I achieved a return of 34.3% in 2023 compared to 24.1% for the S&P over the same period. A detailed review of the current portfolio holdings and 2023 performance can be found at Portfolio Review - December 2023.

The portfolio performed quite well in 2023 on an absolute and relative basis. After the drawdown experienced in 2022 following the Covid bubble of 2020 and 2021, it was satisfying to see the portfolio rebound in 2023 and reach a new all-time high value.

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Since inception, I have achieved a compounded annual growth rate (CAGR) of 12%. While I find this return satisfying, I believe there is potential for further improvement over the long term, thanks to the knowledge and insights gained over the years. My perspective is that by minimizing mistakes, we can ultimately achieve greater returns. To accomplish this, we need to extract the learnings, which I will cover later in this report.

Investment Strategy

My overarching investment strategy guides all decisions. At a very high level, I invest in a combination of growth and value stocks that I believe have the potential to beat the market over the long term. Broadly speaking, I aim to allocate 60% to growth and 40% to value. While the overall strategy has not changed, I have refined the strategy in two areas in 2023:

1. Growth at a Reasonable Price (GARP) over Growth at Any Price (GAAP)

I find myself gravitating towards GARP over GAAP going forward. In previous years, I invested in companies such as DocuSign (DOCU) and Fiverr (FVRR), which at the time were widely expensive. When growth slowed, they were adversely affected. This year, I favoured new growth stocks such as Adyen (ADYEN.AS) and Evolution (EVO.ST), which I believe can achieve +20% growth at much more reasonable valuations. The investing universe is vast, and there is no need to chase opportunities. The market will always present new ones.

2. Value Not Just for Value’s Sake

I realised that I was holding Johnson & Johnson (JNJ) purely because it was a value stock and a very reliable business. However, I had been forgetting the key principle that guides my entire investment strategy: the potential to beat the market over the long term. As I discussed when selling Johnson & Johnson in October, the stock had not beaten the market over the past 10 years, and with growth slowing, I do not believe that it will do so over the next 10 years. If a stock cannot beat the market, then what is its purpose in my portfolio? I do not invest for dividends, and I am certainly not in pursuit of below-market returns. One of the key questions I remind myself when analyzing a new stock is whether I believe it can beat the market over the long term.

Portfolio Turnover

I started 2023 with 20 positions and ended the year with 18. This was achieved by initiating 6 new positions and closing 8 existing ones. The turnover for 2023 exceeded my long-term strategy, but there are a couple of reasons for this. Firstly, as long-term subscribers are aware, I took a career break to travel the world in 2022, placing the portfolio on autopilot and resulting in very low turnover. The average turnover for the combined years of 2022 and 2023 is significantly lower than that of 2021. Secondly, following the market decline in 2022, numerous attractive opportunities emerged, to which I eagerly responded, most notably with Adyen.

Contributors and Detractors

The best performing stock in the portfolio was Meta (META) which returned +194% followed by MercadoLibre (MELI) +86% and Amazon (AMZN) +81%. Shopify (SHOP) and Cloudflare (NET) returned 124% and 84% respectively, which is part of the reason I sold both in December in order to harvest gains as part of my tax loss harvesting strategy. Meta, MercadoLibre and Amazon are all top five positions and this weighting greatly contributed to my portfolio outperformance in 2023.

