Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Uber (UBER)

I initiated a position in Uber back in December 2024 at $60, and since then, the stock has been on a tear, returning over 55% in six months. Earlier this month, I shared a 2025 financial model and valuation update to revisit the investment thesis and assumptions.

One of the challenges with buying at such a low price is that it’s very easy to become price anchored. Going through an exercise like this is one way to overcome that mental hurdle. Even though the share price has risen, I still believe the stock is undervalued based on reasonable assumptions, so I added to the position at $85.

With each passing week, my conviction in Uber continues to grow as its pace of execution shows no signs of slowing. Earlier this month, Volkswagen unveiled its white-label robotaxi, which residents of Los Angeles will be able to hail via Uber starting next year.

What’s most interesting about this partnership is that, unlike companies like Tesla and Waymo (an existing Uber partner), Volkswagen wants to act purely as a supplier, leaving the business of fleet management to Uber. In other words, Volkswagen isn’t even attempting to launch its own ride-sharing app, instead, it’s focusing on its core competency: manufacturing vehicles.

This is yet another reason I believe the autonomous vehicle industry will be fragmented, and that fragmentation will ultimately benefit Uber. With its massive distribution network and infrastructure advantage, Uber is well positioned to be the operating layer that ties everything together.

InPost (INPST)

I added to InPost, a stock that remains very much under the radar. The company is a disruptor in the European e-commerce logistics space. It traded at a forward P/E of just 16, and I expect earnings to compound in the high teens over the next five years. The business has a clear reinvestment runway as it continues to build out its locker network across Europe.

The UK expansion, in particular, is standing out from an execution point of view. Just last week, Debenhams Group announced a partnership with InPost to enhance delivery options for customers across the UK. Debenhams Group is the online retailer behind brands including Debenhams, boohoo, boohooMAN, Karen Millen, and PrettyLittleThing.

This is a major win for InPost, giving it the opportunity to handle up to £1.8 billion in gross merchandise volume that flowed through Debenhams Group in 2024.

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Performance

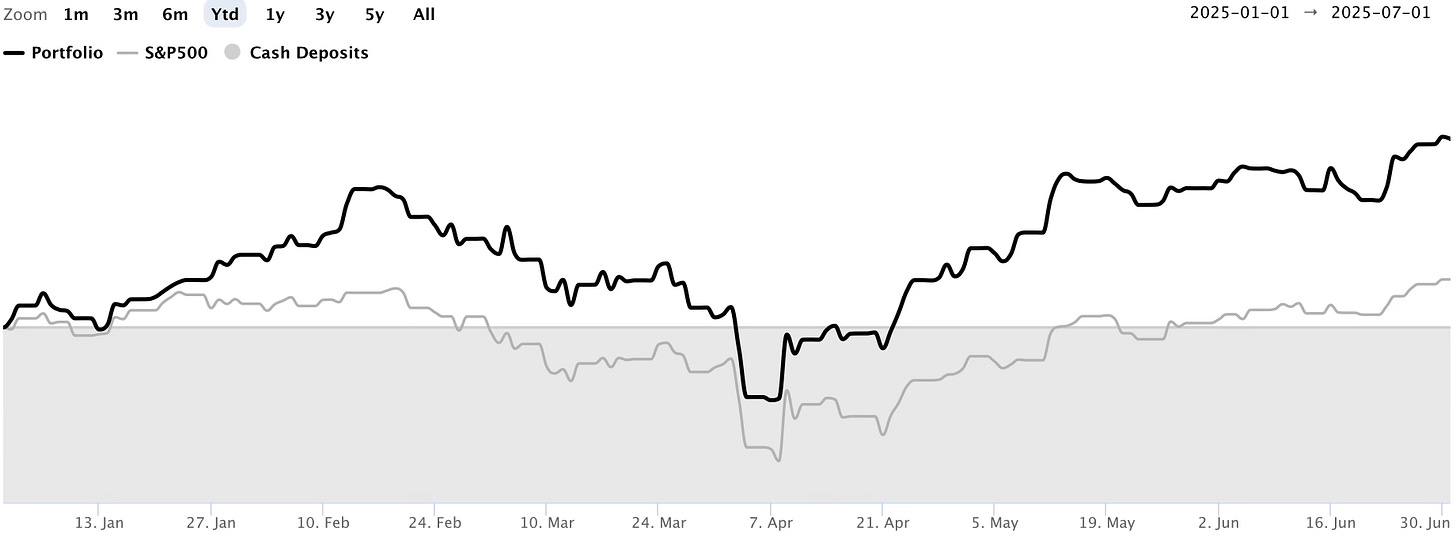

Q2: +20.4% vs. S&P +10.4%

YTD: +21.6% vs. S&P +5.5%

Top Contributors YTD:

UBER: +55%

MELI: +54%

SE: +51%

NU: +32%

META: +26%

Largest Detractors:

NIO: -21%

INPST: -8%

HD: -6%

Buy List

Sea Limited (SE)

SE is one of the best-performing stocks in the portfolio YTD. I last added to the position in April, when the stock dropped to as low as $104 following the “Trump tariff tantrums.” That purchase is now up +50% YTD.

