Welcome back to the Wolf of Harcourt Street Newsletter.

Every month, I'll provide you with an update on my portfolio, including all of the transactions, the current allocation, and my buy list. In addition, I'll share a recap of the articles you may have missed from the previous month.

Meet Scrab – The Fastest Way to Research Stocks

When first starting fundamental analysis, it’s easy to go after the Metas and Teslas, just like everybody else does. Learn why professionals use Scrab’s scoring models and how easy it is – even for beginners – to rank stocks in seconds based on data that is free of biases.

Join us on Thursday, October 3rd at 4PM PST/7PM CST to learn more about:

What scoring models are.

Why they benefit you as an investor.

How to build your own scoring model using spreadsheets.

How to speed it up with Scrab.

Newsletter Community

I've had some fantastic discussions with many of you over email and Twitter DMs, often leading to brilliant debates and new ideas, including InPost. With this in mind, I’m considering setting up a community group where we can all share ideas and engage in more open discussions. Recently, the newsletter surpassed 6,000 subscribers, which is not only a great milestone but also highlights how much our community of readers has grown.

The Substack app offers this functionality, but I haven’t activated it yet. Before moving forward, I’d love to get your thoughts on this idea. Would you be interested in joining a community group? Also, which platform would you prefer: Substack, Facebook, Discord, or WhatsApp?

Transactions

InPost (INPST)

I opened a new position in InPost which is a Polish e-commerce delivery company. I shared a Quick Pitch on why I believe the stock offers strong long-term return potential which you can read if you missed it but in summary, the business is well-positioned to capitalise on the rise of e-commerce in Europe with a business model focused on efficiency, cost advantages, and customer satisfaction. The stock appears undervalued based on its clear path for reinvestment and expansion into new markets.

Auto Partner (APR.WA)

I added to my position in APR after the company reported better-than-expected Q2 2024 earnings, showing sequential margin improvement after consecutive quarters of margin compression. 2024 has been a challenging year for APR, as it faced pressures from wage inflation and foreign exchange headwinds on inventory purchased at the end of 2023. However, it seems that management is gaining control over its cost structure, which bodes well for the future. The full earnings review is linked below.

Visa (V)

I bought more shares of Visa after it dropped 5% following news that the U.S. Justice Department plans to allege Visa illegally monopolized the U.S. debit card market. These types of lawsuits happen periodically, and if any company is built to handle an antitrust inquiry, it’s Visa. The company has pushed back against the lawsuit, calling it meritless and vowing to vigorously defend itself in court.

“Today’s lawsuit ignores the reality that Visa is just one of many competitors in a debit space that is growing, with entrants who are thriving. When businesses and consumers choose Visa, it is because of our secure and reliable network, world-class fraud protection, and the value we provide.”

- Julie Rottenberg, Visa’s General Counsel

Datadog (DDOG)

I sold my position in DDOG, which accounted for 3.8% of my portfolio at the time of sale. I’ve held DDOG since 2020, initially buying in at around $84 and last adding to the position last year at $75. Earlier this month, I shared a financial model and valuation update, which indicated that DDOG is currently very richly valued. My fair value estimate is around $79, compared to the $115 sale price.

The decision to sell wasn't due to a lack of confidence in DDOG as a business—I still believe it has strong secular tailwinds. However, at its current price, it's difficult to see how DDOG will generate market-beating returns given that much of its growth is already priced in. Additionally, the excessive SBC and dilution will likely be a drag on shareholder returns.

Of course, I could be wrong, and DDOG may soar following the Federal Reserve rate cuts, but I’m happy to take some healthy profits and redeploy the capital elsewhere. If DDOG experiences a significant sell-off, I would certainly consider reentering the stock.

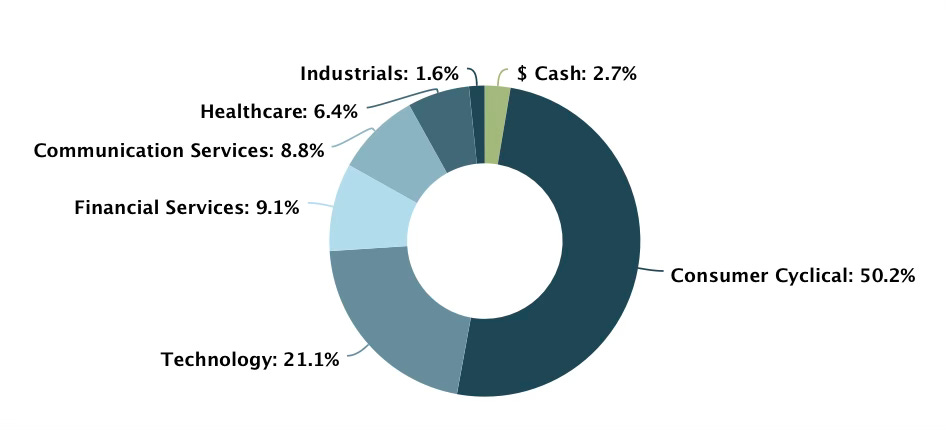

Allocation

Portseido is the tool that I have been using to track my portfolio for a number of years. I really like the charts that it produces and how it tracks performance. They even have a feature to automatically track dividends too. To top it off, it is effortless to update for new transactions. The team have kindly given me an affiliate link so if you would like to sign up you can click here.

