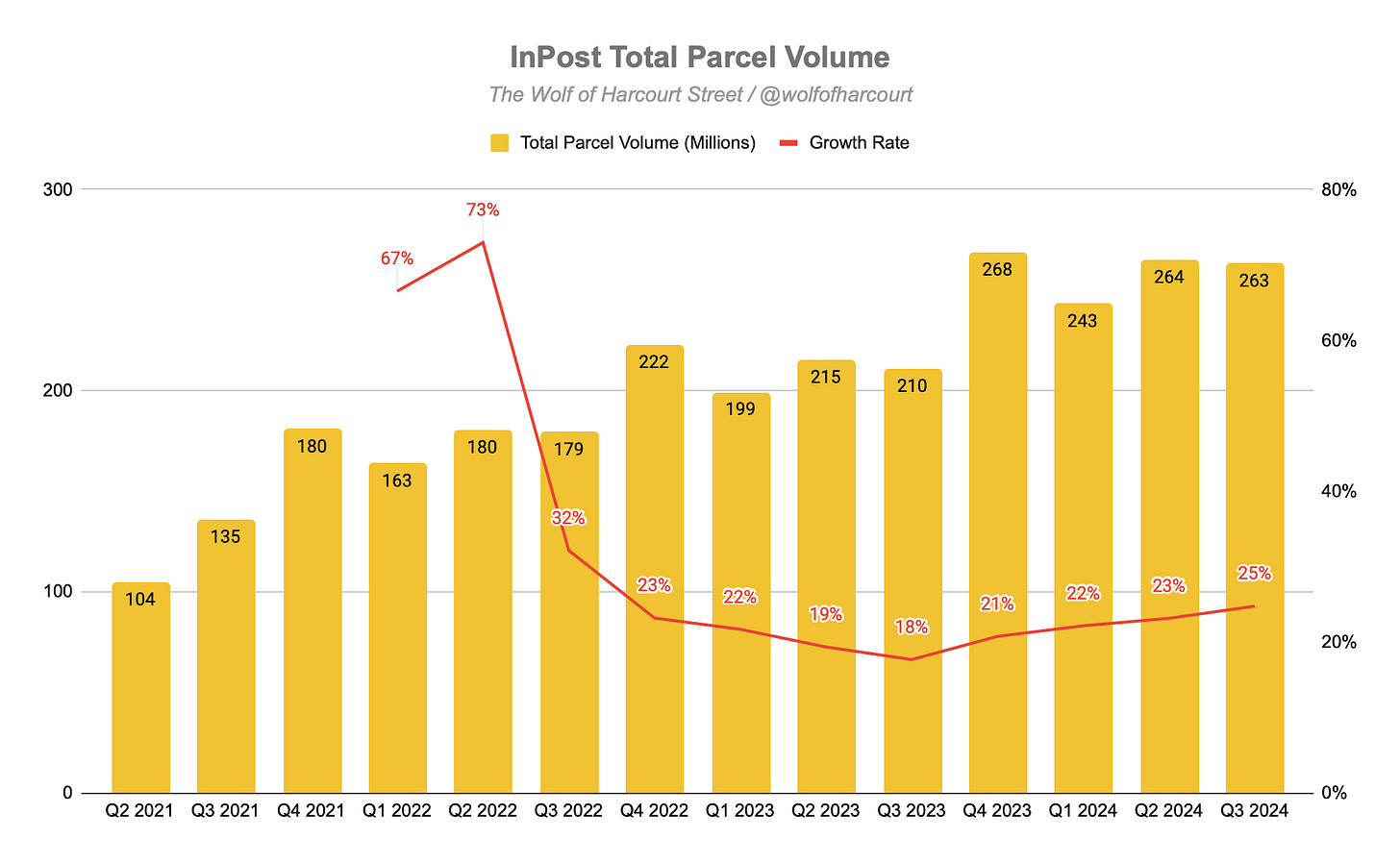

I continued to build my position in InPost, as the stock remains within a valuation range I find attractive. The company’s Q3 earnings demonstrated strong momentum and market share gains.

Key Performance Indicator:

Parcel volume growth accelerated for the fourth consecutive quarter to 25%.

In Poland, parcel volumes grew by 21%, compared to market growth of 11%.

In the UK, parcel volumes surged by 88%, outpacing market growth of just 1%.

Another exciting development was the launch of international shipments across eight countries. As I outlined in the InPost Quick Pitch, this was a key part of my investment thesis—though I didn’t expect it to happen so soon.

