Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Transactions

I added to my position in the following:

MercadoLibre (MELI)

MELI has been my largest holding for some time, having returned +86% in 2023. However, the stock has had a slow start to 2024, returning -14% year-to-date at one point in April compared to the strong returns of the overall market. At the start of April, I shared a revised financial model and valuation update indicating that the stock was undervalued with a significant margin of safety. Despite MELI's weight in my portfolio, it's hard to ignore the compelling opportunity that the market has presented. The full analysis is linked below for those who missed it.

I didn’t open any new positions during the month.

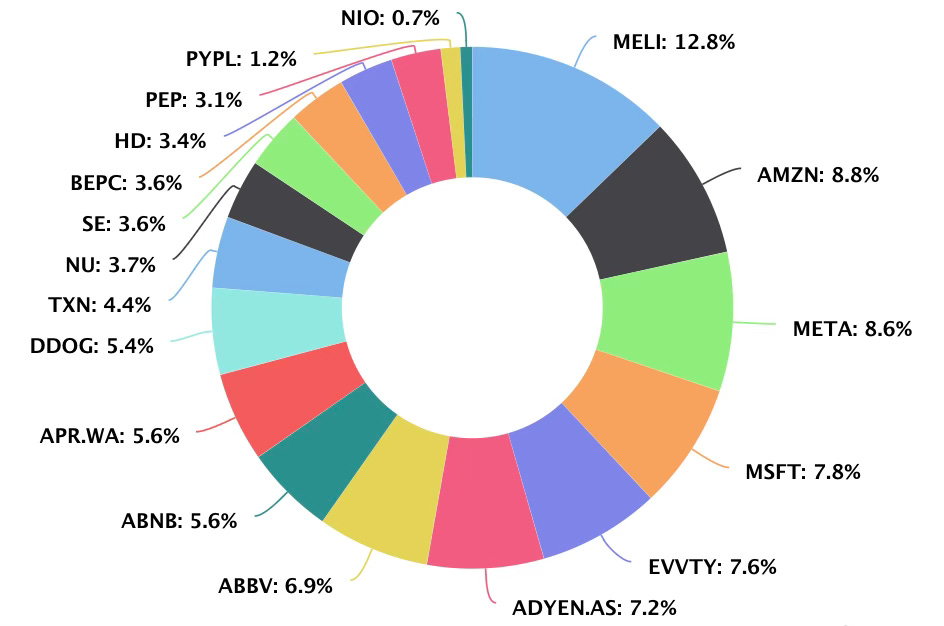

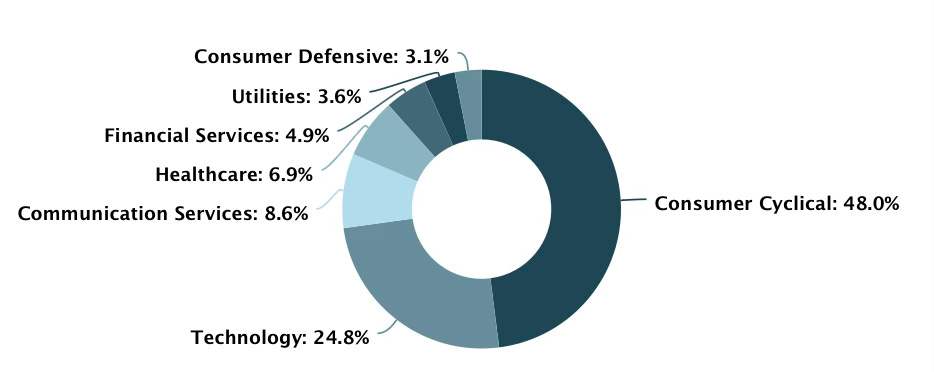

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They also added a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Broker

Trade Republic is the investment broker I use, with over 4 million users and €35 billion in assets across 17 European countries. The platform's combination of low fees (€1 per trade), accessibility, fractional share options, and regulatory backing makes it a reliable choice.

With Trade Republic, you can earn 4% interest on uninvested cash, paid monthly, and you can withdraw the cash at any time. This is one of the most competitive rates on the market for European investors.

Click here to sign up for a free Trade Republic account

Buy List

Stocks that are on my radar to add this month:

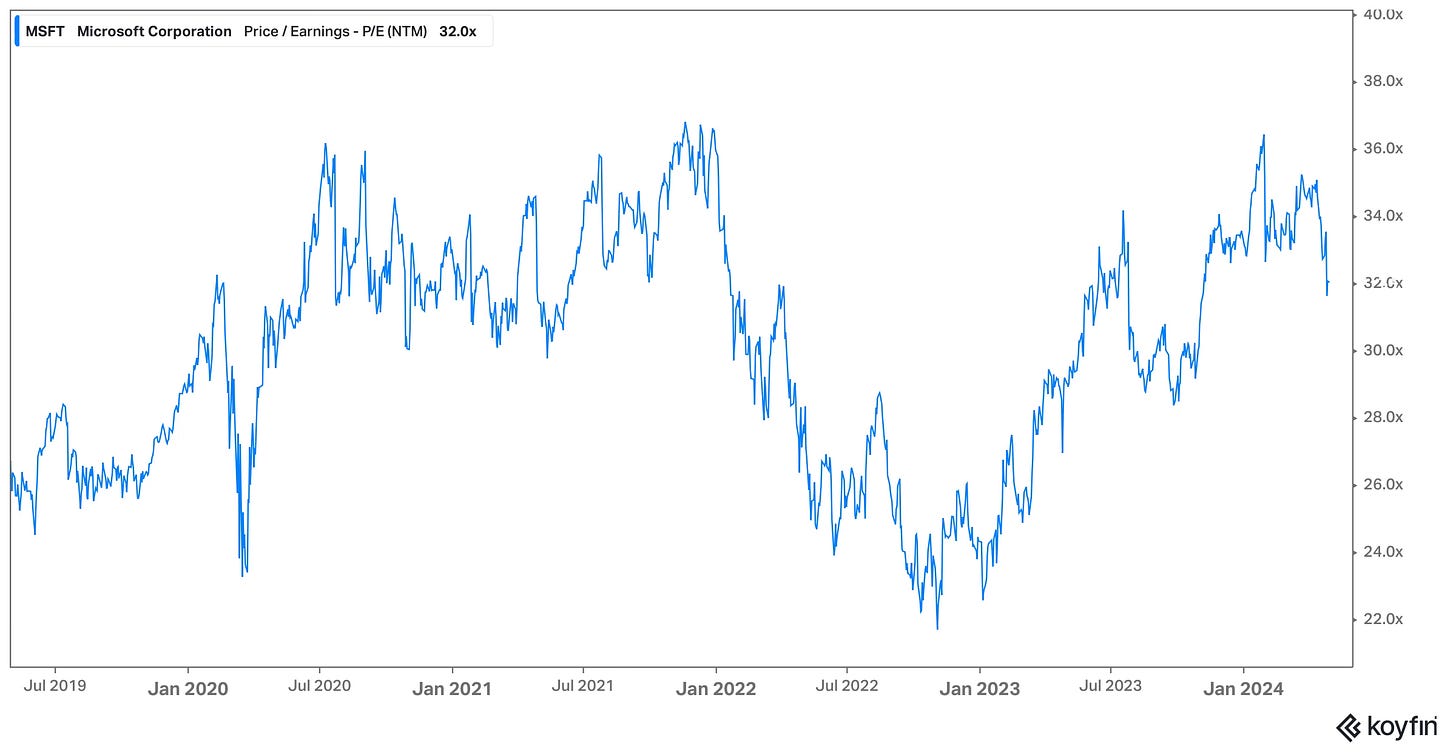

Microsoft (MSFT) - For the first time in my investing journey, my MSFT position is outside my desired weighting. It slipped to 6th place in March but returned to 4th in April due to the declines experienced by Adyen and Evolution. I have not added to my position in over two years because I was focused on other opportunities that I deemed more attractive at the time. Although the stock rarely appears cheap (except in 2022 when it traded at just 22 times forward earnings), it might be wise to begin gradually nibbling some shares to ensure the stock remains a core portfolio holding.

Nu Holdings (NU) - I added NU to the portfolio at the beginning of 2024, and it has had a very strong start to the year. However, I was not able to add as aggressively to the position as I would have liked because the forward earnings multiple expanded from 22 to almost 31 in March. After the recent pullback, the stock trades at 28 times earnings, which is not too expensive for a company expected to grow revenue by almost 40% in 2024.

Airbnb (ABNB) - ABNB presents a very interesting opportunity at the moment. Its long-term prospects remain strong; however, there are also significant short-term catalysts on the horizon. The Summer Olympics will take place in Paris this year, and it appears that analysts' estimates do not account for the potential increase in demand Airbnb could experience in the third quarter, alongside Euro 2024 in Germany a month earlier. Given the elevated hotel prices due to staff shortages, Airbnb may even gain market share during this period of heightened demand in Europe. Last month, I shared a financial model and valuation update suggesting that the stock was undervalued, excluding the impact of the above events. The full analysis is linked below for those who missed it.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

In April, more opportunities emerged as the overall market declined by as much as 5%. This was a welcome development because market expectations were beginning to exceed companies' underlying earnings potential.

Let's use Adyen as a prime example. Before its Q1 business update, I shared analysis indicating the stock was overvalued by as much as 18%. While Adyen remained the same quality company as last year, its valuation reflected this. More was priced into the stock than before. Despite providing a solid Q1 update, the stock dropped by 18%. Although nothing fundamentally changed with the underlying business—in fact, process volume and revenue grew by 46% and 21% respectively—market expectations had gotten ahead of themselves. As of this writing, Adyen now trades 6% below my fair value and could offer an attractive opportunity again if the trend continues. For anyone who missed it, the analysis is linked below.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com