Performance

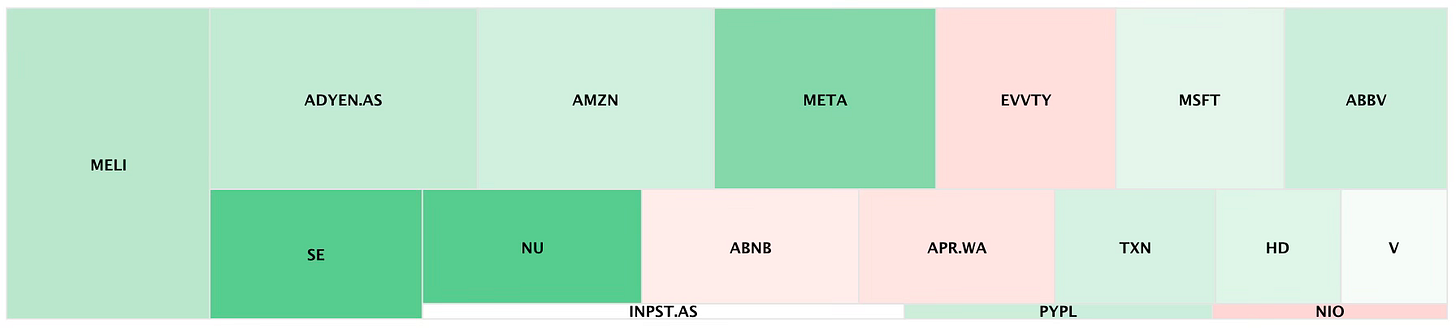

Q2: +10.4% vs S&P +6.4%

YTD: +21.6% vs +20.8% S&P

The biggest contributors to the YTD portfolio performance have been:

SE: +157%

NU: +94%

META: +62%

MELI: +36%

ADYEN: +32%

The largest detractors to the performance have been:

NIO: -26%

EVO: -21%

APR: -17%

ABNB: -12%

Buy List

Stocks that are on my radar to add this month:

InPost (INPST) - I plan to continue building out this new position over the coming months, especially if it stays at or below the current valuation.

Visa (V) - Visa is also a relatively new position that I’d like to increase to a more significant weight. I’m happy to buy more if it experiences any sell-offs related to lawsuit fears.

Nubank (NU) - This is the second-best performing stock in the portfolio this year. Nubank recently hit an all-time high above $15 earlier this month, but it’s now in a minor drawdown—if you can even call it that. If the weakness continues, I’ll likely take advantage of the opportunity.

In Case You Missed It

Some of the articles you might have missed during the past month:

Final Words

September was a relatively active month. I added a new holding to the portfolio, increased two existing positions, and sold out of a stock I’d held for four years. As a result, I’m currently holding a modest cash position, as I haven’t yet redeployed all of the sales proceeds.

A clear theme emerging in the portfolio is a focus on Poland, particularly this month with investments in Auto Partner and InPost. The reason is straightforward: I believe both companies are high-quality businesses, and I see Poland as a compelling opportunity given its economy is growing four times faster than the rest of the European Union. In fact, the Polish economy bears a striking resemblance to Ireland's “Celtic Tiger” economy. Between 1987 and 2007, Ireland's GDP grew by 229%, far outpacing the EU average.

As for the overall portfolio performance, I’m very satisfied, especially relative to the S&P 500 over the past couple of years. Of course, the market can shift at any time, so it’s important to stay focused and not get complacent. A return of over 10% in a single quarter is extremely rare and not sustainable, but it does highlight that time in the market is more important than timing the market. One interesting aspect of the portfolio’s performance is that I’ve managed to achieve these returns without any exposure to Nvidia, which has been a significant driver of the S&P’s overall returns in recent years.

If you'd like to support the work of an independent analyst, you can buy me a coffee. The proceeds will contribute to covering the annual running costs of the newsletter.

Join the community of informed investors – subscribe now to receive the latest content straight to your inbox each week and never miss out on valuable investment insights.

If you found today's edition helpful, please consider sharing it with your friends and colleagues on social media or via email. Your support helps to continue to provide this newsletter for FREE!

Happy investing

Wolf of Harcourt Street

Contact me

Twitter: @wolfofharcourt

Email: wolfofharcourtstreet@gmail.com

Surprised to see Substack as the poll winner, thought it would be Discord. I've been using Substack Chat since the beginning of the year and haven't ran into any issues