Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

House Keeping

Thank you to everyone who completed the subscriber survey a couple of weeks ago. The responses were excellent and gave valuable insight and feedback on the newsletter. Congrats to Rafa who won a copy of Morgan Housel’s new book, The Art of Spending Money.

Due to personal circumstances (all good), newsletter editions will be less frequent between now and Christmas. I still plan to publish a couple of articles during this period, but I want to give everyone advance notice. The subscriber chat will remain active and is a great place to engage with the community.

Now, on with the show.

Be greedy when others are fearful.

Ask yourself this…

Would you rather have bought Meta shares for $378 in September 2021 or $90 in November 2022? Both purchases would have seen tremendous growth.

A $1,000 investment in September 2021 would be worth $2,014 today. But a $1,000 purchase when Meta pulled back in November 2022 would be worth $8,300.

Sometimes it can pay to wait for a pullback. Rebound Capital identifies high-quality companies undergoing drawdowns to capitalise on their eventual rebound. In the last few months, they have identified ASML (up 23%), Google (up 52%), and AMD (up 61%) as ideal rebound prospects.

Transactions

Mercado Libre (MELI)

I added to MELI after a sell off driven by perceived negative news:

Brazil: Amazon made its most aggressive move in Brazil since entering the market. From Sept 30 to Dec 3, during Black Friday season, it reset all storage and shipping fees for Fulfillment by Amazon. In short, joining Amazon Marketplace is practically free. We have seen this play before and history shows it takes much more than free shipping to topple MELI’s dominance.

Argentina: There was fear that President Javier Milei’s party would lose the midterms after losing the Buenos Aires provincial election the prior month. Milei’s party is pro-capitalism and a loss was viewed as negative for MELI. This did not materialise and Milei’s party won.

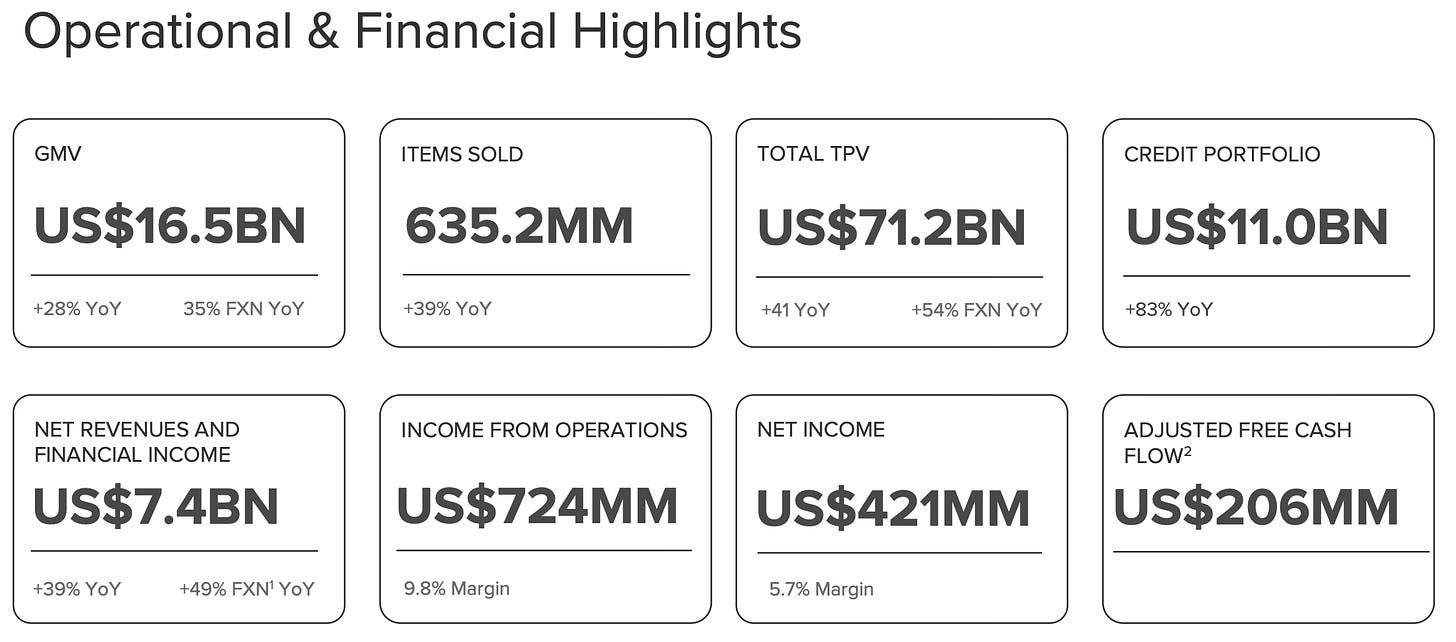

Earlier this week MELI reported another exceptional quarter. Revenue grew 39%, marking the 27th consecutive quarter above 30%, which is nearly seven years. The story was familiar, MELI beat on revenue and missed on earnings because the company continues to prioritise growth and long-term dominance over near-term profitability.

