In 2025, the portfolio delivered a return of 16%, marginally underperforming the S&P 500’s 17% return over the same period. A detailed breakdown of current holdings and performance can be found in Portfolio Review – December 2025.

Overall, I am satisfied with the result. Since the 2022 bear market, the portfolio has generated returns of 34%, 15%, and 16% over the past three years. Since inception, the portfolio has achieved a 16% compounded annual growth rate (CAGR), comfortably above my long-term target of 10%.

Portfolio Turnover

I started 2025 with 18 positions and ended the year with 15, achieving a long-standing goal of consolidating the portfolio. This was accomplished by closing five positions and initiating two new ones.

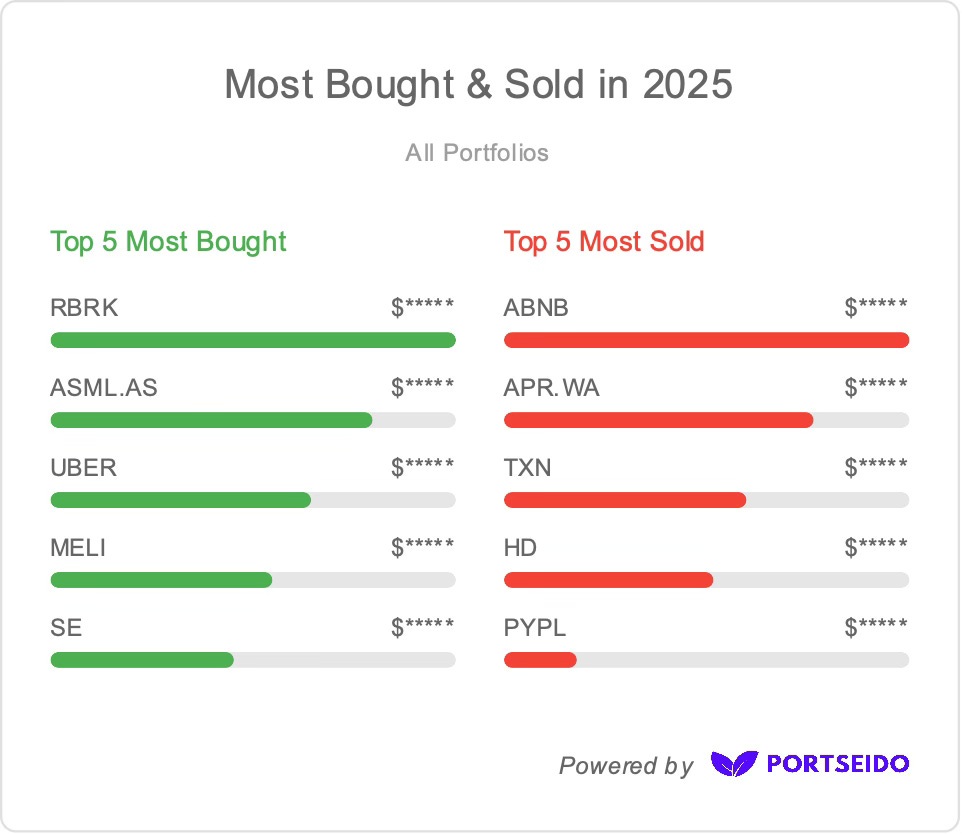

The new additions were Rubrik (RBRK) and ASML (ASML). I exited PayPal (PYPL), Airbnb (ABNB), Auto Partner (APR.WA), Home Depot (HD), and Texas Instruments (TXN). The rationale behind each transaction has been covered in prior monthly portfolio reviews, so I will not repeat it here.

The chart above is from Portseido’s new Year in Review feature. It highlights that my five most sold positions were the five I fully exited, while the most bought positions include the two new additions.

I’ve been using Portseido to track my portfolio for years, and I highly recommend it. It consolidates all my transactions in one place, while its data visualisation and analytics capabilities guide my future decision-making and, ultimately, enhance my returns.

Sign up using my affiliate link here.

