Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

I added to my position in the following:

Auto Partner (APR.WA)

At the start of this month, the company reported preliminary February sales of PLN 334.9 million, representing an increase of 32.9% YoY. These are huge numbers, and I was not expecting anything near 30% growth. Despite the strong growth, APR traded as low as 12 times forward earnings, and I grabbed more shares at what I deem a very reasonable valuation.

Evolution (EVVTY)

Sometimes the market presents you with an opportunity, and that's what happened on Friday, 22nd March, when EVO shares fell 10% (look at that red candle!). Only a week earlier, I shared a financial model and valuation update which suggested that EVO was already trading 18% below its fair value. This analysis is linked below for anyone who missed it.

Initially, the view was that this was due to a pending short report from InPractice focusing on EVO’s Asia and Crypto risk. I didn’t believe anything new would be contained in this report, and this was confirmed when the report was released the following week. The share price duly rebounded by 7% over the next couple of days.

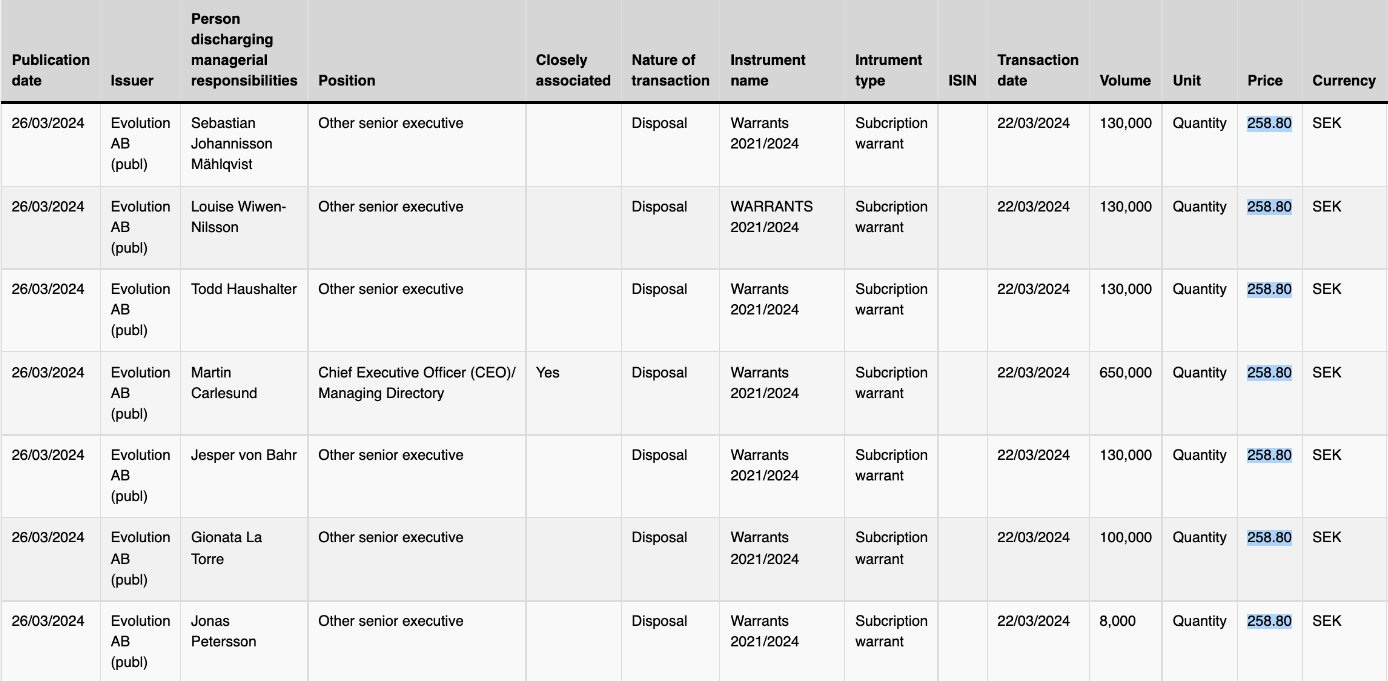

However, the real reason that the stock fell was because of the leadership team exercising the sale warrants that they received as part of the 2021/2024 incentive plan on March 22nd. Hat tip to Ali Gunduz for sharing the graphic below.

