Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

The best opportunities exist in uncertain times.

Apple once fell 83%. Amazon, 90%. Netflix, 74%. Even the greatest companies face brutal drawdowns.

Rebound Capital finds those moments, identifying high-quality businesses poised for a comeback. In just the last 3 months, they flagged:

ASML, now up 23%

Google, now up 52%

AMD, now up 19%

Wolf of Harcourt Street readers get an exclusive 20% discount on a Rebound Capital subscription, but only if you join in the next 24 hours.

Transactions

InPost (INPST)

I added to my position after the stock dropped 13% following its Q2 earnings report. I shared a full analysis below, but in summary: the company reported solid results. The market reacted negatively because INPST prioritised strategic investment for future dominance, primarily front-loaded integration costs from the Yodel acquisition, which came at the expense of near-term profit and resulted in weaker net earnings despite beating on revenue.

Since earnings, INPST has continued executing on UK expansion with two notable partnerships:

536 Aldi stores now feature INPST parcel lockers (with a target of 600+ by year-end).

UK Post Office trial: pick-up and drop-off lockers at hundreds of branches. If successful, INPST could tap into the full 15,000-branch network, a potential game changer for density.

Mercado Libre (MELI)

I added to my position after the stock sold off indiscriminately with all Argentinian ADRs following the Buenos Aires provincial election, where President Milei’s party was defeated. The national election is this month. Milei’s party is pro-capitalism, which can be viewed as a positive for MELI.

That said, he has been in power for 2 years, while MELI has been around for 25. Political shifts that may harm the entire market will hit sub-scale players more than MELI. If you listened to the recent climbers & scalers podcast with MELI’s founders, you know this company is built to thrive during adversity. You can read my key insights below.

Execution highlights this month:

Mercado Pago hits 1M POS terminals in Mexico (doubling since Sept 2024). Its network now rivals the entire traditional banking ecosystem (1.4M terminals), driving inclusion in a country where ~40% remain unbanked.

Launched Mercado Libre Negocios, a wholesale platform for entrepreneurs, companies, and governments to buy in bulk with ease, security, and better pricing.

Launched Dr. Virtual in Argentina, a new digital health service offering unlimited 24/7 tele-consultations and access to specialists like psychologists, nutritionists, and dermatologists, all from your phone.

Acquired Brazilian firm Nikos, allowing Pago to structure and distribute fixed-income securities, funds, and third-party products while growing AUM. This is its first acquisition in Brazil and marks a shift from its usual build-in-house approach.

Rubrik (RBRK)

I added to my position after the stock fell 20% following its Q2 FY26 earnings report. This is a new position I initiated in August, and the stock had already run up by a similar amount into earnings.