Contributors and Detractors

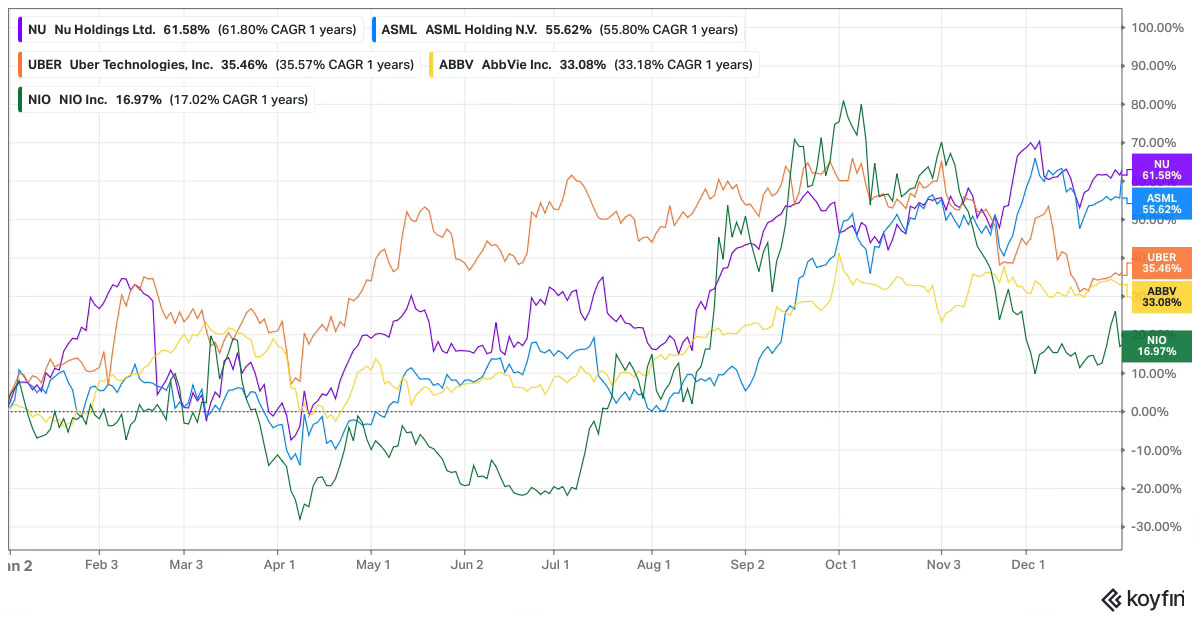

The top-performing stocks in 2025 were:

Nu (NU) +62%

ASML (ASML) +55%

Uber (UBER) +35%

AbbVie (ABBV) +33%

NIO (NIO) +17%

Notably, NIO was my worst-performing stock in 2024, down 52%, yet became a top contributor in 2025, albeit still well below its 2024 price. Meanwhile, NU, which was among the strongest performers in 2024, continued its momentum. Some winners kept winning, while certain beaten-down stocks proved to be somewhat oversold.

The worst-performing stock was InPost (INPST), down 37%, followed by Evolution (EVO), down 23%. All other holdings posted positive returns.

Evolution’s struggles extended into a second consecutive year. After being one of the weakest performers in 2024, it again disappointed in 2025. Put simply, shareholders have endured two years of deeply underwhelming performance.

Looking ahead to 2026, InPost appears best positioned for a turnaround. At the time of writing, the stock is already up 30% year to date. Unlike Evolution, InPost’s weakness in 2025 was driven more by narrative than by deterioration in the underlying business. The recent takeover approach caused the share price to surge, validating my view that its valuation made it an obvious target. My preference remains that any offer is rejected, as an acquisition would remove what I believe could be more than a decade of compounding returns for long-term shareholders.