I didn’t open any new positions during the month.

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

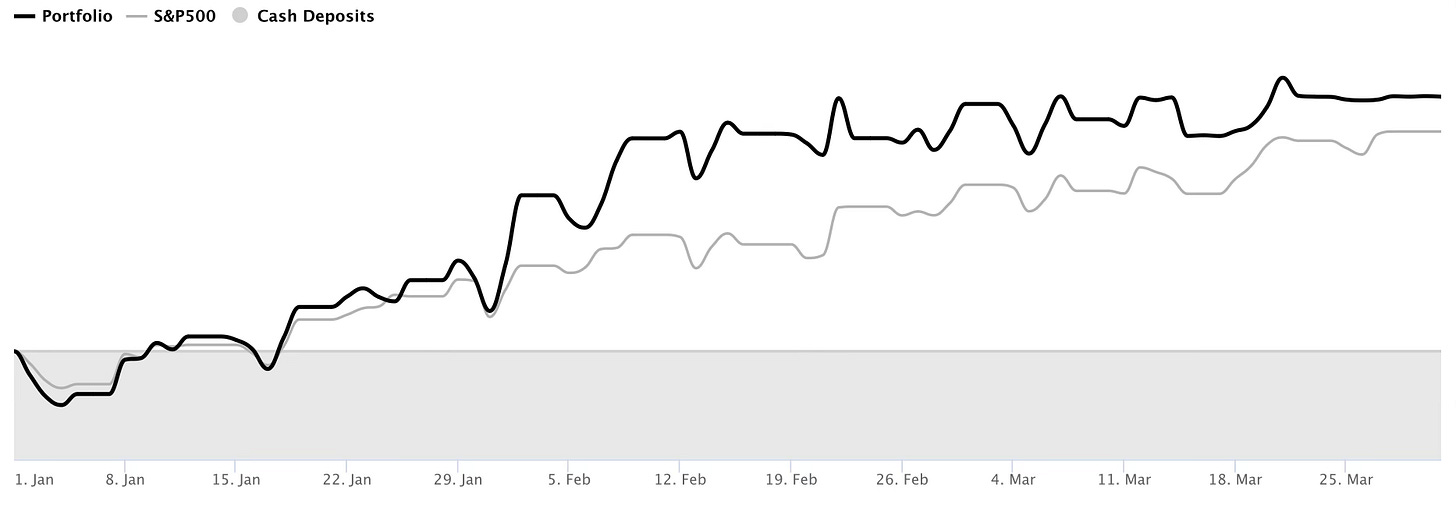

Performance

Q1: 11.8% vs S&P 10.2%

Broker

Trade Republic is the investment broker I use, with over 4 million users and €35 billion in assets across 17 European countries. The platform's combination of low fees (€1 per trade), accessibility, fractional share options, and regulatory backing makes it a reliable choice.

With Trade Republic, you can earn 4% interest on uninvested cash, paid monthly, and you can withdraw the cash at any time. This is one of the most competitive rates on the market for European investors.

Click here to sign up for a free Trade Republic account

Buy List

Stocks that are on my radar to add this month:

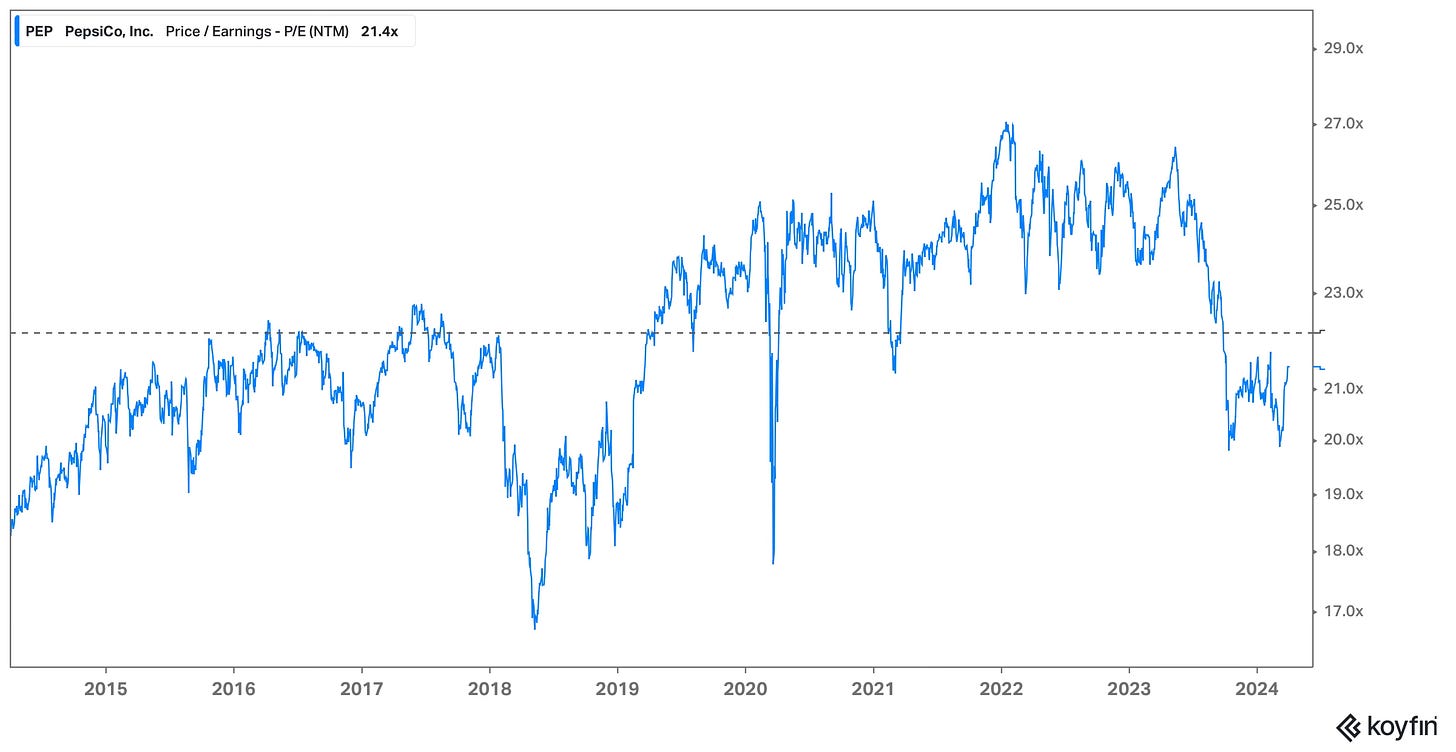

PepsiCo (PEP) - PEP is a relatively small position in my portfolio. I haven't been able to build it as quickly as I'd like due to extended valuation through most of 2022 and 2023. However, over the past 6 to 8 months, the stock has faced pressure due to concerns about weight loss drugs. While the real impact of these drugs is yet to be confirmed, I believe the effect on PEP, given its diversified business, may be overestimated.