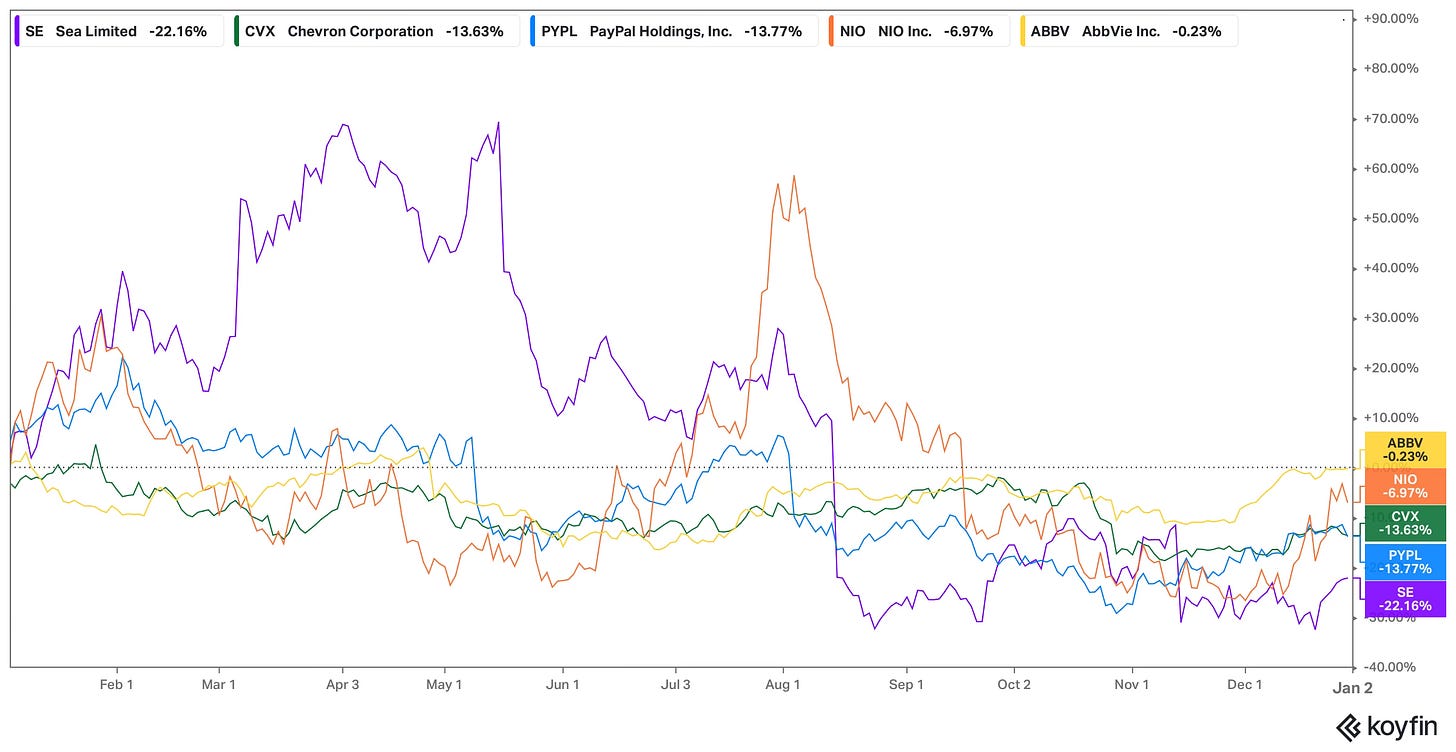

The worst performing stock in the portfolio was Sea Limited (SE) which returned -22% followed by PayPal (PYPL) -14% and Chevron (CVX) -14%.

Dividends Received

While I do not invest for dividends and instead focus on total return, I find it an interesting metric to track, especially given the tax obligation. Dividends received in 2023 increased by 76% year-over-year, compared to an increase of 138% in 2022. As the portfolio continues to increase in value, I expect the growth in dividends received to continue to decrease as the law of large numbers kicks in.

The majority of the increase in dividends received was a result of cash deposits. In addition, Microsoft hiked its dividend by 10% during the year. The remaining dividend hikes were in the 4% to 5% range. I pool together the dividends received with cash contributions and reinvest opportunistically.

Fees

The amount of fees you pay when investing can have a big impact on portfolio returns over the long-term. The investor bulletin How Fees and Expenses Affect Your Investment Portfolio published by the SEC really helps to understand this impact.

I focus on fees as a percentage of new deposits because I believe it's the best reflection of costs, regardless of portfolio size. To calculate, add up all fees incurred during the year and divide by total cash deposits, easily obtained from your brokerage account.

In 2023, the fees as a percentage of new deposits more than doubled from 0.34% to 0.84%. This means that for every €1,000 I invested, I paid fees of €8.40 in 2023 compared to €3.40 in 2022. You can see that in 2021 and 2022, the ratio was pretty consistent.