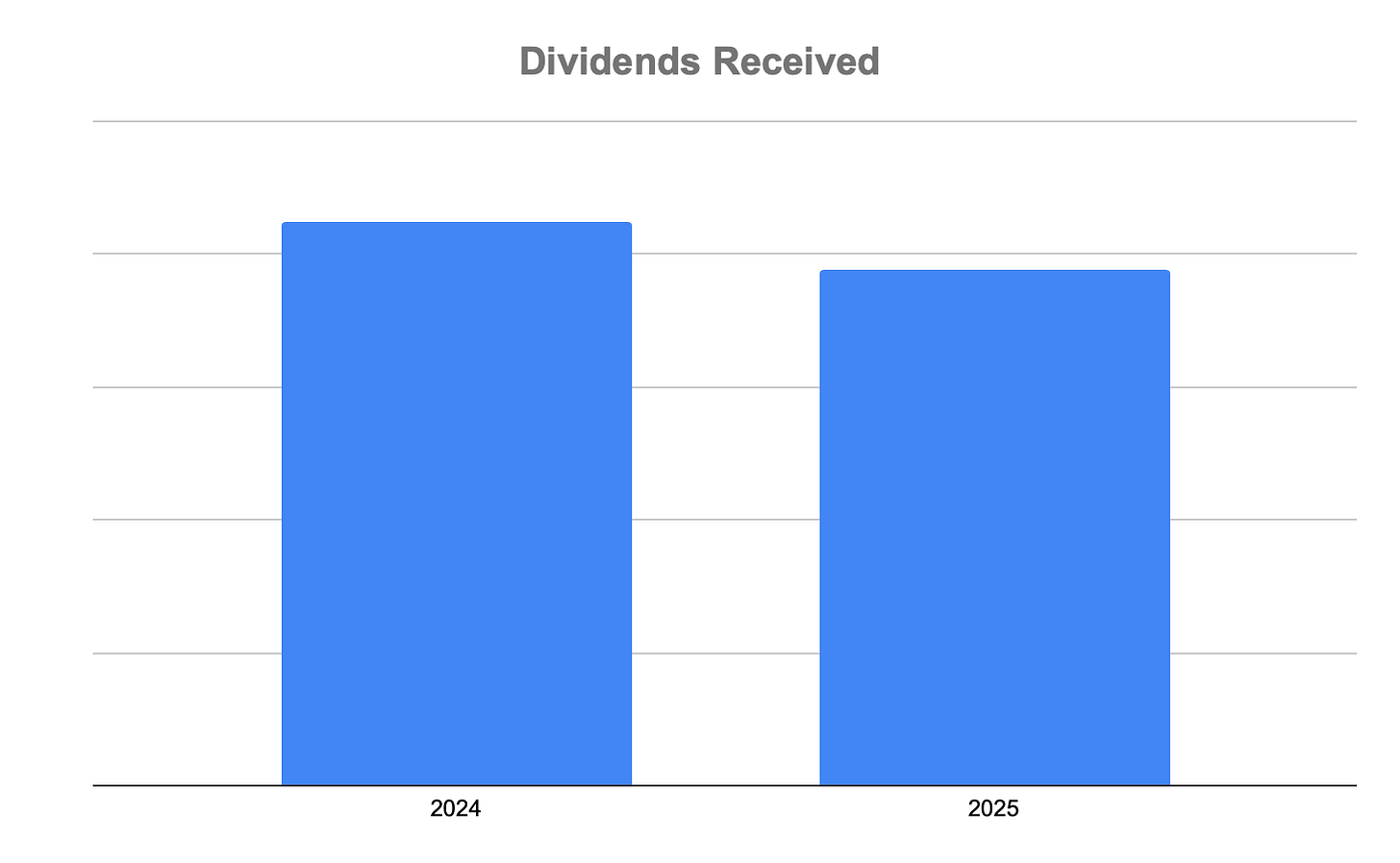

Dividends Received

Dividends received in 2025 declined 9% year over year, reflecting my continued focus on total return rather than dividend optimisation. Of the five positions sold in 2025, three were dividend payers with yields between 1% and 3%. These were not replaced, as Rubrik pays no dividend and ASML’s yield remains well below 1%.

This was partially offset by strong dividend increases from Visa (+14%), Microsoft (+10%), and AbbVie (+6%). Dividends are pooled with cash contributions and reinvested opportunistically.