The customer value proposition is enormous. For example, sending a small parcel (up to 25kg) from Poland to France costs just PLN 28.99 (~€6.71)—a whopping 70% cheaper than competitors like DPD or DHL.

This service could even disrupt airline luggage fees in Europe, as it’s already cheaper for Polish users to ship their luggage domestically via InPost lockers. It’s only a matter of time before this trend catches on internationally. This isn’t just about capturing market share; it’s about creating demand in a previously inaccessible market.

Mercado Libre (MELI)

After reporting Q3 earnings, MELI stock sold off by as much as 17%, which I viewed as an overreaction. I took this opportunity to increase my position. While revenue growth beat expectations, earnings missed because management prioritised long-term market dominance over short-term profitability—something they’ve done successfully for 25 years. You can read my comprehensive earnings review below, but the rebound in the stock didn’t surprise me.

Nubank (NU)

NU also reported Q3 earnings, and, like MELI, the stock saw a double-digit drop in the following week. Despite this, I found no fault in the report—full review below.

Notably, NU reported 81% EPS growth for the quarter. Yet, the stock ended up trading at 22x forward earnings, one of its lowest historical multiples. Fast-growing companies like NU can quickly grow into such valuations, making this dip an ideal buying opportunity. I added to my position accordingly.

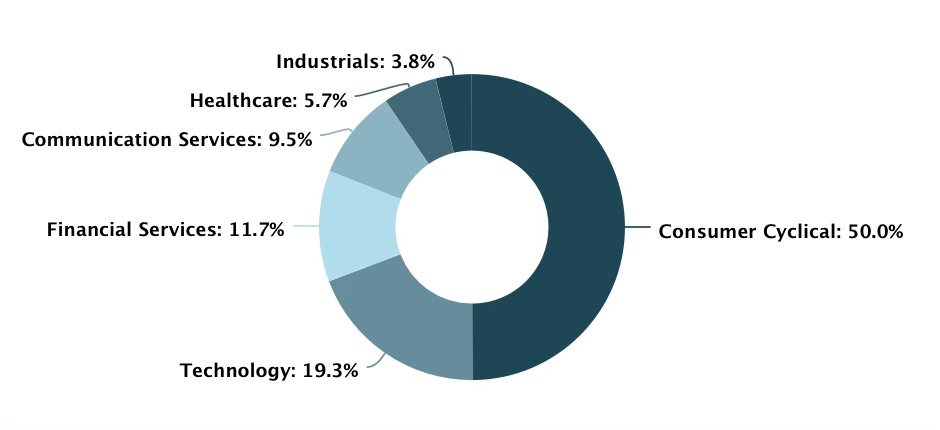

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualization and analytics capabilities guide my future decision-making and, ultimately, enhance my returns.

Thanks to their Black Friday sale, you can get 40% off until 2 December 2024. Sign up using my affiliate link here.

Buy List

Stocks on my radar to add this month:

Sea Limited (SE) - Among all portfolio holdings, SE delivered the most impressive quarterly earnings. Revenue growth accelerated to 31%, significantly exceeding market expectations. Even more remarkable, the company achieved this growth without burning cash; instead, its operating margin continues to expand. The combination of accelerating revenue growth and margin expansion is, in my view, the holy grail of investing. A full earnings review can be found below.

While I was vocal about the stock's undervaluation in 2023, and despite its 186% return so far in 2024, I still see an intriguing opportunity here. This is driven by SE's substantial market potential and the exceptional execution by its management team over the past 12 months.

In Case You Missed It

Here are some of the articles you might have missed this month:

Final Words

This month, I want to discuss the importance of averaging up on your winners. Many investors struggle with this due to price anchoring, a cognitive bias that ties us to historical prices.

Take NU and MELI as examples—both big winners for me. Despite rising prices, I’ve continued buying because my decisions are based on fundamentals and current valuation, not historical prices.

For instance, I started buying NU at ~$9 earlier this year. If I let price anchoring dictate my choices, I might have hesitated to buy more shares at ~$13 this month. But because I focus on fundamentals, I see the stock remains undervalued due to earnings growth and a low forward multiple, even after a +70% YTD return.

As the legendary investor Peter Lynch said:

“The best stock to buy is the one you already own.”

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thoughts on drop this Friday with Nu and other Latin American names ? Seems like it could be another opportunity. Brazil income tax rules.