The increase in fees was a result of DEGIRO hiking their commission & handling fees in May by 400% from €0.50 to €2.00. This is in addition to their currency conversion fee. To avoid paying such high fees, I decided to open an account with Trade Republic who have a much lower fee structure of just €1 per trade. In addition, Trade Republic also offer 4% deposit interest on uninvested cash, paid monthly.

Updates to fee structures is something that I will continue to monitor closely in 2024.

Newsletter Performance

It is fair to say that 2023 has been a breakout year for newsletter growth. After pausing the newsletter for most of 2022 while I was travelling, I returned to writing in 2023 reenergised and with some new ideas. I am delighted to reveal that newsletter subscribers grew by 103% in 2023, reaching 3,710, which means that half of you have subscribed in the past twelve months.

The newsletter, incepted on 4 November 2020, is now over 3 years old and has evolved into a truly global community with subscribers from 107 countries and counting.

I believe that a big part of the growth in 2023 is due to the focus on content quality. As I discussed in Cheers to Three Years, spending months, as opposed to weeks, on researching deep-dive subjects has resulted in more comprehensive and detailed material. In contrast to previous years, where the goal was to produce one deep-dive each month, 2023 saw the publication of five such reports.

The shift from rushing to meet self-imposed deadlines has been replaced by a commitment to delivering well-measured and thoroughly considered updates. Heading into 2024, subscribers can expect deep dives when the time is right and not at a fixed cadence. This ensures that content is both insightful and well thought out.

The most popular posts in 2023 were:

Adyen N.V Investment Thesis - 11.2k views

Evolution AB Investment Thesis - 10.2k views

Datadog, Inc. Investment Thesis - 5.2k views

MercadoLibre, Inc. Investment Thesis - 4.8k views

Auto Partner: A Boring Business with Brilliant Results - 4.7k views

Lessons Learned

1. Blind Dollar-Cost Averaging is Suboptimal

The benefits of dollar-cost averaging are often discussed. While I personally practice dollar-cost averaging into my portfolio each month, I don't believe in blindly applying this strategy to a specific stock. Let me explain why. Suppose you decide to buy stock X over five months. You make your first purchase in month one, and in month two, the stock increases by 50%, prompting another purchase. By month five, it has doubled from your initial buy. Suddenly, you've acquired stock X at 20 times its sales just because you committed to doing so. Now, there's a high likelihood that stock X will pull back because the valuation is stretched. Unfortunately, since you've exhausted your allocation, you won't be able to capitalize on this opportunity. Meanwhile, stock Y on your watchlist might have fallen 50% in month five, but due to blindly dollar-cost averaging into stock X, you missed the chance to capitalize on this opportunity.

This may seem like an oversimplified scenario, but consider Adyen as a perfect example. In August, it traded at €1,557, and after a crash, it fell as low as €630 in October. There was a two-month window to accumulate shares before the stock doubled from its lows in November and December. If you had been blindly dollar-cost averaging, you would have missed this opportunity.

I do believe blind dollar-cost averaging has its place, especially when buying index funds. However, I would be very cautious about applying this strategy to individual stocks. When I add new cash contributions to my investment portfolio each month, I strive to find the best opportunity for that cash at that particular moment in time.

2. Find Good Businesses with Low Expectations

In November 2022, Meta stock was on the floor, and expectations were at an all-time low. The consensus at this time was that the stock was going even lower. Facebook is dead; nobody uses Facebook, etc. At that time, you could have purchased the stock for just 12 times forward earnings—12! Fast forward one year, and the stock price has almost tripled.

Finding good businesses is the first part of the equation and probably the most subjective. For me, a 'good' business is one that earns high returns on invested capital. My approach is to build a watchlist of good businesses that I would like to own, regardless of the valuation at the time. This is a continuous process of turning over as many rocks as possible.

Low expectations then help reduce risk, as the market does not expect much from the business in the future or is worried about current earnings or free cash flow sharply declining. When this happens, the valuation multiple compresses. Adyen is an example of this. I had my homework done on the business and had it on my watchlist in advance of the sell-off. Then, when the stock crashed, I was able to aggressively accumulate shares during the beaten-down period. If the business can exceed these low expectations or generate results that are less bad than expected, the stock price is likely to increase, as was the case with Adyen.