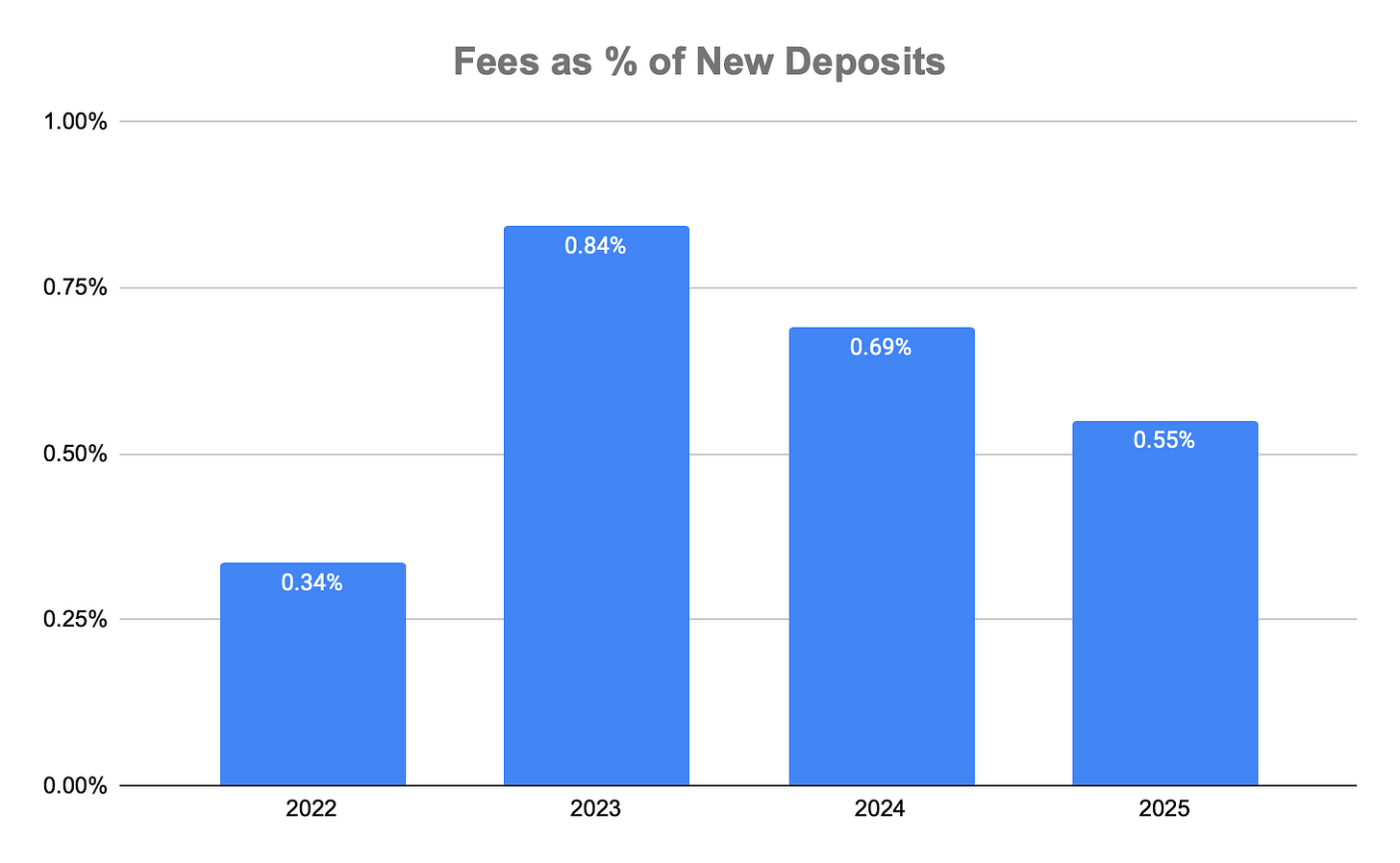

Fees

I track fees as a percentage of new deposits, as this best reflects the drag on compounding regardless of portfolio size. The calculation is straightforward, total annual fees divided by total cash deposits.

After a sharp increase in 2023 following DEGIRO’s fee hikes, I made a concerted effort to reduce this ratio. I subsequently opened Trade Republic and Interactive Brokers accounts, both of which offer significantly lower fee structures.

As a result, I am pleased to report that fees as a percentage of new deposits fell again in 2025 to 0.55%. Driving this figure as close to zero as possible remains a priority.

