Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Sea Limited (SE)

I added to my position in SE, which continues to be one of the best-performing stocks in the portfolio in 2025. Despite the recent run-up in share price, I remain bullish at these levels because I believe Wall Street still doesn’t fully understand the business model or appreciate its long-term earnings power.

SE reports Q2 earnings in a couple of weeks. A number of new Shopee seller order fees came into effect in July, which means they will not be reflected in Q2 results. However, based on my analysis, these fees could conservatively add over $400 million in incremental annual revenue without any increase in existing order volumes.

My investing journey with SE has been a wild ride. I initiated my position at $102 in July 2020, watched it climb to over $350 in October 2022, held on as it crashed 90% to $35 in January 2024, and continued to hold as it rebounded to $160 at the time of writing. As you’ll see in the chart below, I’ve added to my position multiple times throughout this period. As the saying goes, you can’t borrow conviction.

ASML (ASML)

I added to my ASML position after the stock dropped 10% following its Q2 earnings release. The headline numbers were as follows:

Revenue: €7.69 billion, +23% YoY (Est. €7.54 billion)

Adjusted EPS: €5.90, +47% YoY (Est. €5.22)

These were strong beats across the board, but the market reacted negatively due to softer Q3 guidance. Still, full-year 2025 revenue guidance remains unchanged at €32.5 billion. You don’t need to be a genius to figure out which one matters more.

Much of the bearish commentary centered on the fact that management didn’t provide guidance for FY26, citing macroeconomic and geopolitical uncertainty. But this criticism ignores precedent, ASML never provides full-year guidance 18 months in advance. For reference, no FY25 guidance was issued in Q2 of last year either.

Interestingly, a day later, TSMC, one of ASML’s most important customers, released its earnings. While the market took it in stride, TSMC also referenced potential tariff-related uncertainty.

Most importantly, ASML currently has an order backlog of €33 billion, meaning they are effectively sold out for the next 12 months even without new orders. Sounds like a good problem to have.

Auto Partner (APR.WA)

I exited my full position in Auto Partner, which represented 3.5% of the portfolio at the time of sale. I’ve already published a full article explaining my decision, but in short, the fundamentals have deteriorated to the point where I no longer believe the company can meet the expectations behind my original investment thesis.

That thesis was based on sustained high-teens revenue growth over the next 3 to 5 years, alongside stable or improving margins. Continuing to hold the stock now would require thesis creep, essentially betting on a turnaround story where growth reaccelerates to the mid-teens and operating leverage improves. I’m not comfortable with that bet until I see proof.

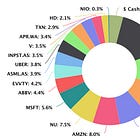

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Buy List

Mercado Libre (MELI)

MELI reports Q2 earnings on Monday, 4 August. Long-time readers will know that Wall Street analysts have a poor track record forecasting MELI results, largely because the company doesn’t provide guidance.

Given the bold new pricing strategy introduced in Brazil this June, I suspect consensus estimates haven’t properly accounted for the impact. My base case is that MELI beats on revenue but misses on EPS, which could prompt a sell-off driven by algorithmic trading.

If that happens, I’m ready. I’ve built up a healthy cash position following recent sales and would welcome the opportunity to make my largest position even larger.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

I ended the month with the portfolio sitting near an all-time high, while my cash position also reached an unusually elevated level. Generally, I aim to be fully invested since I am a net buyer of stocks through monthly cash contributions. However, after selling Auto Partner this month and Airbnb back in May and not yet deploying the proceeds, I’m currently holding nearly 7% in cash.

As long-time readers will know, I’ve been gradually consolidating my portfolio over the past two years, reducing it from 24 positions at its peak in late 2023 to a target of no more than 15 positions. This has been an intentional and measured process, driven by fundamentals rather than forced sales.

Raising cash by trimming lower-conviction holdings while the portfolio is at or near all-time highs feels like a cheat code. It allows me to free up capital without selling winners and triggering capital gains taxes. With the portfolio still at elevated levels, I’ve been deliberately patient in deploying the proceeds. I’m waiting for clear, compelling opportunities. If none emerge, I’ll begin gradually allocating capital starting next week.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks Wolf. Always appreciate your insights. I admire your mission to reduce your portfolio down in size. Would love to get in on MELI and will be watching the response to earnings closely.