3. Collaborating Improves Quality and Results

I have been active on Twitter for many years and have interacted with a huge number of people during this time, which has had a very positive impact on my own knowledge. This year, I took it a step further by seeking out knowledgeable individuals to discuss and challenge my investment theses as part of the research process. I believe that this has had an exponential impact on both the quality and results of the work. As a one-man band, it can be difficult to escape from the echo chamber when performing due diligence and research. I would like to give special mention to the following individuals who were kind enough to give me some of their time as part of my research in 2023:

Fede Sandler - MercadoLibre Investment Thesis

- - Datadog Investment Thesis

Luke Hallard - Adyen Investment Thesis

- - Evolution Investment Thesis

4. Mistakes Only Become Apparent Over Time

We all make mistakes, even the greatest investors. One challenge we must grapple with is that while some investing mistakes become obvious very quickly, the majority can take years to surface.

Some of the mistakes I discovered in 2023 resulted from actions taken in 2020 and 2021. I'll use DocuSign and Fiverr as examples—positions I sold in 2023 for a loss. When I initially purchased both, expectations were sky-high, benefiting from Covid lockdowns and the shift to remote work. However, based on the valuations at the time, I ended up paying for growth at any price rather than growth at a reasonable price. Fast forward a couple of years, and I've learned that Adobe Sign’s distribution network surpasses DocuSign's, and the emergence of Artificial Intelligence would completely disrupt Fiverr's business model.

Investing in businesses with high expectations but lacking substance is a recipe for disaster. The focus should be on finding good businesses first, as this can filter out the first layer of potential mistakes. Some new positions I initiated this year could well prove to be mistakes in 2026 and beyond. Time will tell.

Goals for 2024

One area that I may have overlooked in recent years is goal setting. Now that I'm back in a regular routine, I believe it's crucial to establish goals for 2024. After listening to Gary Fox on The Entrepreneur Experiment, I was inspired to embark on a planning cycle for the upcoming year. I highly recommend checking out his podcast and newsletter, where he outlines a step-by-step 2024 Masterplan Guide. Gary advocates for goals in the areas of Body, Business, and Brain. In this section, I'll be sharing goals related to the newsletter and portfolio.

1. Grow Community to 6,000 Subscribers

The newsletter achieved significant growth in 2023, and I believe that 2024 presents an opportunity to further compound this momentum. I have set a goal of reaching 6,000 subscribers by the end of 2024. In 2023, we welcomed 1,884 new subscribers to the community, aiming to welcome 2,290 new subscribers in 2024.

You can play your part in helping me achieve this goal by sharing the newsletter with family, friends, or work colleagues.

2. Secure a Permanent Newsletter Sponsor

My intention has always been to keep this newsletter free, and there are a couple of reasons for this. Firstly, going behind a paywall will severely restrict the growth of the newsletter. I've seen this happen with other newsletters that went behind a paywall and died a slow death. Secondly, charging for the newsletter would create an expectation of content at fixed intervals. As mentioned earlier, I'm looking to move away from this mindset and instead share content when the time is right to maintain quality standards.

That being said, there are quite a few costs involved in running the newsletter, ranging from website domain and hosting to research and analytics tools, and market research subscriptions. To support the newsletter, I believe that securing a permanent sponsor is the best route to take. If you are interested in sponsoring the newsletter or know somebody who might, please email wolfofharcourtstreet@gmail.com to express your interest.

3. Hit a Portfolio Value of €XXX

I have set a specific portfolio value that I aim to achieve by the end of 2024. While I cannot control how the market will perform during that time, I can manage the amount of cash I contribute to the portfolio each month. Establishing a portfolio value goal not only ensures my commitment to contributing monthly, regardless of market conditions, but also serves as motivation to continuously seek ideas that can outperform the market and contribute to an increased portfolio value.

I appreciate your continued support and look forward to the journey ahead. Here’s to a prosperous and profitable 2024.

Yours sincerely,

Wolf of Harcourt Street

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Excellent annual review! I hope you'll reach your goals in 2024 and thanks for your insights into Adyen last year.