Newsletter Performance

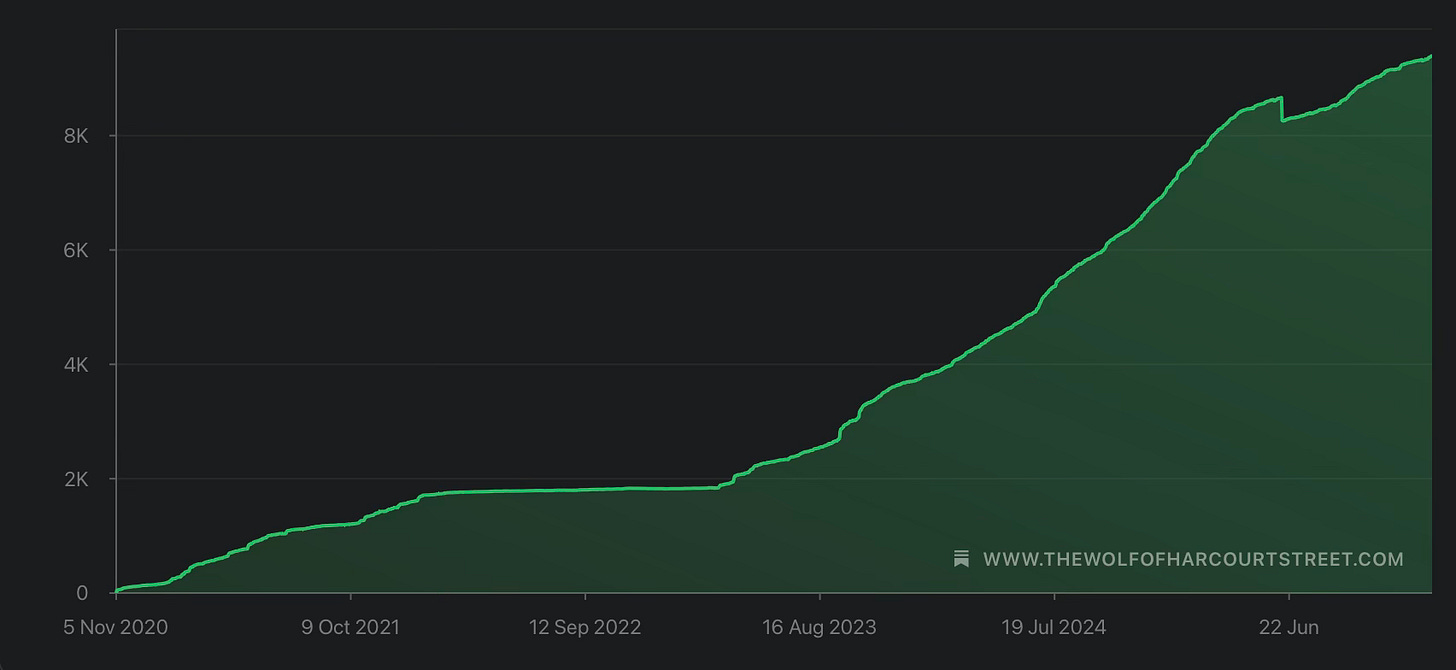

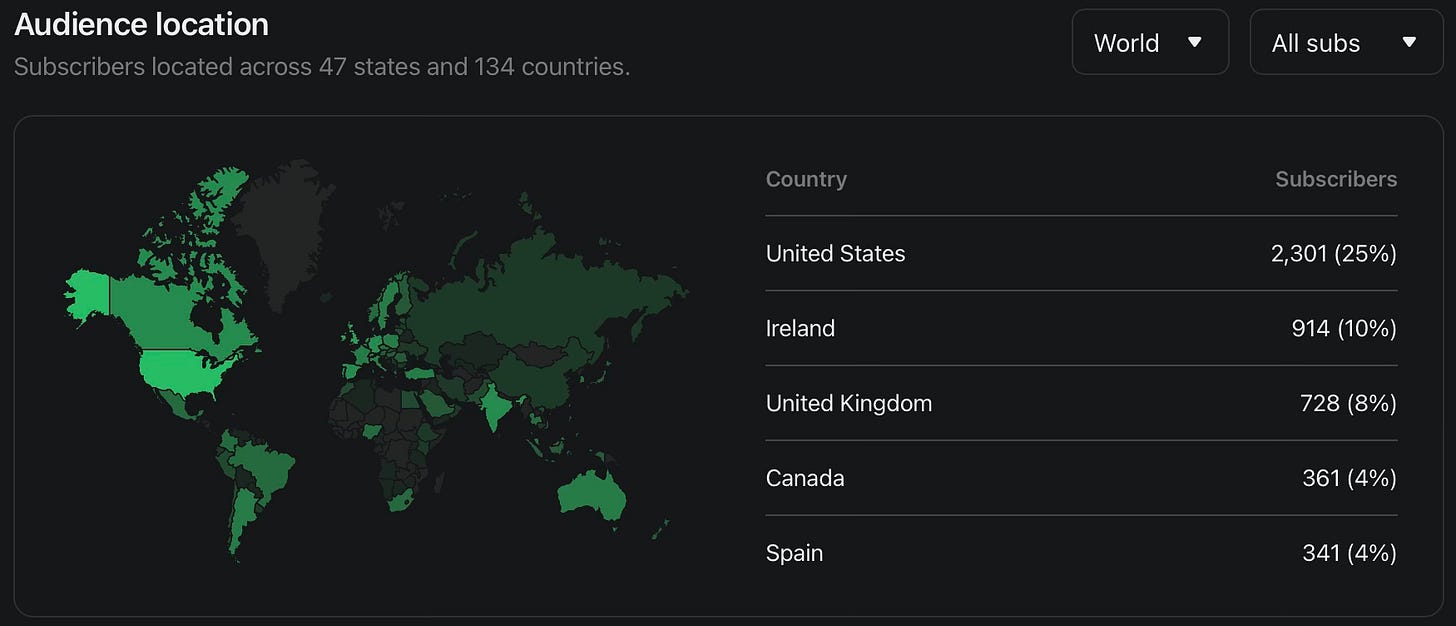

2025 was a solid year for the newsletter, with a net increase of 2,223 subscribers, bringing the total to 9,329. Growth would have been higher had I not conducted a clean-up in June, removing subscribers who had not opened an email or read on the app in the previous twelve months.

Total subscribers is a vanity metric. I would much rather have an engaged readership, so this clean-up will become a recurring exercise.

Growth was also slower than in 2024 due to reduced activity in Q4 while I took an extended travel break. While the newsletter prioritises quality over quantity, the data is clear, more frequent publishing drives faster subscriber growth.

The audience continues to become increasingly global, with subscribers now spanning 134 countries.

The most popular posts in 2025 were:

Rubrik Quick Pitch - 10.4k views

Shopee’s Dominance in Southeast Asia’s E-Commerce Market - 10.4k views

Portfolio Review - November 2025 - 10.4k views

Evolution: Trading Margin for Certainty - 10.3k views

NU: Hidden Pressures Under the Hood - 9.9k views

An underrated aspect of the archive is the longevity of evergreen content. The Nu Holdings Investment Thesis remains the most-read post of all time, with over 18k views.