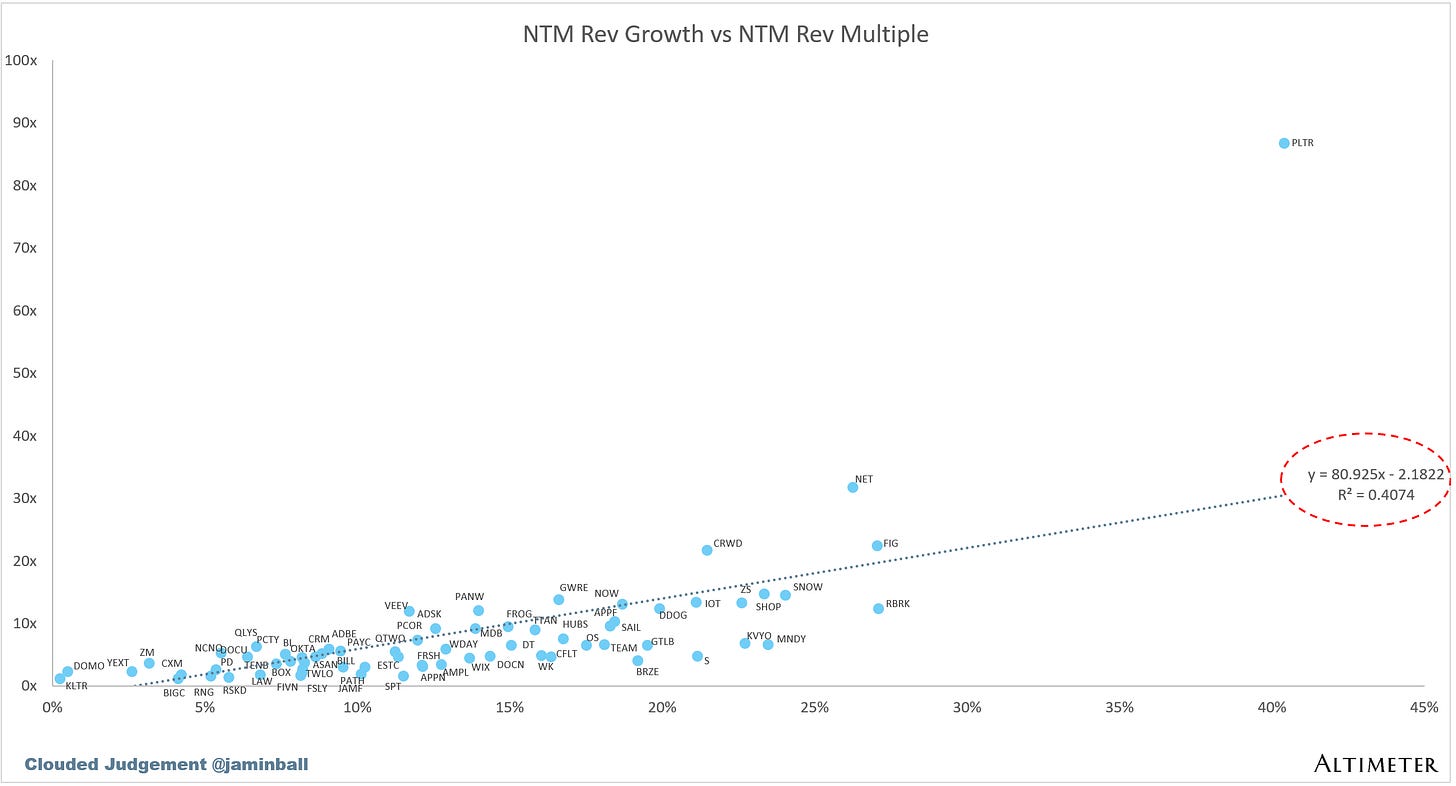

In summary, RBRK posted a fantastic quarter, beating guidance and raising full-year expectations. Despite accelerating overall revenue growth, the market focused on a minor deceleration in Subscription ARR. As I noted, the company shifted from half-yearly to annual sales comp plans at the start of FY26. This means Q2 and Q3 should now look more alike, without the Q2 accelerator seen in prior years. Q4, however, is projected to be seasonally strong, which I believe the market overlooked.

Another observation: RBRK’s valuation reset sharply in one month. When I shared my initial pitch at $83, an inverse DCF implied a 37% growth rate. With revenue growth, four consecutive quarters of positive FCF, and the stock now at $74, the implied growth rate dropped to just 27%. That’s a much more reasonable expectation given revenue growth and margin expansion ahead. A company at an inflection point can make premium valuations look not so premium very quickly.