One example is expanding free shipping, which is core to their long-term strategy. In Brazil the free shipping threshold was reduced from R$79 to R$19 and GMV is already up 36%. Unique buyers grew 29% year on year, the fastest pace since Q1 2021 and the largest quarterly increase ever, surpassing the pandemic peak. Sold items in Brazil rose 42%.

This remains my largest position and the one I have the most conviction in. Even though it is already significantly sized, I prioritise adding during periods of weakness over adding to any other holding

Rubrik (RBRK)

I continued to accumulate Rubrik under $80. As a new position, I want to build it quickly at these levels. Key developments this month:

The Asahi ransomware attack underlined Rubrik’s relevance. A week later Asahi systems were still down and beer was shipping manually. Rubrik’s immutable backups, recovery, and anomaly detection could have limited damage and restored operations within hours.

South Korea has had a major cyber incident every month this year. In one case the government lost all data because servers were in one single location with no backups. This is exactly the problem Rubrik solves and the need grows as data volumes increase.

Chinese hackers breached US cyber firm F5. When even defenders are hit it shows breaches are inevitable and resilience matters.

Launched Rubrik Agent Cloud, the first product designed to monitor, govern, and remediate AI agents.

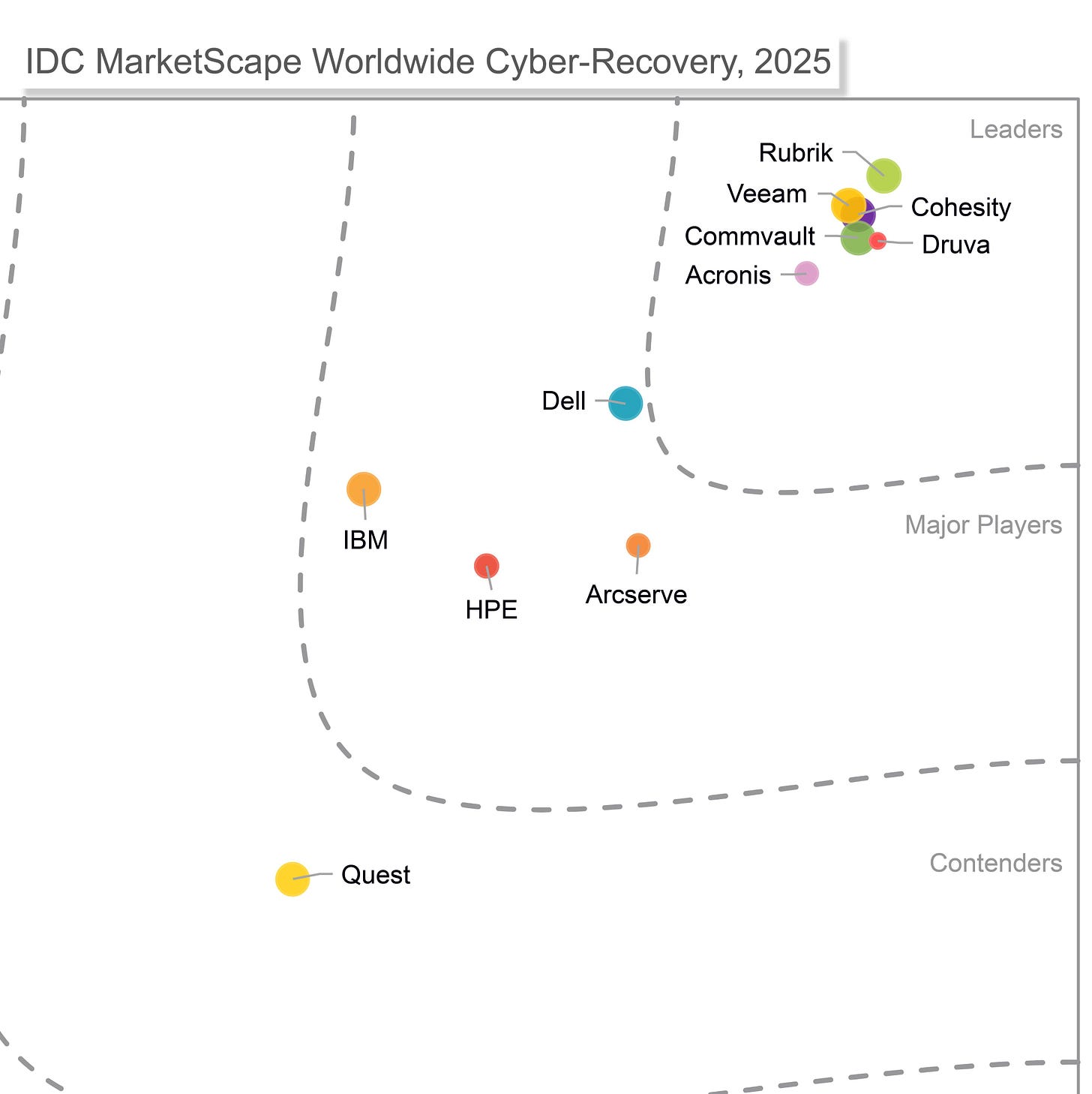

Named a leader in IDC MarketScape for worldwide cyber recovery, which adds external validation.

Uber (UBER)

I added to Uber after a 10% pullback earlier this month. I want this to be a much larger position. The pitch at $60 dollars in December was a fat one, so I have been buying above $90 into strength because I still believe it is undervalued. My valuation work from earlier this year pointed to a fair value near $115.

Uber continues to execute well with several positive developments this month:

Launched JourneyTV Presents, an in-ride entertainment platform with content partners including Time Out. Uber Advertising has strong appeal because it holds high-intent data, it knows where users are and where they are going.

Acquired Segments.ai to strengthen self-driving through better labelled data. Data quality is a key edge in the autonomy race.

Signed a long-term partnership with Riyadh Air to integrate Uber services into the airline’s app and loyalty experience.

Began piloting digital tasks in the United States. Select drivers can earn by completing tasks such as uploading photos to train AI models or submitting multilingual documents. This was already tested in India.

Partnered with Nvidia to scale a level-4-ready mobility network. Stellantis will deliver at least 5,000 Nvidia-powered L4 vehicles to Uber. Uber will run fleet operations and customer support.

Texas Instruments (TXN)

I sold my full TXN position, which was 2.5% of the portfolio. I shared a full writeup already, but in short it does not fit my investment philosophy. The business and industry are highly cyclical, and I do not believe I can forecast them with confidence. I recorded a 20% profit, but returns were much lower than expected because the earnings trough lasted longer than anticipated. Cyclical industries are hard to value and time, and predictability is often worth paying for.

