Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

I added to my positions in the following:

AbbVie (ABBV)

ABBV is my third-largest holding, but I haven't increased it for nearly a year due to valuation concerns. However, despite relatively unchanged fundamentals (the Humira patent expiry has been known for quite some time), the stock has declined by 18% since April 25th. ABBV's aesthetics portfolio, generating billions in annual revenue, benefits from a double-digit growth global market. Notably, ABBV sells two top products: Botox for wrinkles and the Juvederm line of fillers.

Sea Limited (SE)

SE's stock has taken a hit of almost 35% since announcing earnings on May 18th. Personally, I found the earnings satisfactory, especially considering the company's second consecutive profitable quarter. My full review of the Q1 earnings is linked below.

According to Momentum Works' recent data, Shopee, SE's e-commerce platform, reigns as the top player in Southeast Asia for 2022, commanding a market share of around 48% and totalling $47.9 billion out of the region's $99.5 billion e-commerce Gross Merchandise Volume (GMV) across the top nine platforms. It's the leading platform across all Southeast Asian countries, outpacing Alibaba's Lazada, which holds the second spot with a market share of around 20% and $20.1 billion in GMV.

When it comes to valuation, Bernstein's reverse discounted cash flow (DCF) analysis suggests that if we base it on the current share price, ASEAN market share would drop from 45% to 24%. Personally, I believe this view is overly pessimistic and indicates the potential for significant upside. I anticipate a potential reevaluation of SE's stock once Garena stabilizes, which could lead to a positive rerating.

I didn’t sell or open any new positions during the month.

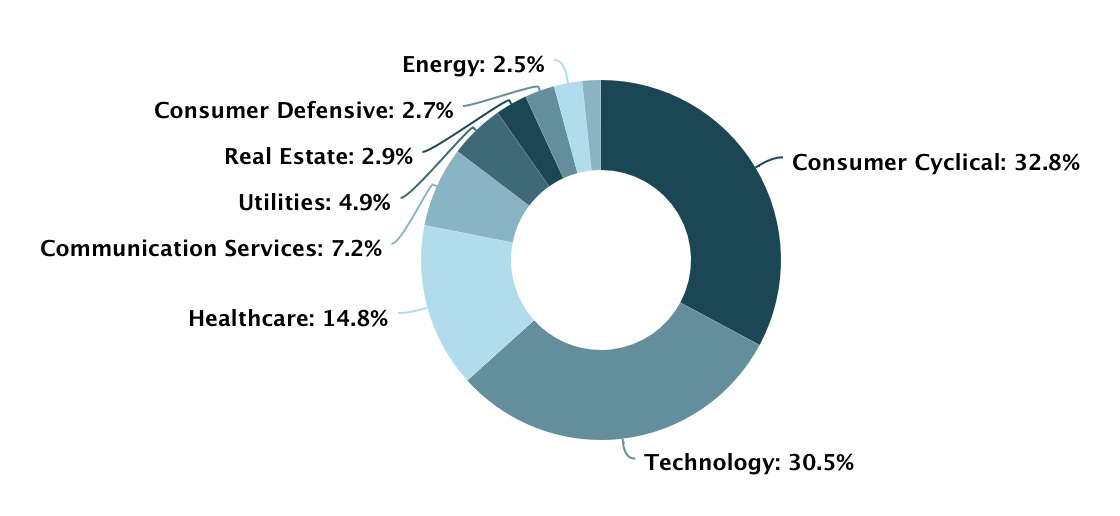

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Trade Republic

Investing made simple.

Invest with just €1. Build wealth with one app for stocks, ETFs, savings plans and crypto.

Low fees, competitive deposit interest rates, and it's also backed by the EU deposit guarantee scheme are just some of the reasons why I opened a Trade Republic account.

Click here to try Trade Republic for yourself for free.

Performance

Q2: +8.9% vs S&P +10.4%

YTD: +19.9% vs S&P +15.8%

Buy List

Stocks that are on my radar to add this month:

Brookfield Renewable Corporation (BEPC) - This stock is still on my buy list from last month. AI hype boosts semiconductor stocks while overlooking the massive energy demand of AI data centers. BEPC, fueling Amazon Web Services, positions itself favorably in this context.

MercadoLibre (MELI) - After declining 12% since 22 May, MELI has slipped to my second largest position. I have not been able to find any new information to warrant such a decline. The current valuation presents an attractive opportunity to add to an already large position. I have the fair value of MELI closer to $1,660 implying potential upside of almost 40%. Full investment thesis from earlier this year linked below.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

MSFT has returned to lead my portfolio as the largest position returning +42% YTD. The recovery in growth stocks has been the main story of 2023 for my portfolio. This is observed by the fact that 9 of the 10 performers are growth stocks.

For the rest of the year, my strategy is to maintain an equal balance of growth and value stocks, unless there are significant changes in market conditions. Given the strong performance of growth stocks in Q1, I shifted my focus towards adding more value stocks during that time.

As I reviewed my portfolio for Q2, I realized that I haven't made any new investments or sold any holdings since February. This was intentional, as I've been concentrating on establishing proper weightings for my best investment ideas in line with my position sizing framework.

Role on Q2 earnings season!

Hit subscribe below if you have not already done so in order to receive the latest content straight to your inbox each week.

If you enjoy today’s edition, then feel free to share as it, it really helps.

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com