Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

I added to my positions in Nubank (NU) and Mercado Libre (MELI) for similar reasons. As I noted in the December portfolio review, both companies sold off at the end of 2024 due to concerns about Brazil’s macroeconomic environment—primarily higher U.S. interest rates, a stronger USD, and tariff threats.

I view these as short-term headwinds rather than new challenges, as Latin America’s economic landscape has been volatile for decades. Regional fears create opportunities to accumulate shares in these companies, as the concerns are not company-specific. Any macroeconomic pressures affecting these two market leaders will likely impact their competition even more.

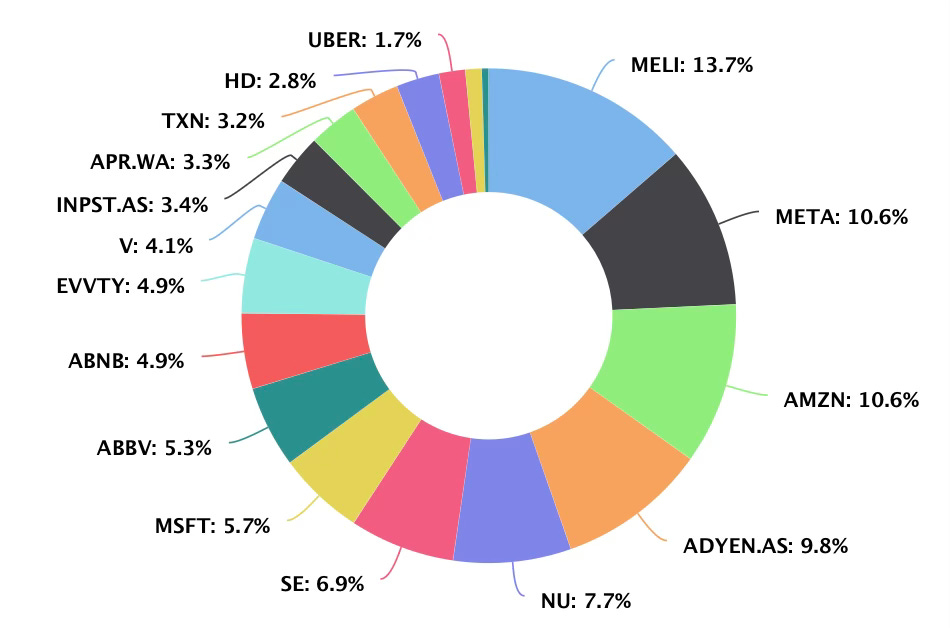

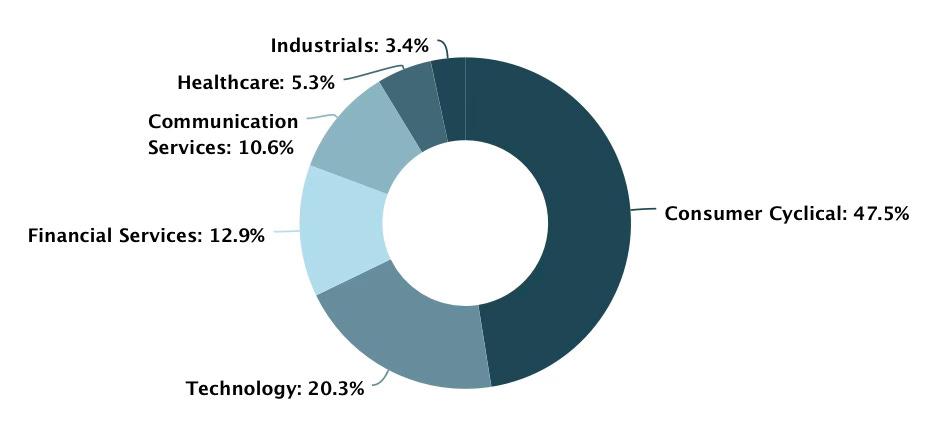

Allocation

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns. Sign up using my affiliate link here.

