Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Scrab – The Fastest Way to Research Stocks

You can be 1 out of millions of investors using the same tools, looking at the same data, and dreaming about getting better results than the rest.

Or, you can use Scrab, your knowledge, and build a fully personalized scoring model to give you the advantage over millions. Scrab rates stocks according to your preference, exactly like you want, almost like having a private analyst on hand.

Backed by FactSet, professionals choose Scrab to gain access to global coverage of over 400 financial metrics and 40+ years of data history.

Don’t follow the crowd, Sign up for a 7-day free trial today!

Transactions

InPost (INPST)

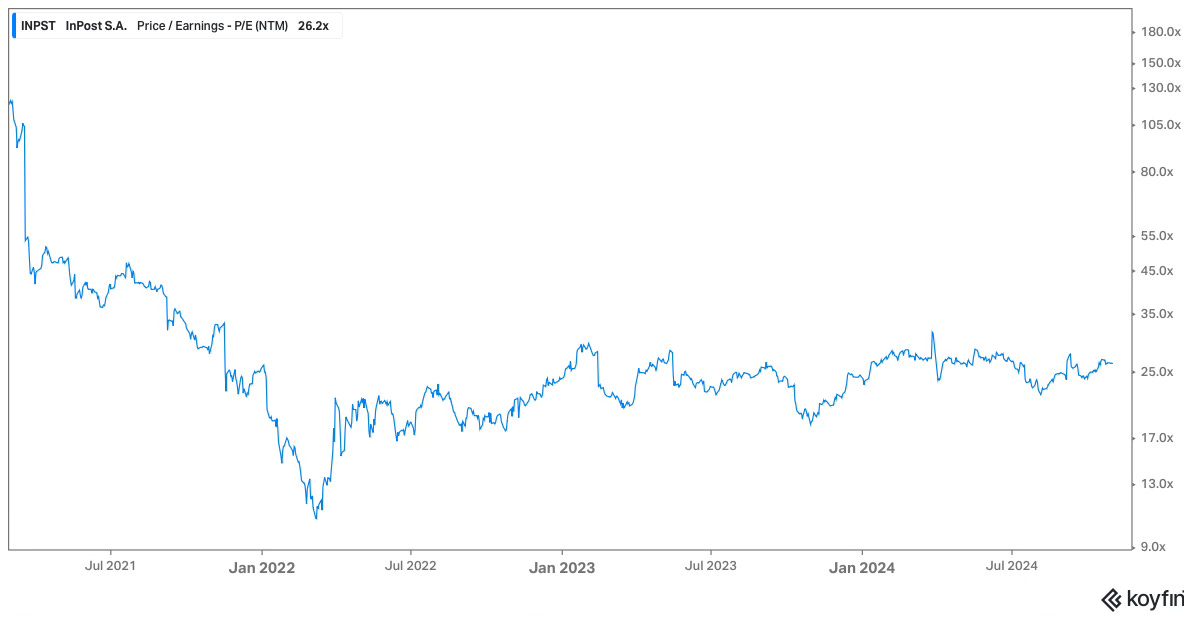

This month, I continued to build out my position in InPost, which I initially added to the portfolio in September. When I introduced the stock, I shared a brief summary outlining the investment thesis.

Over the past month, the company has made significant progress in executing its international growth strategy, achieving key milestones such as:

Launching a loyalty rewards program called “InCoin.”

Acquiring the remaining 70% stake in the British logistics company Menzies Distribution for £60.4 million in cash.

Integrating with the Shopify App in the UK, allowing Shopify retailers to offer their customers access to over 8,000 InPost lockers nationwide.

I also came across a detailed InPost investment case from Granular Capital. It’s an excellent and thorough write-up, so if you’re interested in InPost, I recommend giving it a read.