Lessons Learned

1. Buy and Continuously Verify

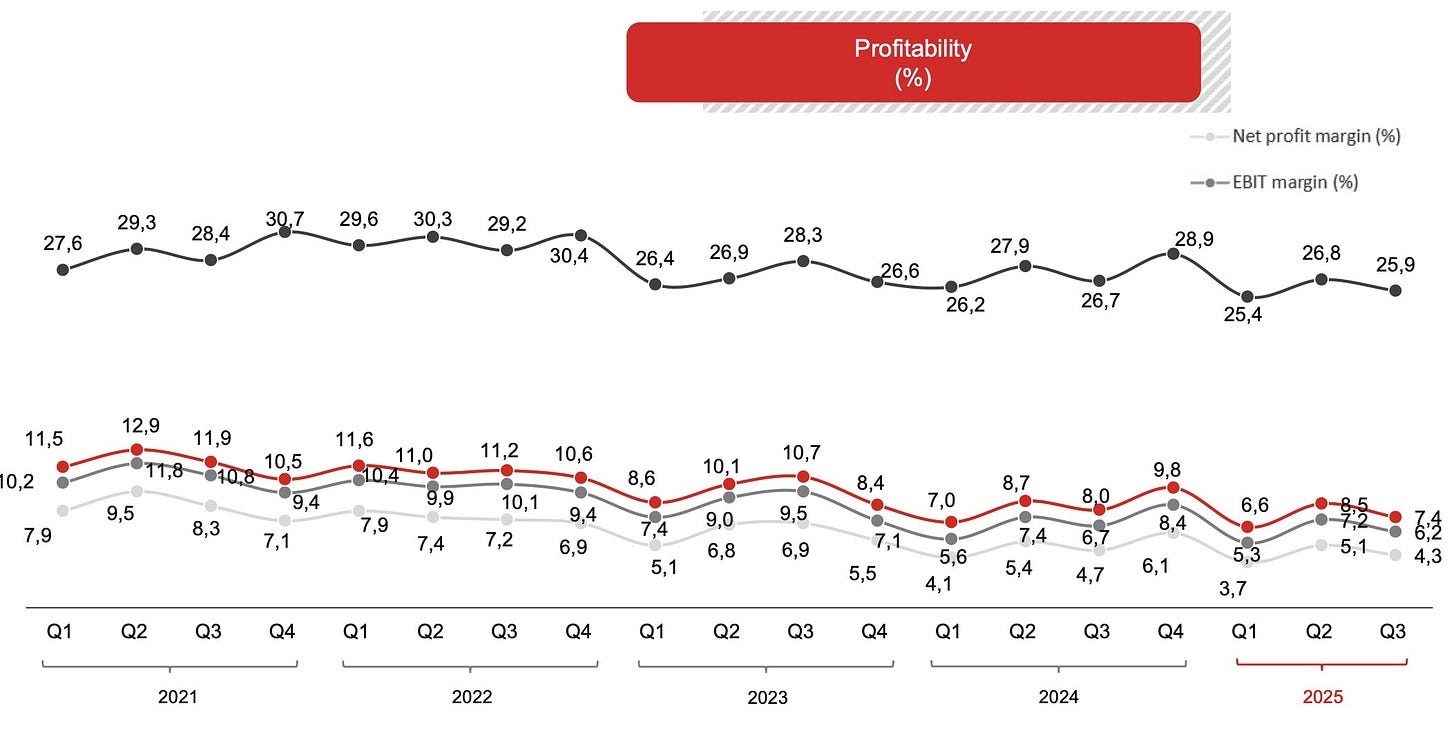

One of my better decisions in 2025 was exiting Auto Partner in July after reviewing its Q1 earnings. It became clear that the original thesis was no longer playing out due to:

Stagnating revenue growth

Gross margins reverting after a period of inflation-driven over-earning

Margin pressure from minimum wage increases

I concluded that these trends were likely to worsen before improving, and I could no longer say with confidence that the company would return to high-teens revenue growth or restore net margins to 2021 levels. Since the sale, margins have continued to deteriorate and the stock was down a further 25% at one point.

I would reconsider the stock if revenue growth reaccelerates decisively into the mid-teens and there is clear evidence of renewed operating leverage, potentially driven by the new distribution centre. At the time, I did not expect either catalyst before mid-2026.

This reinforced a key lesson, it is better to wait for evidence of reacceleration than to rely on hope.

2. Be More Ruthless

The most common investing mistake is selling winners too early. My issue is the opposite, I often hold underperformers for too long.

Evolution is a clear example. Had I applied the same discipline used with Auto Partner, I would have sold when the business first began to stall. Instead, I assumed the weakness was temporary. Over time, it became clear that the problems were structural, not cyclical, and the stock was punished accordingly.

The correct approach would have been to sell, continue monitoring the company, and wait for proof of a turnaround. Today, I am stuck in no-man’s land. The valuation is undemanding, but there is no evidence (yet) that management can fix the issues or reaccelerate growth.

With the portfolio now concentrated at 15 positions, the performance bar is higher. Entry and continued inclusion must be earned. There is little point in active monitoring if I am unwilling to act when evidence contradicts my thesis.