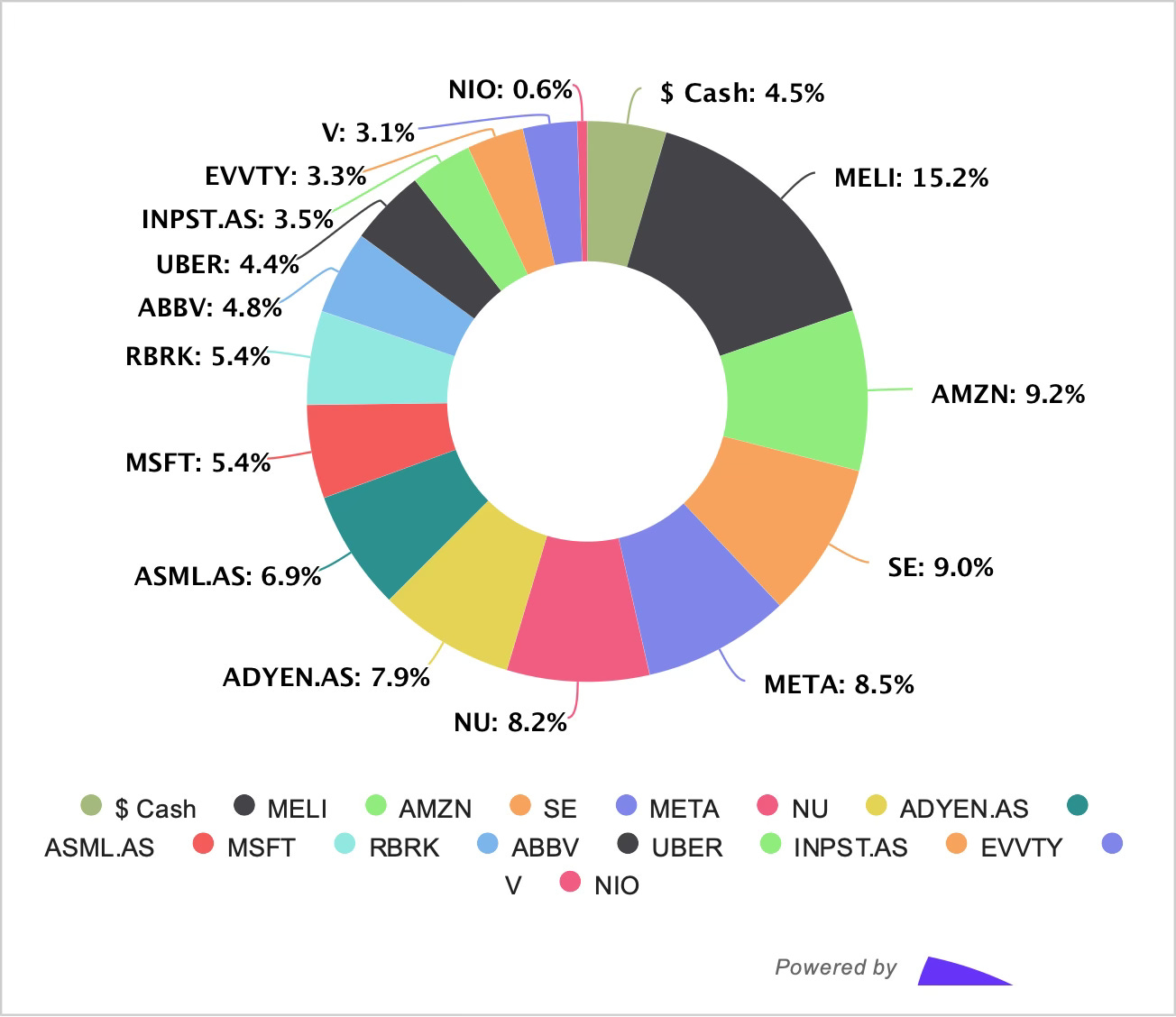

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Buy List

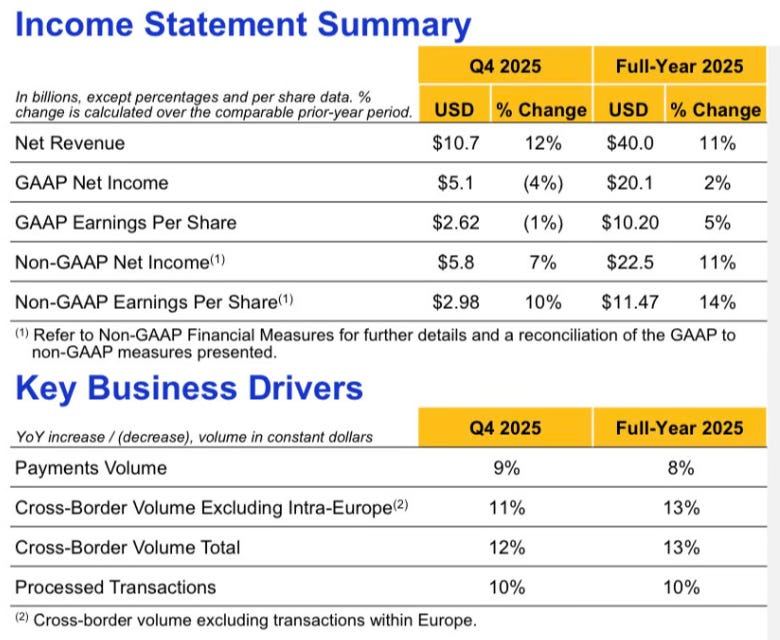

Visa (V)

Visa stays on my buy list from last month. It delivered another dependable quarter with double-digit growth in revenue, earnings and dividends.

It is one of those true sleep-well stocks thanks to low emotional volatility (looking at you Evolution). At 26x forward earnings, the valuation is reasonable for a business of this quality and reliability.

Uber (UBER)

I am careful not to get price-anchored with Uber. It is still undervalued in my view despite the rally this year. At a 4% position there is scope to increase it materially. I will wait for next week’s Q3 earnings before acting.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

This was a very active month. I sold one more position and have now hit the 15-position portfolio I have been working toward for over a year. Long-time readers know this concentration was deliberate and methodical. I was not selling for the sake of it, I was waiting for sound reasons to emerge.

Managing fewer positions has been mentally liberating.

I do not rule out further consolidation where the original thesis has broken or is materially different today. Evolution is one such example, though I am not rushing. The Q3 earnings and thoughtful community commentary have given me plenty to consider.

Even after adding to three positions, I ended the month with 4.5% cash, unchanged from last month. With two months left in 2025, I think the portfolio is positioned for a strong finish. Let’s see if Mr Market agrees.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

nice evolution gaming but the position size is too small. i rate 7/10 — Invader

Congratulations on the good personal circumstances.

Do you have a price range for Visa to add more?