Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

Last month I discussed that I was intending to consolidate my portfolio and I achieved much of this by reducing full exposure in the following:

Block (SQ)

I sold my full position in SQ which was a 1.3% weight at the time. If you read Market Movers - 20 October 2023, where I shared my initial thoughts on the acquisition of Hifi, this will not come as a surprise to you. The stock does not align with my original thesis, and I am not comfortable with the acquisitions. The underlying Cash App and Square Ecosystem businesses are indeed strong, but the capital allocation and shareholder friendliness leave much to be desired. I cannot predict the capital allocation strategy with any degree of certainty. I contrast this with competitors such as Adyen, which is obsessed with defragmenting the payments ecosystem, building everything in-house, and avoiding any acquisitions. This is the type of leadership I want to invest in.

DocuSign (DOCU)

I sold my entire position in DOCU, which accounted for a 1% weight at the time. While DOCU has surpassed expectations in the last few quarters, it's crucial to note that these expectations were relatively low. The tipping point for selling DOCU was my employer's recent shift from DocuSign to Adobe Sign. Upon querying this decision with colleagues in procurement, they revealed that the choice was solely based on pricing, not the product's quality. Essentially, we already have licenses with Adobe, and this additional product can be bundled in. This serves as a prime example of a superior product lacking an underlying competitive advantage, given that big tech dominates distribution. I'd also highlight that DocuSign's rollout of contract life-cycle management products has been subpar, a departure from my initial investment thesis under previous management. While I believe DOCU holds some value at these levels, especially if it becomes a takeover target, a 1% position won't move the needle for my portfolio.

Innovative Industrial Properties (IIPR)

I sold my entire position in IIPR, which accounted for a 2.8% weight at the time. The initial thesis centered around the legalization of cannabis in the US, which remains intact. However, IIPR's growth has significantly slowed, with revenue expected to remain flat in 2024 and earnings experiencing a marginal decline. The company and its tenants are notably impacted by the recent interest rate hikes. Despite offering a substantial dividend with a current yield of 10%, my investment focus is on total return, and I am uncertain about where growth will emerge in the next two to three years given the current environment. While I don't believe the dividend is in jeopardy, I find it challenging to identify sources of growth under these conditions.

Johnson & Johnson (JNJ)

Lastly, but perhaps most surprisingly, I sold my entire position in JNJ, which accounted for a 5.5% weight at the time. JNJ has long been considered a bellwether stock for investors seeking low-volatility investments. Despite the Zero Interest Rate Policy (ZIRP) era, where JNJ comfortably outperformed cash with its ~2.5% dividend yield, it might surprise you to learn that it has underperformed the S&P as a whole during this period.

In Market Movers - 20 October 2023, I shared my thoughts on the Q3 earnings, expressing real concerns about where future growth will come from, given that the company is not expanding outside of the US. If growth is anticipated to be even lower in the future, I struggle to see how the total JNJ return can outperform the market over the next 10 years, especially considering its failure to do so over the past decade. The hurdle to own a stock like JNJ is much higher now because 5% interest can be earned on cash. If a stock cannot beat the market or at least yield more than the risk-free rate, then what is its purpose?

I added to my positions in the following:

Amazon (AMZN)

I invested all the proceeds from SQ into AMZN before Amazon reported Q3 earnings. Recently, I discussed the idea that the Supply Chain by Amazon service could potentially generate tens of billions in revenue, transforming Amazon's logistics network from a cost center into a profit center. However, the current star of the show is ad revenue growth, which accelerated to 26% year-over-year compared to 22% in Q2 and 21% in Q1.

