Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

New Position

Evolution Gaming Group (EVVTY)

Evolution Gaming Group is a market-leading B2B Live Casino content provider. The company delivered strong results in the second quarter of 2023, with top-line growth of 28.2%, reaching €441.1 million. The EBITDA margin for the quarter was the highest ever at 70.7%. Additionally, the trailing twelve months (TTM) net income margin is almost 58%. For some context, this margin profile surpasses even the highly profitable Big Tech companies.

What was most interesting about this earnings report was the new disclosure that Latin America is now the fastest-growing market for Evolution Gaming, increasing by 74% YoY. This surpasses North America at 56%, Asia at 49%, and Europe at 14%. I am extremely bullish on the Latin America region, as evidenced by MercadoLibre (MELI) being my largest holding.

To top it all off, Evolution Gaming trades at a forward P/E of just 20. Considering the margin profile, competitive position, and growth prospects, Evolution Gaming presents a compelling investment case in my opinion.

The above charts are from Koyfin which is the tool that I use to screen and analyse stocks. In my opinion, it is the most comprehensive financial data and visualisation tool that makes the research process so much easier for investors. If you would like to try it for yourself, you can click here to sign up and receive a 10% discount.

I added to my position in the following:

MercadoLibre (MELI)

Regular readers will be aware that I have written at length about MELI in 2023. I added to my position due to the fact that the valuation is pretty much flat over the past six months, despite a big run-up in some of the other tech stocks. My MELI investment thesis is linked below for any new readers.

Brookfield Renewable (BEPC)

I am happy to accumulate more BEPC at the current valuation, given the growth prospects and attractive 4.3% dividend yield. Getting paid to wait for the thesis to play out. What's not to like?

I didn’t sell any positions during the month.

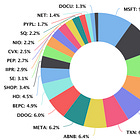

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Buy List

Stocks that are on my radar to add this month:

Paypal (PYPL)/ Square (SQ) - The two digital payments platforms will report their Q2 earnings this week on Wednesday and Thursday, respectively. Total Payment Volume (TPV) and Gross Payment Volume (GPV) are key performance indicators to watch out for while reviewing the earnings. Regarding valuation, PYPL looks extremely beaten down, whereas SQ appears to have stronger growth prospects.

Source: Koyfin

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

It had been a while since I added a new stock to the portfolio, so I was happy to welcome Evolution Gaming into the family last month. Since we are in the thick of Q2 earnings season, I don't expect any major changes to the portfolio. Most of my time will be spent digesting the reports and continuing to dollar-cost average into existing positions where I see fit.

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com