3. Valuation is Relative to Duration

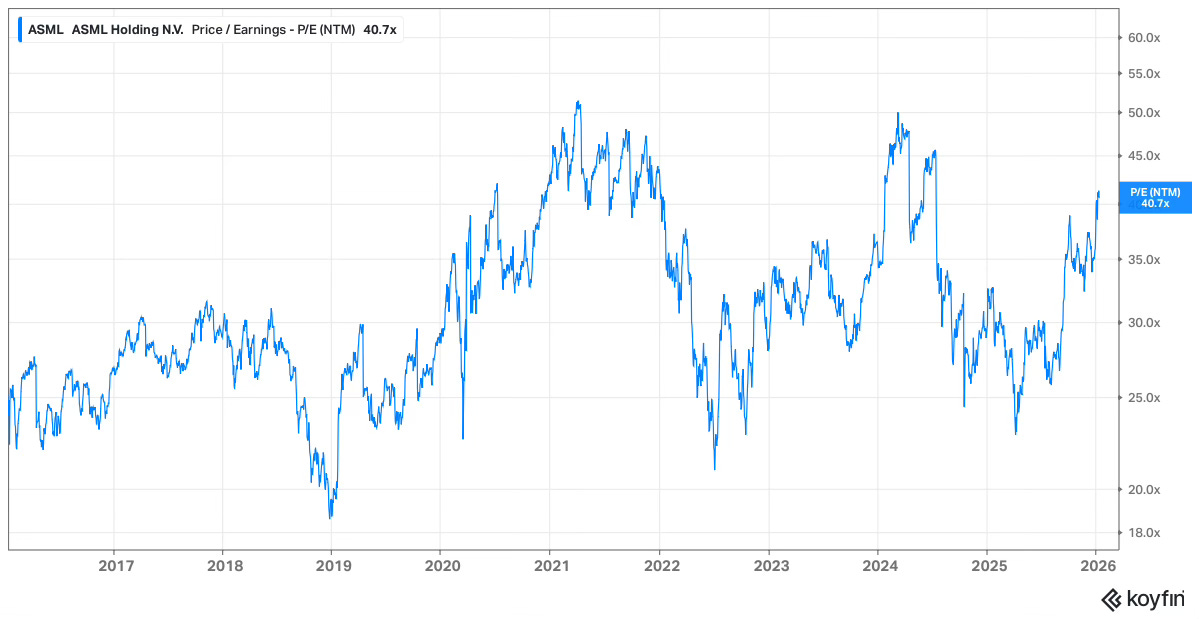

Arguably, the most profitable decision of 2025 was initiating and building a position in ASML below €700. The biggest gains in high quality investing are often made when the market mistakes a temporary cyclical headwind for a permanent structural decline. Buying ASML at 25x forward earnings established a valuation floor for a business with an extraordinary competitive moat. The catalyst was not just earnings growth, it was effectively buying a call option on the market’s eventual return to reality.

The real alpha sits in the gap between a pessimistic multiple (25x) and a justified multiple (40x). When you buy quality at a fair price, you get paid twice. First, through growth in the underlying earnings power of the business. Second, through the market’s willingness to pay more for each euro of those earnings. Success requires the discipline to ignore macro noise and the patience to wait for the inevitable re rating.

When a company with 100% market share in a mission critical technology like EUV sells off due to macro uncertainty or a lack of 18 month forward guidance, the risk is rarely in the business itself. More often, it lies in the investor’s timeframe. By focusing on ASML’s €33 billion order backlog, driven by multi billion dollar fab builds from TSMC, Intel, and Samsung, and the structural necessity of High NA EUV for the next generation of semiconductors, it was clear the trough reflected a temporary accounting reality.

I did not need to predict which AI chip would win. I only needed to know that whoever did would have to pay the ASML tax to manufacture it.

That’s it for 2025. Now on to 2026.

Thank you for your continued support and engagement. A newsletter is only as strong as its readership, and I am genuinely grateful to have you on this journey. Wishing you a healthy and profitable 2026.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

How have you hedged Euro/Dollar given you portfolio is heavy USD weighted ?

Great post — thank you for sharing the investment lessons you learned in 2025. That’s very insightful.