Visa (V)

Like InPost, Visa is a relatively new addition to the portfolio, and I’ve increased its weighting. The company reported earnings earlier this week that exceeded market expectations, beating both revenue and EPS estimates. Its performance was driven by steady growth in payment volumes, cross-border transactions, and processed payments. Additionally, Visa raised its dividend by 13% to $2.36 per share.

The recent stock weakness, triggered by the U.S. Department of Justice’s antitrust lawsuit, provided an ideal opportunity to start building a position in Visa. Investing is simple, but not easy.

Meta (META)

Meta’s stock has had an incredible run over the past two years, gaining over 500% from its lows. Despite this surge, I believe the stock remains reasonably priced so I increased my position. A reverse DCF analysis suggests that the current share price implies a growth rate of 12.5%.

Meta stands out as one of the few companies reaping substantial benefits from its heavy investments in AI, particularly in its core advertising business and in driving user engagement across platforms. For example, AI-driven improvements have enhanced ad delivery efficiency and increased advertisers' return on ad spend. Meta’s algorithms are increasingly effective at determining the optimal timing and placement for ads, resulting in better targeting and higher conversion rates.

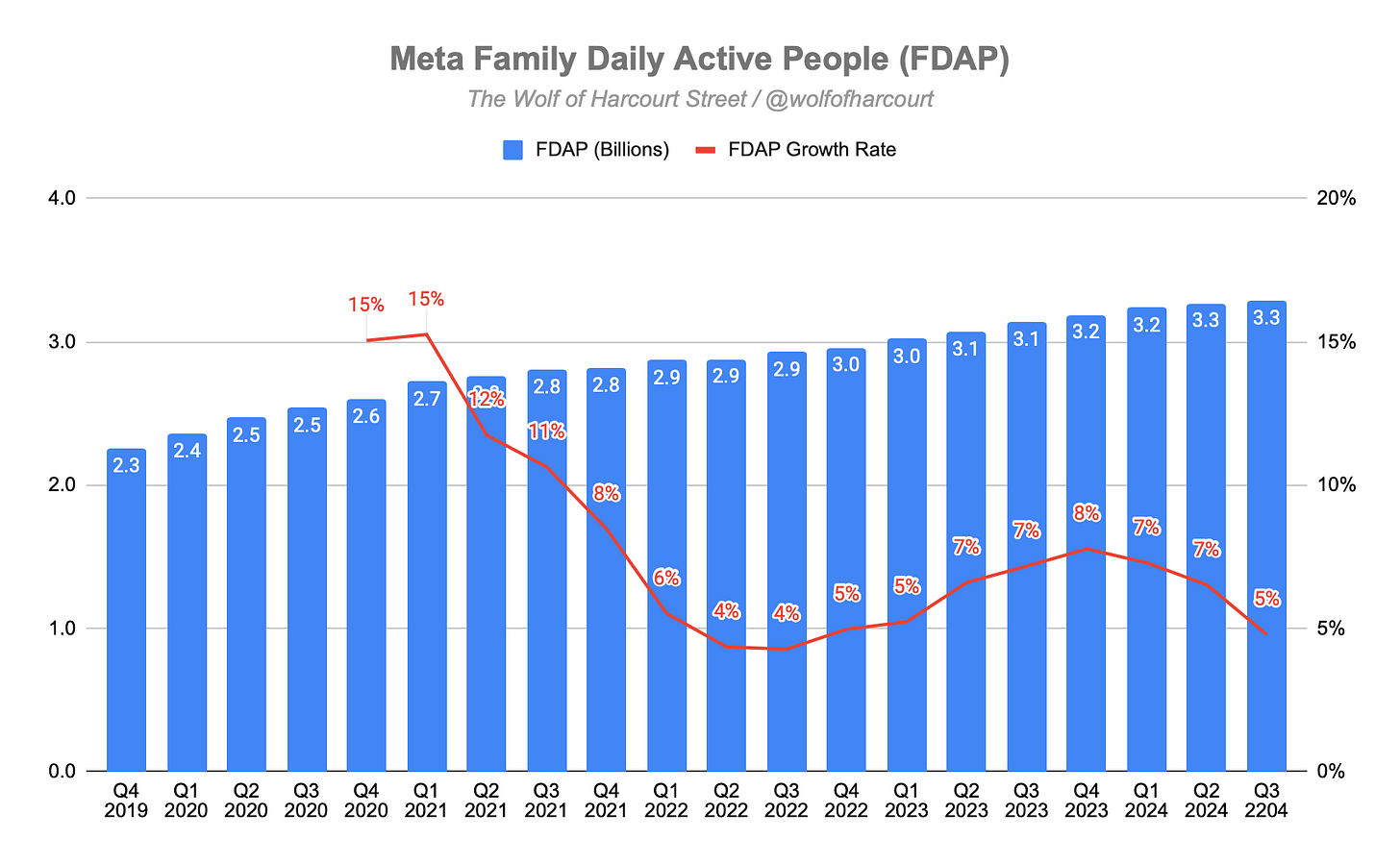

These advantages were reflected in Meta’s Q3 earnings report this week, as revenue grew by 19% year-over-year to $40.6 billion. This growth was fueled by a 5% increase in Family daily active people, a 7% rise in ad impressions, and an 11% increase in the average price per ad. Considering the multibillion-dollar base Meta is already operating from, this growth is remarkable.