Buy List

Stocks on my radar to add this month:

Meta (META)

The recent launch of the DeepSeek Large Language Model (LLM) has reinforced my belief that LLMs are a commodity. As more models become available, prices decline, leading to a race to zero. The real value will be unlocked through how these models are integrated with data and workflows.

Meta is well-positioned to capitalize on this trend due to its massive repository of high-quality data. The company anticipated this shift early, making its model open-source, similar to DeepSeek. This move fosters a community-driven ecosystem, enhances compatibility with other tools, and prevents new players from gaining disproportionate control in AI.

Uber (UBER)

I initiated a starter position in Uber in December, and since then, the stock has already returned +11% YTD. While we invest with the expectation of price appreciation, this rapid rise meant I didn’t get the chance to accumulate more shares at a depressed valuation.

I still believe Uber is undervalued and plan to add another tranche to my position. My Uber Quick Pitch is linked below for those who may have missed it.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

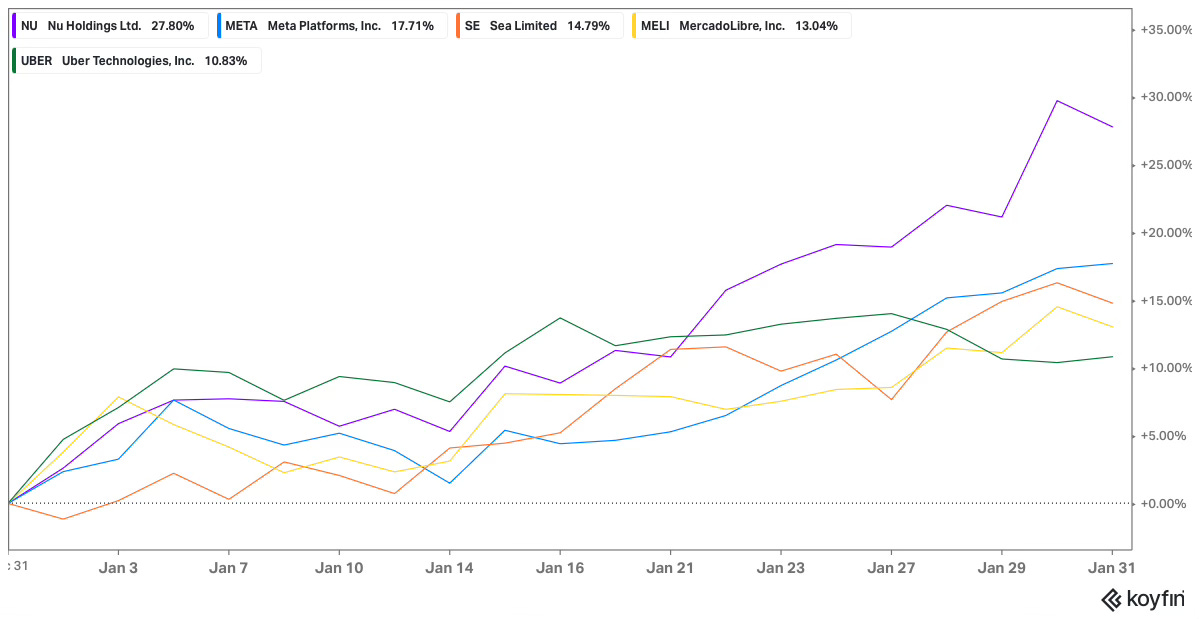

After a 5% correction in December, the portfolio has rebounded strongly at the start of 2025, reaching a new all-time high.

In my 2024 Annual Report, I noted that while general market commentary in 2024 painted a picture of overvaluation, my portfolio’s performance told a different story. One month into 2025, that theory is playing out, with five holdings already delivering double-digit returns.

This serves as a reminder of the classic Wall Street saying:

"The market can stay irrational longer than you can stay solvent."

In the short term, stocks can move for many reasons, but over time, stock prices track free cash flow per share. Sometimes, an investment thesis plays out quickly when a stock is massively oversold—like Adyen in 2023—but more often than not, time is required for returns to materialize, as long as the business fundamentals continue improving.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com