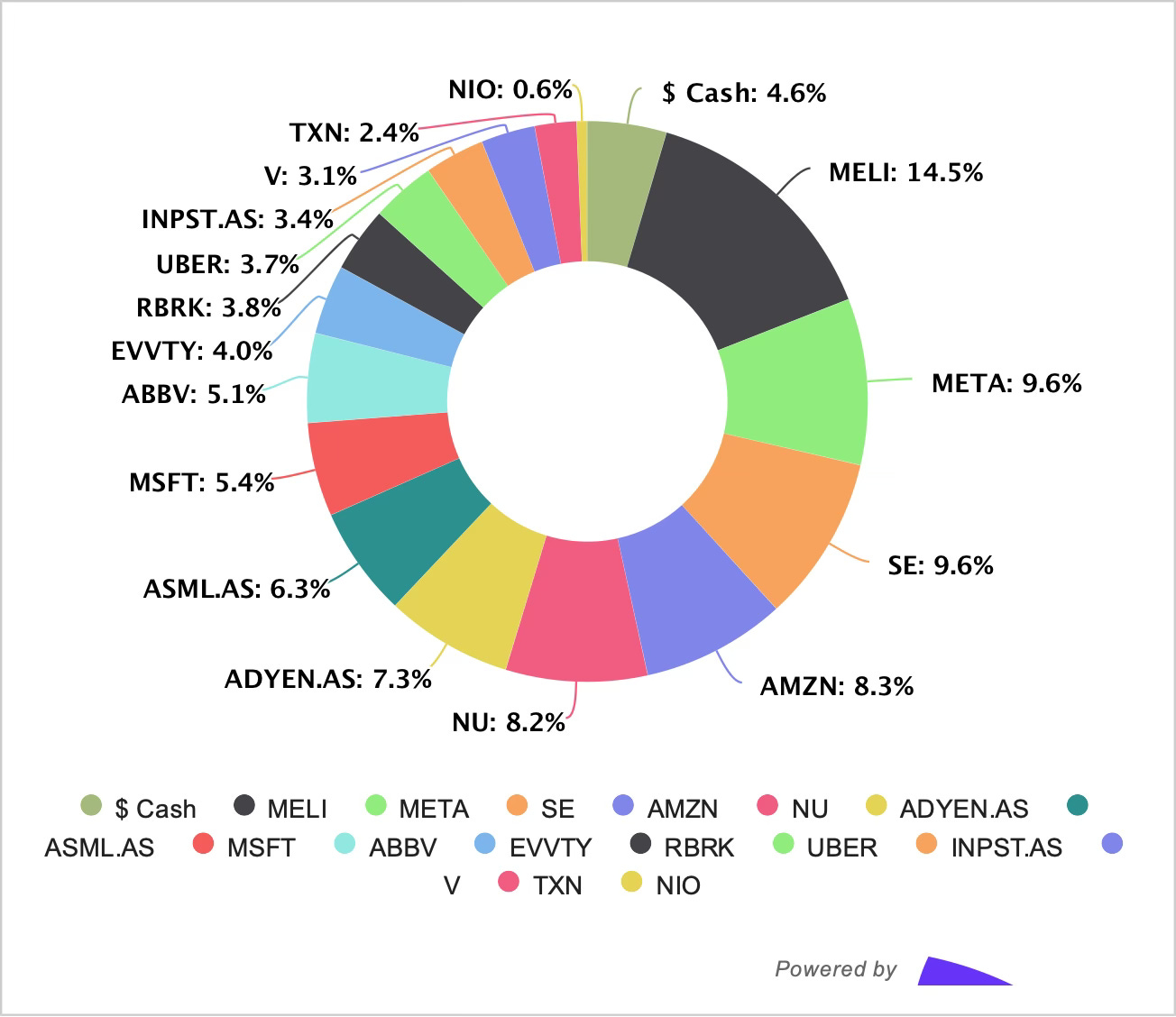

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

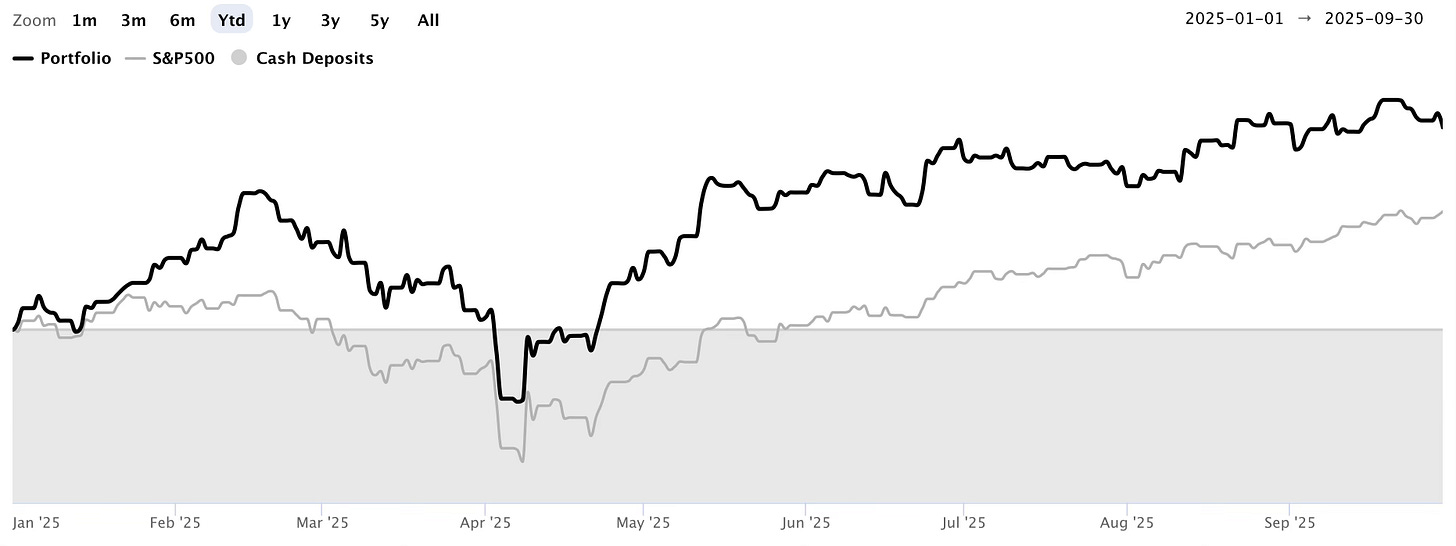

Performance

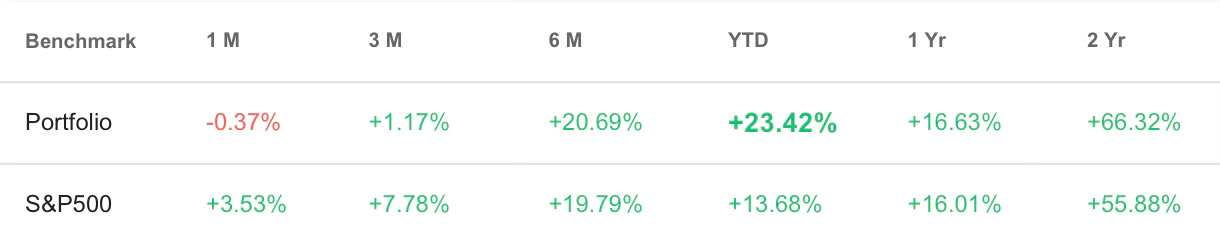

Q3: +1.2% vs. S&P +7.8%

YTD: +23.4% vs. S&P +13.7%

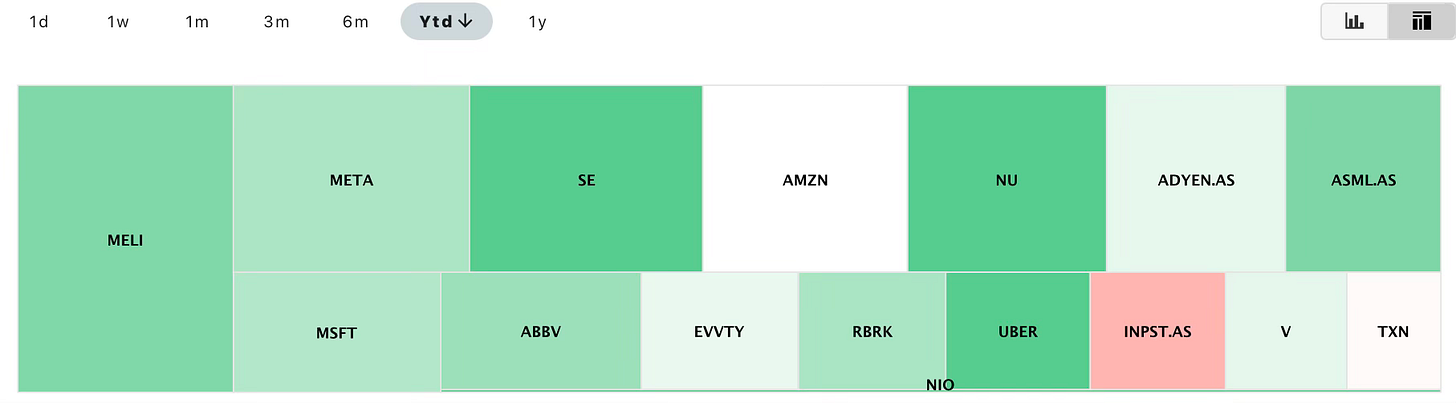

Top Contributors YTD:

NIO: +75%

SE: +68%

UBER: +62%

NU: +55%

MELI: +37%

Largest Detractors:

INPST: -28%

TXN: -2%

AMZN: 0%

Buy List

Rubrik (RBRK)

If RBRK remains below $80, I will continue to accumulate shares aggressively and build this into a substantial position faster than usual, given the cash position I am sitting on. While the stock is not cheap, I believe it is not as expensive as it might initially appear. It remains one of the most attractive high-growth software businesses on the market today.