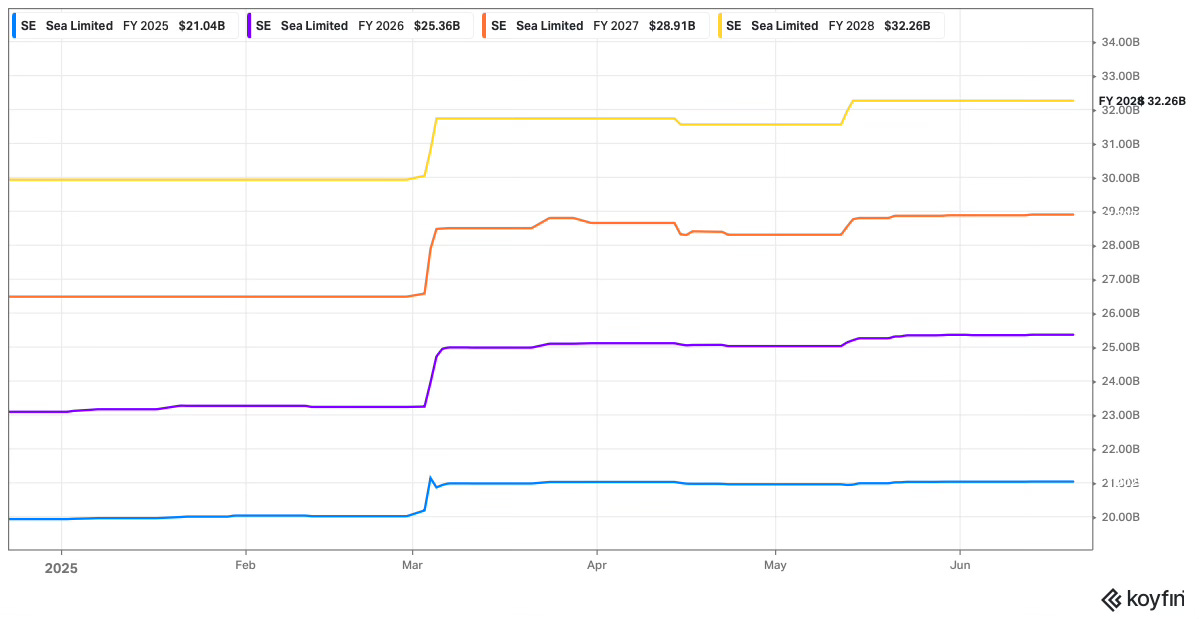

I remain bullish on SE because I believe Wall Street still doesn’t fully grasp the business model or its long-term earnings power. If you look at the 2025 revenue consensus estimates, analysts have made significant upward revisions, especially after the Q4 2024 earnings release, where SE beat revenue expectations by 6%.

SE embodies what I consider the holy grail of growth investing: revenue acceleration coupled with margin expansion.

ASML (ASML)

ASML continues to trade between the €600–€700 range, which I find attractive. S&P Global recently published an update forecasting that ASML is poised for an AI-fueled rebound, driven by surging demand for EUV and High-NA tools.

They project revenue to grow from €32 billion in 2025 to €52 billion by 2030. If accurate, this could equate to EPS of over €50, meaning ASML is currently trading at roughly 13x 2030 earnings.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

The Q2 2025 portfolio return of +20.4% marked the best quarterly performance since Q4 2020, when the portfolio returned +37.3%. While I'm pleased with the performance, especially relative to the broader market, strong short-term returns have made me cautious. I’ve been slow to deploy the cash I built up last month and am currently maintaining a cash position of over 4%.

Generally speaking, anyone can outperform in a bull market by simply taking on more high-beta, high-risk names. Personally, I find far greater satisfaction in outperforming during flat or down markets. While I underperformed the market last year, zooming out, even just one more year, shows that this has been more than offset by the outperformance in 2023 and 2025 to date.

This outperformance has been achieved by sticking to a consistent strategy and avoiding hype-driven stocks that often ignore downside risks. Some of the best-performing stocks of the year so far in UBER, MELI, and NU, were highlighted as undervalued in my December 2024 Portfolio Review. I continue to believe that some of the best opportunities are already in the portfolio. Many of my largest holdings and top performers in 2025 remain reasonably valued, even at current levels.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Great returns, well done! 🙌🏼

Nice work. Solid looking portfolio.