Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

I added to my position in the following:

Nubank (NU)

I continued to accumulate shares in NU at the start of June following very strong Q1 earnings. The potential I have been seeing in the company was soon noticed by the market, as the stock posted double-digit returns in June before hitting a new all-time high at the end of the month. Earlier this week, I shared a comprehensive NU deep dive that covers everything you need to know about the company. The full NU investment thesis is linked below for anyone who missed it.

Since I released this report, NU has published its seventh edition of Nubank Data, this time with the theme Financial Health and Well-Being: Access Beyond Credit. This report did not disappoint and revealed that nearly half of the people who got their first credit card with NU saved money. NU enabled 20.7 million Brazilians to get their first credit card between 2019 and 2023, and 43% of these new credit card users managed to save money over time. The NU value proposition for customers is extremely high.

Evolution (EVO)

Despite already having a rather large position in EVO, I added to this position given the very favourable valuation of just 17 times forward earnings.

I have received quite a few messages from subscribers asking why the stock has been under pressure for the past several months. While I do not have a market crystal ball, I do have my own theory. In my opinion, the market weakness is due to a combination of the following factors:

Fx headwinds on revenue: Underlying revenue grew 24% in Q1 2024 but only 17% in reported terms.

Tax impact on earnings: The tax rate increased from 7% to 15% in 2024.

Unrest in Georgia: Over a third of EVO’s workforce is based there.

My view is that all of these factors present short-term headwinds but do not impact the long-term thesis.

I didn’t open any new positions during the month.

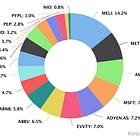

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They even have a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Performance

Q2: -0.6% vs S&P +4.2%

YTD: +11.2% vs +14.4% S&P

One feature that Portseido has recently added, which I really like, is the performance heat map.

The biggest contributors to the YTD portfolio performance have been:

SE: +76%

NU: +74%

META: +42%

The largest detractors to the performance have been:

NIO: -54%

EVO: -15%

APR: -14%

Buy List

Stocks that are on my radar to add this month:

PepsiCo (PEP) - PEP has been under pressure for almost a year now since the release of GLP-1 weight-loss drugs. I do not believe that PEP will be materially impacted by this development, and at 20 times forward earnings, it appears reasonably valued. PEP is a well-diversified business with a large snack segment, and while many services have to grapple with the risk of AI disruption, I don’t see soft drinks or snacks going anywhere.

Adyen (ADYEN) - Adyen was one of my biggest winners of 2023, but I have not added to this position since last October before the big run-up. After rising to over €1,500 in March, the stock has fallen by 29% in the past three months. In March, I shared a financial model and valuation update, linked below, which suggested that the stock was overvalued and had gotten ahead of itself. At the time of writing, the stock is now trading below my fair value of €1,198. The company continues to go from strength to strength, as demonstrated by the new partnerships being onboarded almost weekly. I am comfortable adding at this level.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

On the back of a 34% return for the portfolio in 2023, if you had told me at the start of 2024 that the portfolio would return another 11% by the end of Q2, I would have signed up without hesitation. Interestingly, having beaten the index in 2023, the portfolio is marginally behind the S&P at the midpoint of 2024, and there is one simple reason for this: Nvidia.

As you can see, Nvidia had contributed almost one-third of the total 2024 S&P returns by the end of May. This is a pretty astonishing achievement. The inexperienced investor in me would have sought to chase this opportunity at the top, ignoring the downside risk. Now, as a wily old dog, I can acknowledge that I missed the boat with this one but appreciate that there are plenty more opportunities out there. Trading at over 42 times forward earnings means that a lot is priced into the stock today. In my opinion, the time to buy was a couple of years ago when nobody wanted it, not today.

With a US election to come in November, I’m expecting the overall market to have a strong second half of the year. That being said, I do not let external factors outside of my control influence my decision-making. Stick to the plan.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Thanks for the heads up on Portseido, Fidelity's performance tracking and illustration is awful