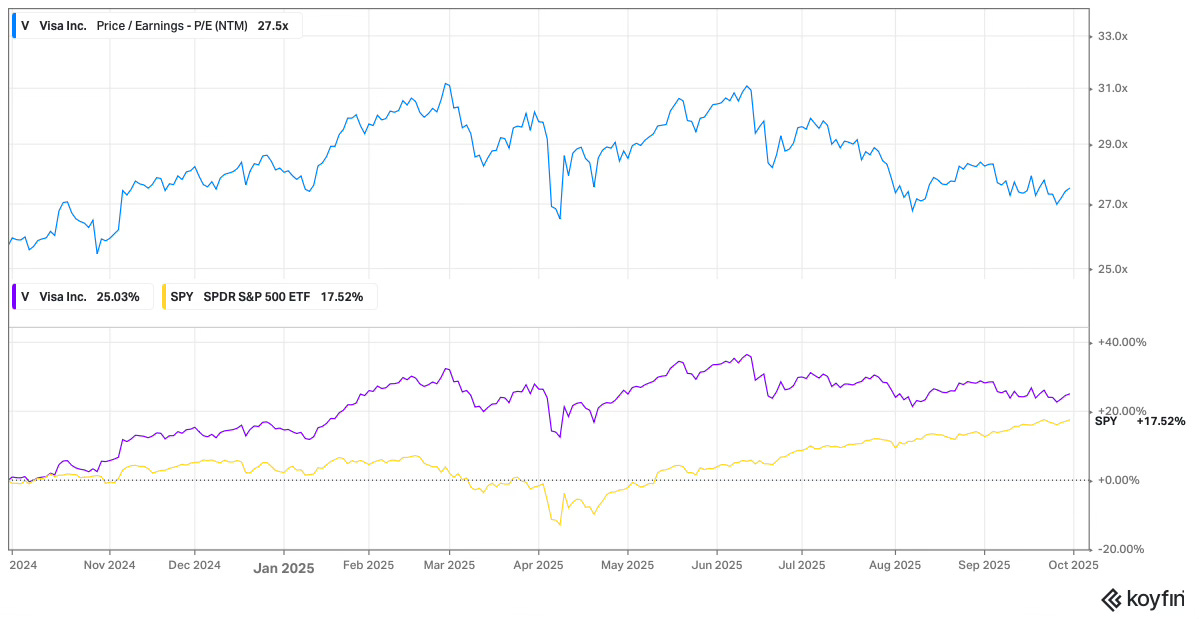

Visa (V)

I built my initial position in Visa about a year ago at 25x forward earnings. The stock was in a mini drawdown at the time following news that the U.S. Justice Department alleged Visa illegally monopolised the U.S. debit card market. These types of lawsuits happen periodically, and if any company is built to handle an antitrust inquiry, it is Visa.

The investment has worked out well, beating the market by a decent margin. With the stock now trading at 27x forward earnings and holding just a 3% weight in my portfolio, it might be time to add more shares in what I view as a very low-risk investment.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

This has been another strong quarter, and year so far, for the portfolio. I am very satisfied with the results. I have consistently beaten the market over several years, but what I am most proud of is achieving this with what I consider a moderate-risk portfolio

As we know, anyone can outperform in a bull market by simply loading up on high-beta, high-risk names. My outperformance has been achieved by sticking to a consistent strategy and avoiding hype-driven stocks that often overlook downside risks. Some of the best-performing stocks of the year so far, SE, UBER, NU, and MELI, were companies I highlighted at the end of 2024. These businesses all share one important trait: they are platform businesses with structural advantages, which is a cornerstone of My Investment Philosophy. They are profitable, growing faster than the market, and continue to benefit from operating leverage.

Despite this outperformance, I remain cautiously optimistic about the future. I am holding a 4.6% cash position and plan to increase it over the next month or two, while reducing my total holdings to 15 (from the current 16) to align with my maximum target allocation.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Looks like Meli has been dropping again this week. Can’t see any specific news… perhaps another buying opportunity?

That is a very solid portfolio. Lately I am following MELI closer and the valuation seems very attractive.