Earlier this week, Acquired released a six-hour episode on Meta. I’m a big fan of Acquired and consider it the gold standard for informative and engaging podcasts. Just when you think you know a company well, you listen to something like this and realize there’s always more to learn. Even if Meta isn’t of particular interest, the episode’s focus on technological evolution offers valuable insights that can be applied to other areas.

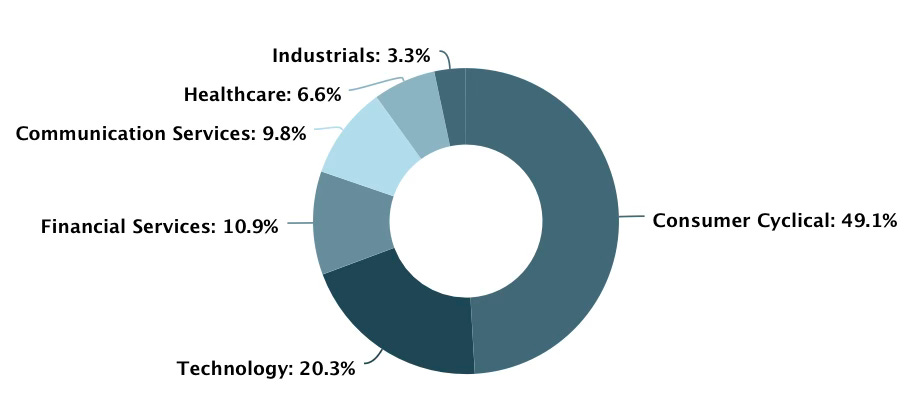

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They even have a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Buy List

Stocks that are on my radar to add this month:

Nubank (NU) - Nubank remains on my buy list from last month, though I didn’t get the chance to add to my position as the stock reached new all-time highs again this month. NU reports Q3 earnings later this month, which I’m eagerly awaiting. Any dips are worth taking advantage of, as they don’t tend to last long.

InPost (INPST) - I don’t have much to add to my previous comments on InPost. I’m happy to keep building my position while the stock remains within its current range.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

I deployed the remaining cash I held from last month's sale of DDOG. As the broader market continued to climb, my portfolio followed suit, reaching another all-time high.

The latest earnings season is well underway, and so far, my holdings have delivered strong reports—most notably Evolution, Visa, Meta, Microsoft and Amazon. Looking forward to the rest!

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

The Chat is a space designed to facilitate, real-time discussions, share knowledge and debate ideas with fellow investors. Join the conversation.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Should hopefully hit another all time high in the AM given Amazon’s beat 😀. I’m thankfully in the same boat

No $WISE yet!?