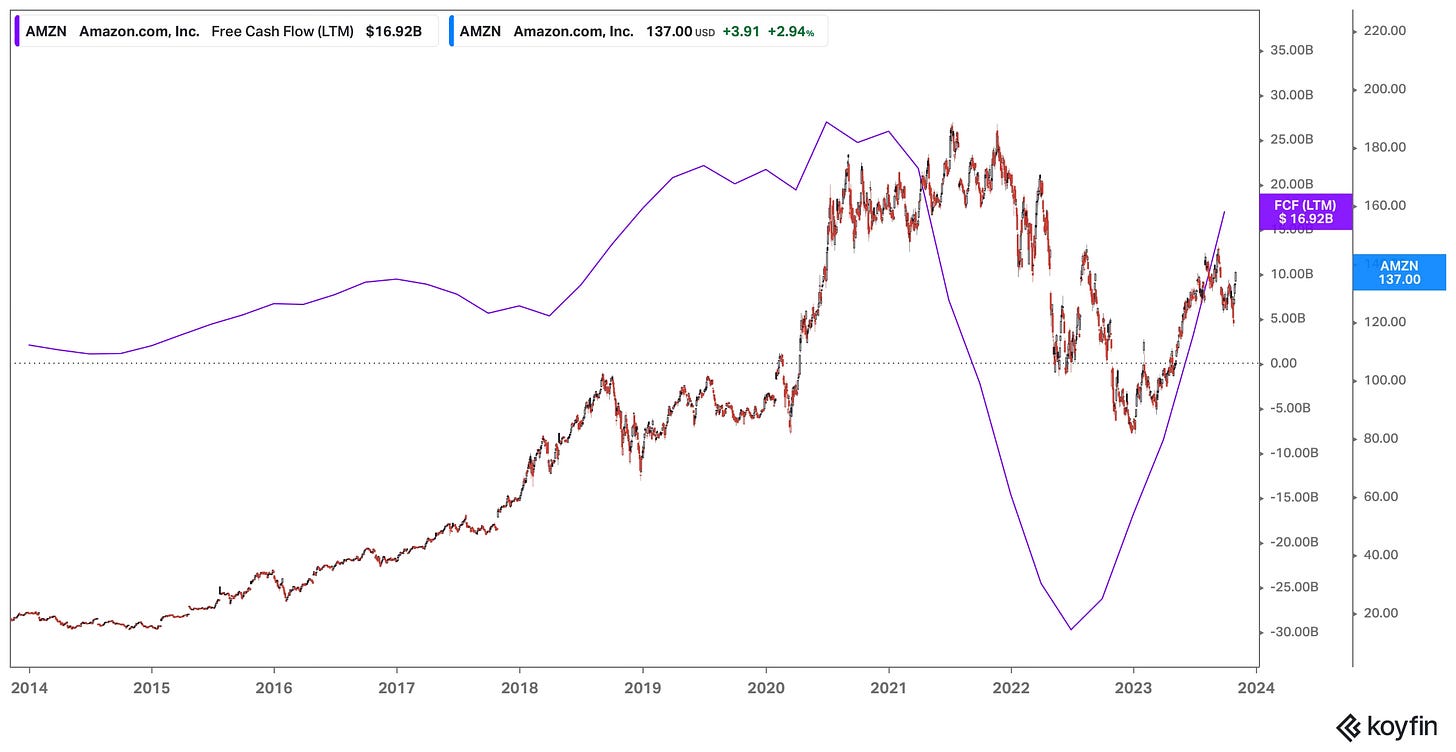

Sharing an updated version of my favorite AMZN chart, which illustrates how Free Cash Flow moves in tandem with the share price. FCF is headed in one direction, and the share price will follow suit.

MercadoLibre (MELI)

I invested all the proceeds from DOCU into MELI before it reported Q3 earnings. What can I say about this company? It is one of the truly rare companies that I follow where I genuinely look forward to its earnings each quarter because I know it will continue to pleasantly surprise me with its flawless execution.

Once again, Q3 was no exception, with MELI growing revenue at an astonishing 69% on an fx-neutral basis. In reported USD currency, MELI grew revenue by 40%, surpassing estimates of 32%, and EPS by 180%, exceeding estimates of 128%. The numbers this company is posting at scale are truly incredible, and the opportunity for the company is still significant given how underserved Latin America is when it comes to e-commerce and fintech. MELI shared its earnings in a video format, I really hope more companies follow suit.

Adyen (ADYEN.AS)

I invested half of the proceeds from IIPR into Adyen. Over the past several months, I have continued Dollar-Cost Averaging (DCA) into Adyen as I work towards achieving my desired portfolio weight. Not much has changed since this stock reported earnings in August, but I am looking forward to the Investor Day later this month, where the management will share Q3 earnings for the first time.

The full Adyen investment thesis is linked below for anyone that missed it.

Evolution (EVVTY)

I invested the remaining half of the proceeds from IIPR into EVO. Since I shared my investment thesis earlier in October, EVO reported solid Q3 numbers. Revenue grew by 20%, which, on an FX neutral basis, would have been 6-8% higher, accompanied by 70% EBITDA margins. The decline of RNG revenues by 2% after +€2 billion in acquisitions raises eyebrows. Can it be turned around, or should EVO cut losses and focus on core competency? It's something I ponder. The company is extremely well-capitalized, so I expect buybacks to be announced once management closes out the warrants.

The full Evolution investment thesis is linked below for anyone that missed it.

I didn’t open any new positions during the month.

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Broker

Trade Republic is the name of the investment broker that I use. The platforms combination of low fees, accessibility, fractional share options, and regulatory backing make it a reliable choice.

From 1 October, Trade Republic has doubled its interest on uninvested cash from 2% to 4% per annum, paid monthly. This is one of the most competitive rates on the market for European investors.

Click here to sign up for a free Trade Republic account

Buy List

Stocks that are on my radar to add this month:

PepsiCo (PEP) - PEP remains on my buy list since last month. The stock has been selling off on the back of the perceived impact of GLP-1 weight-loss drugs but I believe this is being overblown.