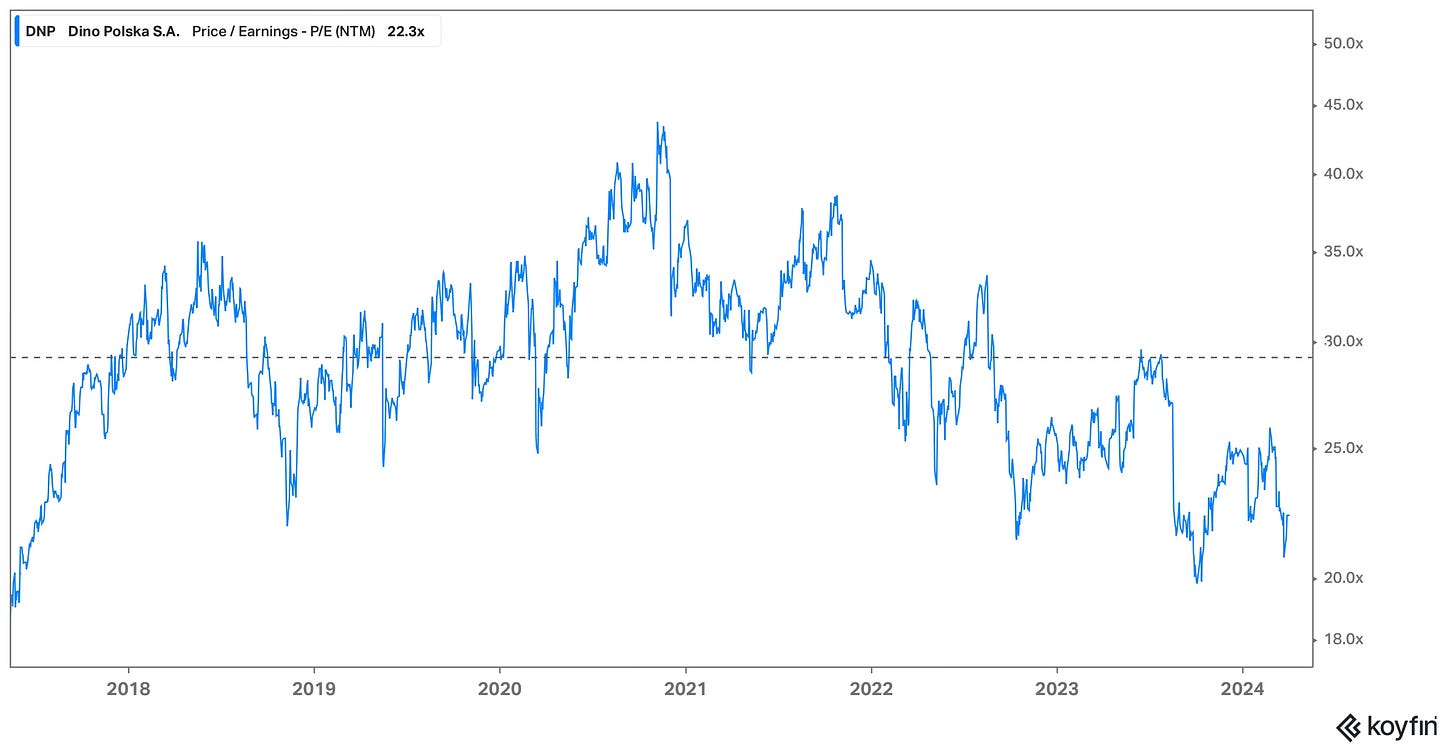

Dino Polska (DNP.WA) - Dino is not an existing holding but rather a name on my watchlist. The company recently released Q4 earnings, which were a little underwhelming. Revenue growth was below the market consensus and declined quarter-over-quarter. At the same time, the EBITDA margin continues to be under pressure and trended downwards. The stock duly sold off after reporting earnings, but when zooming out, the stock is starting to become more appealing from a valuation perspective. One quarter does not mean that the long-term thesis is in jeopardy, and this is why I believe this is a name worth monitoring.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

Q1 was a really strong quarter for the portfolio, even more noteworthy on the back of +34% returns in 2023. In fact, since November 2023, the portfolio has been hitting a new all-time high value every week. This is, of course, after a steep drawdown in 2022.

The outperformance in Q1 was driven mainly by Adyen (+34%) and Meta (+39%), which are my second and third-largest positions. Nu (+48%) was the best-performing stock during the quarter but is a much smaller position, as I only added it to the portfolio in January.

For the past number of months, I have continued to repeat that I believe there are a lot fewer obvious opportunities at the moment. I have been quite measured and selective with the capital that I have deployed during the quarter. While I do not believe sitting on cash or timing the market is an optimal long-term strategy, patiently waiting for opportunities rather than chasing gains is an undervalued skill.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Love the Meli position, big fan of the company.