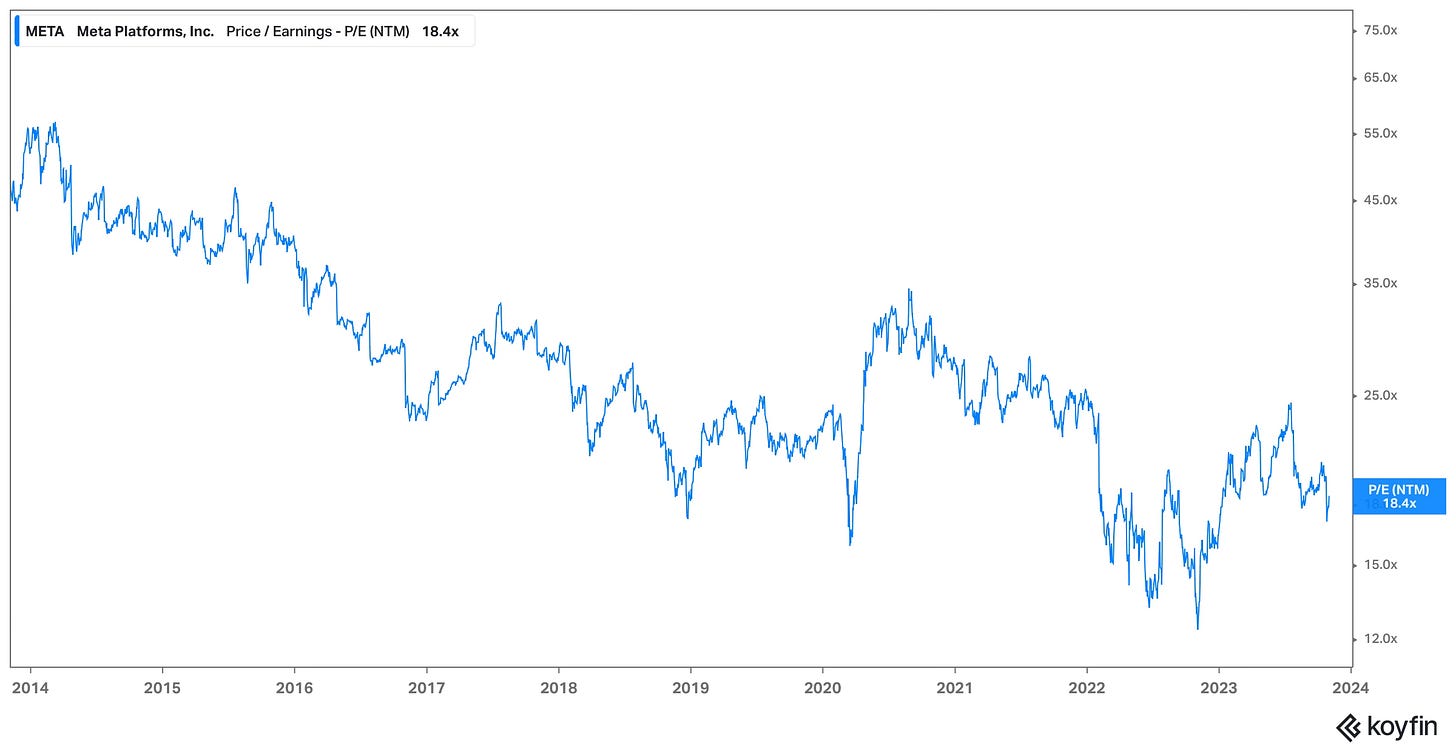

Meta (META) - META crushed Q3 earnings, reporting revenue and EPS of $34.1 billion and $4.39, respectively, compared to estimates of $33.5 billion and $1.64. What I can't help but notice is that Zuckerberg seems to be thriving in the pursuit of his year of efficiency. I genuinely believe that META and Mark have learned a great deal from the experiences of the past 12 months, positioning the company for continued success. Examining the valuation, the stock is trading at a very reasonable 18x forward earnings.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

October marked a period of consolidation for me. The opportunities presented by the market this year led to my portfolio expanding to 24 positions, which is at the upper limit of what I can effectively track. Regular readers will be aware of my historically low turnover; I've only sold one stock in the past two years. What has facilitated this process and allowed for complete objectivity is the comparison of current companies to the initial thesis I laid out when I initially invested. For those who don't maintain an investing journal to track why they invested in a particular company, I strongly recommend setting one up.

At the moment, I perceive few risk-reward scenarios better than those offered by MELI and AMZN. This is the reason behind the heavy concentration of my portfolio in these particular names.

Finally, I'm currently holding 6% cash, as I haven't deployed the proceeds from JNJ, but I expect to put this capital to work over the coming month. While I have successfully consolidated down to 20 positions, I also don't rule out further portfolio consolidation. If I don't believe that a stock has the potential to outperform the market, then it has no place in my portfolio, given the 5% risk-free returns on cash available to investors.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com